Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Hike Concerns

Table of Contents

AT&T's Concerns Regarding Increased VMware Pricing

AT&T's anxieties regarding the Broadcom-VMware deal are not unfounded. The acquisition has the potential to significantly disrupt the telecommunications landscape and impact AT&T's bottom line.

Direct Impact on AT&T's Infrastructure

AT&T's reliance on VMware products for its network infrastructure is substantial.

- Extensive VMware Deployment: AT&T utilizes VMware's virtualization and cloud solutions across its vast network, supporting crucial services like its mobile network, internet services, and enterprise solutions.

- Operational Budget Impact: A significant price hike on VMware products could represent millions, even billions, of dollars in increased operational expenses for AT&T. This would directly impact their profit margins and necessitate difficult budgetary decisions.

- Potential for Service Disruptions: Facing substantial price increases, AT&T might be forced to consider cost-cutting measures. This could involve scaling back services, delaying upgrades, or even impacting the quality of services provided to customers.

- Significant IT Spending: AT&T's annual spending on IT infrastructure is immense. Even a modest percentage increase in VMware licensing fees could represent a massive financial burden.

Ripple Effects on AT&T's Services and Customers

The increased costs associated with the Broadcom VMware acquisition won't be contained within AT&T's internal operations.

- Increased Service Prices: To offset rising operational costs, AT&T might be compelled to increase prices for its services to consumers and businesses, potentially impacting customer retention.

- Competitive Disadvantage: Higher prices could put AT&T at a competitive disadvantage against rivals who don't face the same VMware-related cost pressures.

- Potential Customer Churn: Price increases could lead to customer churn, especially among price-sensitive segments. This would negatively impact AT&T's market share and revenue.

- Expert Opinion: Industry analysts predict a potential negative impact on AT&T's profitability and competitiveness due to this acquisition, citing the significant reliance on VMware's technologies within their operational structure.

Broadcom's Acquisition Strategy and Potential for Monopoly Power

Broadcom's history of acquisitions and its post-acquisition pricing practices are key to understanding the potential implications of the VMware deal.

Broadcom's Past Acquisitions and Pricing Practices

Broadcom has a track record of acquiring companies and subsequently adjusting pricing strategies.

- Acquisition History: A review of Broadcom's previous acquisitions reveals a pattern of integrating acquired technologies into their existing product lines and, in some cases, increasing prices.

- Post-Acquisition Pricing Analysis: Examining price changes following past Broadcom acquisitions provides some indication of potential future pricing strategies for VMware products. Data suggests an upward trend in pricing for similar products post-acquisition.

- Evidence of Price Increases: Specific examples of price increases after previous acquisitions, coupled with financial data, help support the assertion of a potential pricing trend.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom-VMware merger has attracted significant antitrust scrutiny.

- Antitrust Issues: The acquisition raises concerns about reduced competition in the enterprise software market, potentially leading to monopolistic practices.

- Regulatory Investigations: Regulatory bodies are currently investigating the merger, assessing its potential impact on competition and pricing. The outcome of these investigations will be crucial.

- Potential Legal Challenges: Legal challenges to the merger are possible, and their outcome could significantly influence Broadcom's pricing strategies for VMware products.

Impact on the Broader Enterprise Software Market

The Broadcom VMware acquisition will likely have far-reaching consequences for the entire enterprise software market.

Reduced Competition and Increased Prices

The merger significantly reduces competition in the virtualization and cloud computing markets.

- Market Dominance: Broadcom's control over VMware's market-leading technologies could create a dominant player, reducing alternatives for businesses.

- Widespread Price Increases: The elimination of significant competition increases the likelihood of VMware price increases across the board, not just for AT&T.

- Industry Parallels: Similar acquisitions in other industries have shown that reduced competition often leads to increased prices for consumers and businesses.

Shifting Dynamics in Cloud Computing

The acquisition will reshape the dynamics of the cloud computing landscape.

- Cloud Provider Strategies: Cloud providers will need to adjust their strategies in response to the increased market consolidation and potential price increases from VMware.

