Canadian Dollar Weakness: A Deeper Dive Into Recent Currency Movements

Table of Contents

Global Economic Factors Influencing CAD Weakness

Several global economic factors contribute to the current Canadian dollar weakness. Understanding these external pressures is key to predicting future CAD performance.

Impact of US Dollar Strength

The USD's strength often negatively impacts the CAD due to their close economic ties. The US dollar frequently acts as a safe haven currency during times of global uncertainty. This "flight to safety" increases demand for USD, pushing its value up and consequently weakening the CAD.

- Recent interest rate hikes in the US: The Federal Reserve's aggressive interest rate hikes have significantly boosted the USD's attractiveness to international investors seeking higher returns. This increased demand for US dollars directly impacts the USD/CAD exchange rate.

- Global recessionary fears: Concerns about a potential global recession often lead investors to move their assets into safer havens, like the US dollar, further strengthening the USD against the CAD.

- USD/CAD exchange rate fluctuations: The USD/CAD exchange rate has risen by 15% in the last 12 months, a clear indicator of Canadian dollar weakness. This volatility underscores the importance of understanding the factors driving these fluctuations.

Influence of Global Commodity Prices

Canada's economy is heavily reliant on commodity exports, particularly oil and natural gas. Fluctuations in global commodity prices directly impact the CAD's value.

- Impact of oil price volatility: Oil prices are a major driver of the Canadian dollar. A drop in oil prices weakens the CAD, as Canada's export revenue diminishes. Conversely, rising oil prices tend to strengthen the CAD.

- Demand for Canadian resources: Global demand for Canadian resources, including lumber, minerals, and energy, influences the CAD. Decreased global demand leads to lower export revenues and a weaker CAD.

- Correlation between commodity prices and the CAD: There's a strong positive correlation between commodity prices and the CAD's value. Charts showing this correlation clearly illustrate the impact of fluctuating commodity markets on the Canadian dollar. A 10% decrease in oil prices can lead to a 5% decrease in the CAD value.

Domestic Economic Factors Contributing to Canadian Dollar Weakness

Beyond global factors, domestic economic conditions also significantly influence Canadian dollar weakness.

Bank of Canada Monetary Policy

The Bank of Canada's monetary policy decisions play a crucial role in shaping the CAD's value. Interest rate adjustments influence investor sentiment and capital flows.

- Bank of Canada's inflation targets: The Bank of Canada's attempts to control inflation through interest rate adjustments impact the CAD. Higher interest rates generally attract foreign investment, strengthening the currency.

- Current economic outlook: The Bank of Canada's assessment of the Canadian economy influences its policy decisions. A pessimistic outlook might lead to lower interest rates, potentially weakening the CAD.

- Interest rate differentials: The difference in interest rates between Canada and other major economies significantly affects exchange rates. A lower Canadian interest rate compared to the US, for example, can make the CAD less attractive to investors.

Canadian Economic Growth and Political Stability

Slower-than-expected economic growth or political uncertainty can negatively affect investor confidence, putting downward pressure on the CAD.

- Key economic indicators: GDP growth, employment rates, and consumer confidence are key indicators that influence investor sentiment toward the Canadian economy and, consequently, the CAD. Weak economic data can lead to a weaker currency.

- Political factors: Political instability or uncertainty can deter foreign investment and negatively impact the CAD's value. Clear and stable political leadership promotes investor confidence.

Strategies for Navigating Canadian Dollar Weakness

Businesses and investors need strategies to navigate the challenges and potential opportunities presented by a weakening Canadian dollar.

Hedging Strategies for Businesses

Businesses can mitigate risks associated with CAD weakness through hedging strategies.

- Forward contracts: These contracts lock in a specific exchange rate for a future transaction, eliminating uncertainty.

- Options: Options contracts offer the right, but not the obligation, to buy or sell currency at a specific rate, providing flexibility.

- Currency swaps: These agreements exchange principal and interest payments in one currency for payments in another, managing currency risk.

Investment Strategies for Investors

Investors can adjust their portfolios to account for a weakening CAD.

