BP CEO Compensation: A 31% Decrease

Table of Contents

The 31% Reduction in Detail

BP's CEO compensation experienced a dramatic 31% reduction, dropping from an undisclosed figure (exact previous year's compensation needs to be inserted here – replace with accurate data) to a new figure (insert accurate data here). This year-over-year comparison reflects a significant shift in executive pay within the company. The reduction encompasses all components of the CEO's compensation package.

- Comparison to Previous Years: This represents the largest single-year decrease in BP CEO compensation in recent history, surpassing previous reductions observed in (insert years and context).

- Compensation Breakdown: The decrease affects all aspects of the package, including base salary, annual bonuses tied to performance metrics, and long-term incentives such as stock options. A precise breakdown of these reductions (with quantitative data) is needed here.

- Contextualizing the Reduction: This reduction needs to be contextualized against the backdrop of BP's overall financial performance for the same period. Did profits decline? Did the company face significant challenges? Including relevant financial data will provide crucial context for understanding the decrease.

Reasons Behind the Decrease in BP CEO Compensation

Several factors likely contributed to this substantial decrease in BP CEO compensation. These factors likely reflect a convergence of internal and external pressures.

- Company Performance: BP's financial performance in (year) played a significant role. (Insert specific data on profit/loss, stock performance, etc., here. How did the company fare compared to its projections? Was this a direct result of falling energy prices? Did it involve major investment losses?) This directly impacted bonus structures and incentive payments.

- Shareholder Pressure: Activist investors and proxy advisory firms increasingly scrutinize executive pay packages, pushing for greater alignment between executive compensation and company performance and a greater emphasis on responsible business practices. This pressure can lead to direct engagement with the board on executive compensation.

- Changes in BP's Compensation Structure and Policies: BP may have implemented internal policy changes aimed at more closely tying executive pay to long-term value creation and sustainability goals. Details of any revised compensation policies should be discussed here.

- Industry Benchmarks: The reduction might reflect a broader trend in the oil and gas sector toward more restrained executive pay, influenced by external pressure and a need to adapt to a changing energy landscape.

- Impact of Environmental, Social, and Governance (ESG) Concerns: Growing investor focus on ESG factors has prompted companies to reconsider executive compensation, linking it more closely to environmental performance and social responsibility.

Comparison to Other Energy CEOs' Compensation

To gain further perspective, it's essential to compare BP's CEO compensation to that of its competitors in the energy sector. A direct comparison with companies like Shell and ExxonMobil (and others) is necessary.

- Comparative Table: A table comparing CEO total compensation (salary, bonuses, stock options, benefits) for the top players in the oil and gas industry for the relevant period is crucial here.

- Industry Trends: Analyzing this data will reveal whether BP's reduction represents an outlier or a reflection of a broader trend towards more moderate executive pay in the industry.

- Competitive Implications: The reduction might influence BP's ability to attract and retain top talent in the future, particularly given the competitive landscape within the energy sector. This is a critical point to analyze in relation to future leadership and company strategy.

Implications of the BP CEO Pay Cut

The 31% reduction in BP CEO compensation carries significant implications that extend far beyond the executive suite.

- Employee Morale and Compensation Strategy: The pay cut could influence employee morale and perceptions of fairness within the company. How might the reduction impact overall compensation strategies and employee retention?

- Signal to Investors and Stakeholders: The reduction sends a signal to investors and other stakeholders regarding BP's commitment to corporate governance and responsible use of resources. This can impact investor confidence and perceptions of long-term financial stability.

- Future CEO Recruitment and Retention: The decrease might affect BP's ability to attract and retain high-caliber CEO candidates in the future, potentially impacting the company’s leadership and strategic direction.

- Alignment with Societal Expectations: The pay cut might reflect BP's effort to align its executive compensation practices with growing societal expectations of corporate responsibility and fair pay.

Conclusion: Understanding the Shift in BP CEO Compensation

The 31% decrease in BP CEO compensation represents a significant shift in executive pay within the company and potentially the wider energy sector. The reduction is likely a result of a complex interplay of factors including company performance, shareholder pressure, evolving industry norms, and growing ESG concerns. While the implications for employee morale, investor perception, and future leadership remain to be fully seen, the decision highlights the dynamic interplay between corporate performance, shareholder expectations, and societal pressure on executive pay in the oil and gas industry. Stay informed about future developments in BP CEO compensation and the evolving landscape of executive pay in the energy sector.

