Can Wall Street's Recovery Undermine The German DAX's Gains?

Table of Contents

The Interdependence of Global Markets and the DAX's Vulnerability

The global financial system is a complex web of interconnectedness, and events on Wall Street rarely remain confined to US borders. The impact of a Wall Street recovery or downturn ripples through to other major indices, including the German DAX, highlighting the vulnerability of even seemingly strong national markets. This interdependence is driven by several key factors:

- Impact of US economic performance on German exports: Germany is a major exporter, and a strong US economy often translates to increased demand for German goods. Conversely, a US slowdown can significantly impact German export performance.

- Influence of investor sentiment in the US on global investment strategies: Wall Street's sentiment significantly influences global investor behavior. Positive sentiment in the US can lead to capital flowing into the US market, potentially drawing funds away from other markets like the DAX.

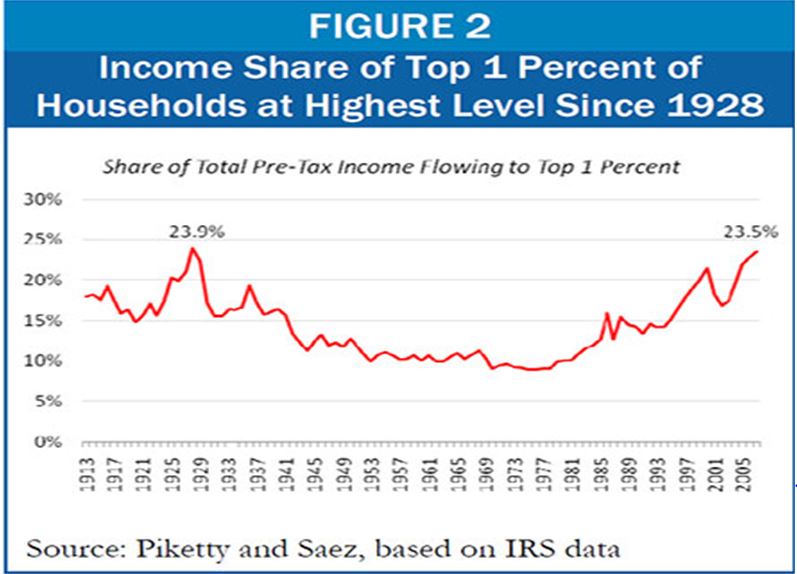

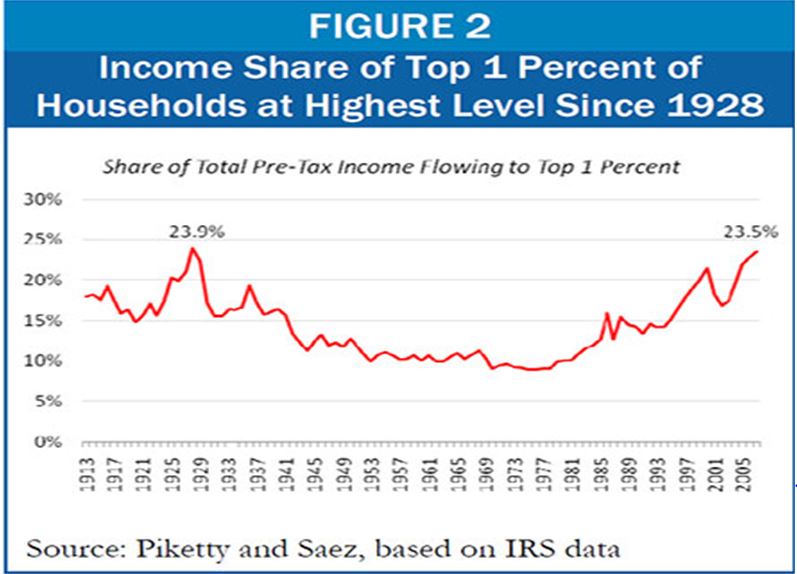

- Correlation between the S&P 500 and the DAX – historical data and analysis: Historical data shows a notable correlation between the performance of the S&P 500 and the DAX. While not always perfectly aligned, significant movements in one index often influence the other.

- Role of international trade and supply chains in linking the two markets: Global supply chains intricately link the US and German economies. Disruptions in one market can quickly cascade through these chains, affecting businesses in both countries.

Economic factors like interest rate hikes by the Federal Reserve, inflation levels in the US, and volatile energy prices further complicate this interdependence, creating a dynamic environment where the impact of Wall Street's recovery on the DAX is far from straightforward. A strong US dollar, for instance, can make German exports more expensive in the US, negatively affecting German companies.

