Canadian Economic Outlook: Ultra-Low Growth Predicted By David Dodge

Table of Contents

Renowned Canadian economist David Dodge has issued a stark warning about the Canadian economic outlook, predicting a period of ultra-low growth. This forecast, raising significant concerns about the nation's economic trajectory and potential risks, necessitates a careful examination. This article delves into Dodge's prediction, examining the underlying factors and potential implications for Canadian businesses and consumers. We will analyze the risks, consider alternative perspectives, and ultimately explore what this means for Canadians.

Dodge's Prediction: Ultra-Low Growth and its Implications

David Dodge's prediction points towards a significantly subdued Canadian GDP growth rate. While the precise percentage isn't consistently specified across all his statements, his warnings consistently paint a picture of ultra-low growth, potentially hovering near or even below 1% for a considerable period. This timeframe is expected to extend into at least the next year, potentially longer depending on evolving global and domestic economic conditions.

Several key factors underpin Dodge's pessimistic outlook:

-

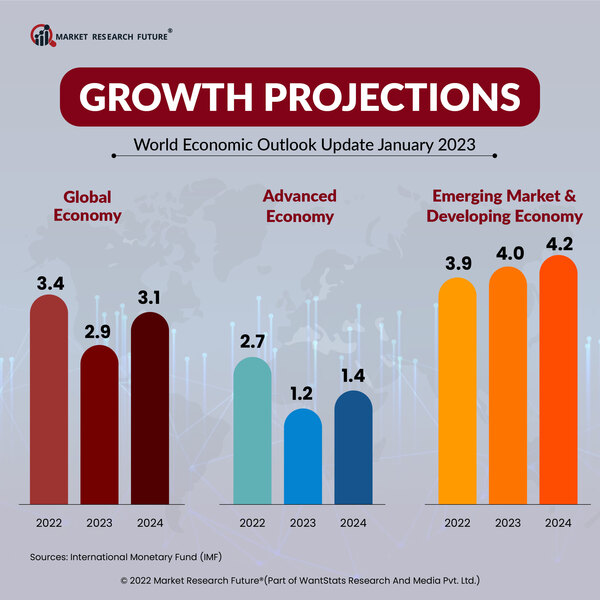

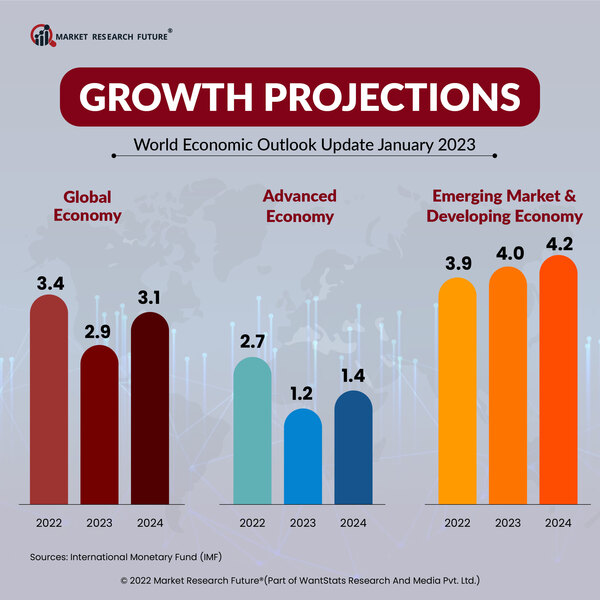

Global Economic Slowdown: The global economy faces persistent headwinds, including inflation, supply chain disruptions, and geopolitical uncertainty. This sluggish global growth directly impacts Canada's export-oriented economy.

-

High Interest Rates: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have significantly impacted consumer spending and business investment. Higher borrowing costs discourage major purchases and capital expenditures, slowing economic activity.

-

Housing Market Correction: The once-booming Canadian housing market is experiencing a correction, leading to decreased construction activity and reduced consumer wealth. This ripple effect extends throughout the economy, impacting related sectors.

-

Geopolitical Uncertainties and Supply Chain Disruptions: Ongoing geopolitical tensions, particularly the war in Ukraine, continue to disrupt global supply chains and contribute to inflationary pressures. This instability adds further uncertainty to the Canadian economic outlook.

Analyzing the Risks of Prolonged Low Growth

Sustained ultra-low growth poses several significant risks to the Canadian economy:

-

Increased Unemployment Rates: Reduced economic activity often translates to job losses across various sectors, potentially leading to higher unemployment rates and increased social strain.

