BP Chief Aims To Double Company Valuation: No US Listing Planned, Reports FT

Table of Contents

BP's Ambitious Valuation Target

BP's current market capitalization (precise figures would need to be sourced from the FT report at the time of writing and inserted here) is significantly below the CEO's target of doubling this figure. This represents a hugely ambitious goal, requiring substantial growth and strategic execution. Several factors are driving this aspiration:

- Successful Energy Transition Strategy: BP's investment in renewable energy sources and its commitment to reducing carbon emissions are central to this ambitious plan. The success of this transition will directly impact its future profitability and appeal to environmentally conscious investors.

- Growth in Renewable Energy: Projected growth in renewable energy investments and subsequent profits are key to achieving the targeted BP company valuation. Expansion into solar, wind, and other green energy sectors is expected to be a major contributor to future revenue streams.

- Efficiency and Cost-Cutting: Internal efficiency improvements and effective cost-cutting measures will be crucial for enhancing profitability and boosting the company's overall valuation. Streamlining operations and optimizing resource allocation are integral components of this strategy.

- Strong Oil and Gas Performance: While transitioning to renewables, BP’s continued strong performance in the traditional oil and gas sector remains a crucial foundation for achieving its ambitious growth targets. Maintaining profitability in this area will provide the financial stability needed to fund investments in renewables.

However, significant challenges lie ahead:

- Geopolitical Instability: Global political events and their impact on energy prices pose a considerable risk. Fluctuations in oil and gas prices can significantly affect BP's profitability and its ability to reach its valuation goal.

- Intense Competition: The energy sector is fiercely competitive. Competition from other oil and gas companies, as well as emerging players in the renewable energy market, presents a significant hurdle.

- Regulatory Hurdles and Environmental Concerns: Stringent environmental regulations and growing public concern about climate change could impact BP's operations and investment decisions, potentially hindering the achievement of its ambitious targets.

Reasons Behind No US Listing

BP's decision to forgo a US listing, as reported by the FT, is a significant strategic choice. While the precise reasons given by BP would need to be referenced from the original FT article (and inserted here), potential factors could include:

- Regulatory Complexity: Navigating the complex regulatory landscape of the US stock market, with its stringent reporting requirements and potential legal challenges, might be perceived as more burdensome than remaining on its current exchanges.

- Shareholder Activism: US markets are known for higher levels of shareholder activism, potentially leading to increased pressure on management regarding strategic decisions and short-term performance.

- Listing Costs: The costs associated with a US listing, including legal fees, regulatory compliance, and marketing expenses, could be substantial.

Conversely, a US listing could offer several benefits, including increased investor access, potentially higher liquidity, and easier access to US capital markets. However, the disadvantages, as outlined above, seem to outweigh these advantages for BP at this time. The decision significantly impacts investor access and potential future capital raising strategies, possibly limiting the pool of investors.

Investor Reactions and Market Analysis

The market reaction to BP's ambitious valuation goals and the decision against a US listing would require analysis of market data post-publication of the FT report (and should be inserted here). Financial experts' and analysts' views on the feasibility of BP's plan should also be included here, alongside an examination of the impact on BP's share price and the wider energy market. Positive or negative movements in BP's share price, and the reaction of competing energy company stocks, would provide crucial insights into market sentiment.

Long-Term Strategy and Sustainability

BP's long-term strategic vision is intrinsically linked to its ambitious valuation target. The company's commitment to sustainability plays a pivotal role in attracting environmentally conscious investors and securing long-term growth.

- Renewable Energy Investments: BP's investments in renewable energy sources are not merely a public relations exercise; they are a fundamental part of its strategy to diversify its revenue streams and future-proof its business model, thereby contributing to increased BP company valuation.

- Decarbonization Efforts: The company's efforts to reduce its carbon footprint are essential for meeting evolving regulatory requirements and enhancing its reputation. This focus on sustainability is viewed as increasingly important by investors and consumers.

Conclusion

In summary, BP's bold strategy to double its company valuation involves a significant shift towards renewable energy and a strategic decision to avoid a US listing. While the ambitious target presents substantial challenges, including geopolitical instability and fierce competition, BP's focus on renewable energy and operational efficiency, if successfully executed, could potentially deliver the desired growth. Monitoring the progress of BP's strategic initiatives and the evolution of its market valuation will be crucial for investors and industry observers.

Call to Action: Stay informed on the progress of BP's strategic initiatives and the development of its market valuation. Follow reputable financial news sources for the latest updates on the BP company valuation and its impact on the global energy sector. Learn more about BP's sustainability efforts and how they contribute to its future growth. This ambitious plan promises significant changes within BP, and monitoring its progress will be crucial for investors and industry watchers alike.

