BP's Chief Executive Plans To Double The Company's Valuation, According To The FT

Table of Contents

BP's Current Valuation and Market Position

Understanding BP's current valuation is crucial to assessing the feasibility of doubling it. As of [Insert Date], BP's market capitalization sits at approximately [Insert Current Market Cap - Source needed]. This places it [Insert Position - e.g., second or third] among its major competitors, such as Shell and ExxonMobil. A comparison reveals that Shell boasts a market cap of [Insert Shell Market Cap - Source needed], while ExxonMobil stands at [Insert ExxonMobil Market Cap - Source needed]. These figures highlight the scale of the challenge facing BP's CEO.

- Current market cap of BP: [Insert Current Market Cap - Source needed]

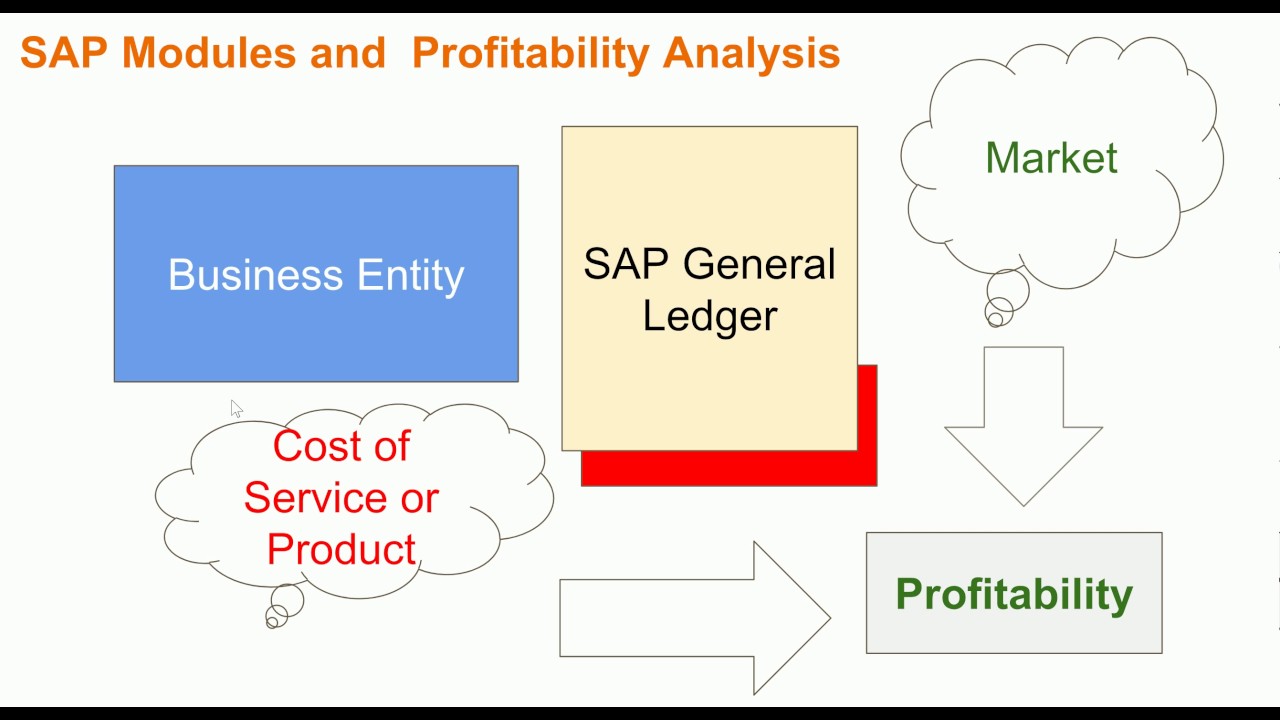

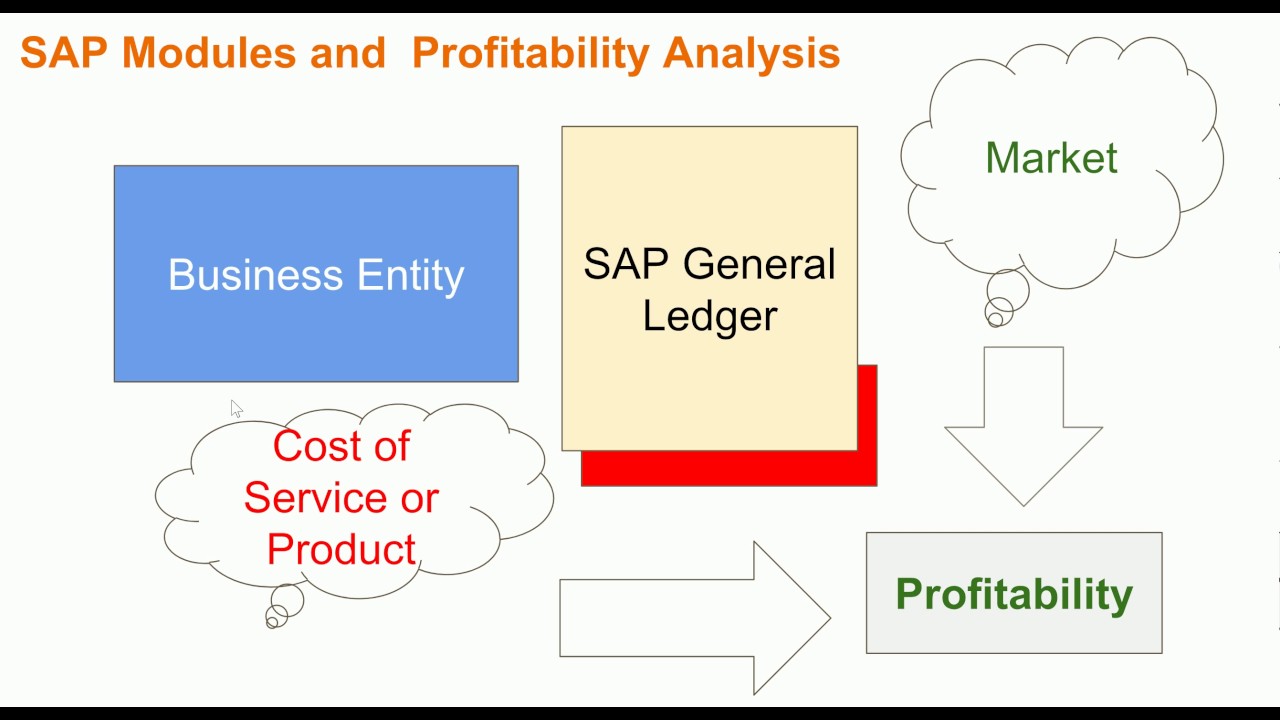

- Key performance indicators (KPIs) affecting BP's valuation: Profitability, revenue growth, debt levels, ESG (Environmental, Social, and Governance) performance, and investor sentiment.

- Comparison to competitor valuations: BP lags behind Shell and ExxonMobil in terms of market capitalization, indicating a need for significant growth.

- Analysis of BP's recent stock performance: [Insert recent stock performance data and analysis - Source needed]. This provides insights into investor confidence and market perception.

Key Strategies for Doubling BP's Valuation

The FT article outlines several key strategies intended to propel BP's valuation to unprecedented heights. These include a significant shift towards renewable energy, operational efficiency improvements, and strategic cost-cutting measures.

- Increased investment in renewable energy sources (solar, wind, etc.): BP plans to drastically increase its investments in renewable energy technologies, aiming to become a major player in the green energy transition. This diversification aims to attract environmentally conscious investors.

- Technological advancements and efficiency improvements in oil and gas operations: Optimizing existing oil and gas operations through technological advancements will boost profitability and enhance efficiency, improving the overall BP valuation.

- Cost reduction strategies and streamlining operations: Identifying and eliminating redundancies within the company's structure will free up capital for reinvestment in growth areas.

- Exploration and development of new energy resources: Investing in research and development of innovative energy solutions will position BP at the forefront of the energy sector's evolution.

- Potential mergers and acquisitions to enhance market share: Strategic acquisitions of smaller companies operating in complementary sectors could accelerate growth and expand BP's market reach.

Challenges and Potential Risks

Doubling BP's valuation presents formidable challenges. The volatile nature of the energy market, geopolitical instability, and increasing regulatory scrutiny all pose significant risks.

- Volatility of oil and gas prices: Fluctuations in oil prices directly impact BP's profitability and, consequently, its valuation.

