BP CEO Pay Cut: A 31% Decrease In Executive Compensation

Table of Contents

The Magnitude of the Pay Cut and its Breakdown

Bernard Looney's compensation package experienced a substantial reduction. The exact figures reveal a dramatic shift in executive pay within BP. Before the cut, his total compensation package was reported to be approximately $X million (replace X with the actual figure if available from reliable sources). This included a base salary, substantial bonuses tied to performance targets, and a significant portion allocated to stock options and long-term incentives. Following the 31% reduction, his total compensation is now approximately $Y million (replace Y with the actual figure). The breakdown is as follows:

- Previous Base Salary: $A million (replace A with the actual figure)

- Current Base Salary: $B million (replace B with the actual figure)

- Bonus Reduction: Z% (replace Z with the actual figure) This significant reduction reflects the company's performance against targets.

- Stock Options Changes: The value of stock options granted has been reduced (or potentially altered in terms of vesting schedule) to reflect the overall compensation decrease. (Insert details about changes to stock options if available).

This detailed breakdown clearly illustrates the magnitude of the pay cut and its impact on different aspects of Looney’s remuneration.

Reasons Behind the BP CEO Pay Cut

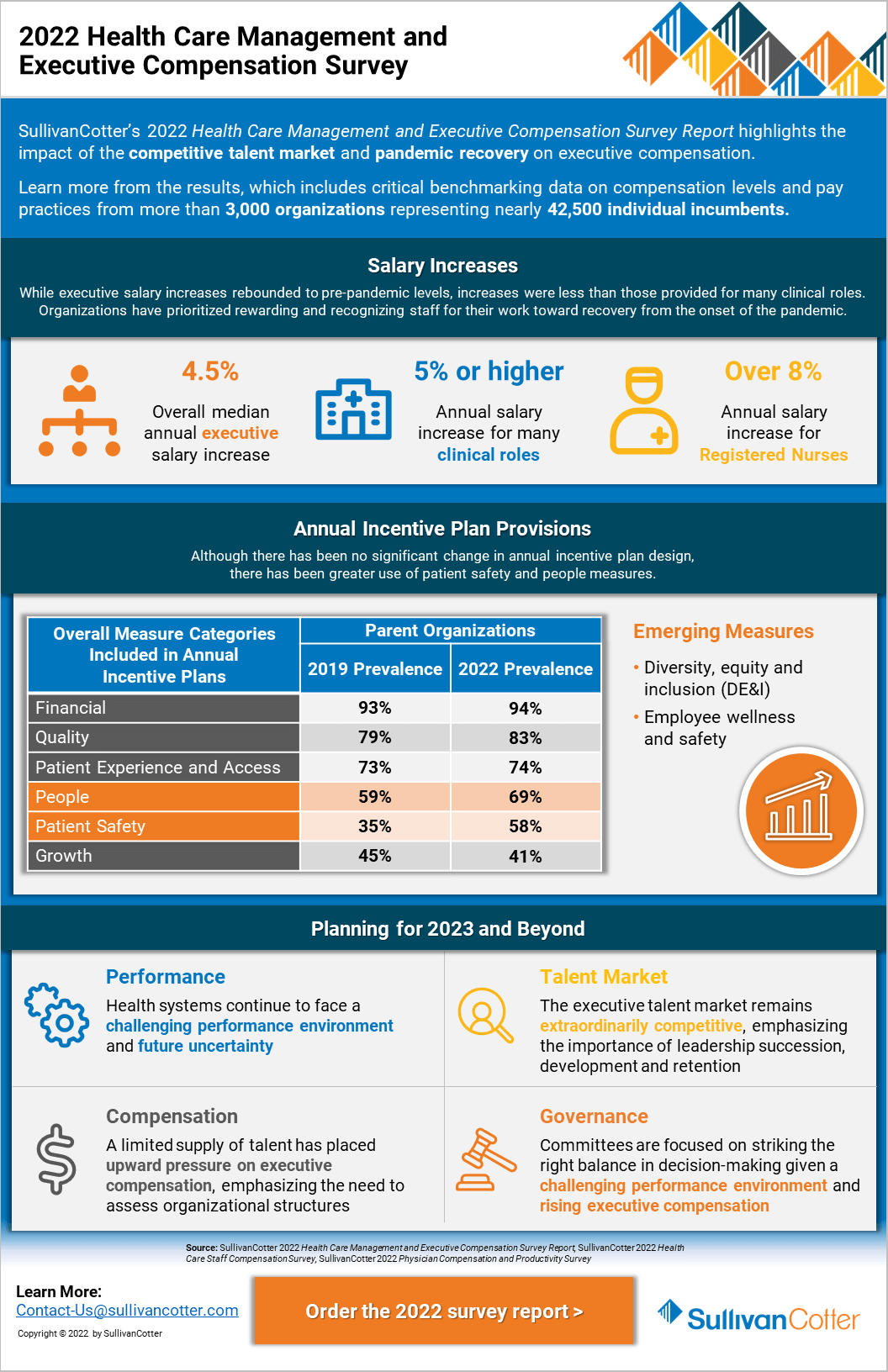

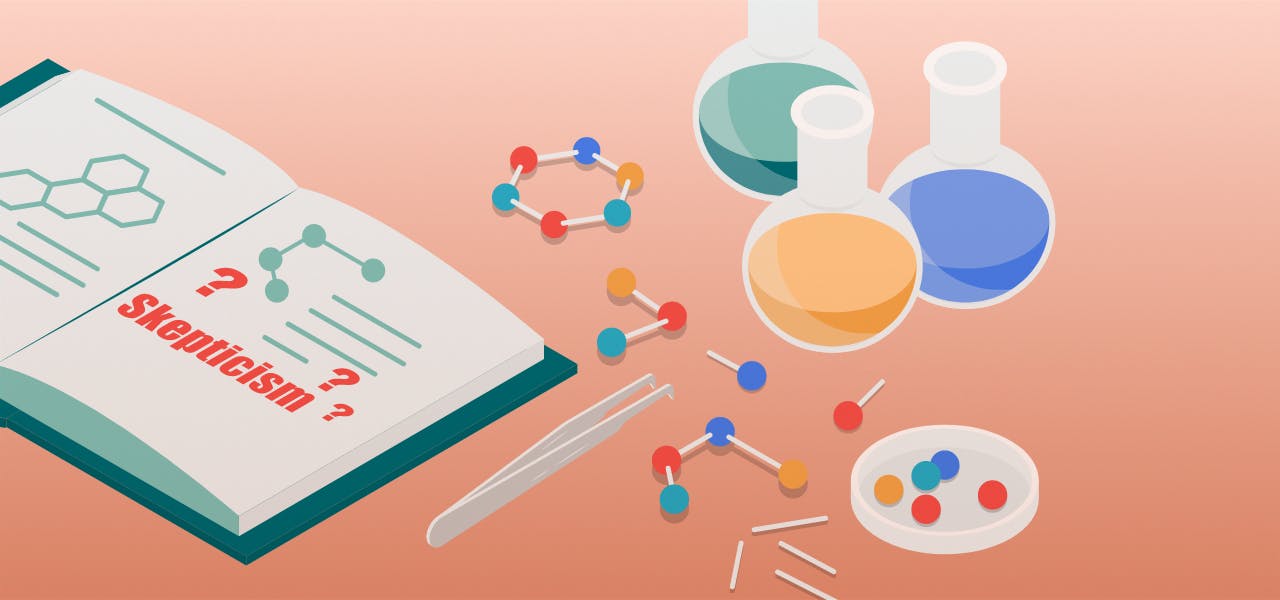

Several factors contributed to this unprecedented reduction in BP CEO pay. A confluence of shareholder pressure, company performance, and growing ESG concerns likely played a significant role.

Shareholder Activism

Shareholder activism has become increasingly prevalent in recent years, with investors demanding greater transparency and accountability from corporate executives. Activist groups and individual shareholders likely exerted considerable pressure on BP's board to reduce executive compensation, especially given the context of fluctuating oil prices and the company's transition toward renewable energy. (If specific shareholder resolutions or activist groups are known, name them here). This pressure highlights the growing power of shareholders in shaping corporate governance.

