Broadcom's VMware Acquisition: A 1,050% Price Spike For AT&T

Table of Contents

Understanding Broadcom's Acquisition of VMware

Broadcom, a leading semiconductor company, successfully acquired VMware, a virtualization and cloud computing giant, in a deal valued at approximately $61 billion. This Broadcom VMware deal signifies a major consolidation within the enterprise software and semiconductor industries. Broadcom's rationale centers on expanding its software portfolio and strengthening its position in the burgeoning cloud computing market. The acquisition combines Broadcom's hardware expertise with VMware's leading software solutions, creating a powerful force in the tech industry.

- Acquisition Timeline: The acquisition process spanned several months, including regulatory approvals and shareholder votes, finally concluding in late 2023.

- Broadcom's Strategic Goals: Broadcom aims to integrate VMware's technology into its existing offerings, creating a more comprehensive and competitive suite of products for enterprise clients. This includes leveraging VMware's expertise in cloud infrastructure, virtualization, and software-defined networking.

- Market Reactions and Regulatory Hurdles: The acquisition faced scrutiny from regulators concerned about potential anti-competitive practices. However, the deal ultimately received the necessary approvals, resulting in a significant positive market reaction.

AT&T's VMware Investment: A Pre-Acquisition Perspective

Prior to the Broadcom VMware deal, AT&T held a substantial investment in VMware stock. The exact size of their holdings wasn't publicly disclosed in detail, but it was significant enough to yield enormous profits following the acquisition. AT&T likely held VMware stock as part of its broader investment strategy, recognizing VMware's dominant position in the enterprise software market and its potential for growth.

- AT&T's Technology Infrastructure: AT&T, a major telecommunications company, relies heavily on robust and scalable technology infrastructure. VMware products likely played a crucial role in managing and virtualizing AT&T's networks and data centers.

- AT&T's Investment Strategy: AT&T's investment portfolio reflects a diversified approach, aiming to spread risk across various sectors while generating healthy returns. VMware represented a significant holding within this diversified strategy.

- Public Statements: While AT&T didn't publicly discuss the specifics of their VMware holdings extensively before the acquisition, their overall investment strategy generally focuses on long-term growth and technological innovation.

The 1,050% Price Spike: Analyzing the Impact on AT&T

The announcement of Broadcom's acquisition sent shockwaves through the market, resulting in a dramatic 1,050% surge in VMware's stock price. This was driven by market speculation about the value of VMware's technology within Broadcom's broader portfolio and the premium Broadcom was willing to pay. This surge directly translated into massive gains for AT&T.

- Profit Increase Calculation: While precise figures require knowledge of AT&T's exact holdings, a 1,050% increase represents a phenomenal return on investment. This represents a significant boost to AT&T's financial performance.

- Tax Implications: The substantial capital gains from this investment will undoubtedly have significant tax implications for AT&T. They will need to account for these gains in their financial reporting and pay the corresponding taxes.

- Strategic Options: Following the acquisition, AT&T now has the strategic option to hold onto the increased value or sell its shares, realizing the significant profits generated by the acquisition.

Long-Term Implications for AT&T and the Broader Market

The Broadcom VMware acquisition carries substantial long-term implications for AT&T and the broader market. The integration of VMware's technology into Broadcom's portfolio could reshape the competitive landscape in the telecommunications and enterprise software sectors.

- Changes to AT&T's Infrastructure: Depending on the integration strategy, AT&T may see changes in its technology infrastructure, potentially leveraging new capabilities offered by the combined Broadcom-VMware entity.

- Impact on Market Competition: The merger could lead to increased competition or consolidation in the market, impacting other players in the cloud computing and enterprise software sectors.

- Future Market Trends: This acquisition highlights the ongoing consolidation and innovation within the technology industry, indicating a future where large, integrated companies dominate various sectors.

Conclusion: Navigating the Post-Acquisition Landscape of Broadcom and VMware

Broadcom's acquisition of VMware proved exceptionally lucrative for AT&T, resulting in a remarkable 1,050% price spike for its VMware investment. This underscores the significant impact mergers and acquisitions can have on investment strategies. Understanding the dynamics of such technology mergers, like the Broadcom VMware deal, is crucial for navigating the evolving landscape of the technology sector. Stay informed about the ongoing developments surrounding the integration of VMware into Broadcom and the broader implications for the market. Keep your eye on how VMware's price surge influences future investment strategies in the rapidly changing world of technology. Understanding these shifts is key to making informed investment decisions in the future.

Featured Posts

-

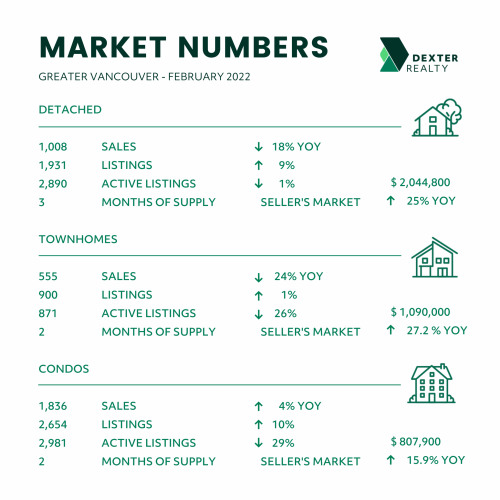

Metro Vancouver Housing Market Update Slower Rent Growth Persistent Cost Increases

Apr 28, 2025

Metro Vancouver Housing Market Update Slower Rent Growth Persistent Cost Increases

Apr 28, 2025 -

Mets Biggest Rival Dominant Pitcher Performance

Apr 28, 2025

Mets Biggest Rival Dominant Pitcher Performance

Apr 28, 2025 -

Chat Gpt And Open Ai Facing An Ftc Investigation

Apr 28, 2025

Chat Gpt And Open Ai Facing An Ftc Investigation

Apr 28, 2025 -

Antlaq Fealyat Fn Abwzby Fy 19 Nwfmbr

Apr 28, 2025

Antlaq Fealyat Fn Abwzby Fy 19 Nwfmbr

Apr 28, 2025 -

Legal Showdown Minnesota Challenges Trumps Transgender Athlete Ban

Apr 28, 2025

Legal Showdown Minnesota Challenges Trumps Transgender Athlete Ban

Apr 28, 2025

Latest Posts

-

Adam Sandlers Oscars 2025 Appearance A Detailed Look At The Outfit Jokes And Chalamet Interaction

May 11, 2025

Adam Sandlers Oscars 2025 Appearance A Detailed Look At The Outfit Jokes And Chalamet Interaction

May 11, 2025 -

A Former Singapore Airlines Stewardess Shares Her Story Latest Updates

May 11, 2025

A Former Singapore Airlines Stewardess Shares Her Story Latest Updates

May 11, 2025 -

Rochelle Humes Roksanda Show Hairstyle A Front Row Look

May 11, 2025

Rochelle Humes Roksanda Show Hairstyle A Front Row Look

May 11, 2025 -

Oscars 2025 Adam Sandlers Cameo Hilarious Outfit And Timothee Chalamet Hug

May 11, 2025

Oscars 2025 Adam Sandlers Cameo Hilarious Outfit And Timothee Chalamet Hug

May 11, 2025 -

From Serving Passengers To Taking Flight An Ex Sia Flight Attendants Journey To Becoming A Pilot

May 11, 2025

From Serving Passengers To Taking Flight An Ex Sia Flight Attendants Journey To Becoming A Pilot

May 11, 2025