Buy-and-Hold Investing: The Long Game's Gut-Wrenching Reality

Table of Contents

Understanding the Buy-and-Hold Strategy

What is Buy-and-Hold Investing?

Buy-and-hold investing is a long-term investment strategy where you buy assets (stocks, bonds, real estate, and even cryptocurrencies for some) and hold them for an extended period, typically several years or even decades, regardless of short-term market fluctuations. It's a cornerstone of passive investing, requiring minimal active management.

-

Benefits of Buy-and-Hold:

- Potential for Long-Term Capital Appreciation: Historically, markets have trended upwards over the long term, offering significant growth potential.

- Tax Advantages: Depending on your jurisdiction, holding investments for extended periods can lead to lower capital gains taxes compared to frequent trading.

- Reduced Transaction Costs: Minimizing trading activity reduces brokerage fees and other transaction costs.

- Simplified Investment Management: Requires less time and effort compared to active trading strategies.

-

Drawbacks of Buy-and-Hold:

- Potential for Significant Short-Term Losses: Market downturns can lead to substantial temporary losses in your portfolio.

- Requires Patience and Discipline: Successfully implementing this strategy demands the ability to weather market storms without making impulsive decisions.

- Susceptibility to Market Downturns: While long-term growth is the goal, short-term losses are inevitable and can be emotionally challenging.

Choosing Your Assets for Buy-and-Hold

Diversification is key to mitigating risk in any long-term investment strategy, including buy-and-hold. Spreading your investments across different asset classes and sectors reduces the impact of any single investment's underperformance.

-

Index Funds and ETFs: These offer low-cost, diversified exposure to a broad market segment, making them ideal for passive buy-and-hold investing. They track a specific index, such as the S&P 500, providing instant diversification.

-

Individual Stocks: While offering potentially higher returns, individual stocks carry significantly higher risk. Thorough research and a deep understanding of the company's fundamentals are crucial before investing.

-

Real Estate: Real estate can provide rental income and long-term appreciation, but it's less liquid than stocks and involves higher management costs. Consider factors like property location, market trends, and potential rental income before investing.

The Emotional Rollercoaster of Buy-and-Hold

Dealing with Market Volatility

Buy-and-hold investing is a test of emotional resilience. Market volatility, including corrections and bear markets, is inevitable. Learning to manage your emotions is crucial for long-term success.

-

Fear and Greed: These powerful emotions can lead to poor investment decisions. Fear can cause you to sell low during downturns, while greed can tempt you to buy high during market bubbles.

-

Market Corrections and Bear Markets: These are normal parts of the market cycle. While painful in the short term, they are opportunities for long-term investors to buy at lower prices.

-

Long-Term Perspective: Maintain a focus on your long-term goals. Short-term market fluctuations are irrelevant if your investment horizon is 10, 20, or 30 years.

-

Tips for Managing Emotions:

- Develop a robust investment plan before you start. This provides a framework for decision-making and reduces emotional reactions.

- Avoid emotional decision-making. Stick to your plan, even when the market is volatile.

- Seek professional advice from a financial advisor if needed.

Patience and Discipline

The success of buy-and-hold hinges on patience and discipline. Resisting the urge to panic sell during market downturns is crucial.

-

Sticking to Your Plan: Your pre-defined investment strategy should act as your guide, preventing impulsive decisions based on fear.

-

Regularly Reviewing Your Portfolio: While regular review is beneficial, avoid frequent trading. Adjustments should be based on long-term considerations, not daily market fluctuations.

-

Avoiding Market Timing: Trying to predict market tops and bottoms is futile. Time in the market is far more crucial than trying to time the market.

Is Buy-and-Hold Right for You?

Assessing Your Risk Tolerance

Before embracing buy-and-hold, assess your risk tolerance and investment goals.

-

Determining Your Investment Time Horizon: A longer time horizon generally increases the suitability of buy-and-hold. Short-term needs may require different investment strategies.

-

Understanding Your Financial Goals: Are you saving for retirement, a down payment, or other long-term objectives? Your goals will influence your investment strategy.

