Brexit's Negative Influence On UK Luxury Exports To The EU Market

Table of Contents

Increased Trade Barriers and Bureaucracy

Brexit has erected a formidable wall of trade barriers between the UK and the EU, impacting the luxury sector disproportionately. The introduction of new customs checks, tariffs, and non-tariff barriers (NTBs) has dramatically increased the cost and complexity of exporting luxury goods. Exporters now face a mountain of paperwork, certifications, and compliance requirements that were previously nonexistent.

This bureaucratic burden translates into tangible losses. For example, delays in wine shipments due to increased customs inspections can lead to spoilage and significant financial losses for producers. Similarly, the increased costs associated with shipping high-end clothing, along with the added risk of goods being held up at customs, significantly diminishes profit margins.

- Increased transportation costs: Shipping costs have risen substantially, eroding the profitability of already high-value items.

- Delays in delivery times leading to loss of sales: Delayed shipments can result in missed deadlines and lost sales, particularly in the time-sensitive luxury market.

- Higher compliance costs for paperwork and certifications: The administrative burden of complying with new regulations significantly increases operational expenses.

- Risk of goods being held up at customs: The increased scrutiny at customs points creates uncertainty and potential delays, disrupting supply chains and impacting customer satisfaction.

Weakened Pound and Currency Fluctuations

The weakening of the pound sterling (£) against the euro (€) since Brexit has further exacerbated the challenges faced by UK luxury exporters. This makes UK luxury goods significantly more expensive for EU consumers, reducing their purchasing power and competitiveness. The volatile nature of currency fluctuations also makes it incredibly difficult for businesses to accurately forecast costs and set prices, impacting profitability and long-term planning.

A visual representation of the pound's performance against the euro since the Brexit referendum would clearly illustrate this point. The instability creates uncertainty and risk, discouraging investment and hindering growth within the luxury sector.

- Reduced purchasing power for EU consumers: Higher prices due to currency fluctuations directly reduce demand from EU consumers.

- Price competitiveness issues compared to competitors: UK luxury brands now face stiffer competition from brands in the Eurozone that offer similar products at lower prices.

- Difficulty in forecasting costs and setting prices effectively: Currency fluctuations make it challenging for businesses to maintain consistent pricing and profitability.

Loss of Access to the EU Single Market

Perhaps the most significant blow to UK luxury exports is the loss of frictionless trade within the EU single market. Before Brexit, UK luxury goods enjoyed seamless access to this vast and affluent market. Now, the complexities of navigating customs procedures, regulatory hurdles, and differing standards create significant obstacles. This impacts not only the direct export of goods but also the intricate supply chains that underpin the luxury industry.

The loss of preferential trade access further disadvantages UK luxury brands, making them less attractive to distributors and retailers within the EU.

- Increased complexity of supply chain management: Navigating the new trade regulations adds layers of complexity to already intricate supply chains.

- Loss of market access benefits previously enjoyed: The ease of access to the EU market, a key advantage for UK luxury brands, is now significantly diminished.

- Difficulty in reaching key distribution networks within the EU: Establishing and maintaining strong relationships with EU distributors has become more challenging and costly.

The Impact on Specific Luxury Sectors

Several luxury sectors have been particularly hard hit by Brexit. The Scotch whisky industry, for example, has experienced a significant decline in exports to the EU. Similarly, the high-end fashion and luxury car sectors have also faced substantial challenges. Specific brands and companies within these sectors could be cited to illustrate the real-world impact of Brexit on individual businesses. Data and statistics on export volumes before and after Brexit would strengthen this section's argument.

Conclusion: Navigating the Challenges of Brexit for UK Luxury Exports

Brexit has undeniably had a severe negative influence on UK luxury exports to the EU market. The increased trade barriers, currency fluctuations, and loss of single market access have created significant economic consequences for businesses and the UK economy as a whole. The future outlook remains challenging, requiring UK luxury exporters to adapt, innovate, and navigate a more complex and costly trading environment.

To understand the full extent of the challenges and contribute to a potential recovery, further research into the Brexit impact analysis is vital. We must actively support UK luxury goods recovery by understanding the nuances of these challenges and supporting British brands through informed policy discussions and advocacy. Let’s work together to address the lingering negative impacts of Brexit on UK luxury exports and build a more resilient future for this important sector.

