Boston Celtics Sold For $6.1 Billion: Fans React To Private Equity Takeover

Table of Contents

The $6.1 Billion Price Tag: A Record-Breaking Deal?

The $6.1 billion price tag attached to the Boston Celtics sale is undeniably eye-watering. While the exact details of the deal and the acquiring private equity firm may not yet be publicly known, the sheer magnitude of this transaction sets a new benchmark in professional sports valuations. Several factors contributed to such a high valuation.

- Comparison to previous NBA team sales: This sale surpasses previous record-breaking sales, solidifying the Celtics' position as one of the most valuable franchises in the league. The sale price reflects a significant premium compared to recent transactions.

- Impact of the Celtics' brand recognition and history: The Celtics boast a rich history, a legendary roster of players, and a passionate fanbase. This storied legacy contributes significantly to their market value. The brand recognition and associated prestige are invaluable assets.

- Role of the lucrative Boston market: The team’s location in the vibrant and wealthy Boston market further enhances its appeal to potential buyers. The vast media market and affluent fanbase offer significant revenue generation opportunities.

Fan Reactions to the Boston Celtics Private Equity Takeover

The Boston Celtics sale has sparked a wave of diverse reactions among fans. While many express excitement about the potential for increased investment and future success, others harbor concerns.

- Social media sentiment analysis (positive, negative, neutral): A quick look at social media reveals a mixture of excitement, apprehension, and uncertainty. Positive comments often center on the potential for enhanced team performance and infrastructure improvements. Negative sentiments frequently cite concerns about rising ticket prices and a potential shift away from the team's traditional values. A significant portion remains neutral, awaiting concrete plans from the new owners.

- Quotes from fans expressing their concerns or excitement: “I hope they invest wisely and keep the team competitive,” says one long-time fan. Another adds, “I’m worried about ticket prices becoming unaffordable for average fans.” These contrasting opinions highlight the range of emotions surrounding the sale.

- Discussion of potential impact on fan engagement and loyalty: The success of this new ownership structure hinges on maintaining fan engagement and loyalty. Transparency and consistent communication will be crucial to address fan concerns and foster a sense of continuity.

Potential Implications for the Team's Future

The Boston Celtics private equity takeover has significant implications for the team’s future, both on and off the court.

- Potential changes in team management and coaching staff: While immediate changes are unlikely, the new owners may eventually implement changes to leadership and coaching strategies to optimize performance.

- Impact on player recruitment and salary cap: Private equity investment could provide the Celtics with greater financial flexibility in player recruitment, potentially leading to a strengthened roster. However, navigating the NBA’s salary cap rules remains a crucial factor.

- Long-term financial implications for the franchise: The substantial investment from private equity presents both opportunities and challenges. Strategic financial management will be crucial to ensure the long-term sustainability and success of the franchise.

The Role of Private Equity in Professional Sports

The Boston Celtics sale is part of a broader trend: increasing private equity investment in professional sports franchises.

- Examples of other sports teams owned by private equity: Several prominent sports teams across various leagues have already transitioned to private equity ownership, demonstrating the growing influence of this investment model in the sector.

- Potential benefits (increased investment, improved infrastructure): Private equity often brings substantial capital, facilitating improvements to stadium infrastructure, training facilities, and player recruitment.

- Potential drawbacks (focus on profit maximization over team loyalty): A potential drawback is that private equity firms prioritize profit maximization, potentially leading to decisions that compromise long-term team success or fan loyalty for short-term gains.

Conclusion: The Future of the Boston Celtics After the $6.1 Billion Sale

The $6.1 billion Boston Celtics sale represents a pivotal moment for the franchise and the NBA. The high price reflects the team’s value, history, and market position. Fan reactions are mixed, with concerns about future impacts balanced by hope for continued success. The new ownership structure presents both opportunities and challenges; strategic financial management and transparent communication will be crucial to navigate this new era successfully. The long-term impact of this Boston Celtics sale on the team's performance, fan engagement, and the NBA landscape remains to be seen.

