Canada's Housing Market: The Impact Of Steep Down Payments

Table of Contents

The Affordability Crisis Exacerbated by Steep Down Payments

The high cost of housing in Canada is a widely discussed issue, and steep down payments significantly worsen the affordability crisis. The need to save a substantial amount before even qualifying for a mortgage creates a significant hurdle, particularly for younger generations and those with limited savings.

Impact on First-Time Homebuyers

High down payment requirements severely restrict access to homeownership for many Canadians.

- Delayed Homeownership: Saving for a large down payment can delay homeownership for years, potentially impacting family planning and long-term financial security.

- Increased Competition: The limited pool of buyers who can afford substantial down payments fuels intense competition, driving up property prices further. This creates a vicious cycle where affordability becomes increasingly unattainable for the average Canadian.

- Reduced Economic Mobility: The inability to access homeownership disproportionately impacts lower-income individuals and families, hindering their economic mobility and creating a significant wealth gap.

Regional Variations in Down Payment Requirements and Affordability

The impact of down payment requirements varies considerably across Canada. While a 20% down payment is often cited as standard, the reality is far more nuanced, depending on factors like location, property type, and the buyer's financial situation.

- Toronto and Vancouver: These major metropolitan areas often require significantly larger down payments due to sky-high housing prices. Competition is fierce, and buyers often need to put down 25% or even more to secure a mortgage.

- Smaller Markets: Smaller cities and towns may have more manageable down payment requirements reflecting lower average property prices and potentially different lending practices.

- Government Interventions: Provincial and federal governments have introduced various initiatives aimed at improving affordability in specific regions, often including programs to assist with down payments or reduce mortgage insurance premiums. The success and reach of these programs vary widely.

Market Trends Influenced by Steep Down Payments

Steep down payments in Canada significantly influence housing market trends, creating a complex interplay between supply, demand, and pricing.

Impact on Housing Inventory and Prices

The high barrier to entry created by substantial down payments restricts the number of potential buyers. This contributes to a seller's market, characterized by low housing inventory and escalating property values.

- Limited Buyer Pool: Fewer qualified buyers mean less competition to drive prices down and a greater potential for rapid price increases.

- Rental Market Pressure: As homeownership becomes less attainable, increased demand drives up rental prices, adding to the overall financial pressure on Canadians.