Featured Posts

-

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025 -

14 279 Voies Abidjan Le Point Sur Le Projet D Adressage

May 20, 2025

14 279 Voies Abidjan Le Point Sur Le Projet D Adressage

May 20, 2025 -

Solve The Nyt Mini Crossword March 27 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 27 Answers

May 20, 2025 -

Aldhkae Alastnaey W Aghatha Krysty Imkanyat La Hdwd Lha Fy Ealm Aladb

May 20, 2025

Aldhkae Alastnaey W Aghatha Krysty Imkanyat La Hdwd Lha Fy Ealm Aladb

May 20, 2025 -

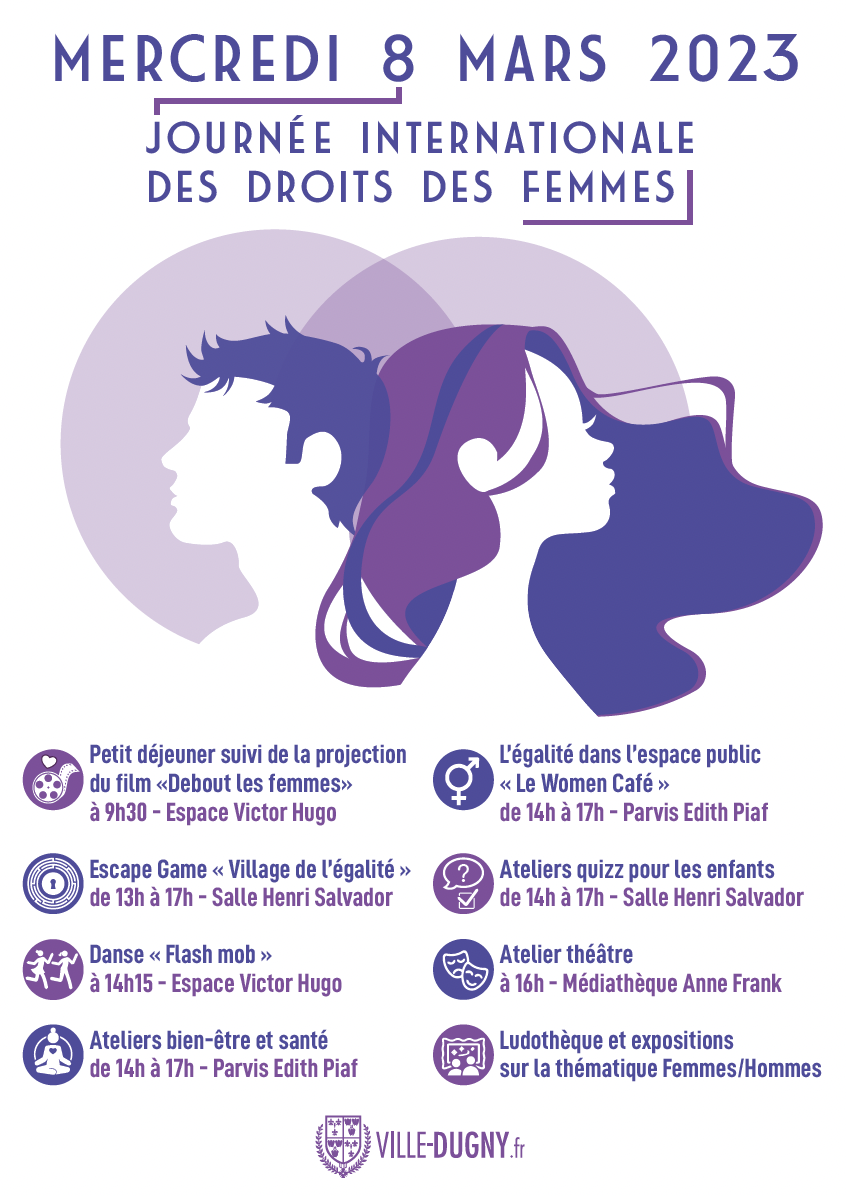

Journee Internationale Des Droits Des Femmes Echanges A Biarritz

May 20, 2025

Journee Internationale Des Droits Des Femmes Echanges A Biarritz

May 20, 2025