- Diversification: Diversifying investments across different currencies reduces exposure to CAD weakness.

- CAD-denominated assets: Investing in assets priced in CAD that are expected to perform well despite currency fluctuations can mitigate losses.

- Currency ETFs: Exchange-traded funds (ETFs) focused on specific currencies can offer exposure to global currency markets.

Conclusion

The recent weakness of the Canadian dollar is a complex issue stemming from a combination of global and domestic factors. Understanding the interplay between US dollar strength, commodity price fluctuations, Bank of Canada policy, and domestic economic growth is crucial for effectively navigating the current market conditions. By employing appropriate hedging and investment strategies, businesses and investors can mitigate the risks associated with this Canadian dollar weakness and potentially capitalize on emerging opportunities. Stay informed about economic indicators, central bank policies, and global market trends to make informed decisions regarding the Canadian dollar. Continue to monitor the evolving dynamics of Canadian dollar weakness to proactively manage your financial exposure.

Featured Posts

-

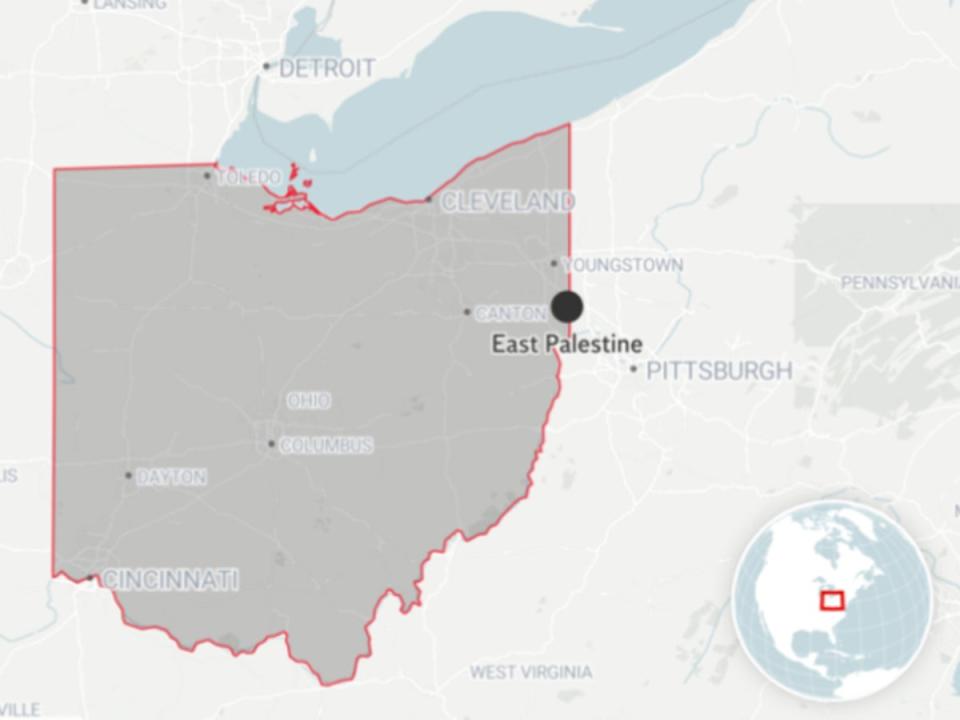

Ohio Train Derailment Months Of Lingering Toxic Chemical Contamination In Buildings

Apr 24, 2025

Ohio Train Derailment Months Of Lingering Toxic Chemical Contamination In Buildings

Apr 24, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025 -

Dram Market Shift Sk Hynixs Ai Driven Rise To The Top

Apr 24, 2025

Dram Market Shift Sk Hynixs Ai Driven Rise To The Top

Apr 24, 2025 -

Private Credit Jobs 5 Crucial Dos And Don Ts To Get Hired

Apr 24, 2025

Private Credit Jobs 5 Crucial Dos And Don Ts To Get Hired

Apr 24, 2025 -

Securing Canadas Future The Importance Of Fiscal Responsibility

Apr 24, 2025

Securing Canadas Future The Importance Of Fiscal Responsibility

Apr 24, 2025