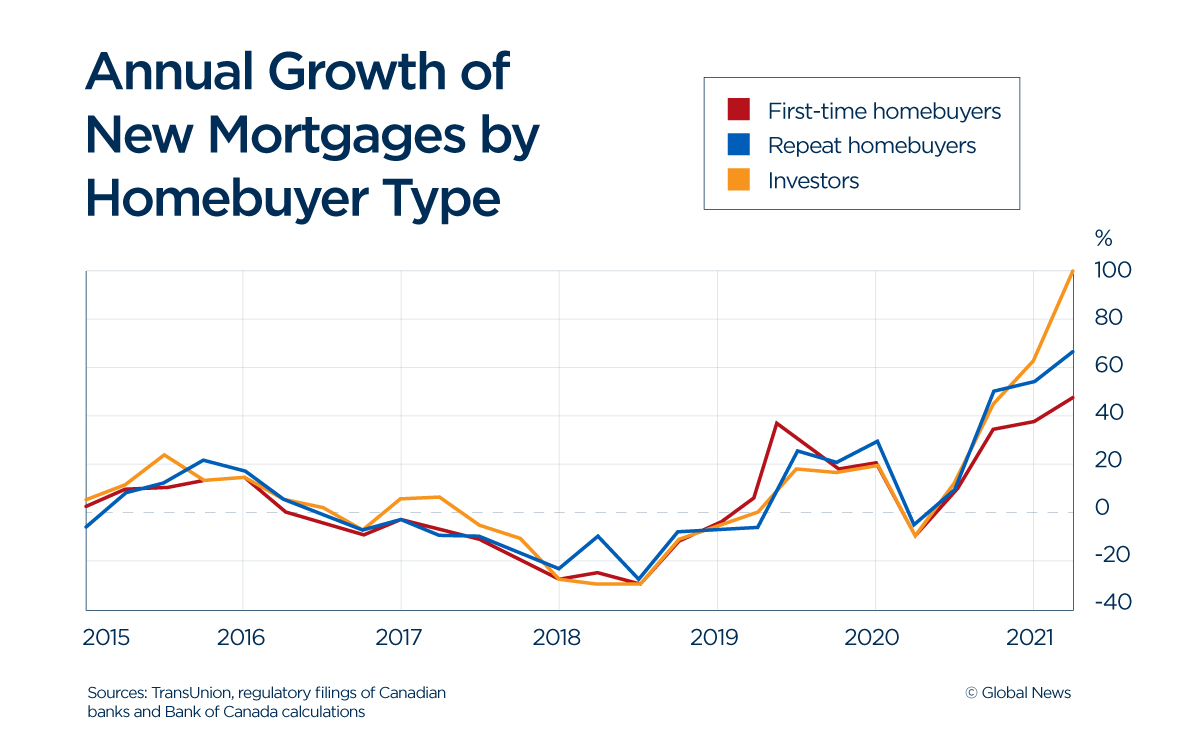

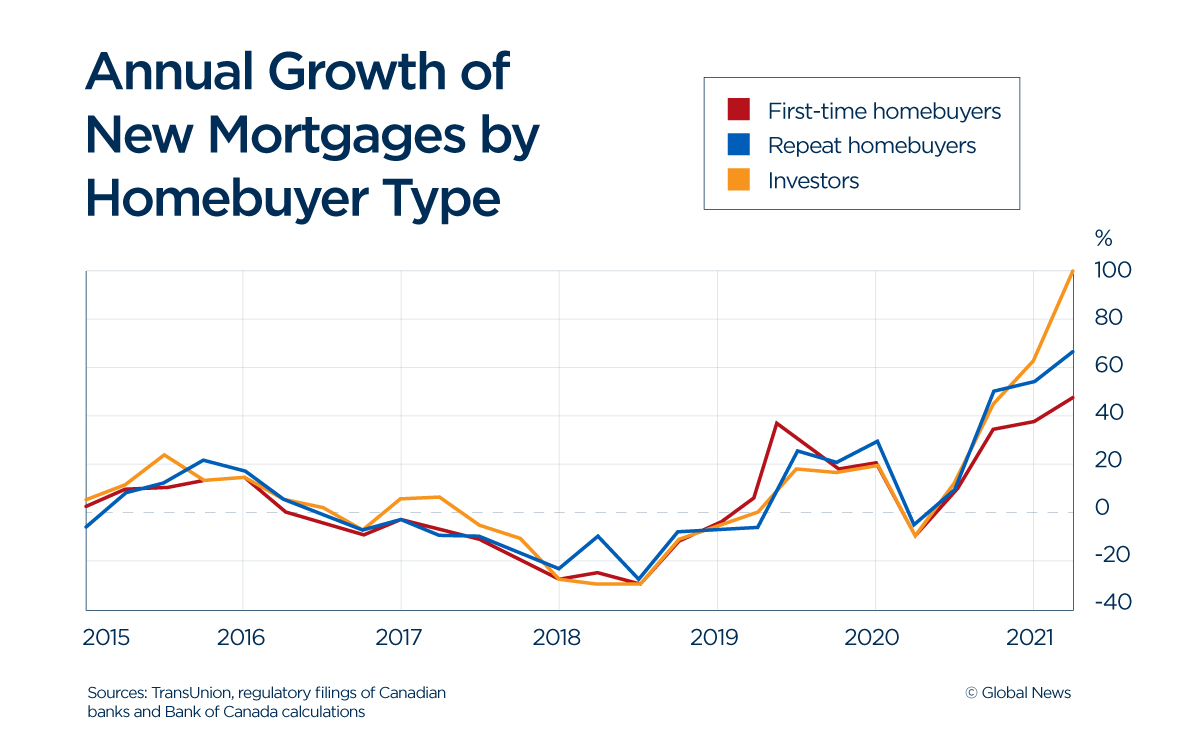

- Data Correlation: Analyzing market data reveals a strong correlation between the average down payment size and subsequent increases in average property prices.

The Role of Mortgage Stress Tests and Interest Rates

The influence of steep down payments is magnified by Canada's stringent mortgage stress tests and fluctuating interest rates.

- Mortgage Stress Tests: These tests ensure borrowers can handle higher interest rates, often making it more difficult to qualify for a mortgage, especially with a larger down payment.

- Interest Rate Fluctuations: Even a small increase in interest rates can significantly increase monthly mortgage payments, making a large down payment less effective in reducing the overall financial burden.

- Market Stability: The combined effects of high down payments, stress tests, and interest rates contribute to market instability and volatility.

Potential Solutions and Government Interventions

Addressing the challenges posed by high down payment requirements in Canada requires a multifaceted approach involving government intervention and the exploration of alternative financing options.

Government Programs and Initiatives

The Canadian government has implemented various programs designed to support first-time homebuyers.

- First-Time Home Buyers' Incentive: This program offers shared-equity mortgages, reducing the amount of the down payment needed. However, its effectiveness is limited by eligibility criteria and program availability.

- Program Improvements: Expanding the eligibility criteria and financial support offered by existing programs could broaden their impact and make homeownership more accessible.

- New Initiatives: Innovative government programs that directly address affordability challenges and focus on lower-income populations could provide vital support.

Alternative Financing Options

Beyond government programs, alternative financing options are emerging to make homeownership more attainable.

- Shared Equity Mortgages: These mortgages involve a third-party investor contributing a portion of the down payment in exchange for a share of the property's equity.

- Co-ownership Models: This approach allows individuals to purchase a share of a property with others, reducing the individual financial burden of the down payment.

- Private Sector Initiatives: Innovative private sector initiatives, such as flexible mortgage products or collaborative ownership models, could play an important role in increasing access to homeownership.

Conclusion

Steep down payments Canada represent a significant obstacle to homeownership for many Canadians. The impact is far-reaching, affecting not only individual affordability but also broader market trends and economic stability. While government initiatives and alternative financing options provide some assistance, further innovative solutions and strategic adjustments are essential to alleviate the burden of high down payments and make homeownership a more attainable goal for a wider range of Canadians. Continue researching options like the First-Time Home Buyers' Incentive and explore alternative financing options to find the best solution for your circumstances. Don't let the perceived hurdle of steep down payments deter your dreams of homeownership in Canada; there are pathways to success.

Featured Posts

-

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025 -

Turkey Blocks Jailed Mayors Social Media After Opposition Outcry

May 10, 2025

Turkey Blocks Jailed Mayors Social Media After Opposition Outcry

May 10, 2025 -

Whats App Spyware Lawsuit Metas 168 Million Loss And Future Implications

May 10, 2025

Whats App Spyware Lawsuit Metas 168 Million Loss And Future Implications

May 10, 2025 -

Samuel Dickson Industrialist And Leader In Canadas Lumber Industry

May 10, 2025

Samuel Dickson Industrialist And Leader In Canadas Lumber Industry

May 10, 2025