Brazil's Banking Power Shift: BRB Challenges The Giants After Banco Master Buy

Table of Contents

BRB's Strategic Acquisition of Banco Master

BRB's purchase of Banco Master represents a bold move with far-reaching consequences. Let's examine the deal's financial implications and its impact on BRB's market reach.

Analyzing the Deal's Financial Implications

While precise financial details may not be publicly available immediately following such acquisitions, analyzing the potential impact is crucial.

- Market Capitalization: The acquisition is expected to significantly increase BRB's market capitalization, solidifying its position as a major player in the Brazilian banking sector. The exact figures will depend on the final purchase price and subsequent market reactions.

- Synergies and Cost Savings: Combining operations offers significant potential for cost savings through streamlined processes, shared infrastructure, and economies of scale. This increased efficiency should improve BRB's profitability.

- Balance Sheet and Loan Portfolio: Integrating Banco Master's loan portfolio into BRB's existing assets will alter the bank's overall risk profile. Careful management of this integration will be critical for maintaining financial stability. A thorough due diligence process was likely conducted to assess any potential risks associated with the acquired assets.

Expanding BRB's Market Reach and Customer Base

Banco Master brought a substantial existing customer base and geographic reach to BRB.

- Market Share and Geographic Presence: Banco Master held a notable market share in specific regions of Brazil, particularly in [Insert specific regions if known]. This acquisition extends BRB's footprint into previously underserved areas.

- New Customer Segments: The acquisition allows BRB to access new customer segments, diversifying its client base and reducing reliance on any single market segment. This diversification reduces risk and opens up new revenue streams.

- Cross-Selling Opportunities: BRB can now cross-sell its existing products and services to Banco Master's customer base and vice-versa, generating increased revenue and strengthening customer relationships.

- Growth Strategy: This acquisition is a key component of BRB's aggressive growth strategy, aiming to challenge the dominance of larger Brazilian banks. This signals a proactive approach to market expansion.

The Impact on the Brazilian Banking Sector

The BRB/Banco Master merger has significant ramifications for the entire Brazilian banking sector.

Increased Competition and Market Dynamics

This acquisition significantly alters the competitive landscape.

- Competitive Landscape: The combined entity of BRB and Banco Master creates a stronger competitor for the established banking giants, leading to increased competition and potentially lower prices for consumers.

- Reactions from Other Banks: Expect other major Brazilian banks to respond strategically, possibly through their own mergers, acquisitions, or enhanced service offerings to maintain their market share.

- Interest Rates and Lending Practices: Increased competition could lead to more competitive interest rates and improved lending practices for both consumers and businesses.

- Further Mergers and Acquisitions: This acquisition could trigger a wave of further mergers and acquisitions within the Brazilian banking sector as other institutions seek to consolidate their position and compete effectively.

Implications for Brazilian Consumers and Businesses

The acquisition's consequences extend directly to consumers and businesses.

- Benefits for Consumers: Consumers may benefit from increased choice, improved services, and potentially more competitive pricing for banking products and services.

- Implications for Businesses: Businesses can potentially benefit from increased access to credit and a wider range of financial products tailored to their needs.

- Financial Inclusion: The expanded reach of BRB might lead to improved financial inclusion, especially in previously underserved areas, making banking services more accessible.

- Potential Risks and Challenges: While there are numerous potential benefits, consumers and businesses should remain aware of potential risks associated with any major banking merger, including potential service disruptions during the integration process.

BRB's Future Growth and Expansion Strategies

BRB's long-term vision and objectives are significantly influenced by this acquisition.

Long-Term Vision and Objectives

The acquisition is a major step towards BRB's long-term goals.

- Strategic Goals: BRB's stated goals likely include achieving a larger market share, enhanced profitability, and establishing itself as a leading player in the Brazilian banking industry.

- Investment in Technology and Innovation: Expect increased investment in technology and innovation to streamline operations, enhance customer experience, and improve risk management capabilities.

- International Expansion: While not immediately apparent, future international expansion plans may be part of BRB's long-term vision to become a truly global banking institution.

