BP Valuation To Double? CEO's Plans And FT Report

Table of Contents

The Financial Times Report: Key Findings and Implications

A recent Financial Times report fueled the discussion surrounding BP's potential valuation increase. The report's core argument hinges on BP's strategic shift towards renewable energy and its projected operational efficiencies.

-

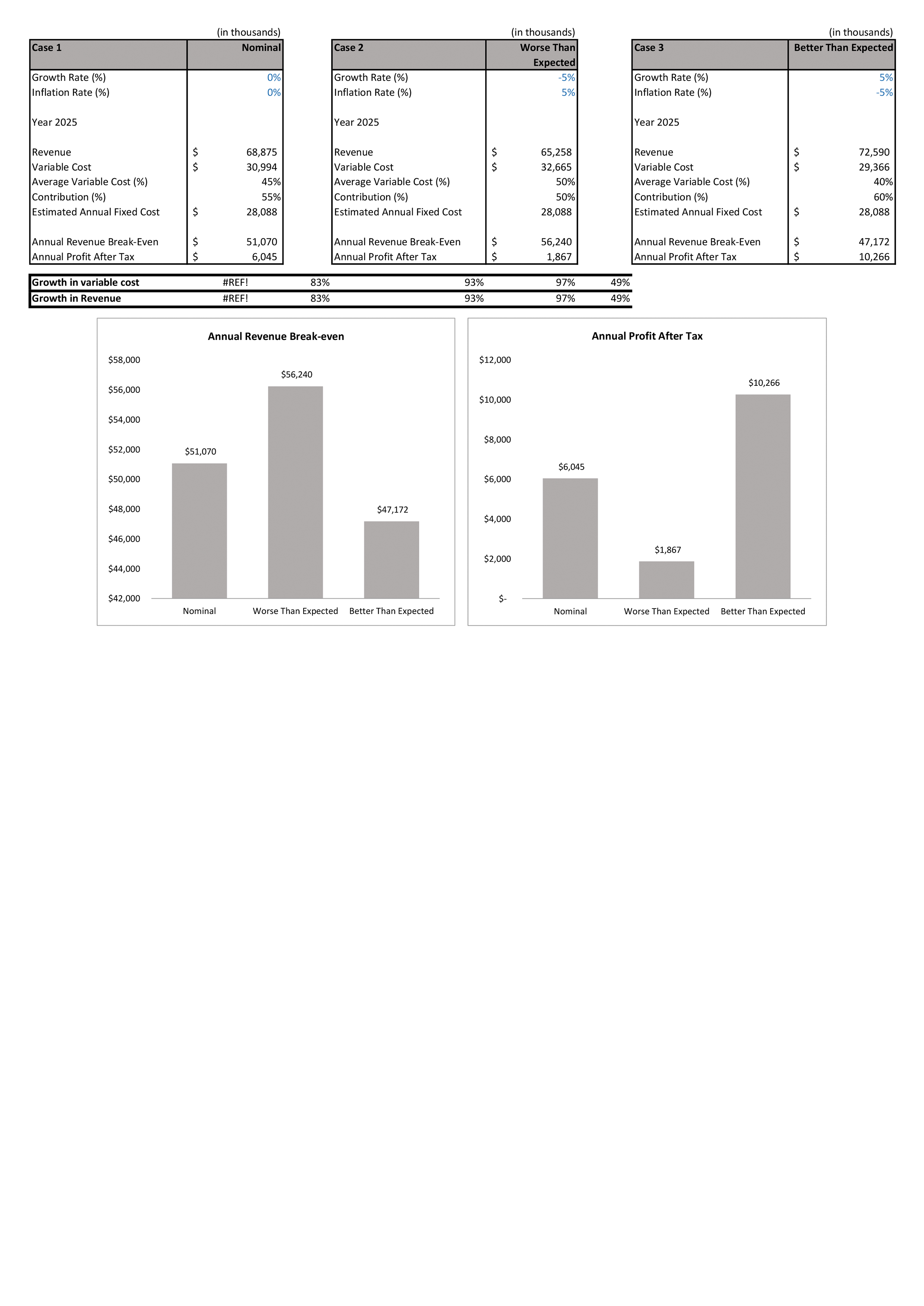

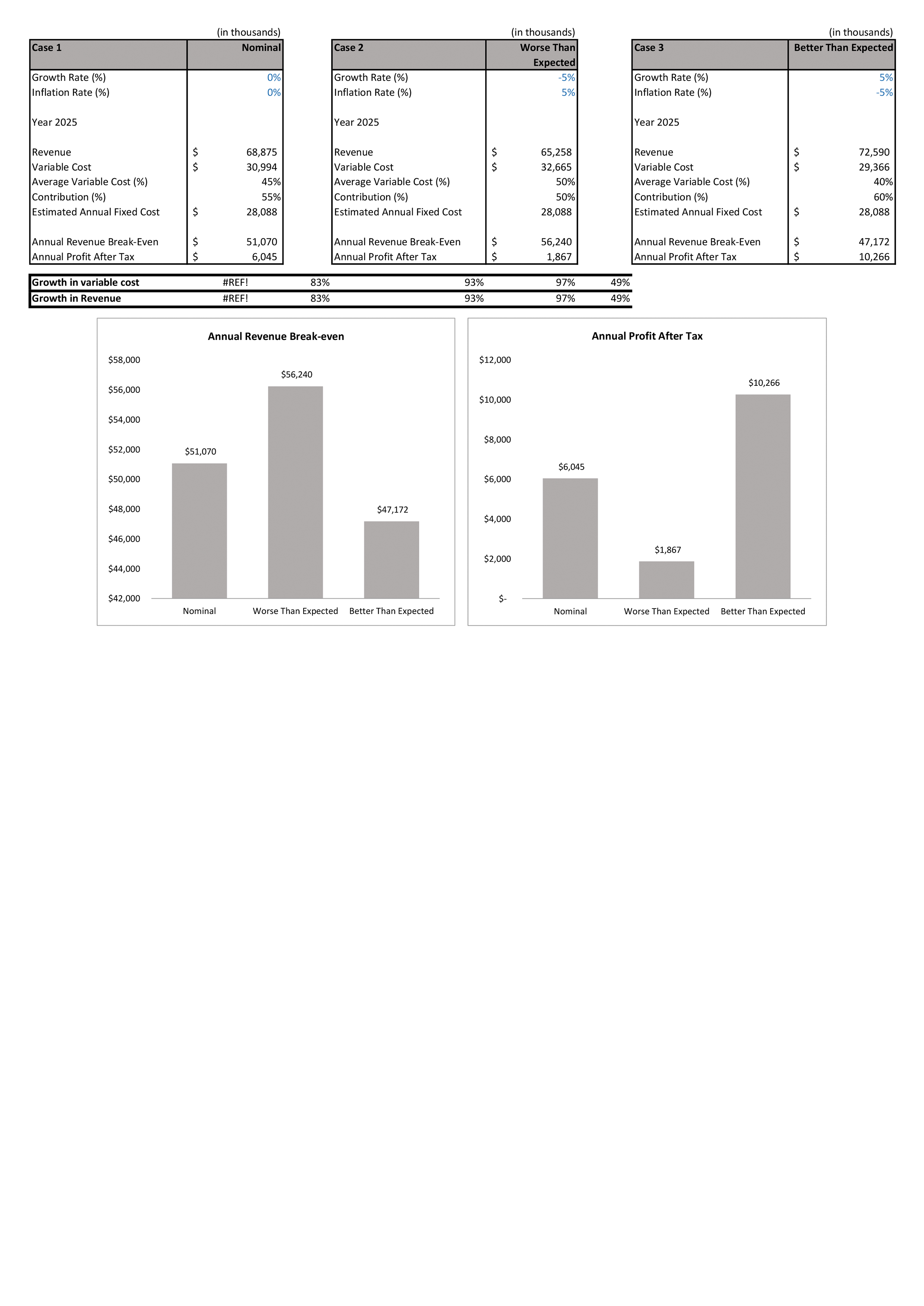

Specific projected growth numbers mentioned in the report: While the FT report didn't explicitly state a "doubling" of BP's valuation, it projected significant growth in earnings per share (EPS) over the next five years, driven by increased investment returns and cost reductions. Specific figures varied depending on different scenarios presented.

-

Key factors cited by the FT contributing to increased valuation: The FT highlighted several crucial factors, including:

- Significant investments in renewable energy: BP's commitment to expanding its renewable energy portfolio, including solar, wind, and hydrogen projects, was cited as a major driver of future growth.

- Improved operational efficiency: Streamlining operations and reducing costs were identified as key to improving profitability and investor confidence.

- Strategic divestments: The report also acknowledged that BP's strategic divestment of certain assets could free up capital for reinvestment in more profitable ventures.

-

Potential risks or caveats highlighted in the FT report: The FT report wasn't entirely optimistic. It acknowledged risks such as volatile oil prices, increased competition in the renewable energy sector, and the potential for regulatory changes to impact profitability.

-

Market reaction to the FT report: The stock market reacted positively to the FT report, with BP's share price experiencing a noticeable increase in the days following its publication. However, some analysts expressed caution, citing the need for BP to successfully execute its ambitious plans to achieve the projected growth.

CEO's Strategic Vision: Driving Force Behind Valuation Growth?

BP's CEO has outlined a bold strategic plan to transform the company into a leading player in the energy transition. This plan is central to the discussions surrounding a potential doubling of BP's valuation.

-

Specific investments in renewable energy sources: BP has committed billions of dollars to renewable energy projects, aiming to significantly expand its capacity in solar, wind, and hydrogen power generation.

-

Targets for reducing carbon emissions and their impact on BP's long-term sustainability: The company has set ambitious targets for reducing its carbon emissions, aiming to achieve net-zero emissions by a specific date. Meeting these targets is crucial for attracting environmentally conscious investors and maintaining its social license to operate.