-

Considering Your Financial Situation: Do you have an emergency fund and other financial safety nets? A strong financial foundation is crucial before committing to long-term investments.

Alternatives to Buy-and-Hold

Buy-and-hold isn't the only investment strategy. Consider alternatives based on your risk tolerance and goals.

- Value Investing: Focuses on identifying undervalued assets with the potential for future growth.

- Growth Investing: Concentrates on companies with high growth potential, often involving higher risk.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of market price, reduces the impact of market volatility.

Conclusion

Buy-and-hold investing, while potentially lucrative in the long run, demands significant patience, discipline, and a realistic understanding of market volatility. Successfully navigating this long-term investment strategy requires careful planning, diversification, and a strong understanding of your own risk tolerance. Before committing to buy-and-hold investing, carefully assess your financial goals and risk tolerance. Consider seeking advice from a qualified financial advisor to determine if this strategy aligns with your individual circumstances. Remember, successful buy-and-hold investing isn't about timing the market, but about time in the market. Start your journey towards long-term financial security with a well-defined buy-and-hold investment strategy today.

Featured Posts

-

A Persistencia De Uma Imagem O Legado De Um Trailer Cinematografico

May 26, 2025

A Persistencia De Uma Imagem O Legado De Um Trailer Cinematografico

May 26, 2025 -

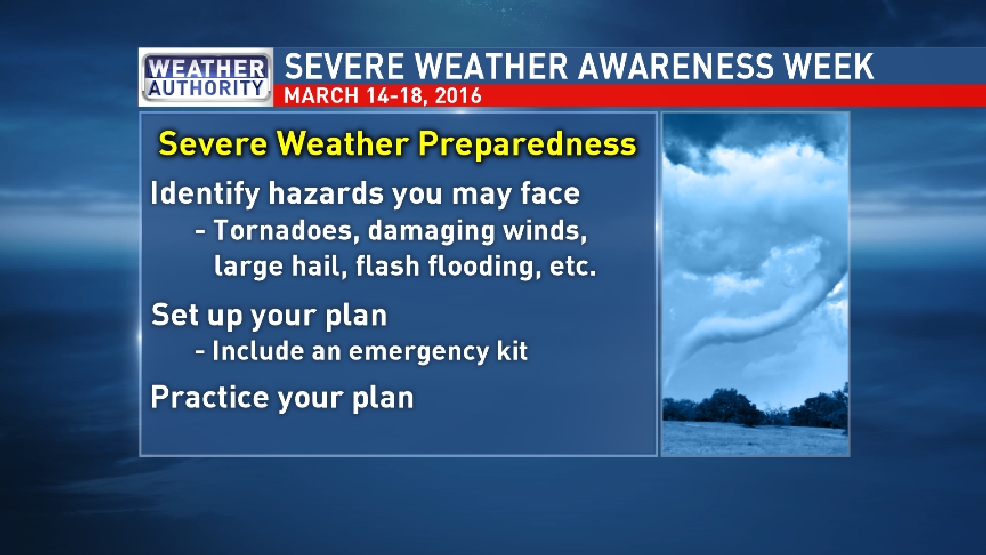

Flood Preparedness Essential Steps For Severe Weather Awareness Week Day 5

May 26, 2025

Flood Preparedness Essential Steps For Severe Weather Awareness Week Day 5

May 26, 2025 -

The Complex Emotions Of Parenthood Jonathan Peretz Reflects On Loss And Love

May 26, 2025

The Complex Emotions Of Parenthood Jonathan Peretz Reflects On Loss And Love

May 26, 2025 -

Tirreno Adriatico 2024 Examining Mathieu Van Der Poels Custom Canyon Aeroad

May 26, 2025

Tirreno Adriatico 2024 Examining Mathieu Van Der Poels Custom Canyon Aeroad

May 26, 2025 -

Crowd Violence At Paris Roubaix Mathieu Van Der Poel Seeks Justice

May 26, 2025

Crowd Violence At Paris Roubaix Mathieu Van Der Poel Seeks Justice

May 26, 2025