Broadcom's VMware Deal: AT&T Exposes A Potential 1,050% Cost Increase

Table of Contents

Broadcom's acquisition of VMware has sent shockwaves through the tech industry, with potentially devastating consequences for many businesses. The most dramatic example? AT&T, facing a projected 1050% increase in VMware licensing costs. This massive price hike isn't just an AT&T problem; it highlights the significant implications of this deal for businesses of all sizes and across various sectors, forcing a critical reassessment of vendor lock-in, pricing strategies, and the future of virtualization technology.

The Broadcom-VMware Deal: A Deep Dive

Understanding the Merger and its Market Impact:

Broadcom's acquisition of VMware represents a major consolidation in the technology landscape. Broadcom, known for its semiconductor and infrastructure solutions, significantly expands its software portfolio with VMware, a dominant player in virtualization and cloud infrastructure. This merger creates a powerful combined entity with the potential to influence pricing and innovation across multiple markets. While proponents point to potential synergies and efficiency gains, concerns remain about reduced competition and the potential for monopolistic practices. Regulatory scrutiny is intense, with antitrust investigations underway in several jurisdictions.

- Broadcom's acquisition strategy: A clear pattern of acquiring key players in software and networking to create a comprehensive, vertically integrated technology ecosystem.

- VMware's market position: A leading provider of server virtualization, cloud computing, and networking solutions, holding a significant market share across various industries.

- Potential synergies: Integration of VMware's software with Broadcom's hardware could potentially lead to performance improvements and optimized solutions. However, the actual benefits remain to be seen.

- Antitrust concerns: The merger faces intense scrutiny from regulators globally, concerned about its potential impact on competition and the pricing power of the combined entity.

AT&T's Case Study: A 1050% Cost Increase

AT&T's situation serves as a stark warning. The reported 1050% cost increase is not just a significant financial burden; it's a symbol of the potential risks inherent in relying heavily on a single vendor. AT&T's extensive use of VMware across its network infrastructure makes it particularly vulnerable to these price hikes. The company is likely exploring various options, including renegotiating contracts, seeking alternative virtualization solutions like those offered by Nutanix or Red Hat, and potentially absorbing some of the increased costs, though this will inevitably impact profitability and competitiveness.

- AT&T's VMware dependence: A significant portion of AT&T's network infrastructure relies on VMware’s virtualization technologies.

- Projected cost increase: This staggering increase of 1050% represents a dramatic shift in costs for AT&T, illustrating the potential impact on their bottom line.

- AT&T's response: The telecom giant is likely exploring all possible avenues, from negotiation and legal action to seeking alternative providers and technological solutions.

- Telecom sector impact: Other large telecom firms, also heavily reliant on VMware, are likely facing similar pressure, creating instability in the sector.

Impact on Other Businesses and Industries:

The ramifications of Broadcom's acquisition extend far beyond AT&T. Businesses across various industries, particularly those heavily reliant on VMware solutions such as finance, healthcare, and government, may face significant cost increases. Smaller businesses, lacking the bargaining power of larger corporations, may be disproportionately affected. This situation underscores the importance of diversified IT infrastructure and the exploration of alternative virtualization technologies to prevent vendor lock-in.

- Broader industry impact: A ripple effect is anticipated, with numerous companies, irrespective of size, facing challenges due to increased VMware licensing costs.

- Vulnerable industries: Sectors with high reliance on VMware, such as finance, telecom, and healthcare, are most at risk of substantial cost increases.

- Impact on small businesses: Smaller companies are likely to be hit harder, with limited options to mitigate cost increases.

- Alternative virtualization technologies: Open-source solutions and other virtualization platforms offer a path toward mitigating risk and avoiding vendor lock-in.

Conclusion: Navigating the Post-Acquisition Landscape: Mitigating Risks from Broadcom's VMware Deal

Broadcom's acquisition of VMware creates a complex and potentially volatile landscape for businesses. AT&T's experience underscores the critical need for proactive risk mitigation. Businesses must evaluate their reliance on VMware, explore alternative virtualization technologies, and strengthen their negotiating positions to avoid being caught off guard by potential price increases. Understanding the implications of this merger is crucial for long-term IT planning and financial stability. Don't wait for a 1050% cost increase to act; assess your VMware strategy and develop a plan to mitigate the risks associated with Broadcom's VMware deal.

Featured Posts

-

Baltimore Orioles Hit Streak Ends Announcers Jinx A Factor

Apr 28, 2025

Baltimore Orioles Hit Streak Ends Announcers Jinx A Factor

Apr 28, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 28, 2025

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 28, 2025 -

Richard Jeffersons Espn Future Uncertainty Surrounds Nba Finals Coverage

Apr 28, 2025

Richard Jeffersons Espn Future Uncertainty Surrounds Nba Finals Coverage

Apr 28, 2025 -

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025 -

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Remain High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Remain High

Apr 28, 2025

Latest Posts

-

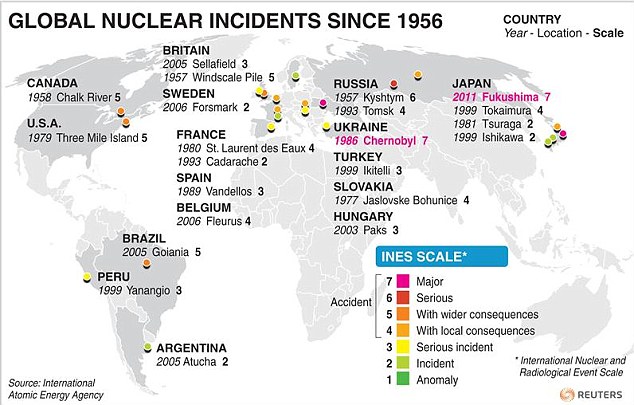

Faster Nuclear Power Plants Trump Administrations New Approach

May 11, 2025

Faster Nuclear Power Plants Trump Administrations New Approach

May 11, 2025 -

Nuclear Power Plant Construction Trump Team Weighs Faster Timeline

May 11, 2025

Nuclear Power Plant Construction Trump Team Weighs Faster Timeline

May 11, 2025 -

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 11, 2025

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 11, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 11, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 11, 2025 -

The Shrinking Chinese Market A Threat To Bmw Porsche And Competitors

May 11, 2025

The Shrinking Chinese Market A Threat To Bmw Porsche And Competitors

May 11, 2025