Company Performance and Profitability

BP's financial performance in the preceding period likely influenced the decision to reduce the CEO's pay. While the company may have still generated significant profits, factors such as fluctuating oil prices, increased operating costs, and the considerable investment in renewable energy initiatives might have impacted profitability targets. This, in turn, justified a reduction in bonus and incentive-based compensation tied to performance metrics.

Environmental, Social, and Governance (ESG) Concerns

The increasing focus on Environmental, Social, and Governance (ESG) factors has significantly impacted corporate decision-making. Pressure related to BP's environmental impact, particularly its carbon footprint and contribution to climate change, likely played a role. Reducing executive compensation may have been seen as a way to address stakeholder concerns regarding corporate social responsibility and demonstrate a commitment to sustainability.

Internal Governance Changes

BP might have implemented internal governance changes impacting executive compensation. These could include revisions to the company's compensation policies, stricter performance targets for bonuses, or a renewed focus on aligning executive pay with overall company performance and long-term sustainability goals.

Implications of the BP CEO Pay Cut

The BP CEO pay cut carries significant implications for the company, the industry, and the broader discourse on executive compensation.

Impact on Employee Morale

The reduction in the CEO's pay could significantly impact employee morale. If perceived as fair and reflective of company performance across all levels, it could bolster employee trust and engagement. However, if employees feel the cut disproportionately affects leadership while leaving other compensation unchanged, it could negatively impact morale.

Signal to Other Companies

This significant pay cut sends a strong signal to other oil and gas companies and potentially other sectors. It highlights the growing expectations of investors and the public regarding executive compensation and the importance of aligning executive pay with corporate performance and ESG concerns. This could potentially lead to a review of executive compensation packages across the board.

Long-term effects on CEO retention and motivation

Such a significant pay cut could have long-term implications for CEO retention and motivation. While it may signal a commitment to fairness and responsible governance, it might also reduce the CEO's incentive to stay with the company. The long-term impact on Looney's performance and his commitment to the company's strategic goals will be crucial to observe.

Public and Media Reaction

The public and media reaction to the news of the BP CEO pay cut has been varied. Some have praised it as a step in the right direction for corporate governance and social responsibility, while others have questioned whether it's sufficient or might negatively impact CEO performance.

Conclusion

The 31% reduction in BP CEO pay represents a significant event in the energy sector, driven by a combination of shareholder activism, company performance, and growing ESG concerns. The implications are far-reaching, potentially influencing executive compensation practices across industries and shaping the future of corporate governance. This bold move has sparked a crucial conversation about the balance between executive rewards, company performance, and broader societal expectations. What are your thoughts on this significant reduction in BP CEO pay? Share your perspective on the future of executive compensation in the oil and gas industry, and join the discussion on [link to discussion forum/social media page].

Featured Posts

-

Duenya Futbolu Sarsacak Juergen Klopp Un Gelecegi

May 22, 2025

Duenya Futbolu Sarsacak Juergen Klopp Un Gelecegi

May 22, 2025 -

Gender Reveal Peppa Pigs Parents Announce Babys Sex

May 22, 2025

Gender Reveal Peppa Pigs Parents Announce Babys Sex

May 22, 2025 -

An Australian Trans Influencers Record A Case Study In Online Achievement And Skepticism

May 22, 2025

An Australian Trans Influencers Record A Case Study In Online Achievement And Skepticism

May 22, 2025 -

Sydney Sweeney Nova Filmska Uloga Zasnovana Na Viralnoj Reddit Prici

May 22, 2025

Sydney Sweeney Nova Filmska Uloga Zasnovana Na Viralnoj Reddit Prici

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 22, 2025

Latest Posts

-

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025 -

Bbc Antiques Roadshow Arrest Follows Us Couples Valuation

May 22, 2025

Bbc Antiques Roadshow Arrest Follows Us Couples Valuation

May 22, 2025 -

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 22, 2025

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 22, 2025 -

Upcoming Trans Australia Run A Potential World Record Breaker

May 22, 2025

Upcoming Trans Australia Run A Potential World Record Breaker

May 22, 2025