-

Details on any restructuring efforts aimed at improving efficiency and profitability: BP is undertaking significant restructuring efforts to improve operational efficiency, reduce costs, and streamline its business operations. This includes streamlining its organizational structure and divesting from less profitable assets.

-

Credibility and feasibility of the CEO's plan: The CEO's plan is ambitious but faces several challenges. The success hinges on its ability to execute on its renewable energy investments, manage the transition away from fossil fuels, and navigate fluctuating oil prices and increasing competition.

Analyzing the Potential for a Doubled BP Valuation

The possibility of BP's valuation doubling is a complex question.

-

Strengths of BP's current position in the energy market: BP retains a significant presence in the oil and gas sector, providing a stable revenue stream. Its strong brand recognition and established global network are also significant assets.

-

Challenges and risks that could hinder the achievement of a doubled valuation: Fluctuating oil prices, intensified competition from other energy companies (both traditional and renewable), and the regulatory landscape present significant challenges. Geopolitical instability and unexpected economic downturns could also derail progress.

-

Comparative analysis of BP's valuation against competitors: Comparing BP's valuation multiples (like price-to-earnings ratio) to its competitors provides context, indicating whether its current valuation is undervalued or overvalued relative to peers.

-

Balanced perspective: A doubled valuation is a highly optimistic scenario. While the strategic shifts are promising, several factors could prevent it from becoming a reality. A more realistic projection may involve a significant but less dramatic increase in valuation.

Risks and Challenges to BP's Valuation Growth

Several factors could hinder BP's valuation growth.

-

Geopolitical instability and its effect on the energy market: Geopolitical events can significantly impact oil and gas prices, creating uncertainty and volatility.

-

Regulatory changes impacting the oil and gas industry: Governments worldwide are implementing stricter regulations on carbon emissions and fossil fuel exploration, which can constrain BP's operations and profitability.

-

The competitive landscape and the actions of rival energy companies: The energy sector is highly competitive, with established players and new entrants vying for market share. Aggressive competition could pressure BP's pricing and profitability.

-

Potential mitigation strategies: BP can mitigate some of these risks through diversification, strategic partnerships, and lobbying efforts to influence regulatory changes.

Conclusion

This article explored the potential for BP's valuation to double, analyzing the key factors driving this speculation. We examined the findings of the Financial Times report, the CEO's strategic vision, and the inherent risks and challenges. The possibility of a doubled BP valuation depends on the successful execution of ambitious plans, navigating a complex energy market, and overcoming significant challenges. While the potential for substantial growth is present, a doubled valuation remains a highly optimistic scenario.

Call to Action: Stay informed about the future of BP and its potential for growth. Continue researching BP valuation and its strategic initiatives to make informed investment decisions. Follow further developments on the BP valuation and the CEO's plans to assess the likelihood of this ambitious target being reached.

Featured Posts

-

Watch The New Looney Tunes Animated Short With Cartoon Network Stars 2025

May 22, 2025

Watch The New Looney Tunes Animated Short With Cartoon Network Stars 2025

May 22, 2025 -

Abn Amro Aex Stijging Analyse Van De Kwartaalresultaten

May 22, 2025

Abn Amro Aex Stijging Analyse Van De Kwartaalresultaten

May 22, 2025 -

Week End Velo En Loire Atlantique Nantes Vignoble Et Estuaire

May 22, 2025

Week End Velo En Loire Atlantique Nantes Vignoble Et Estuaire

May 22, 2025 -

Love Monster A Childrens Book Review

May 22, 2025

Love Monster A Childrens Book Review

May 22, 2025 -

I Hope You Rot In Hell Pub Landlords Vicious Verbal Attack On Employee

May 22, 2025

I Hope You Rot In Hell Pub Landlords Vicious Verbal Attack On Employee

May 22, 2025

Latest Posts

-

Analyse Stijgende Occasionverkoop Bij Abn Amro En De Toekomst Van De Automarkt

May 22, 2025

Analyse Stijgende Occasionverkoop Bij Abn Amro En De Toekomst Van De Automarkt

May 22, 2025 -

Abn Amro Rapporteert Flinke Toename Occasionverkoop Impact Van De Groeiende Vraag

May 22, 2025

Abn Amro Rapporteert Flinke Toename Occasionverkoop Impact Van De Groeiende Vraag

May 22, 2025 -

Abn Amro Ziet Occasionverkoop Explosief Stijgen Analyse Van De Groeiende Automarkt

May 22, 2025

Abn Amro Ziet Occasionverkoop Explosief Stijgen Analyse Van De Groeiende Automarkt

May 22, 2025 -

Hypotheekmarkt Karin Polman Neemt Directierole Op Zich Bij Abn Amro Florius En Moneyou

May 22, 2025

Hypotheekmarkt Karin Polman Neemt Directierole Op Zich Bij Abn Amro Florius En Moneyou

May 22, 2025 -

Abn Amro En Transferz Samenwerking Voor Innovatieve Digitale Oplossingen

May 22, 2025

Abn Amro En Transferz Samenwerking Voor Innovatieve Digitale Oplossingen

May 22, 2025