Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Market Position and Growth Prospects

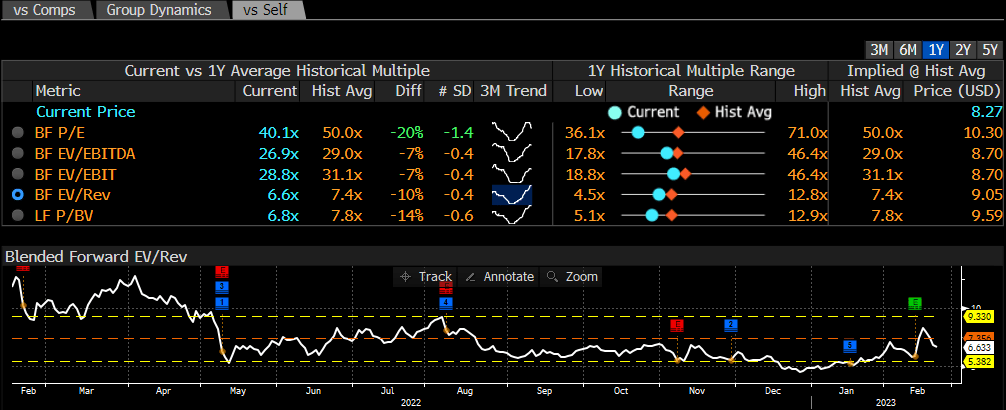

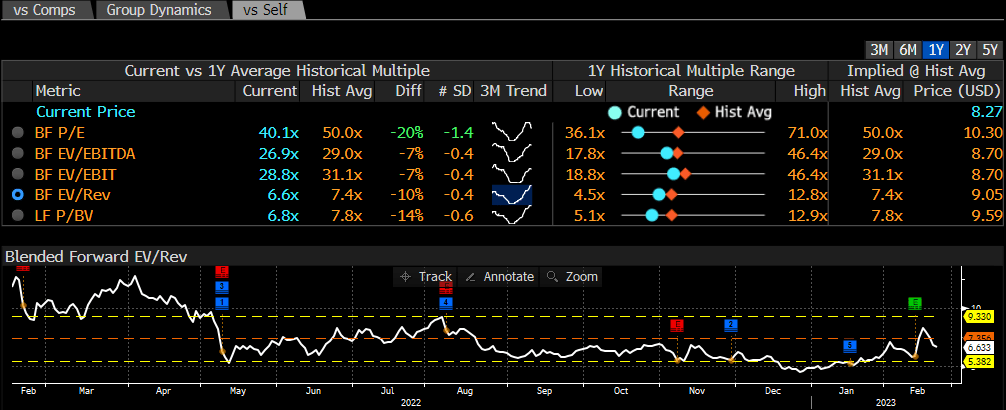

Understanding Palantir's current standing is crucial to assessing its trillion-dollar potential. The company operates primarily in the big data analytics sector, providing sophisticated software solutions to government agencies and commercial clients. Analyzing its recent financial performance offers valuable insights. While revenue growth has been positive, showing significant year-over-year increases, profitability remains a key focus for investors. Maintaining consistent growth while improving profit margins will be essential to supporting such a high valuation.

Palantir's competitive advantages are undeniable. Its proprietary technology, Gotham and Foundry, offer unparalleled capabilities in data integration, analysis, and visualization. Its strong relationship with government agencies, particularly in defense and intelligence, provides a stable revenue stream. Furthermore, expanding commercial partnerships across various sectors like finance, healthcare, and manufacturing are driving its growth beyond its traditional government clientele.

- Current revenue figures and growth projections: Palantir has consistently reported strong revenue growth, exceeding market expectations in recent quarters. Analysts project continued growth, but the rate of expansion will be crucial in achieving a trillion-dollar valuation.

- Key clients and partnerships: Significant contracts with government agencies and prominent commercial clients, demonstrating Palantir's ability to secure large-scale deals, are a key indicator of success.

- Market share in the big data analytics industry: While precise market share figures are challenging to obtain, Palantir's position as a leading provider of advanced analytics solutions is undisputed, setting a firm base for further growth.

- Potential future market expansion: Expansion into new sectors and geographic regions, such as further penetration in the healthcare and financial technology sectors, would be paramount to reaching a trillion-dollar market cap.