What are your predictions for the Boston Celtics under their new ownership? Share your thoughts on the Boston Celtics sale and its implications in the comments section below!

Featured Posts

-

You Tube Offers Three Free Star Wars Andor Episodes

May 17, 2025

You Tube Offers Three Free Star Wars Andor Episodes

May 17, 2025 -

Tokyos Quiet Revolution Soundproof Apartments And Tranquil Living

May 17, 2025

Tokyos Quiet Revolution Soundproof Apartments And Tranquil Living

May 17, 2025 -

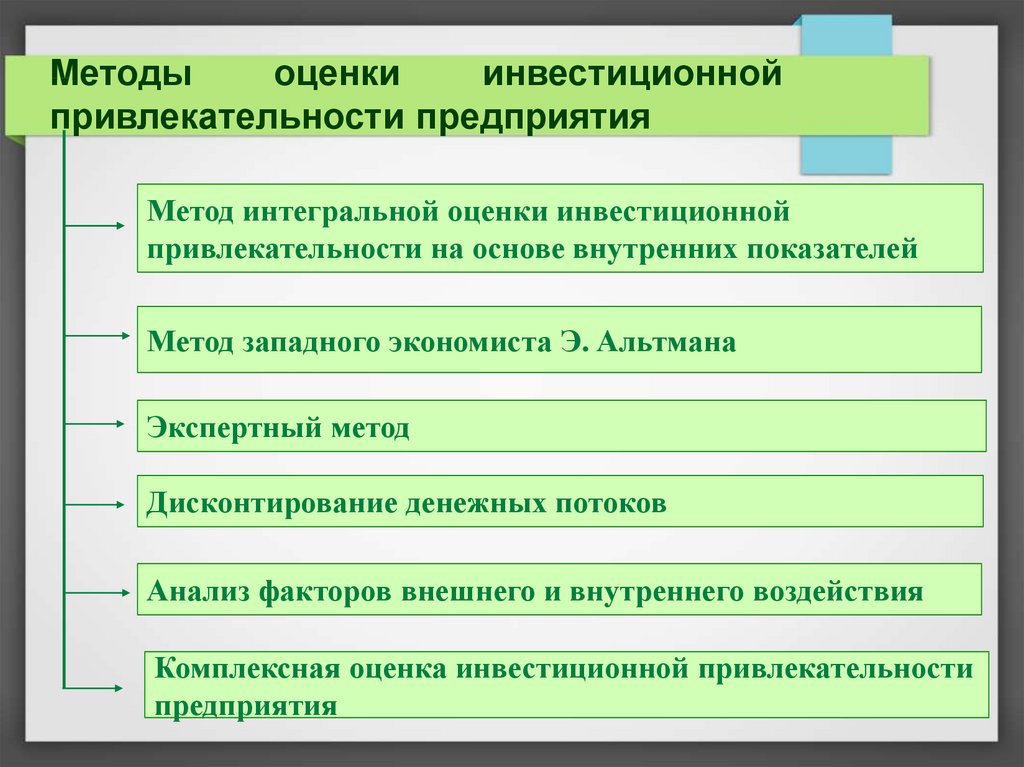

Industrialnye Parki Analiz Plotnosti Zanyatosti I Investitsionnoy Privlekatelnosti

May 17, 2025

Industrialnye Parki Analiz Plotnosti Zanyatosti I Investitsionnoy Privlekatelnosti

May 17, 2025 -

Sherlock Holmes 10 Greatest Quotes Of All Time

May 17, 2025

Sherlock Holmes 10 Greatest Quotes Of All Time

May 17, 2025 -

Pistons Outraged Blown Foul Call Steals Game 4 Victory

May 17, 2025

Pistons Outraged Blown Foul Call Steals Game 4 Victory

May 17, 2025