- Sustainability of Growth: The sustainability of BRB's growth trajectory will depend on various factors, including the successful integration of Banco Master, effective management of risks, and adaptability to changing market conditions.

Challenges and Risks for BRB

Despite the opportunities, BRB faces challenges.

- Integration Challenges: Integrating two banking systems is a complex undertaking, requiring careful planning and execution to avoid service disruptions and operational inefficiencies.

- Regulatory Hurdles and Compliance Issues: BRB must navigate regulatory hurdles and ensure full compliance with all applicable laws and regulations throughout the integration process.

- Economic Uncertainties: The Brazilian economy's volatility poses a risk to BRB's growth trajectory. Effective risk management is crucial.

- Risks Associated with Expansion: Expansion strategies carry inherent risks, including potential market entry challenges, competition from established players, and adapting to different market dynamics.

Conclusion

BRB's acquisition of Banco Master represents a significant turning point in Brazil's banking sector. This bold move has the potential to reshape the competitive landscape, offering both opportunities and challenges for consumers, businesses, and the industry as a whole. The long-term impact remains to be seen, but one thing is certain: BRB's strategic play has intensified competition and sets the stage for a dynamic period of change within the Brazilian financial market. To stay informed about the evolving dynamics and future developments in this crucial sector, continue to follow updates on BRB’s progress and the broader implications of this significant banking power shift. Stay tuned for further analysis on the impact of this strategic acquisition and how BRB's actions continue to reshape the landscape of Brazilian banking. The future of Brazilian banking, and the role of BRB within it, is a story still unfolding, and understanding the implications of this acquisition is crucial for anyone involved in or observing the Brazilian financial market.

Featured Posts

-

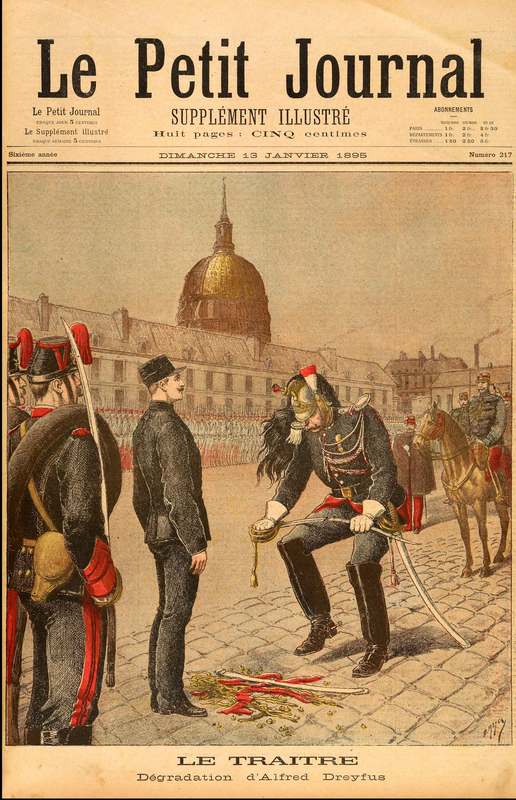

Dreyfus Affair A Century Late Push For Military Promotion

May 24, 2025

Dreyfus Affair A Century Late Push For Military Promotion

May 24, 2025 -

First Official Ferrari Service Centre Opens In Bengaluru A Comprehensive Overview

May 24, 2025

First Official Ferrari Service Centre Opens In Bengaluru A Comprehensive Overview

May 24, 2025 -

The New Single From Joy Crookes Carmen

May 24, 2025

The New Single From Joy Crookes Carmen

May 24, 2025 -

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025 -

Analyzing The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Analyzing The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Latest Posts

