Canada Election: Conservatives Pledge Tax Cuts, Fiscal Responsibility

Table of Contents

Proposed Tax Cuts: Details and Impact

The Conservative party's proposed tax cuts are multifaceted, targeting both individuals and corporations. The aim is to stimulate economic activity and boost disposable income.

Individual Income Tax Reductions

The Conservatives propose a broad-based reduction in individual income tax rates. While specific percentage decreases haven't been fully detailed as of this writing (and will need to be sourced from official party documents as they become available), the general aim is to increase disposable income for Canadian families.

- Projected Impact: Lower tax rates are expected to leave more money in the pockets of Canadians, potentially leading to increased consumer spending and a boost in economic activity. The impact will vary depending on income bracket, with lower-income earners potentially seeing a smaller percentage increase in disposable income compared to higher-income earners. Further analysis is needed to determine the exact distribution of benefits across income levels.

- Economic Stimulus: The Conservatives believe these reductions will act as a significant economic stimulus, creating a ripple effect throughout the economy. Increased consumer spending fuels business growth and job creation.

Corporate Tax Rate Cuts

Another key plank of the Conservative platform involves lowering the corporate tax rate. This is intended to enhance Canada's competitiveness on the global stage, attracting foreign investment and stimulating domestic job creation.

- Proposed Rate: The exact proposed corporate tax rate needs to be confirmed from official Conservative party sources. However, the goal is to make Canada's corporate tax environment more attractive compared to its competitors.

- International Comparison: A comparison with corporate tax rates in other G7 countries will be crucial in assessing the competitiveness of the proposed changes. Lowering the rate could attract significant foreign direct investment, boosting economic growth and generating high-paying jobs.

- Foreign Investment Impact: A more competitive tax environment is anticipated to lure significant foreign investment, particularly in sectors like technology and manufacturing.

Targeted Tax Relief Measures

Beyond broad-based cuts, the Conservatives are also likely to propose targeted tax relief measures aimed at specific segments of the Canadian population.

- Examples: These might include increased child tax benefits, expanded tax credits for small businesses, or tax incentives for specific industries. Details on these targeted measures should be sought from official Conservative party pronouncements.

- Demographic Impact: The effectiveness of these measures will depend on how precisely they target specific demographics and their needs. Careful consideration is required to ensure equity and prevent unintended consequences.

Fiscal Responsibility Plan: Maintaining a Balanced Budget

While promising significant tax cuts, the Conservatives also emphasize their commitment to fiscal responsibility and a balanced budget. This requires careful management of government spending and strategic debt reduction.

Spending Control Measures

The Conservatives plan to achieve fiscal responsibility through targeted spending control measures. This might involve:

- Proposed Cuts: Identifying areas for efficiency gains within government operations, potentially leading to spending reductions in non-essential programs. The specifics of these cuts will likely be outlined in detail closer to the election.

- Program Impact: The impact on government programs and services will depend on the specific areas where spending reductions are implemented. The Conservative party will need to demonstrate how these cuts can be implemented without compromising essential public services.

Debt Reduction Strategies

Addressing Canada's national debt is central to the Conservative platform. Their approach focuses on:

- Debt Reduction Methods: A combination of increased revenue (through economic growth stimulated by tax cuts) and controlled spending will be employed to gradually reduce the national debt.

- Projected Timeline: A realistic and achievable timeline for debt reduction must be presented, taking into account economic forecasts and potential unforeseen circumstances.

- Economic Implications: The success of debt reduction strategies has significant implications for long-term economic stability and Canada's credit rating.

Transparency and Accountability

The Conservatives may also highlight increased transparency and accountability in government spending as part of their fiscal responsibility plan.

- Transparency Measures: This might involve measures such as enhanced public reporting of government finances, independent audits, and stronger oversight mechanisms.

- Public Scrutiny: Ensuring greater public access to government financial information empowers citizens to hold elected officials accountable for their spending decisions.

Potential Economic Impacts and Criticisms

The Conservative platform's economic impact remains a subject of debate. While tax cuts stimulate economic activity, potential downsides exist.

Economic Growth Projections

Experts offer varied opinions on the potential economic effects of the Conservative plan.

- Growth Potential: Some economists predict significant economic growth fueled by increased consumer spending and investment. Others caution against potential inflationary pressures.

- Risks and Uncertainties: External factors, such as global economic conditions and commodity prices, could significantly influence the actual economic outcomes.

Criticisms and Counterarguments

The Conservative plan faces criticisms, including concerns about:

- Increased Inequality: Critics argue that tax cuts disproportionately benefit higher-income earners, exacerbating income inequality. The Conservatives may counter by emphasizing the positive economic effects, which benefit all Canadians through job creation.

- Social Program Funding: Concerns exist regarding the potential impact of spending cuts on social programs. The Conservatives will likely emphasize their commitment to essential services while identifying areas for efficiency improvements.

