Broadcom's VMware Acquisition: AT&T Highlights A Potential 1,050% Price Surge

Table of Contents

Understanding the Broadcom-VMware Merger

The Broadcom-VMware merger represents a monumental shift in the technology landscape. Broadcom, renowned for its expertise in semiconductors and networking hardware, gains control of VMware, a dominant force in virtualization, cloud infrastructure, and enterprise software. This union creates a behemoth with unparalleled market power, potentially leading to increased dominance across multiple sectors.

- Broadcom's Expertise: Broadcom brings extensive experience in designing and manufacturing high-performance networking chips and other hardware essential for modern data centers and cloud infrastructure.

- VMware's Leading Position: VMware's virtualization software, vSphere, is ubiquitous in enterprise data centers, and its cloud platforms like VMware Cloud on AWS are critical to many businesses.

- Synergies and Market Domination: The synergy between Broadcom's hardware and VMware's software promises enhanced performance and integration, potentially leading to a near-monopoly in certain segments of the market. This combined power could influence pricing across the board.

AT&T's Reliance on VMware and Broadcom Technologies

AT&T, a major player in telecommunications, relies heavily on both VMware and Broadcom technologies for its network infrastructure and operations. The merger could significantly impact AT&T's network operations, costs, and service offerings.

- VMware Products Used by AT&T: AT&T likely utilizes VMware vSphere for server virtualization, vCenter for management, and potentially other VMware cloud solutions.

- Broadcom Products Used by AT&T: AT&T’s network infrastructure likely incorporates Broadcom's networking chips and switching solutions, crucial for routing data traffic.

- Dependence on Core Services: These technologies are integral to AT&T's core services, from voice and data communications to its cloud offerings. Any disruption or price increase from the merger could be substantial.

Analyzing the Potential 1,050% Price Surge Claim

The claim of a 1,050% price surge for AT&T services is dramatic and needs careful examination. While the merger could lead to increased prices, such a massive jump requires significant context.

- Potential Scenarios for Price Increases: Reduced competition due to the merger's increased market power is a significant factor. Increased demand for combined Broadcom-VMware solutions could also drive prices up.

- Factors Mitigating the Price Surge: The existence of alternative providers, regulatory scrutiny, and potential antitrust investigations could limit the extent of price increases. AT&T might also explore alternative vendors to reduce dependence on the merged entity.

- AT&T's Response: AT&T's response will be crucial. They might negotiate aggressively with Broadcom, seek alternative technologies, or even challenge the merger through legal channels.

Implications for AT&T Customers and the Broader Market

The Broadcom-VMware merger has far-reaching implications, affecting AT&T customers, competitors, and the broader IT landscape.

- Impact on Consumer Pricing: Higher costs for AT&T could directly translate into increased prices for consumers for various services.

- Impact on Other Telecom Providers: Other telecom companies relying on VMware and Broadcom will face similar challenges and might experience pressure to increase prices to maintain profitability.

- Long-Term Implications: The merger's long-term effects on competition, innovation, and the future development of cloud computing and networking technologies remain to be seen.

Conclusion: Navigating the Post-Merger Landscape of Broadcom and VMware

The Broadcom-VMware merger presents a complex scenario with significant uncertainty. While the potential for substantial price increases exists, especially for companies like AT&T, the extent of these increases will depend on numerous factors, including regulatory actions and competitive responses. The 1,050% figure, while attention-grabbing, needs further substantiation. Stay updated on the Broadcom VMware acquisition and monitor the impact of the Broadcom VMware merger on your telecom costs. Understanding the evolving situation is crucial for businesses and consumers alike.

Featured Posts

-

Caso Becciu Oltre Il Danno La Beffa Per Gli Accusatori Il Risarcimento

Apr 30, 2025

Caso Becciu Oltre Il Danno La Beffa Per Gli Accusatori Il Risarcimento

Apr 30, 2025 -

Schneider Electric Accelerates Womens Careers In Nigeria Iwd Initiatives

Apr 30, 2025

Schneider Electric Accelerates Womens Careers In Nigeria Iwd Initiatives

Apr 30, 2025 -

Familys Plea San Diego Jail Inmate Died After Hours Of Untended Torture

Apr 30, 2025

Familys Plea San Diego Jail Inmate Died After Hours Of Untended Torture

Apr 30, 2025 -

Horrific Accident Car Strikes Afterschool Program Multiple Child Fatalities

Apr 30, 2025

Horrific Accident Car Strikes Afterschool Program Multiple Child Fatalities

Apr 30, 2025 -

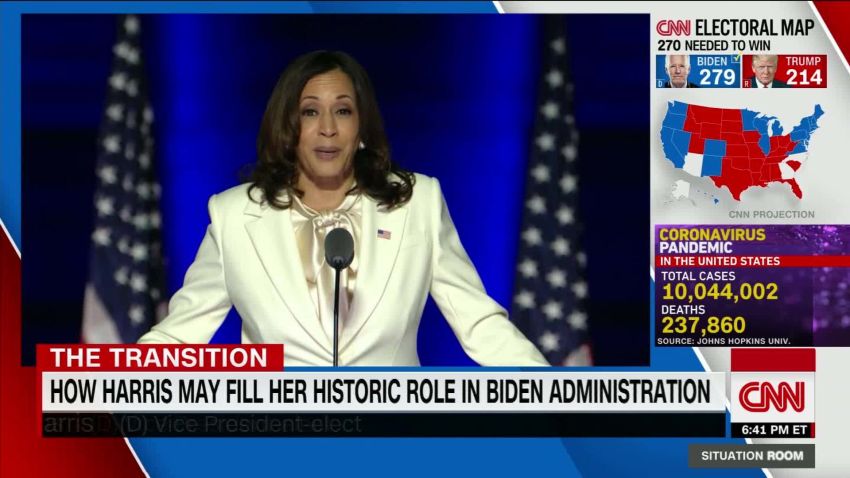

Kamala Harriss Evolving Role

Apr 30, 2025

Kamala Harriss Evolving Role

Apr 30, 2025