BP Announces 31% Decrease In CEO Compensation

Table of Contents

Briefly, Bernard Looney, BP's CEO, will see a significant decrease in his remuneration. This comes at a time when BP, like many energy companies, navigates fluctuating oil prices and increasing pressure to meet ambitious environmental targets. Recent financial reports show mixed results for BP, creating a backdrop against which this bold decision on executive pay must be considered. Our purpose is to unpack the motivations behind this drastic change and explore its broader consequences.

Reasons Behind the 31% Reduction in BP CEO Compensation

BP's official statements regarding the decrease in BP CEO compensation cite a need for greater alignment with the company's overall performance and its commitment to Environmental, Social, and Governance (ESG) goals. However, a deeper analysis reveals several likely contributing factors:

-

Company Performance: While BP has reported profits, they haven't consistently met ambitious targets. Stock performance, a key metric for executive compensation, may have also played a role in the decision. Fluctuations in oil prices and the ongoing energy transition present significant challenges, impacting overall profitability and influencing the board's decision on executive pay.

-

Pressure from Shareholders and Activist Investors: Growing shareholder activism and increasing scrutiny of executive pay packages, particularly within the energy sector, have likely influenced BP's decision. Shareholders are increasingly demanding greater transparency and accountability regarding executive compensation, especially in relation to company performance and environmental commitments.

-

Alignment with Broader ESG Goals: BP has publicly committed to ambitious ESG goals, including reducing its carbon footprint and transitioning to cleaner energy sources. The reduction in BP CEO compensation may be viewed as a demonstration of the company's commitment to these goals and a way to show alignment with stakeholder expectations regarding responsible corporate behavior.

-

Public Scrutiny of Executive Pay in the Energy Industry: The energy industry has faced intense public scrutiny over executive pay in recent years. Concerns about excessive executive compensation, particularly during periods of fluctuating profits or environmental controversies, have put pressure on companies to demonstrate greater responsibility and fairness in their compensation structures. The BP CEO compensation cut can be seen as a direct response to this public pressure.

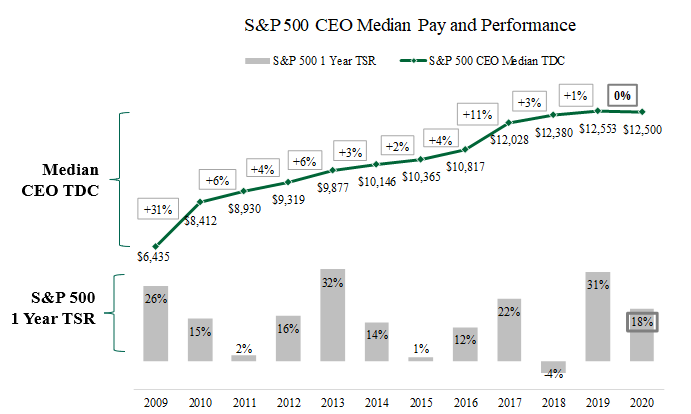

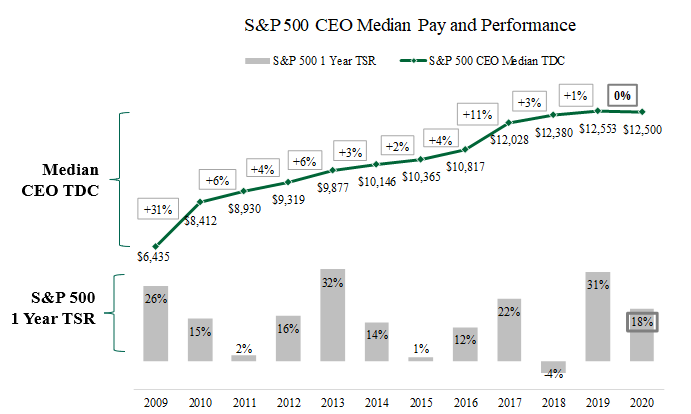

Comparison to Previous Years and Industry Averages

Bernard Looney's compensation in previous years has been significantly higher than the revised figure. [Insert a chart or graph here visually representing BP CEO compensation over the past few years]. Comparing BP CEO compensation to that of CEOs in comparable energy companies like Shell, ExxonMobil, and Chevron reveals a range of practices. While some companies maintain relatively high executive pay packages, others have implemented more moderate approaches. These variations reflect differing corporate strategies, shareholder pressures, and prevailing market conditions. The significant reduction in BP CEO compensation positions BP as an outlier in the current industry landscape.

Impact of the Pay Cut on BP's Image and Investor Sentiment

The 31% reduction in BP CEO compensation is likely to have a positive impact on BP's public image. This decision showcases a commitment to responsible corporate governance and can enhance perceptions of corporate social responsibility (CSR). However, the impact on investor sentiment remains complex. While some may view this as a positive sign of fiscal responsibility, others might worry about potential implications for leadership motivation or the company’s overall financial health. Initial market reactions, including any shifts in BP's stock price following the announcement, will be crucial in assessing the immediate investor response.

-

Improved Corporate Social Responsibility (CSR) Perception: The pay cut can be interpreted as a move towards improved social responsibility, appealing to environmentally and socially conscious investors.

