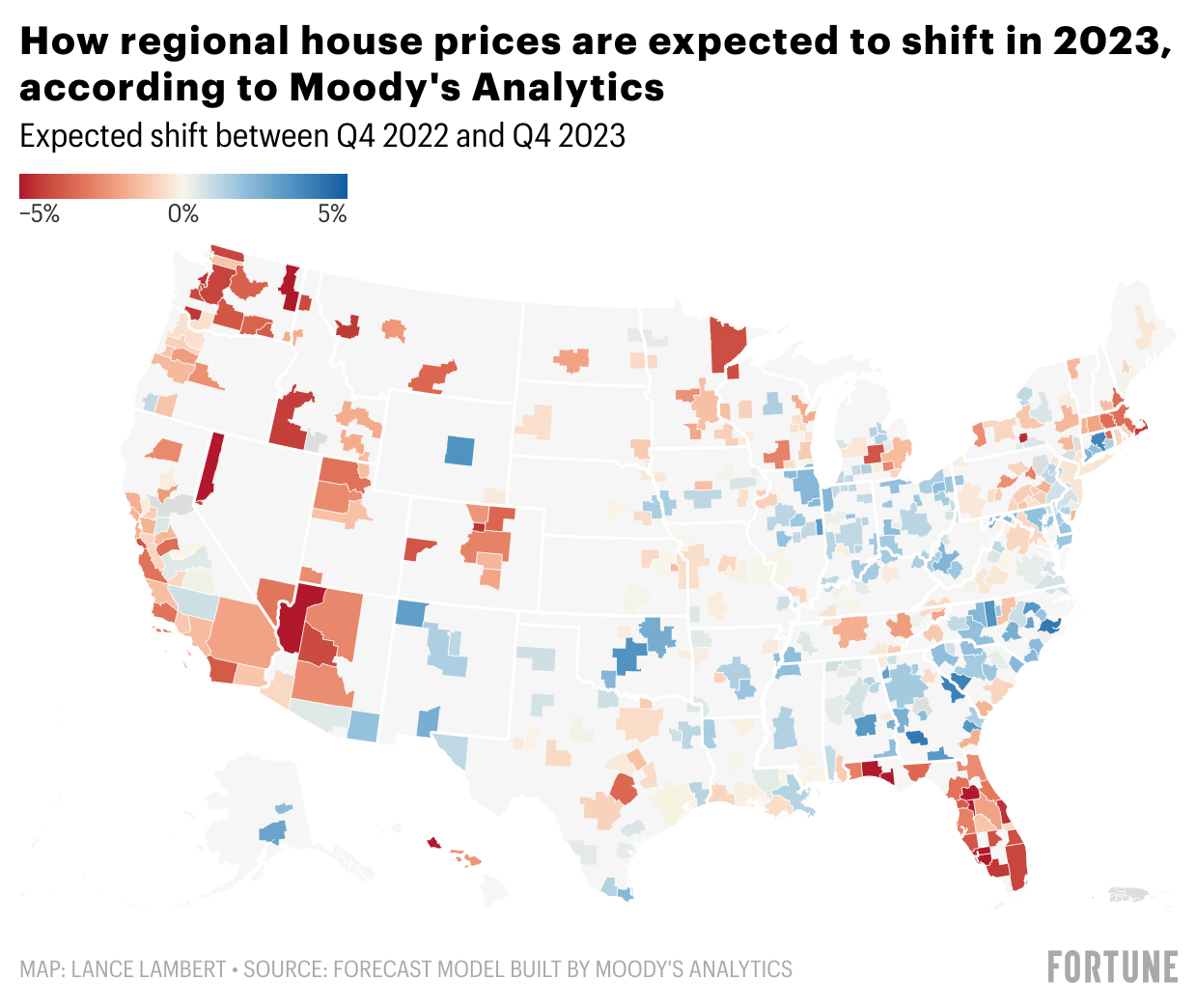

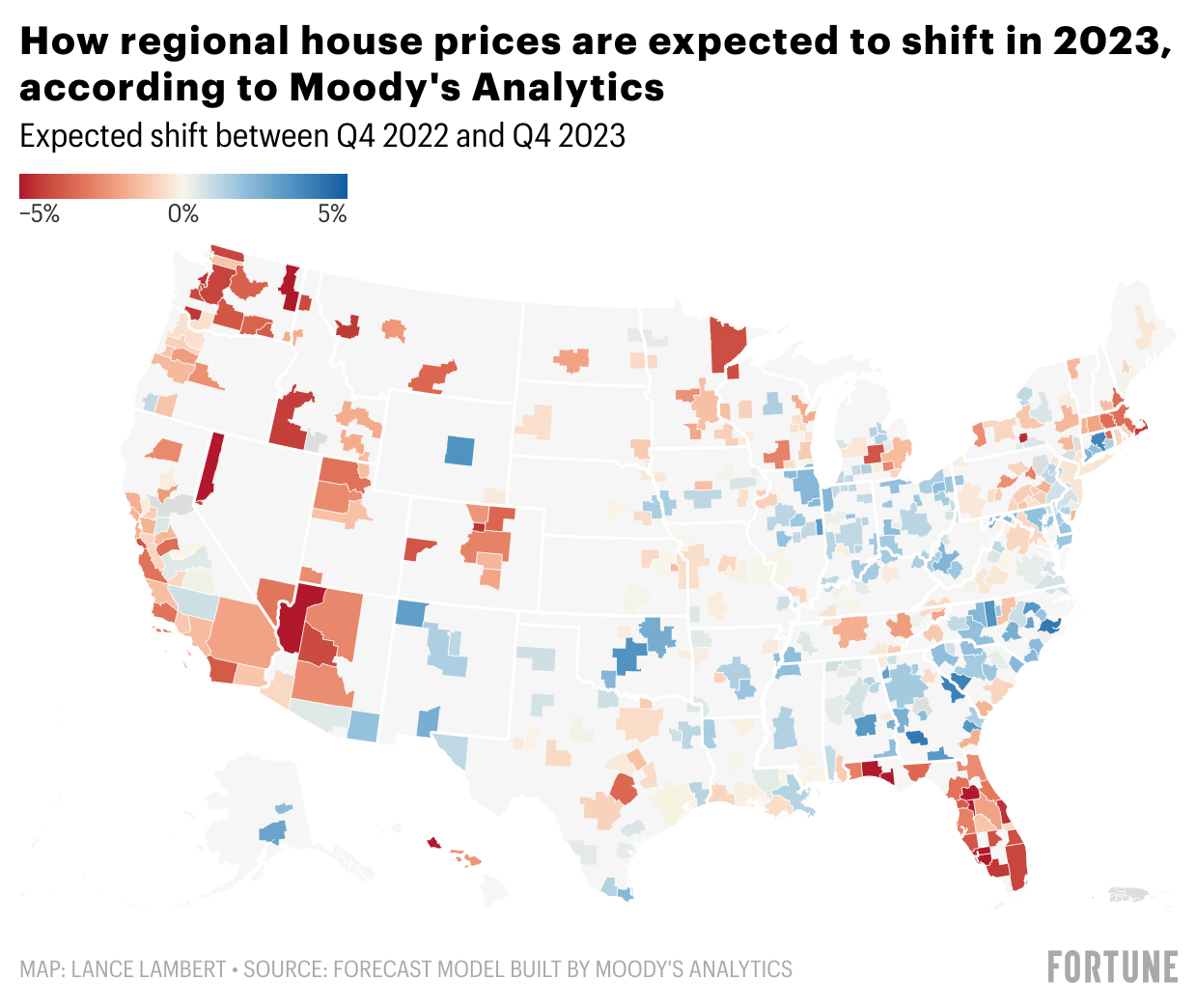

Canada's Housing Market: Signs Of A Price Correction

Table of Contents

Rising Interest Rates and Their Impact

The Bank of Canada's aggressive interest rate hikes have profoundly impacted the affordability of homes across the country. These increases directly affect mortgage payments, significantly reducing the purchasing power of potential buyers. Higher interest rates translate to larger monthly mortgage payments, making homeownership less attainable for many. The impact is readily apparent in the data: the Bank of Canada's key interest rate has increased by X percentage points since [Start Date], leading to a Y% increase in average mortgage payments for a typical home. This correlation between interest rate increases and slowing sales is undeniable.

- Increased mortgage stress tests: Stricter lending criteria mean buyers need a larger down payment and higher income to qualify for a mortgage.

- Reduced borrowing capacity: With higher interest rates, lenders approve smaller loan amounts, limiting the price range buyers can afford.

- Fewer pre-approvals: The tightening lending environment makes it harder for buyers to secure pre-approvals, hindering their ability to make competitive offers.

