Buy-and-Hold: Facing The Harsh Realities Of Long-Term Investing

Table of Contents

Understanding the Buy-and-Hold Strategy

Buy-and-hold investing, at its core, is a long-term investment strategy focused on minimizing trading activity. The fundamental tenets involve selecting investments you believe in, holding them through market fluctuations (both upswings and downturns), and reaping the rewards of compounding returns over an extended period. This approach theoretically minimizes transaction costs and maximizes tax efficiency, as capital gains taxes are only incurred upon selling the asset.

The theoretical benefits are significant: compounding allows your returns to generate further returns, creating a snowball effect over time. Reduced trading means lower brokerage fees and less time spent managing your portfolio. Tax efficiency is another advantage, particularly with dividend-paying stocks or assets held in tax-advantaged accounts.

Different buy-and-hold strategies exist. Some investors favor index fund investing, passively tracking a broad market index like the S&P 500. Others prefer a more active approach, carefully selecting individual stocks believed to have long-term growth potential.

Advantages of Buy and Hold:

- Simplicity and ease of execution.

- Potential for significant long-term growth through compounding.

- Reduced stress from frequent trading and market timing attempts.

- Tax efficiency due to lower turnover.

The Psychological Challenges of Buy-and-Hold

While the financial theory behind buy-and-hold is sound, the psychological challenges are substantial. Market downturns can be emotionally draining, tempting investors to panic-sell at the worst possible time, locking in losses and missing out on potential future gains. Sticking to your investment plan during prolonged periods of underperformance requires discipline and resilience.

Fear of Missing Out (FOMO) also plays a significant role. Seeing other investments soar while your buy-and-hold portfolio lags can lead to second-guessing your strategy and impulsive decisions. A well-defined investment plan, based on your risk tolerance and financial goals, is crucial to navigate these emotional hurdles. Understanding that market volatility is normal and that short-term fluctuations don't negate the long-term potential is key to success.

Psychological hurdles:

- Fear and panic selling during market corrections, leading to realized losses.

- Regret over missed opportunities in other, seemingly better-performing, asset classes.

- Difficulty sticking to the plan during prolonged periods of underperformance, especially when facing peer pressure or market hype.

Financial Realities and Risks of Buy-and-Hold

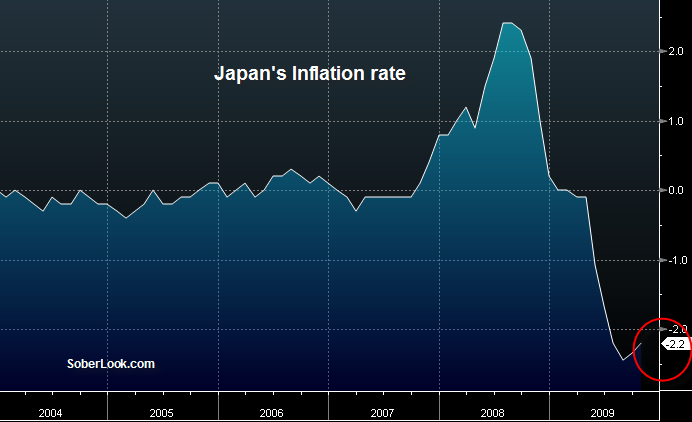

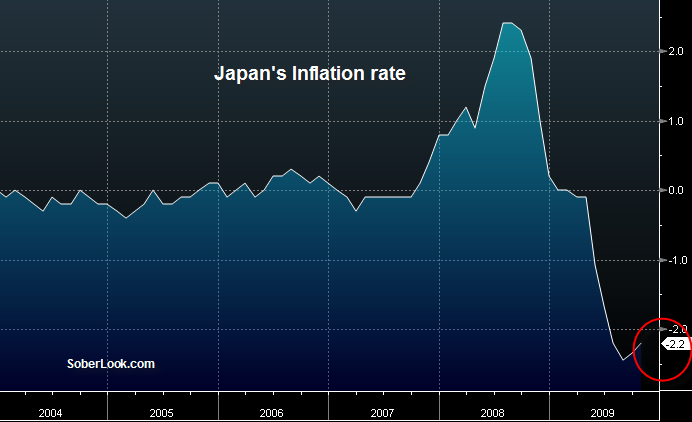

Despite its merits, buy-and-hold investing isn't without financial risks. Inflation erodes the purchasing power of your returns over time, meaning a seemingly impressive return might not translate to the same level of real wealth. Moreover, significant market crashes and prolonged bear markets can severely impact your portfolio's value, potentially taking years to recover.

Diversification is essential to mitigate these risks. Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) reduces your dependence on any single investment's performance. Regular portfolio rebalancing, adjusting your asset allocation to maintain your target proportions, helps to capitalize on market fluctuations and prevent overexposure to underperforming assets.

Financial considerations:

- Inflation erosion of returns: Understanding the real rate of return is crucial.