Analyzing Wall Street's Recent Performance and its Potential Implications

Wall Street's recent recovery has been fueled by several factors, including strong corporate earnings, advancements in technology sectors, and government policies aimed at stimulating economic growth. This positive momentum, however, could have implications for the DAX:

- Specific sectors driving the Wall Street recovery and their relevance to German companies: The tech sector's strong performance in the US, for example, could affect German tech companies, depending on their competitive landscape and the global demand for their products.

- Potential for capital outflow from Europe to the US: A more attractive US market could lead to investors shifting their capital away from Europe, potentially impacting the DAX.

- Impact of a stronger US dollar on German businesses: A strong US dollar makes US assets more attractive to international investors and makes German exports more expensive, potentially impacting profitability.

- Analysis of investor confidence shifts and their potential impact on the DAX: A shift in investor confidence from European markets towards the US could put downward pressure on the DAX.

Analyzing charts and data on Wall Street's key performance indicators (KPIs) is vital to understand the magnitude and potential trajectory of this impact. A sustained strong performance on Wall Street could indeed lead to significant capital reallocation, affecting the DAX's performance.

Factors Protecting the German DAX from a Wall Street Downturn

Despite the interconnectedness of global markets, several factors could insulate the DAX from negative effects stemming from Wall Street:

- Strength of the German economy and its resilience to external shocks: Germany's robust industrial base and export-oriented economy give it a degree of resilience to external shocks.

- Specific sectors in the German economy that are less susceptible to US market fluctuations: Sectors like automotive manufacturing, which has a strong global presence but also benefits from domestic consumption, might be less susceptible to US market shifts.

- Government policies and regulatory measures supporting the German economy: Government initiatives aimed at supporting domestic industries and infrastructure could lessen the impact of external economic downturns.

- Potential for increased domestic investment and consumption in Germany: A strong domestic market in Germany can offset some of the negative impacts from a weaker external market.

A comparative analysis of the relative strengths and weaknesses of the German and US economies is crucial to assess the degree of vulnerability of the DAX to Wall Street fluctuations. Germany's strong manufacturing base and its comparatively lower dependence on the tech sector could provide a degree of insulation.

Predicting Future Performance: DAX vs. Wall Street

Predicting the future performance of both indices requires considering the interplay of various factors. We can develop scenario analyses:

-

Scenario analysis:

- Best-case: Sustained growth on Wall Street coexists with robust German economic performance, leading to moderate gains for both indices.

- Worst-case: A sharp downturn on Wall Street triggers a significant capital outflow from Europe, negatively impacting the DAX.

- Most likely: Wall Street's growth gradually moderates, impacting the DAX to a degree, but not causing a dramatic downturn.

-

Discussion of potential risks and opportunities for investors in both markets: Investors need to carefully evaluate the risks and opportunities associated with investing in both markets, considering potential correlations and diversifications.

-

Mention alternative investment strategies to mitigate risk: Diversification across various asset classes and geographic regions is crucial to mitigate risk.

-

Recommendations for investors based on the analysis: Investors might consider a more cautious approach, possibly reducing exposure to the DAX or diversifying further.

Conclusion: Understanding the Complex Relationship Between Wall Street and the German DAX

This article highlights the complex and dynamic relationship between Wall Street and the German DAX. While Wall Street's recovery could potentially undermine the DAX's gains through capital outflow, investor sentiment shifts, and currency fluctuations, several factors could mitigate this impact. The strength of the German economy, its diverse industrial base, and government support all contribute to its resilience. However, the interconnectedness of global markets demands that investors carefully consider this relationship when making investment decisions. Staying informed about the evolving relationship between Wall Street and the German DAX is crucial for navigating the complexities of the global financial landscape. Continue your research on this dynamic interplay by exploring additional resources and expert analyses to make sound investment choices. Understanding how Wall Street's recovery might influence the German DAX requires continuous monitoring and careful analysis.

Featured Posts

-

Road Closure On M56 Affecting Cheshire Deeside Drivers

May 25, 2025

Road Closure On M56 Affecting Cheshire Deeside Drivers

May 25, 2025 -

Past Florida Film Festivals Notable Celebrity Appearances Mia Farrow Christina Ricci

May 25, 2025

Past Florida Film Festivals Notable Celebrity Appearances Mia Farrow Christina Ricci

May 25, 2025 -

David Hockneys A Bigger Picture An In Depth Look At His Landscape Paintings

May 25, 2025

David Hockneys A Bigger Picture An In Depth Look At His Landscape Paintings

May 25, 2025 -

Planned M62 Closure Westbound Lanes Shut For Resurfacing Manchester Warrington

May 25, 2025

Planned M62 Closure Westbound Lanes Shut For Resurfacing Manchester Warrington

May 25, 2025 -

Carolina Country Music Fest 2025 Tickets Completely Sold

May 25, 2025

Carolina Country Music Fest 2025 Tickets Completely Sold

May 25, 2025