Buy-and-Hold Investing: The Long Game's Harsh Truths

Table of Contents

The Illusion of Passive Income & Effortless Returns

The allure of buy-and-hold lies in its perceived passivity. However, the truth is, generating wealth through buy-and-hold is far from passive. It requires consistent effort and vigilance. While you might not be actively trading daily, it’s a misconception to think it's completely hands-off.

- Market fluctuations still impact long-term growth. Even with a long-term horizon, market corrections and bear markets will inevitably occur, impacting your portfolio's value.

- Rebalancing portfolios requires active management. To maintain your desired asset allocation and risk profile, you'll need to periodically rebalance your portfolio, buying and selling assets as needed. This is an active management process.

- Unexpected economic events can significantly impact returns. Unforeseen circumstances, such as recessions, pandemics, or geopolitical instability, can dramatically affect the performance of your investments.

- Regular monitoring is essential to adjust to changing market conditions. Staying informed about economic trends, industry news, and the performance of your investments is crucial for making informed decisions and adapting your strategy when necessary.

The Psychological Toll of Long-Term Investing

Buy-and-hold investing demands patience and discipline. The emotional rollercoaster of market fluctuations can be intense. Fear, greed, and impatience are common enemies of long-term investors.

- Dealing with market corrections and downturns. Market dips are inevitable. The ability to withstand these periods without panic selling is critical for success.

- Resisting the urge to panic sell during market volatility. Emotional decision-making during market downturns can lead to significant losses. Sticking to your plan is crucial.

- Maintaining discipline during periods of slow or negative growth. There will be periods where your investments don't perform as expected. Maintaining discipline and staying the course is essential.

- The importance of emotional detachment from short-term market fluctuations. Focus on your long-term goals and avoid being swayed by daily market noise.

Hidden Costs and Fees in Buy-and-Hold Strategies

While buy-and-hold might seem cost-effective, various fees and expenses can subtly erode your returns over time. Understanding these costs is crucial for maximizing your long-term profits.

- Brokerage fees and commissions. These fees are incurred when buying or selling assets. Choosing a low-cost brokerage can significantly reduce these expenses.

- Mutual fund expense ratios. These ongoing fees are charged by mutual funds to cover their operating expenses. Lower expense ratios translate to higher returns.

- Capital gains taxes on profitable sales. When you sell assets for a profit, you'll likely owe capital gains taxes. Tax-efficient investing strategies can help minimize this burden.

- The impact of inflation on long-term returns. Inflation erodes the purchasing power of your returns over time. Consider inflation when setting your investment goals.

Diversification and Risk Management in Buy-and-Hold

Diversification is a cornerstone of successful buy-and-hold investing. It's not enough to simply buy and hold; you must also spread your investments across various asset classes to mitigate risk.

- The necessity of a diversified portfolio across stocks, bonds, and potentially other assets. A well-diversified portfolio reduces your exposure to any single investment's volatility.

- Understanding your risk tolerance and adjusting the portfolio accordingly. Your risk tolerance will influence your asset allocation. A younger investor might tolerate more risk than someone nearing retirement.

- Regularly rebalancing the portfolio to maintain the desired asset allocation. As markets fluctuate, your portfolio's asset allocation will drift. Rebalancing ensures you stay on track with your risk profile.

- The role of risk tolerance in choosing appropriate investment vehicles. Different investment vehicles carry different levels of risk. Choose those aligned with your risk tolerance.

Adapting Your Buy-and-Hold Strategy Over Time

Buy-and-hold isn't a "set it and forget it" strategy. Life changes and market conditions require periodic review and adjustments.

- Reassessing investment goals and risk tolerance. Your goals and risk tolerance will evolve over time, requiring adjustments to your investment strategy.

- Adjusting asset allocation based on life changes (retirement, marriage, etc.). Significant life events necessitate reviewing and potentially adjusting your portfolio's allocation.

- Responding to significant market shifts or economic downturns. Major economic events might require re-evaluating your investment strategy and making necessary adjustments.

- Seeking professional financial advice when necessary. Don't hesitate to consult a qualified financial advisor for personalized guidance.

Conclusion: Navigating the Realities of Buy-and-Hold Investing

Buy-and-hold investing, while potentially rewarding, isn't a passive path to riches. It requires understanding the inherent challenges—from the psychological toll to hidden costs and the need for adaptation. Realistic expectations, proactive management, and a well-diversified portfolio are crucial for long-term success. Don't let the simplicity of buy-and-hold investing mislead you. Learn more about managing the risks and rewards of a long-term buy-and-hold strategy to ensure your investment success.

Featured Posts

-

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 25, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 25, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 89 Par Vybrali Krasivuyu Datu

May 25, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 89 Par Vybrali Krasivuyu Datu

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025 -

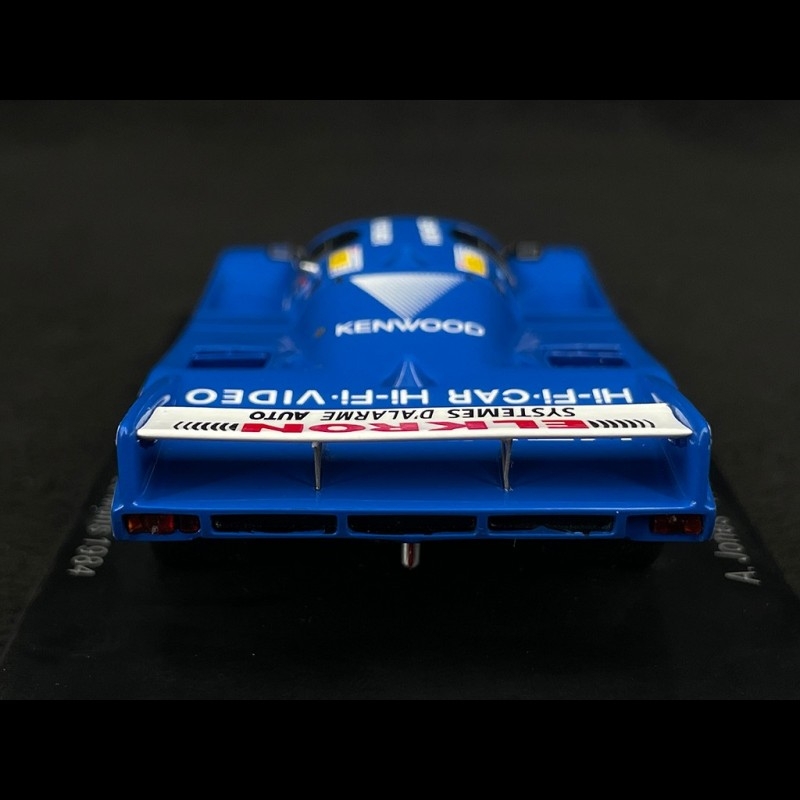

Porsche 956 Tavan Sergilemesinin Arkasindaki Muehendislik

May 25, 2025

Porsche 956 Tavan Sergilemesinin Arkasindaki Muehendislik

May 25, 2025 -

Guccis New Designer Kering Reports Lower Sales Figures

May 25, 2025

Guccis New Designer Kering Reports Lower Sales Figures

May 25, 2025