- Unexpected economic downturns and their potentially severe impact on portfolio value.

- The need for diversification across asset classes to reduce overall portfolio risk.

- The role of rebalancing in maintaining your target asset allocation and controlling risk.

Adapting Your Buy-and-Hold Strategy

A truly successful buy-and-hold strategy isn't static. Regular review and adaptation are vital. Periodically assessing your investment plan (at least annually, or even semi-annually), considering changes in your financial goals, risk tolerance, and market conditions, is crucial.

Rebalancing should be an integral part of your strategy. This involves selling some of your better-performing assets and using the proceeds to buy more of your underperforming assets, bringing your portfolio back to its target allocation.

Dollar-cost averaging, a technique of investing a fixed amount of money at regular intervals regardless of market price, can help mitigate some of the risk associated with investing a lump sum during market highs.

Adaptive strategies:

- Regular portfolio reviews (annual or semi-annual) to adapt to changing circumstances.

- Rebalancing to maintain target asset allocation and exploit market inefficiencies.

- Considering dollar-cost averaging for new investments to smooth out market volatility.

Conclusion: Navigating the Realities of Buy-and-Hold Investing

Buy-and-hold investing offers the potential for substantial long-term growth through compounding, but it's not a "set it and forget it" strategy. Successfully implementing a buy-and-hold strategy requires a deep understanding of its inherent risks, including the psychological challenges and the impact of inflation and market downturns. A well-defined plan, incorporating diversification, rebalancing, and a realistic assessment of your risk tolerance, is paramount. Understanding the realities of buy-and-hold investing, and regularly reviewing and adapting your strategy, are key to navigating the long-term journey to financial success. Before adopting a buy-and-hold approach, carefully consider your investment goals and risk tolerance.

Featured Posts

-

Info Terbaru Jadwal Tayang Moto Gp Argentina 2025 Di Trans7

May 26, 2025

Info Terbaru Jadwal Tayang Moto Gp Argentina 2025 Di Trans7

May 26, 2025 -

Canada Posts Decline A Boon For Competing Delivery Companies

May 26, 2025

Canada Posts Decline A Boon For Competing Delivery Companies

May 26, 2025 -

10 Must See British Pop Films From Classics To Modern Hits

May 26, 2025

10 Must See British Pop Films From Classics To Modern Hits

May 26, 2025 -

La Semaine Des 5 Heures La Rtbf Precise Son Avenir Sur La Premiere

May 26, 2025

La Semaine Des 5 Heures La Rtbf Precise Son Avenir Sur La Premiere

May 26, 2025 -

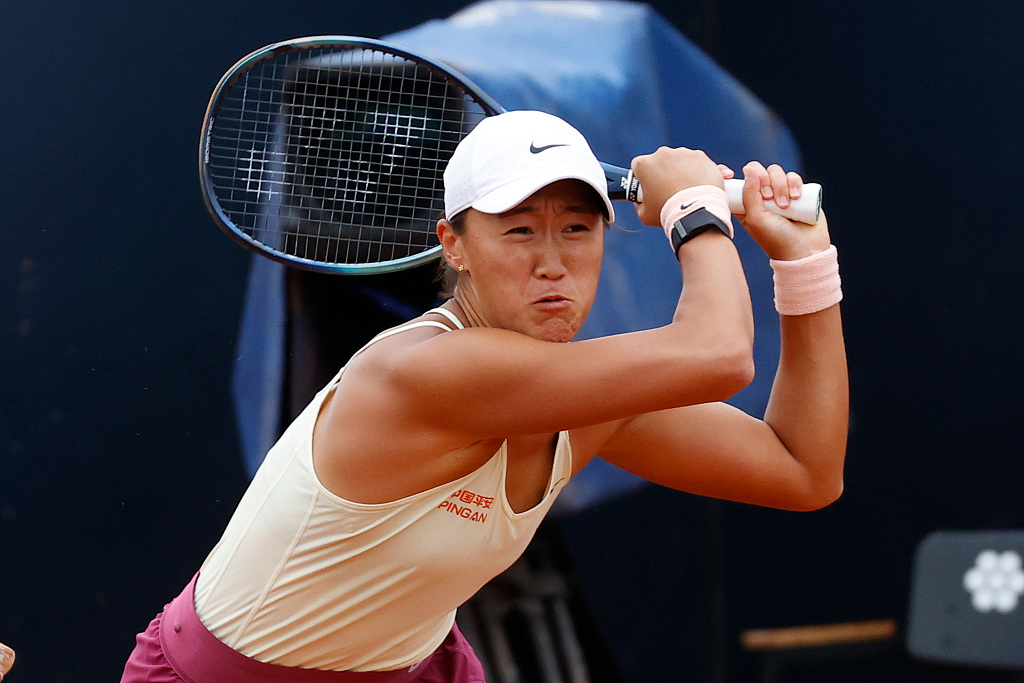

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 26, 2025

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 26, 2025