Featured Posts

-

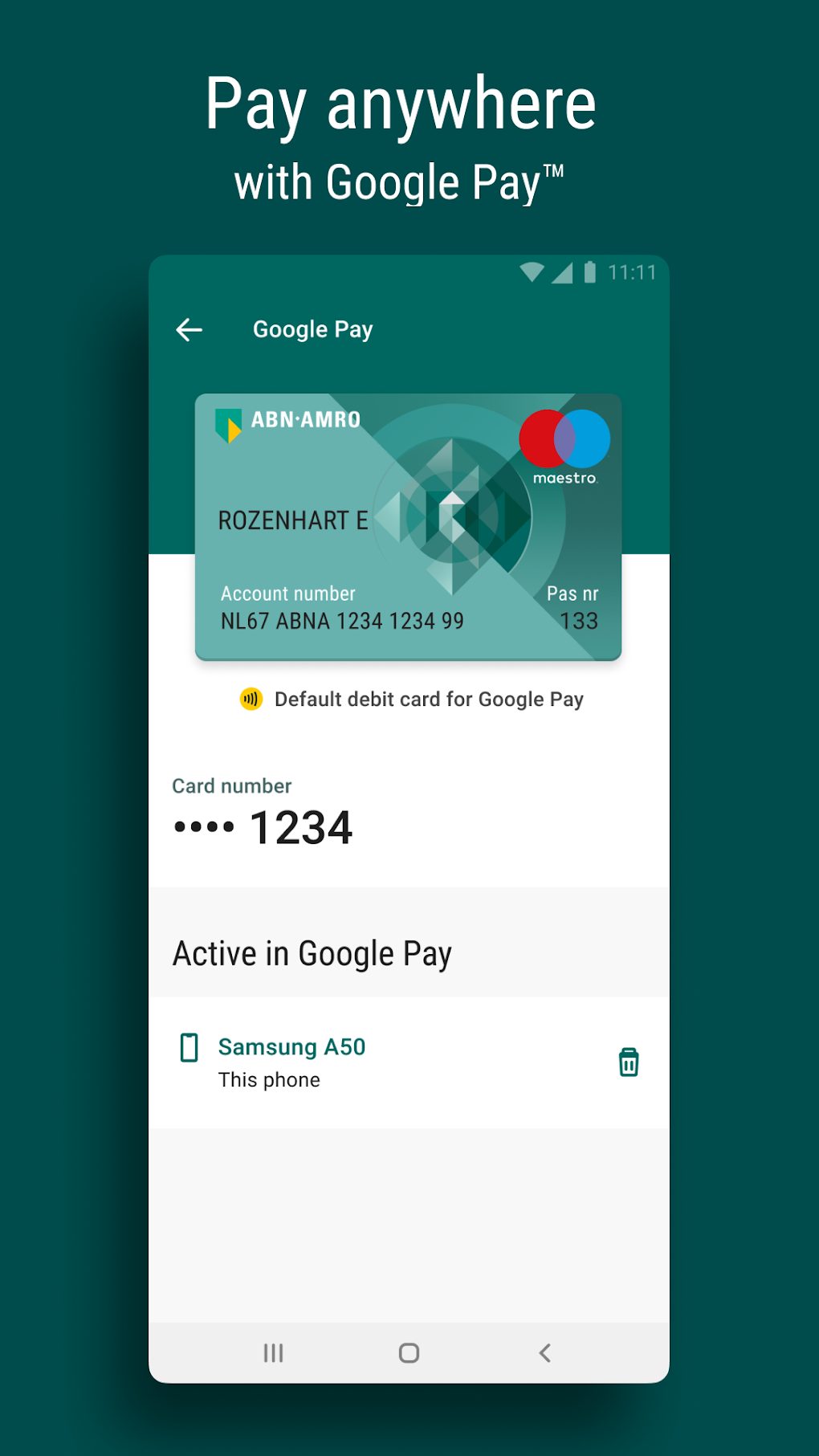

Huizenprijzen Is Nederland Aan Het Zaniken Volgens Abn Amro En Geen Stijl

May 21, 2025

Huizenprijzen Is Nederland Aan Het Zaniken Volgens Abn Amro En Geen Stijl

May 21, 2025 -

Table Tennis Star Oh Jun Sung Triumphs In Chennai

May 21, 2025

Table Tennis Star Oh Jun Sung Triumphs In Chennai

May 21, 2025 -

Klopp Un Gelecegi Son Dakika Transfer Soeylentileri Ve Analiz

May 21, 2025

Klopp Un Gelecegi Son Dakika Transfer Soeylentileri Ve Analiz

May 21, 2025 -

Kwartaalcijfers Abn Amro Impact Op Aex Koers

May 21, 2025

Kwartaalcijfers Abn Amro Impact Op Aex Koers

May 21, 2025 -

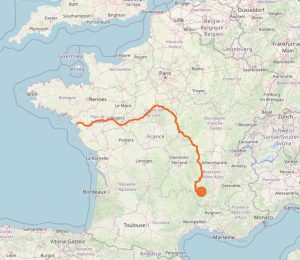

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Pour Le Decouvrir

May 21, 2025

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Pour Le Decouvrir

May 21, 2025

Latest Posts

-

The Trans Australia Run On The Cusp Of A New Record

May 21, 2025

The Trans Australia Run On The Cusp Of A New Record

May 21, 2025 -

Fastest Ever Mans Record Setting Australian Foot Crossing

May 21, 2025

Fastest Ever Mans Record Setting Australian Foot Crossing

May 21, 2025 -

A Bid To Conquer The Trans Australia Run World Record

May 21, 2025

A Bid To Conquer The Trans Australia Run World Record

May 21, 2025 -

Record Breaking Run Man Fastest To Cross Australia On Foot

May 21, 2025

Record Breaking Run Man Fastest To Cross Australia On Foot

May 21, 2025 -

Upcoming Trans Australia Run A Potential Record Breaker

May 21, 2025

Upcoming Trans Australia Run A Potential Record Breaker

May 21, 2025