- Higher monthly payments: Even for those who can qualify, the significantly higher monthly payments represent a considerable increase in financial burden.

Declining Sales and Increased Inventory

Across major Canadian cities like Toronto, Vancouver, and Montreal, we're seeing a clear trend of declining housing sales. This slowdown, coupled with a rise in housing inventory, is putting downward pressure on prices. The number of months of inventory (the time it takes to sell all available homes at the current sales rate) is increasing, indicating a shift from a seller's market to a more balanced or even buyer's market in some areas. Comparing current sales figures to those of previous years reveals a stark contrast.

- Month-over-month sales decline: Sales are consistently falling each month in many regions.

- Year-over-year sales decline: The comparison to the previous year's sales shows a more substantial decrease in activity.

- Rising days on market: Homes are staying on the market for longer periods before finding a buyer.

- Increase in unsold properties: The number of unsold properties is climbing, further indicating a softening market.

Shifting Buyer Sentiment and Market Confidence

Negative news coverage regarding economic uncertainty, coupled with rising interest rates, has undeniably impacted buyer confidence. This decreased confidence translates to lower demand, influencing prices and potentially leading to price reductions. Consumer surveys and market sentiment indicators paint a picture of a more cautious and less optimistic approach to purchasing real estate.

- Decreased buyer activity: Fewer buyers are actively searching for properties.

- Increased negotiation power for buyers: Buyers now have more leverage to negotiate prices and terms.

- More cautious approach to purchases: Buyers are taking a more measured approach, carefully considering their financial capacity.

- Potential for price reductions: As inventory increases and demand softens, sellers are becoming more willing to negotiate.

Government Policies and Regulations

Government policies, including stress tests and tax policies, significantly influence market activity. Changes in regulations, such as adjustments to mortgage insurance rules or new tax implications for homebuyers and investors, can impact affordability and purchasing decisions. The effectiveness of past government interventions in stabilizing the Canada housing market remains a subject of ongoing debate.

- Impact of new stress tests: Recent changes to stress test requirements have made it more challenging for some buyers to qualify for a mortgage.

- Changes to mortgage insurance rules: Adjustments to CMHC insurance premiums can affect the affordability of homes for first-time buyers.

- Tax implications for homebuyers and investors: Tax policies related to capital gains or property taxes influence investment decisions.

- Potential for future policy changes: Governments may introduce new measures to address market fluctuations.

Conclusion: Navigating the Canadian Housing Market Price Correction

Several key indicators point towards a potential price correction in Canada's housing market: rising interest rates are reducing affordability, sales are declining, buyer sentiment is shifting, and government policies continue to play a role. While this presents challenges for some, it also creates opportunities for others. A balanced perspective acknowledges both the difficulties and the potential benefits for astute buyers. To navigate this evolving landscape effectively, it's crucial to stay informed about Canada's housing market trends. Consult with real estate professionals for personalized advice, conduct thorough market research, and understand the current Canadian real estate market analysis and Canada housing market forecast before making any significant decisions. Understanding the current market is key to successfully navigating this potential housing price correction.

Featured Posts

-

Core Weave Stock Soars On Nvidias Stake Announcement

May 22, 2025

Core Weave Stock Soars On Nvidias Stake Announcement

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Abn Amro Rapporteert Sterke Groei In Occasionverkoop

