Broadcom's VMware Acquisition: AT&T Highlights Extreme Cost Increase Of 1,050%

Table of Contents

The VMware Acquisition: A Deep Dive into Broadcom's Strategy

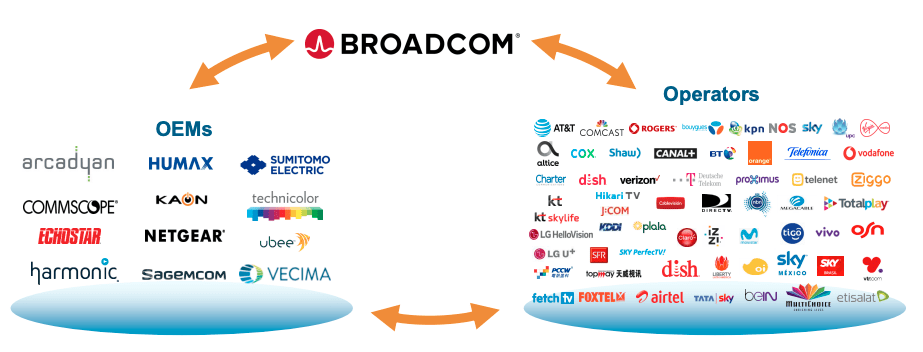

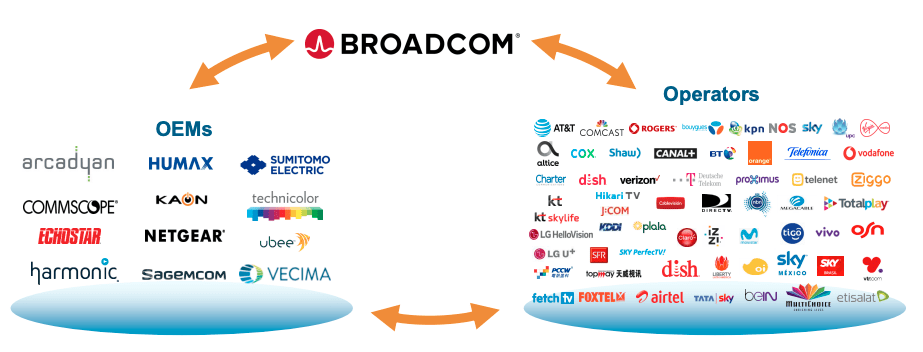

Broadcom's acquisition of VMware, a leading provider of virtualization and cloud infrastructure software, represents a significant strategic move for the semiconductor giant. Broadcom's primary motivation lies in expanding its reach beyond its core semiconductor business into the lucrative and rapidly growing market of enterprise software and cloud infrastructure. This acquisition allows them to leverage VMware's extensive customer base and technological expertise to diversify their revenue streams and strengthen their position in the technology ecosystem.

The potential benefits for Broadcom are substantial:

- Increased market dominance in enterprise infrastructure: The combined entity controls a significant portion of the market, potentially leading to increased pricing power.

- Diversification beyond semiconductor manufacturing: This move reduces Broadcom's reliance on a single sector, mitigating risk and enhancing long-term stability.

- Potential for innovation through combining technologies: Synergies between Broadcom's hardware and VMware's software could lead to innovative solutions and new product offerings.

However, concerns remain:

- Risks related to integration: Merging two large companies with distinct cultures and technologies presents significant integration challenges.

- Potential customer migration: Existing VMware customers may seek alternative solutions due to concerns about increased prices or changes in service.

- Antitrust issues: Regulatory scrutiny is inevitable, with potential antitrust concerns raised due to the increased market concentration.

AT&T's 1050% Cost Increase: A Case Study of Post-Acquisition Impacts

AT&T's experience serves as a stark warning of the potential negative consequences of the Broadcom-VMware merger. The reported 1050% increase in costs is a dramatic illustration of the pricing power that the combined entity now possesses. While the exact reasons behind this drastic increase remain unclear, several factors are likely at play:

- New pricing structures: Broadcom may have implemented new pricing models that significantly increase costs for existing VMware customers.

- Contract renegotiations: AT&T's contracts may have been renegotiated under less favorable terms, leading to substantially higher fees.

- Lack of competition: The reduced competition in the market following the acquisition could have emboldened Broadcom to increase prices aggressively.

The impact on AT&T is substantial:

- Significant budget constraints: The massive price hike could force AT&T to make significant budget cuts in other areas.

- Service adjustments: AT&T might need to adjust its services or offerings to offset the increased costs, potentially impacting customers.

- Potential legal challenges: AT&T may explore legal avenues to address the dramatic increase in costs.

Broader Implications and Future Outlook: The Ripple Effect on the Tech Industry

The Broadcom-VMware acquisition has far-reaching implications for the entire tech industry. The potential for similar cost increases for other VMware customers is a major concern. This event raises serious questions about the future of competition and pricing in the enterprise software market.

- Potential for increased prices across the enterprise software market: Other vendors might be emboldened to increase their prices, potentially squeezing businesses' budgets.

- Impact on innovation due to decreased competition: Reduced competition can stifle innovation as companies have less incentive to develop better products or services.

- Regulatory scrutiny and potential antitrust concerns: Expect increased regulatory scrutiny and potential antitrust investigations in the coming months and years.

- Long-term forecast for VMware and Broadcom's integration: The success of the integration will depend on many factors, including effective management, technological compatibility, and customer retention.

Conclusion: Understanding the Broadcom-VMware Acquisition and its Cost Implications

The Broadcom-VMware acquisition is a pivotal moment in the tech industry, with AT&T's staggering 1050% cost increase serving as a stark reminder of the potential consequences. The acquisition’s impact on competition, pricing, and innovation requires close monitoring. Businesses relying on VMware services must carefully analyze their own cost implications and explore alternative solutions if necessary. The long-term effects are still unfolding, but it's clear this merger will reshape the enterprise software landscape. To stay updated on the Broadcom VMware merger and monitor the cost implications of the Broadcom acquisition, subscribe to our newsletter for expert analysis and insights into the evolving landscape of the Broadcom VMware integration.

Featured Posts

-

Nba Fans Anxious Jimmy Butler Injury Could Impact Warriors Rockets Game 4

May 15, 2025

Nba Fans Anxious Jimmy Butler Injury Could Impact Warriors Rockets Game 4

May 15, 2025 -

Watch Senators Vs Maple Leafs Live Nhl Playoffs Game 2 April 22 2025

May 15, 2025

Watch Senators Vs Maple Leafs Live Nhl Playoffs Game 2 April 22 2025

May 15, 2025 -

Bruins En Npo Toezichthouder Bespreken Leeflang Kwestie

May 15, 2025

Bruins En Npo Toezichthouder Bespreken Leeflang Kwestie

May 15, 2025 -

Earthquakes Loss To Rapids Exposes Goalkeeping Weakness Steffen Under Scrutiny

May 15, 2025

Earthquakes Loss To Rapids Exposes Goalkeeping Weakness Steffen Under Scrutiny

May 15, 2025 -

Roma Monza Sigue El Partido En Directo

May 15, 2025

Roma Monza Sigue El Partido En Directo

May 15, 2025