- Geopolitical risks impacting energy markets: Global events, such as wars or political instability in key oil-producing regions, can create uncertainty and negatively affect BP's operations.

- Intense competition within the energy sector: Competition from established players and new entrants in both fossil fuels and renewables creates a highly competitive environment.

- Regulatory challenges and environmental concerns: Stringent environmental regulations and increasing public pressure on fossil fuel companies can lead to higher compliance costs and reputational risks.

- Public perception and pressure on fossil fuel investments: Growing concerns about climate change are impacting investor sentiment towards fossil fuel companies, potentially limiting investment opportunities.

Investor and Market Reaction

The initial market reaction to the FT report was [Insert Description of Market Reaction - e.g., mixed, positive, negative]. [Insert Stock Price Movement Data – Source needed]. Analyst opinions vary, with some expressing optimism about BP's long-term prospects while others remain cautious due to the inherent risks involved. Investor sentiment will likely be closely tied to BP’s progress in delivering on its ambitious goals.

- Stock price movement following the FT report: [Insert details and source]

- Analyst opinions and forecasts: [Summary of analyst opinions and forecasts – source needed]

- Investor confidence and investment strategies: [Analysis of investor confidence and potential investment strategies]

Conclusion

BP's CEO has set an ambitious goal: to double BP's valuation. This involves a multifaceted strategy encompassing increased investment in renewables, operational efficiencies, cost-cutting, and potential acquisitions. However, significant challenges remain, including volatile oil prices, geopolitical risks, and the transition to a low-carbon economy. The success of this plan will depend heavily on navigating these challenges and effectively executing the outlined strategies. Stay informed about the progress of BP's ambitious plan to double its valuation. Follow our updates on BP's valuation and the energy sector for the latest news and analysis.

Featured Posts

-

Little Britain Cancelled In 2020 Understanding Gen Zs Unexpected Obsession

May 21, 2025

Little Britain Cancelled In 2020 Understanding Gen Zs Unexpected Obsession

May 21, 2025 -

Mission Patrimoine 2025 La Restauration De Sites Bretons A Plouzane Et Clisson

May 21, 2025

Mission Patrimoine 2025 La Restauration De Sites Bretons A Plouzane Et Clisson

May 21, 2025 -

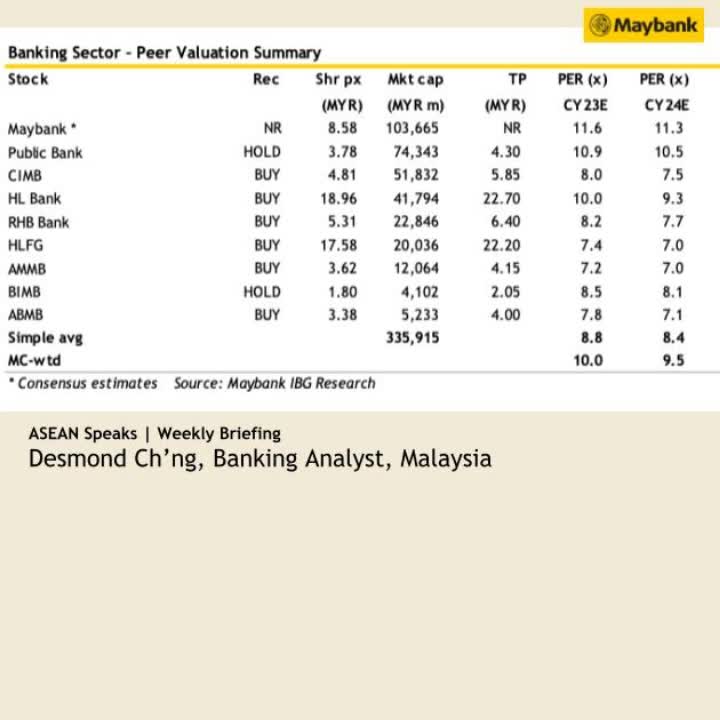

Maybanks 545 Million Economic Zone Investment Boost

May 21, 2025

Maybanks 545 Million Economic Zone Investment Boost

May 21, 2025 -

Le Grand Quiz De La Loire Atlantique Histoire Gastronomie Culture

May 21, 2025

Le Grand Quiz De La Loire Atlantique Histoire Gastronomie Culture

May 21, 2025 -

Early Exit For Aruna At Wtt Chennai Open

May 21, 2025

Early Exit For Aruna At Wtt Chennai Open

May 21, 2025

Latest Posts

-

Femicide In The Spotlight Recent Murders Of Colombian Model And Mexican Influencer Spark Global Condemnation