-

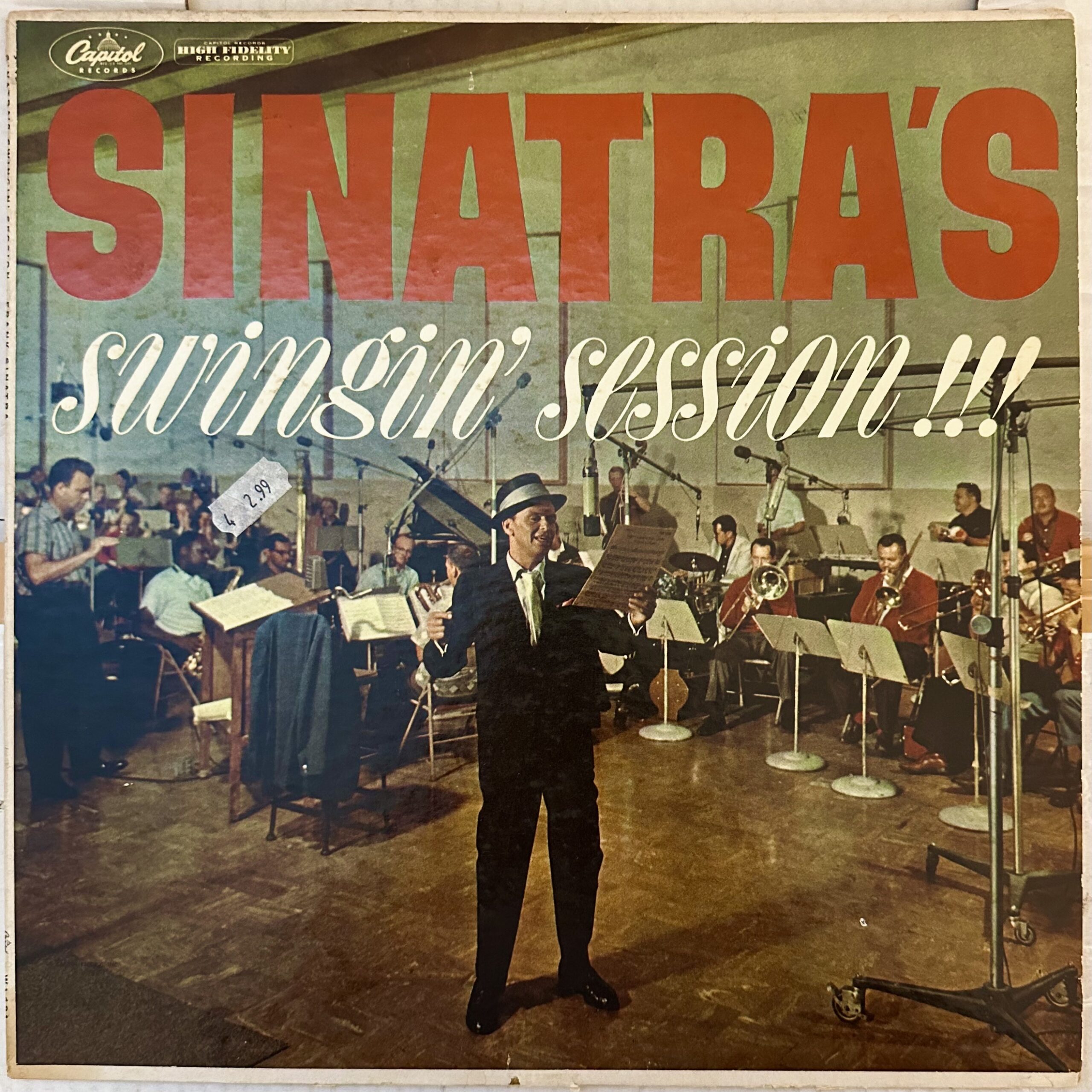

Frank Sinatras Marital History His Wives And Their Stories

May 24, 2025

Frank Sinatras Marital History His Wives And Their Stories

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 24, 2025 -

The Four Women Who Loved Frank Sinatra Exploring His Marriages

May 24, 2025

The Four Women Who Loved Frank Sinatra Exploring His Marriages

May 24, 2025 -

From Grace To Disgrace 17 Celebrity Reputations Ruined Overnight

May 24, 2025

From Grace To Disgrace 17 Celebrity Reputations Ruined Overnight

May 24, 2025 -

17 Celebrities Who Destroyed Their Careers In 24 Hours

May 24, 2025

17 Celebrities Who Destroyed Their Careers In 24 Hours

May 24, 2025