Factors Favoring a Trillion-Dollar Valuation

Several factors could propel Palantir towards a trillion-dollar valuation. The company's relentless innovation in artificial intelligence (AI) and machine learning (ML) is a significant driver. Integrating AI and ML into its platforms enhances analytical capabilities, attracting new clients and expanding its market reach. The ever-growing demand for big data analytics across diverse sectors—from optimizing supply chains to improving healthcare outcomes—presents an enormous market opportunity. Strategic acquisitions and partnerships could also accelerate its growth trajectory, providing access to new technologies, talent, and market segments.

- Technological leadership: Palantir's consistent investment in R&D keeps it at the forefront of technological advancements in data analytics, crucial for maintaining its competitive edge and attracting top talent.

- Big data market growth: Market research consistently points to exponential growth in the global big data analytics market, offering substantial potential for Palantir's continued expansion.

- Strategic partnerships: Successful collaborations with leading tech companies and industry players provide synergy and expanded market access, adding significant value.

- Government support: Continued government investment in data-driven solutions and national security initiatives will be critical to Palantir's growth, especially in its government contracts sector.

Challenges Hindering a Trillion-Dollar Valuation

Despite its potential, significant hurdles stand in Palantir's way. Intense competition from established tech giants like Microsoft and Google, along with numerous agile startups, poses a continuous threat. Concerns about data privacy and security, particularly in the government sector, could impact its reputation and ability to secure contracts. Its relatively high valuation could lead to investor skepticism, especially if growth does not meet aggressive projections. Furthermore, dependence on government contracts exposes Palantir to potential budget cuts or policy changes.

- Competition: Analyzing the strengths and strategies of key competitors is essential to understanding the challenges Palantir faces in maintaining its market share.

- Data privacy regulations: Navigating complex data privacy regulations and ensuring compliance will be vital in maintaining customer trust and avoiding regulatory penalties.

- Government contract risk: The inherent volatility of government contracts, subject to political shifts and budget constraints, needs careful consideration.

- Valuation concerns: A high valuation necessitates consistent high growth to justify investor confidence. Failure to meet these projections could lead to a significant market correction.

Realistic Projections and Scenarios

Predicting Palantir's future with certainty is impossible. However, considering various scenarios—from conservative to aggressive growth projections—is essential for a balanced assessment. A conservative projection, focusing on sustained but moderate growth rates, might not lead to a trillion-dollar valuation by 2030. An aggressive scenario, assuming significant market share gains and successful product diversification, presents a higher probability but relies on several key factors aligning perfectly.

- Conservative projections: A slower growth trajectory would require a significantly extended timeframe to reach a trillion-dollar valuation.

- Aggressive projections: Achieving a trillion-dollar valuation within the timeframe requires exceptional growth rates and a near-perfect execution of Palantir's strategic plan.

- Probability analysis: Based on current market trends, competitive landscape, and Palantir's performance, a realistic assessment of the probability of achieving the trillion-dollar milestone by 2030 can be made, acknowledging both the potential and inherent risks.

Conclusion: The Palantir Trillion-Dollar Question

Whether Palantir can achieve a trillion-dollar valuation by 2030 is a complex question with no definitive answer. While its innovative technology, strategic partnerships, and strong government ties present significant opportunities for growth, intense competition, regulatory hurdles, and the inherent risks associated with high valuations remain considerable challenges. The ultimate success hinges on consistent technological innovation, successful expansion into new markets, and the ability to maintain investor confidence.

What do you think? Can Palantir achieve a trillion-dollar valuation? Join the discussion on Palantir's future and the potential for a trillion-dollar market cap! Share your predictions and insights in the comments below.