May 21, 2025

Femicide In The Spotlight Recent Murders Of Colombian Model And Mexican Influencer Spark Global Condemnation

May 21, 2025 -

Is Your College Town Next Understanding The Risks Of Enrollment Decline

May 21, 2025

Is Your College Town Next Understanding The Risks Of Enrollment Decline

May 21, 2025 -

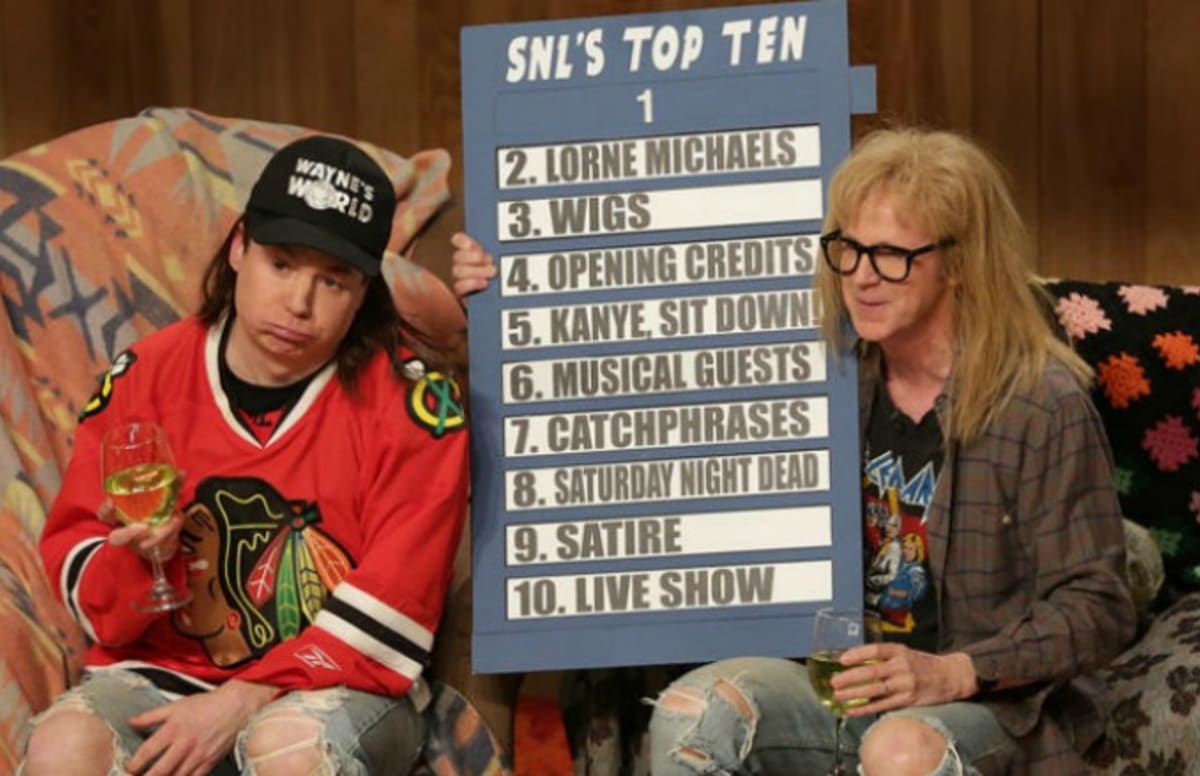

Snl Season 50 Finale Shatters Ratings Records

May 21, 2025

Snl Season 50 Finale Shatters Ratings Records

May 21, 2025 -

Lufthansa Flight Investigation 10 Minutes Without A Pilot After Co Pilot Collapses

May 21, 2025

Lufthansa Flight Investigation 10 Minutes Without A Pilot After Co Pilot Collapses

May 21, 2025 -

The Rise Of Femicide Causes And Consequences

May 21, 2025

The Rise Of Femicide Causes And Consequences

May 21, 2025