Conclusion

The Conservative party's strategy for the upcoming Canada election centers on a combination of Canada Election Conservatives Tax Cuts and fiscal responsibility. Their plan includes significant reductions in individual and corporate income taxes coupled with measures aimed at controlling government spending and reducing the national debt. The economic consequences, however, remain uncertain and subject to debate. Understanding the detailed proposals and potential impacts is essential for Canadian voters to make informed choices. Stay informed about the latest developments in the Canada Election Conservatives Tax Cuts debate and exercise your democratic right to vote.

Featured Posts

-

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025 -

Key Bench Players Hield And Payton Secure Warriors Win Against Blazers

Apr 24, 2025

Key Bench Players Hield And Payton Secure Warriors Win Against Blazers

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

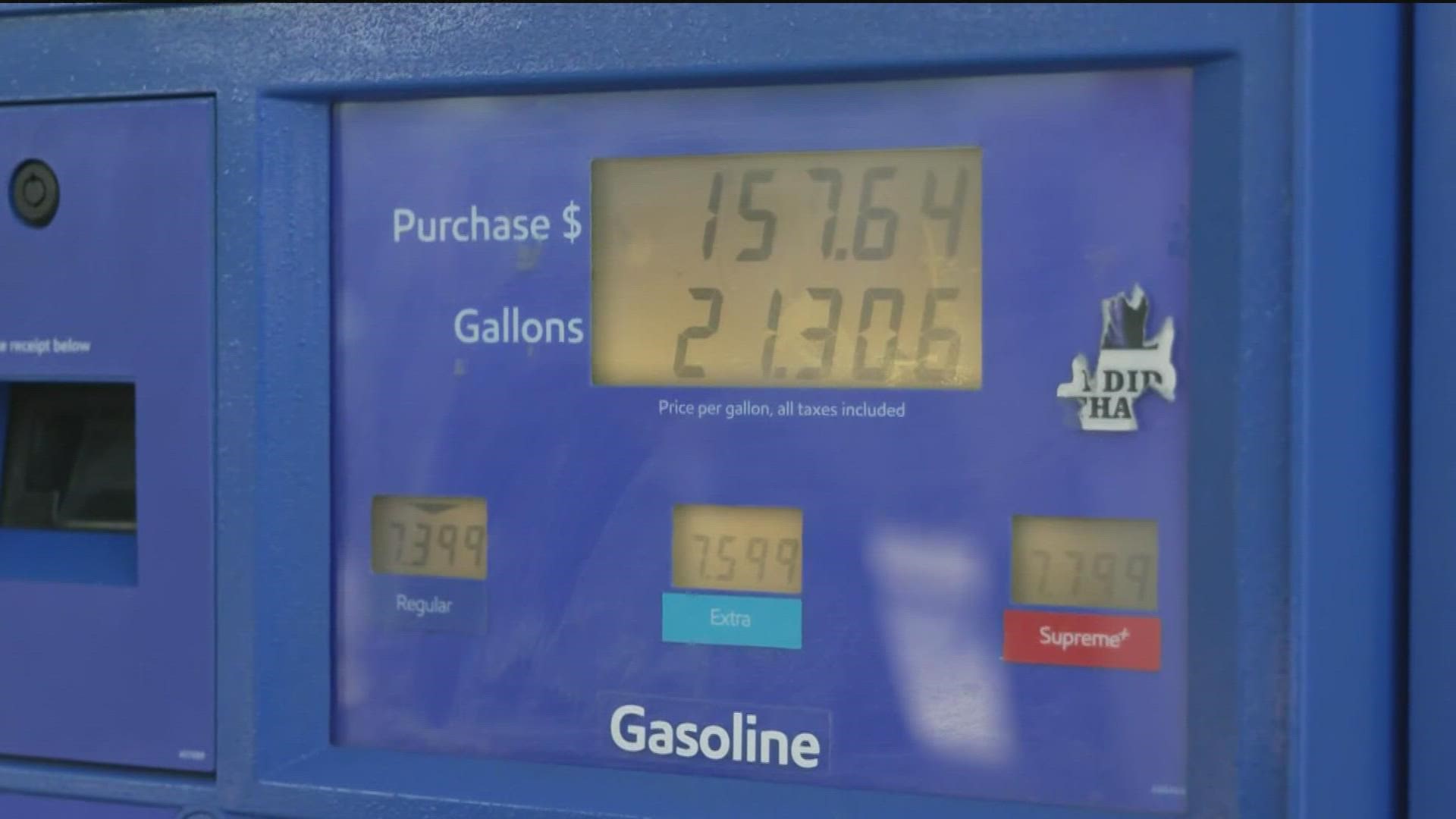

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Office365 Security Breach Exposes Millions In Losses Criminal Charges Filed

Apr 24, 2025

Office365 Security Breach Exposes Millions In Losses Criminal Charges Filed

Apr 24, 2025