-

Potential Impact on Employee Morale and Motivation: The impact of the CEO's pay cut on employee morale and motivation needs careful consideration. A fair and transparent compensation structure throughout the organization is crucial for maintaining employee engagement.

Long-Term Implications for Executive Compensation at BP and the Energy Sector

This significant reduction in BP CEO compensation could set a precedent, influencing future executive compensation structures within BP and potentially across the energy sector. It signifies a potential shift towards greater pay transparency and accountability, encouraging other companies to re-evaluate their executive compensation practices.

-

Future Adjustments to Bonus Schemes and Performance-Related Pay: We may see adjustments to bonus schemes and performance-related pay to better align executive compensation with company performance and broader ESG targets.

-

Influence on Other Large Corporations' Executive Compensation Strategies: The BP decision could spark similar discussions and adjustments to executive pay in other large corporations, particularly in industries facing scrutiny for their compensation practices.

Conclusion: Analyzing the Future of BP CEO Compensation and Executive Pay

The 31% decrease in BP CEO compensation marks a significant development in the energy sector. The reasons behind the reduction are multifaceted, encompassing company performance, shareholder pressure, ESG goals, and public scrutiny. While the short-term impact on investor sentiment remains to be fully assessed, the long-term implications could be far-reaching, potentially influencing executive compensation practices across the industry. The decision highlights a growing trend towards greater transparency and accountability in executive pay, reflecting the changing expectations of stakeholders and the evolving social and environmental landscape. Follow us for updates on BP CEO compensation and industry trends to stay informed on this evolving story and learn more about the evolving dynamics of executive pay in the energy sector.

Featured Posts

-

Abn Amro Aex Prestatie Na Publicatie Kwartaalcijfers

May 22, 2025

Abn Amro Aex Prestatie Na Publicatie Kwartaalcijfers

May 22, 2025 -

Visiting The Peppa Pig Theme Park A Texas Family Vacation Guide

May 22, 2025

Visiting The Peppa Pig Theme Park A Texas Family Vacation Guide

May 22, 2025 -

Wife Of Jailed Tory Councillor Claims Migrant Hotel Remarks Were Misinterpreted

May 22, 2025

Wife Of Jailed Tory Councillor Claims Migrant Hotel Remarks Were Misinterpreted

May 22, 2025 -

Tikkie Gebruiken In Nederland Een Complete Handleiding

May 22, 2025

Tikkie Gebruiken In Nederland Een Complete Handleiding

May 22, 2025 -

Could This Runner Break The Trans Australia Run World Record

May 22, 2025

Could This Runner Break The Trans Australia Run World Record

May 22, 2025

Latest Posts

-

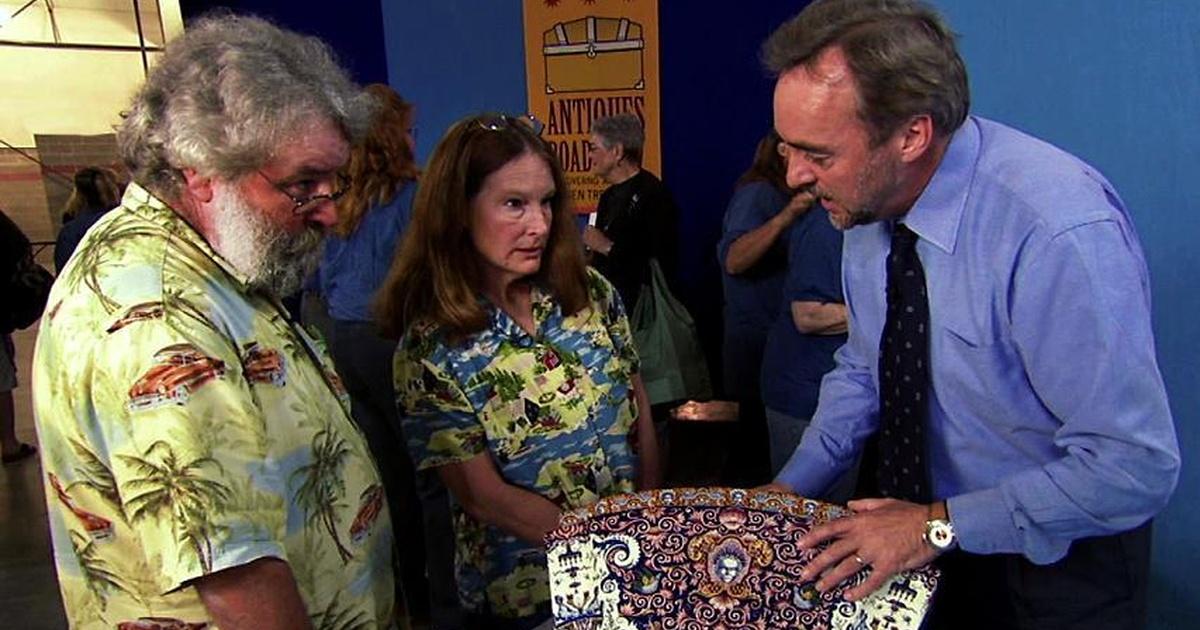

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025 -

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025