May 22, 2025

Abn Amro Rapporteert Sterke Groei In Occasionverkoop

May 22, 2025 -

Fortnites Return To Us I Phones What You Need To Know

May 22, 2025

Fortnites Return To Us I Phones What You Need To Know

May 22, 2025 -

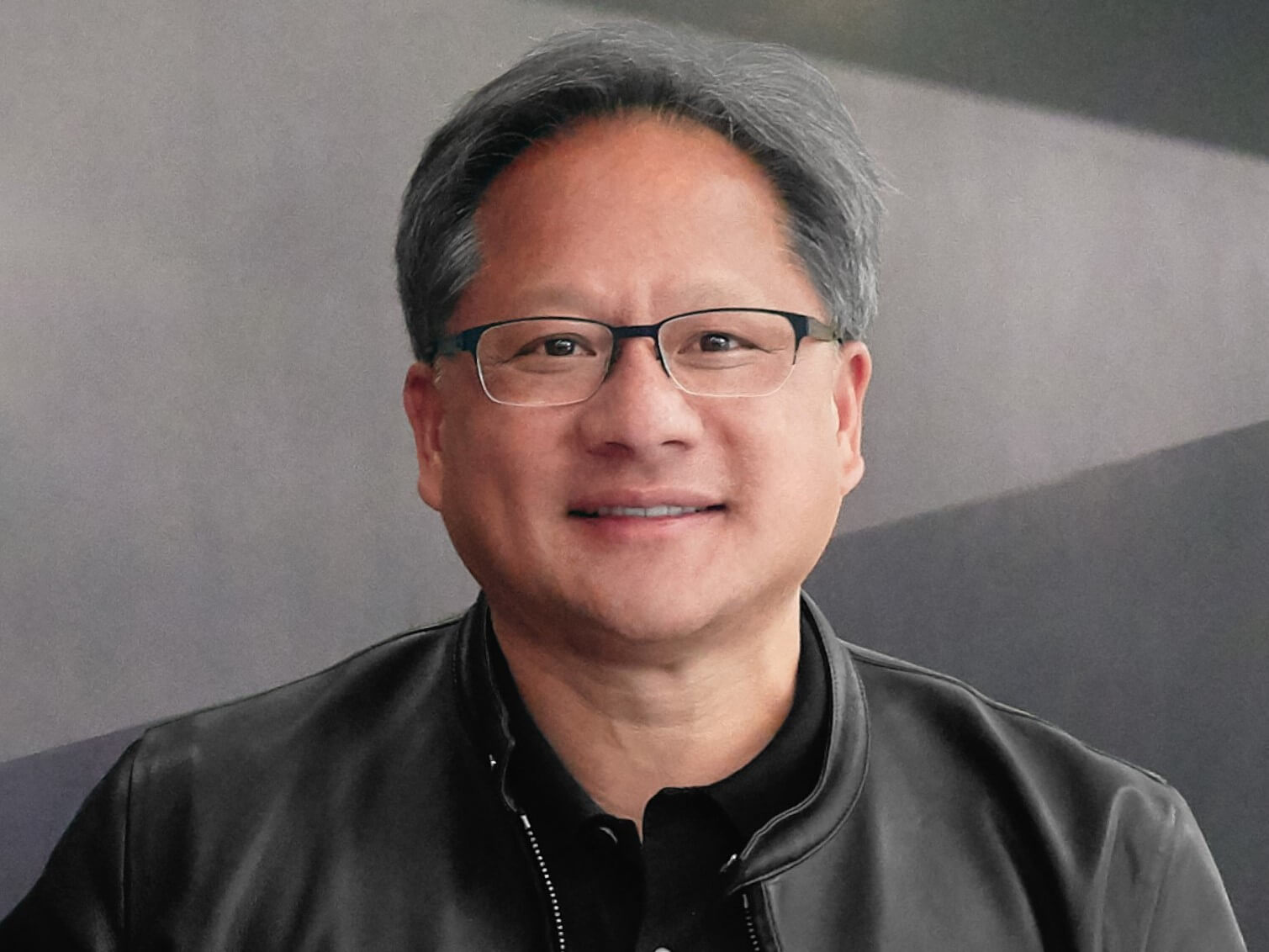

Jensen Huang Nvidia On Us Export Controls A Failure Trumps Success

May 22, 2025

Jensen Huang Nvidia On Us Export Controls A Failure Trumps Success

May 22, 2025

Latest Posts

-

Investigation Launched After Fed Ex Truck Fire On Route 283 Lancaster County

May 22, 2025

Investigation Launched After Fed Ex Truck Fire On Route 283 Lancaster County

May 22, 2025 -

Interstate 83 Closed Following Produce Truck Accident

May 22, 2025

Interstate 83 Closed Following Produce Truck Accident

May 22, 2025 -

Fed Ex Truck Catches Fire On Route 283 Lancaster County Traffic Delays

May 22, 2025

Fed Ex Truck Catches Fire On Route 283 Lancaster County Traffic Delays

May 22, 2025 -

Produce Truck Rollover Shuts Down Part Of Interstate 83

May 22, 2025

Produce Truck Rollover Shuts Down Part Of Interstate 83

May 22, 2025 -

I 83 Tractor Trailer Crash Involving Produce Shipment

May 22, 2025

I 83 Tractor Trailer Crash Involving Produce Shipment

May 22, 2025