Featured Posts

-

1509 4 5

May 09, 2025

1509 4 5

May 09, 2025 -

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025 -

Putins Victory Day Ceasefire A Strategic Move Or Genuine Peace Offering

May 09, 2025

Putins Victory Day Ceasefire A Strategic Move Or Genuine Peace Offering

May 09, 2025 -

Analyzing The Impact Of The 2025 Nhl Trade Deadline On The Playoffs

May 09, 2025

Analyzing The Impact Of The 2025 Nhl Trade Deadline On The Playoffs

May 09, 2025 -

Polish Woman Charged With Stalking After Madeleine Mc Cann Claim

May 09, 2025

Polish Woman Charged With Stalking After Madeleine Mc Cann Claim

May 09, 2025

Latest Posts

-

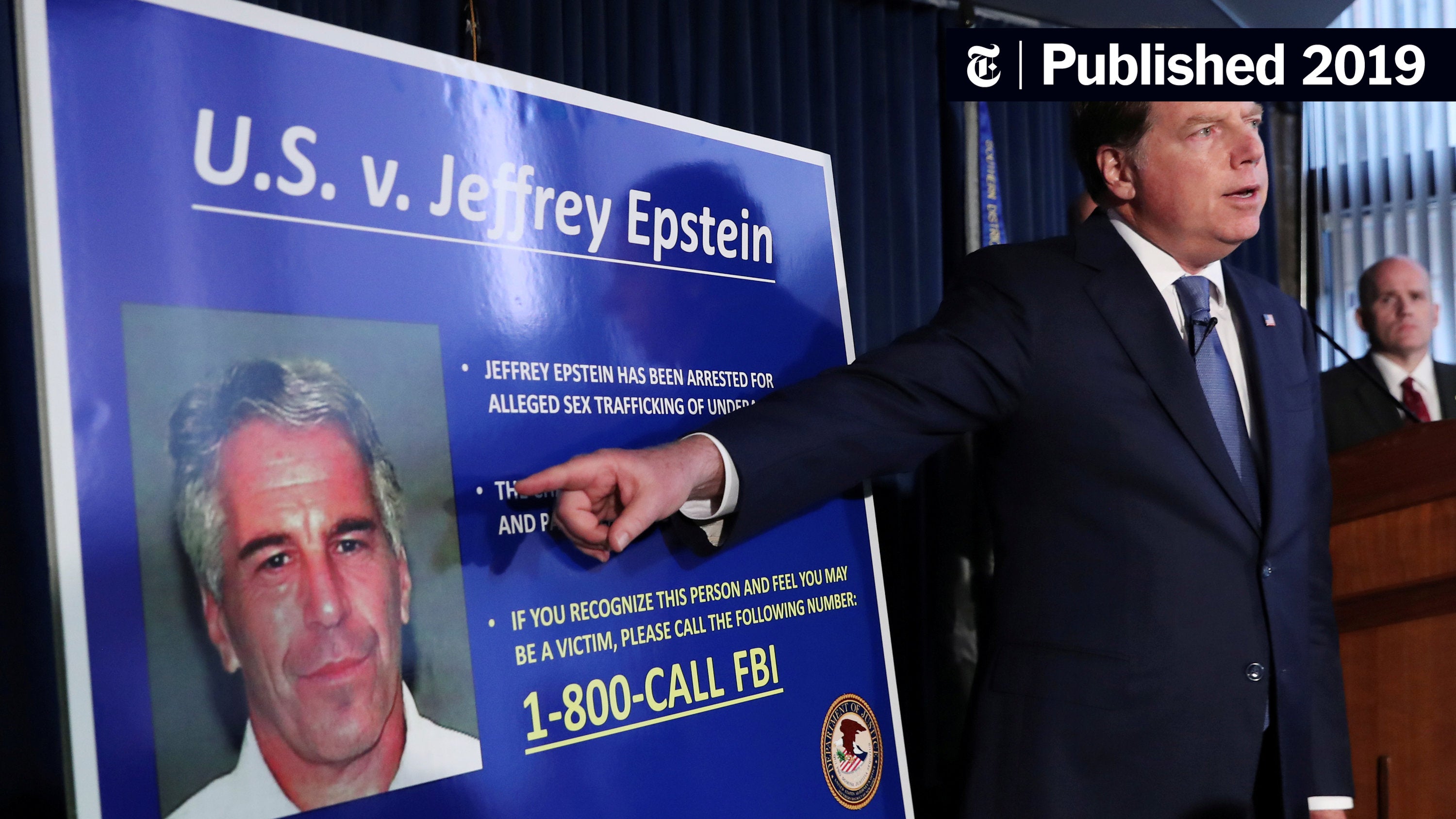

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025 -

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025 -

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025 -

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025