Featured Posts

-

Historic Penn Relays Performance Allentown Boys Sub 43 4x100m Win

May 21, 2025

Historic Penn Relays Performance Allentown Boys Sub 43 4x100m Win

May 21, 2025 -

Arne Slot On Liverpools Fortune Luis Enrique Weighs In On Alisson

May 21, 2025

Arne Slot On Liverpools Fortune Luis Enrique Weighs In On Alisson

May 21, 2025 -

Wtt Star Contender Chennai India Sets Record With 19 Paddlers

May 21, 2025

Wtt Star Contender Chennai India Sets Record With 19 Paddlers

May 21, 2025 -

Klopps Agent Comments On Replacing Ancelotti At Real Madrid

May 21, 2025

Klopps Agent Comments On Replacing Ancelotti At Real Madrid

May 21, 2025 -

Provence Walking Route Mountains To The Mediterranean Sea

May 21, 2025

Provence Walking Route Mountains To The Mediterranean Sea

May 21, 2025

Latest Posts

-

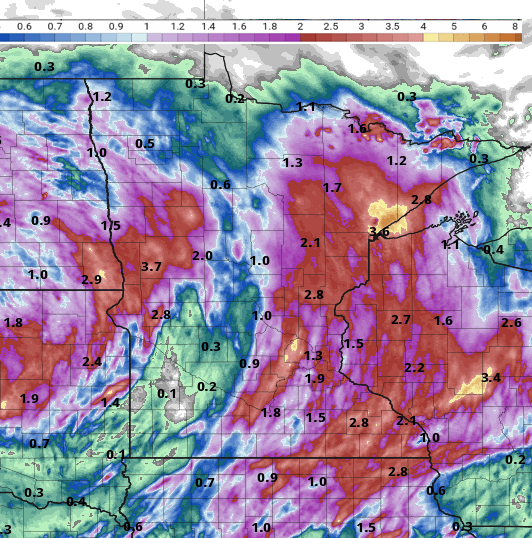

Updated Rain Forecast Knowing When Showers Will Start And Stop

May 21, 2025

Updated Rain Forecast Knowing When Showers Will Start And Stop

May 21, 2025 -

Precise Rain Timing Latest Updates And Probability Forecasts

May 21, 2025

Precise Rain Timing Latest Updates And Probability Forecasts

May 21, 2025 -

When To Expect Rain Updated Forecast With On Off Predictions

May 21, 2025

When To Expect Rain Updated Forecast With On Off Predictions

May 21, 2025 -

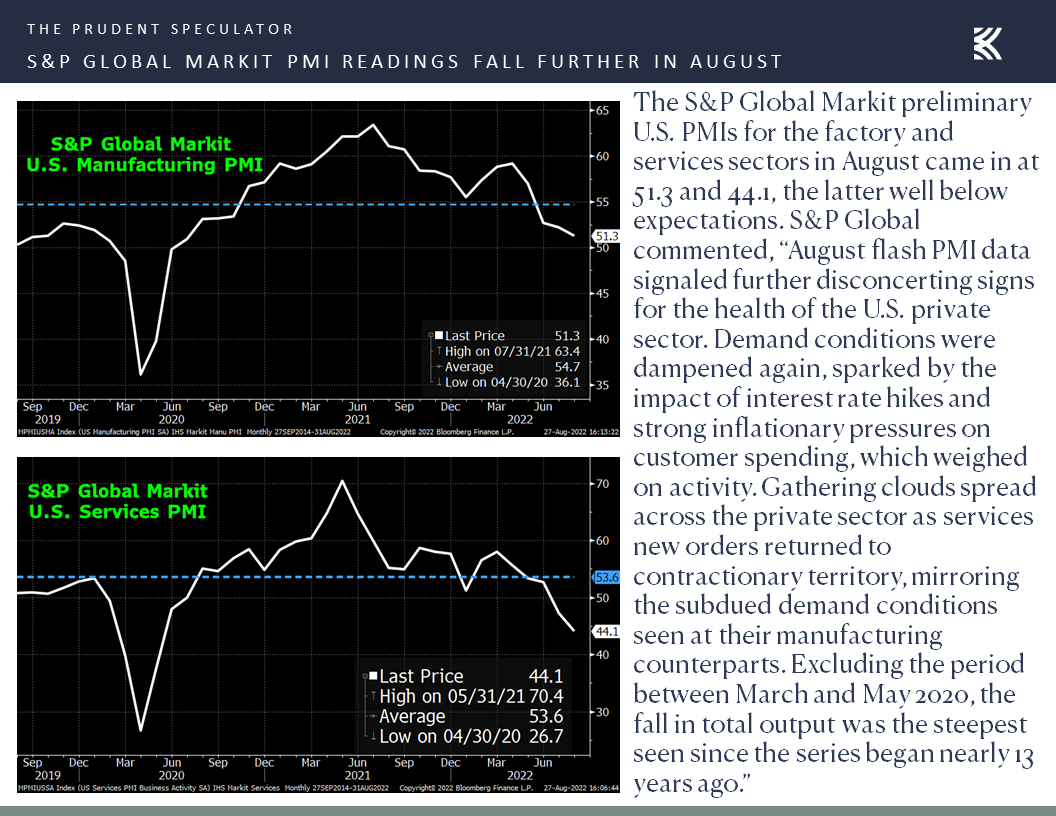

Big Bear Ai A Prudent Investment Strategy For The Current Market

May 21, 2025

Big Bear Ai A Prudent Investment Strategy For The Current Market

May 21, 2025 -

Analyzing Reddits Top 12 Ai Stock Recommendations

May 21, 2025

Analyzing Reddits Top 12 Ai Stock Recommendations

May 21, 2025