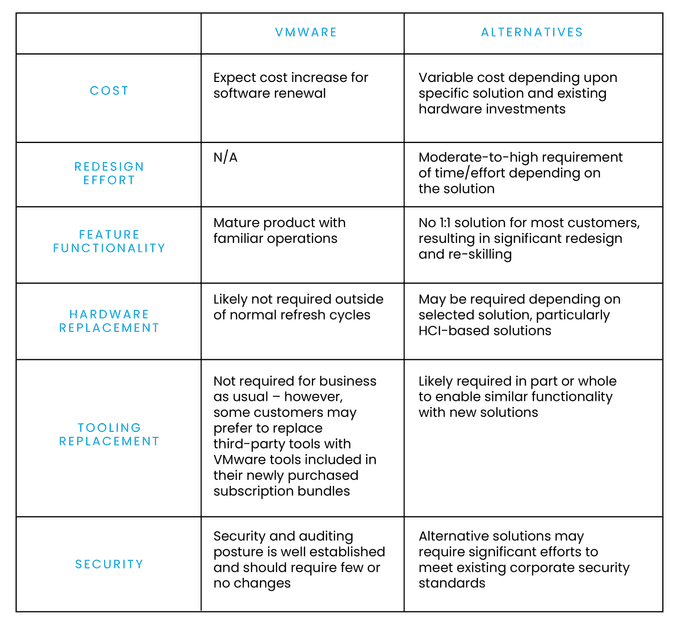

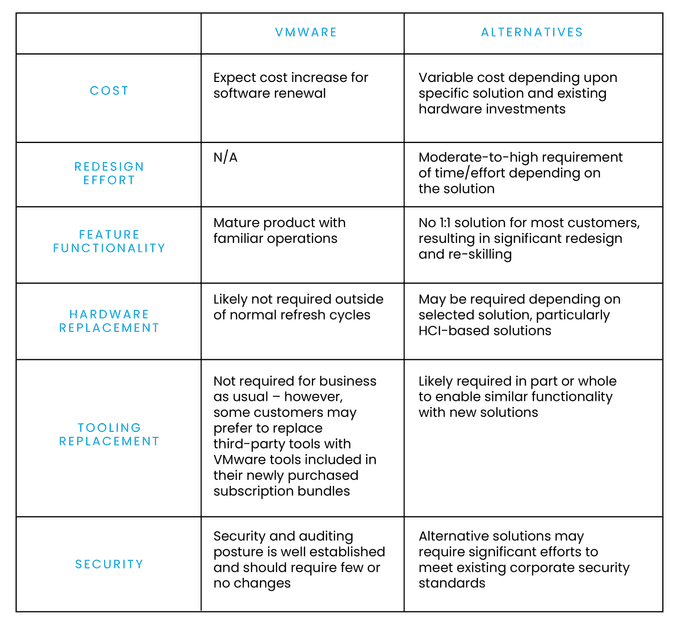

- Alternative Solutions: Businesses may be driven to seek alternative virtualization and cloud solutions to avoid the potential price increases associated with VMware.

- Market Share Shifts: The acquisition could lead to shifts in market share among cloud providers as businesses explore alternative options.

Conclusion

AT&T's concerns regarding potential price hikes following the Broadcom VMware acquisition are valid and highlight the potential for significant disruption within the enterprise software market. Broadcom's acquisition history, the potential for reduced competition, and the ongoing regulatory scrutiny all point to the possibility of substantial price increases for VMware products. This could impact not only AT&T but businesses of all sizes reliant on VMware technologies for their critical infrastructure. The Broadcom VMware acquisition presents a critical juncture. Staying informed about developments and exploring alternative solutions is crucial for businesses to mitigate potential price hikes stemming from this merger. Continue following updates on the Broadcom VMware acquisition to protect your business's bottom line.

Featured Posts

-

Franco Colapinto And Sergio Perez Lead Tributes To F1 Figure

May 09, 2025

Franco Colapinto And Sergio Perez Lead Tributes To F1 Figure

May 09, 2025 -

Handhaving Van De Relatie Brekelmans India Uitdagingen En Kansen

May 09, 2025

Handhaving Van De Relatie Brekelmans India Uitdagingen En Kansen

May 09, 2025 -

Rakesh Sharma Indias First Astronaut His Journey And Current Endeavors

May 09, 2025

Rakesh Sharma Indias First Astronaut His Journey And Current Endeavors

May 09, 2025 -

Analyzing The Potential Success Or Failure Of The Monkey In 2025

May 09, 2025

Analyzing The Potential Success Or Failure Of The Monkey In 2025

May 09, 2025 -

Barbashev Scores In Ot Golden Knights Beat Wild Series Tied 2 2

May 09, 2025

Barbashev Scores In Ot Golden Knights Beat Wild Series Tied 2 2

May 09, 2025

Latest Posts

-

Palantir Stock Prediction 2025 40 Growth Time To Buy Or Sell

May 09, 2025

Palantir Stock Prediction 2025 40 Growth Time To Buy Or Sell

May 09, 2025 -

R3

May 09, 2025

R3

May 09, 2025 -

Indian Stock Market Update Sensex And Niftys Significant Rise

May 09, 2025

Indian Stock Market Update Sensex And Niftys Significant Rise

May 09, 2025 -

Stock Market Live Sensex Nifty Rally Detailed Market Analysis

May 09, 2025

Stock Market Live Sensex Nifty Rally Detailed Market Analysis

May 09, 2025 -

R3 2

May 09, 2025

R3 2

May 09, 2025