-

Reduced Consumer Confidence: A prolonged period of slow growth can erode consumer confidence, further dampening spending and investment. This creates a negative feedback loop, hindering economic recovery.

-

Potential for a Recession: Ultra-low growth significantly increases the risk of a recession, defined as two consecutive quarters of negative economic growth. This would have severe consequences for businesses and individuals.

-

Strain on Government Finances: Lower economic growth reduces government tax revenues, potentially limiting the government's ability to fund essential social programs and infrastructure projects.

-

Impact on Different Sectors: Various sectors will be differentially affected. The real estate, manufacturing, and retail sectors are particularly vulnerable to the impacts of ultra-low growth and high interest rates.

Alternative Perspectives and Counterarguments

While Dodge's prediction warrants serious consideration, it's essential to acknowledge alternative perspectives and potential mitigating factors. Not all economists share equally pessimistic views. Some argue that Canada's strong banking system and robust resource sector could provide some resilience against the global downturn.

-

Strengths of the Canadian Economy: Canada possesses a diversified economy with strengths in natural resources, technology, and agriculture. These sectors may offer some insulation against the broader global economic slowdown.

-

Potential Government Stimulus Measures: The government could implement fiscal stimulus measures to boost economic activity, although the effectiveness and potential drawbacks of such measures are subject to debate.

-

Unforeseen Positive Global Events: Unforeseen positive global developments, such as a faster-than-expected resolution to geopolitical conflicts or breakthroughs in technological innovation, could positively impact the Canadian economy.

Comparing Dodge's Forecast to Other Economic Predictions

Dodge's forecast aligns with the concerns of several other prominent economists and financial institutions who also predict slower-than-expected growth for the Canadian economy. However, there's a range of predictions regarding the severity and duration of the slowdown. Some forecasts are less pessimistic than Dodge's, highlighting the inherent uncertainties in economic prediction.

Conclusion

David Dodge's prediction of ultra-low growth for the Canadian economy underscores significant risks. Factors like a global economic slowdown, high interest rates, and a housing market correction contribute to this pessimistic outlook. While alternative viewpoints and mitigating factors exist, the potential for increased unemployment, reduced consumer confidence, and even a recession necessitates careful consideration. Understanding the Canadian economic outlook is crucial.

Call to Action: Stay informed about the evolving Canadian economic outlook. Follow reputable sources for updates on the Canadian economy and economic predictions from experts like David Dodge. Monitoring the Canadian economic outlook closely and planning accordingly for ultra-low growth scenarios is crucial for businesses and individuals to make informed decisions and prepare for the potential challenges ahead. Understanding the complexities of the Canadian economic outlook is vital for navigating the future.

Featured Posts

-

2024s Under The Radar Ps Plus Game Worth Checking Out

May 02, 2025

2024s Under The Radar Ps Plus Game Worth Checking Out

May 02, 2025 -

Japans Economy Slows Bank Of Japan Lowers Growth Projections Due To Trade Disputes

May 02, 2025

Japans Economy Slows Bank Of Japan Lowers Growth Projections Due To Trade Disputes

May 02, 2025 -

Winning Numbers Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025

Winning Numbers Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025 -

The Best Shrimp Ramen Stir Fry Recipe You Ll Ever Try

May 02, 2025

The Best Shrimp Ramen Stir Fry Recipe You Ll Ever Try

May 02, 2025 -

Los Angeles Wildfires Gambling On Tragedy And Its Implications

May 02, 2025

Los Angeles Wildfires Gambling On Tragedy And Its Implications

May 02, 2025

Latest Posts

-

Understanding The Narrative Of Wynne And Joanna All At Sea

May 10, 2025

Understanding The Narrative Of Wynne And Joanna All At Sea

May 10, 2025 -

Strictly Come Dancing Katya Joness Departure And The Wynne Evans Controversy

May 10, 2025

Strictly Come Dancing Katya Joness Departure And The Wynne Evans Controversy

May 10, 2025 -

Exploring Wynne And Joannas All At Sea A Deep Dive

May 10, 2025

Exploring Wynne And Joannas All At Sea A Deep Dive

May 10, 2025 -

Wynne Evans Called Out By Joanna Page On Recent Bbc Appearance

May 10, 2025

Wynne Evans Called Out By Joanna Page On Recent Bbc Appearance

May 10, 2025 -

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025