Canadian Economy Faces Recession: TD's 100,000 Job Loss Prediction

Table of Contents

TD Bank's Recession Prediction: The Details

TD Bank's prediction paints a concerning picture for the Canadian economy. While the precise wording and official report may vary, the core message highlights a significant risk of a recession leading to substantial job losses. Let's break down the key aspects of this prediction:

-

Precise number of job losses: While the exact figure fluctuates in media reporting based on interpretations of TD's analysis, the headline figure consistently revolves around 100,000 job losses. This represents a significant blow to the Canadian labor market.

-

Timeframe for predicted job losses: TD's prediction doesn't typically specify an exact date for these job losses, but rather indicates a timeframe tied to the projected recession's duration. The impact could be felt over several quarters, not necessarily concentrated in a single period.

-

Industries expected to be hit hardest: Sectors heavily reliant on consumer spending, such as retail and hospitality, are likely to be among the hardest hit. The housing market, already experiencing cooling, is also anticipated to suffer, impacting construction and related industries. Manufacturing, sensitive to global economic fluctuations, could also face significant challenges.

-

Supporting data and economic indicators: TD Bank bases its prediction on a range of economic indicators, including inflation rates, interest rate hikes, consumer confidence data, and global economic forecasts. These factors are interconnected and contribute to the overall pessimistic outlook.

-

Link to TD's official report or statement: [Insert link to official TD report or statement if available]. Always refer to the original source for the most accurate and up-to-date information.

Underlying Causes of the Predicted Economic Downturn in Canada

Several intertwined factors are contributing to the increased likelihood of a Canadian recession and the projected job losses. Understanding these causes is crucial for effective mitigation strategies:

-

High inflation rates: Persistent high inflation erodes purchasing power, reducing consumer spending and impacting business profitability. This creates a negative feedback loop that weakens economic growth.

-

Rising interest rates: The Bank of Canada's efforts to combat inflation through interest rate hikes increase borrowing costs for businesses and consumers, dampening investment and spending. This can lead to reduced economic activity and job losses.

-

Global economic slowdown: A global economic slowdown negatively impacts Canadian exports, reducing demand for Canadian goods and services. Geopolitical instability further exacerbates this challenge.

-

Geopolitical instability: The ongoing war in Ukraine, along with other global uncertainties, contributes to supply chain disruptions and increased energy prices, adding pressure on the Canadian economy.

-

Government policies: While not always a direct cause, government policies surrounding fiscal spending and economic regulation can inadvertently influence the overall economic climate and contribute to recessionary pressures.

Potential Consequences of a Canadian Recession and 100,000 Job Losses

The projected 100,000 job losses and a potential recession would have far-reaching consequences across the Canadian economy and society:

-

Increased unemployment rate: A significant rise in unemployment leads to increased social hardship, including financial strain on families and communities.

-

Decline in consumer confidence and spending: Uncertainty surrounding job security and economic stability can cause consumers to reduce spending, further slowing economic growth.

-

Impact on the housing market: Higher interest rates and reduced consumer confidence are already cooling the housing market. A recession could lead to a more significant decline in real estate prices.

-

Government intervention measures: The government may implement stimulus packages or other measures to mitigate the effects of the recession, but the effectiveness of such interventions is debated.

-

Long-term effects on economic growth: A prolonged recession can have lasting negative impacts on long-term economic growth potential, impacting future prosperity.

Preparing for a Potential Canadian Recession: Advice for Individuals and Businesses

Preparing for a potential recession is crucial for both individuals and businesses. Proactive steps can significantly mitigate the impact of an economic downturn:

-

Individuals:

- Budgeting and saving: Creating a detailed budget and building an emergency fund are essential steps to weather economic uncertainty.

- Reducing debt: Minimizing debt reduces financial vulnerability during economic hardship.

- Diversifying investments: Spreading investments across different asset classes helps reduce risk.

-

Businesses:

- Cost-cutting measures: Identifying and eliminating unnecessary expenses is crucial for maintaining profitability.

- Diversifying products/services: Reducing reliance on single markets or products minimizes vulnerability.

- Investing in technology: Improving efficiency and productivity through technology can enhance competitiveness.

-

Resources available: Various government programs and support services are available to help individuals and businesses navigate economic hardship. Check with your provincial and federal government websites for details.

Conclusion

TD Bank's prediction of 100,000 job losses highlights the significant risk of a Canadian recession. Factors such as high inflation, rising interest rates, a global economic slowdown, and geopolitical instability contribute to this challenging outlook. The potential consequences include increased unemployment, reduced consumer spending, and a further cooling of the housing market. To prepare, individuals should focus on budgeting, saving, and reducing debt, while businesses should consider cost-cutting and diversification strategies. Stay informed about the evolving Canadian economic landscape by regularly checking reputable news sources and financial institutions for updates on the Canadian recession and job market predictions. Understanding the potential impact on your finances and taking proactive steps is key to navigating this potential economic downturn. Learn more about managing your finances during a potential Canadian recession and protect your financial well-being.

Featured Posts

-

Man Utd Star Slammed Analysis Of A Costly Mistake And Unconventional Reaction

May 28, 2025

Man Utd Star Slammed Analysis Of A Costly Mistake And Unconventional Reaction

May 28, 2025 -

Hailee Steinfeld And Josh Allens Wedding Plans Intimate Ceremony Four Months Post Engagement

May 28, 2025

Hailee Steinfeld And Josh Allens Wedding Plans Intimate Ceremony Four Months Post Engagement

May 28, 2025 -

Peksuv Odchod Znamena To Konec Pro Piraty

May 28, 2025

Peksuv Odchod Znamena To Konec Pro Piraty

May 28, 2025 -

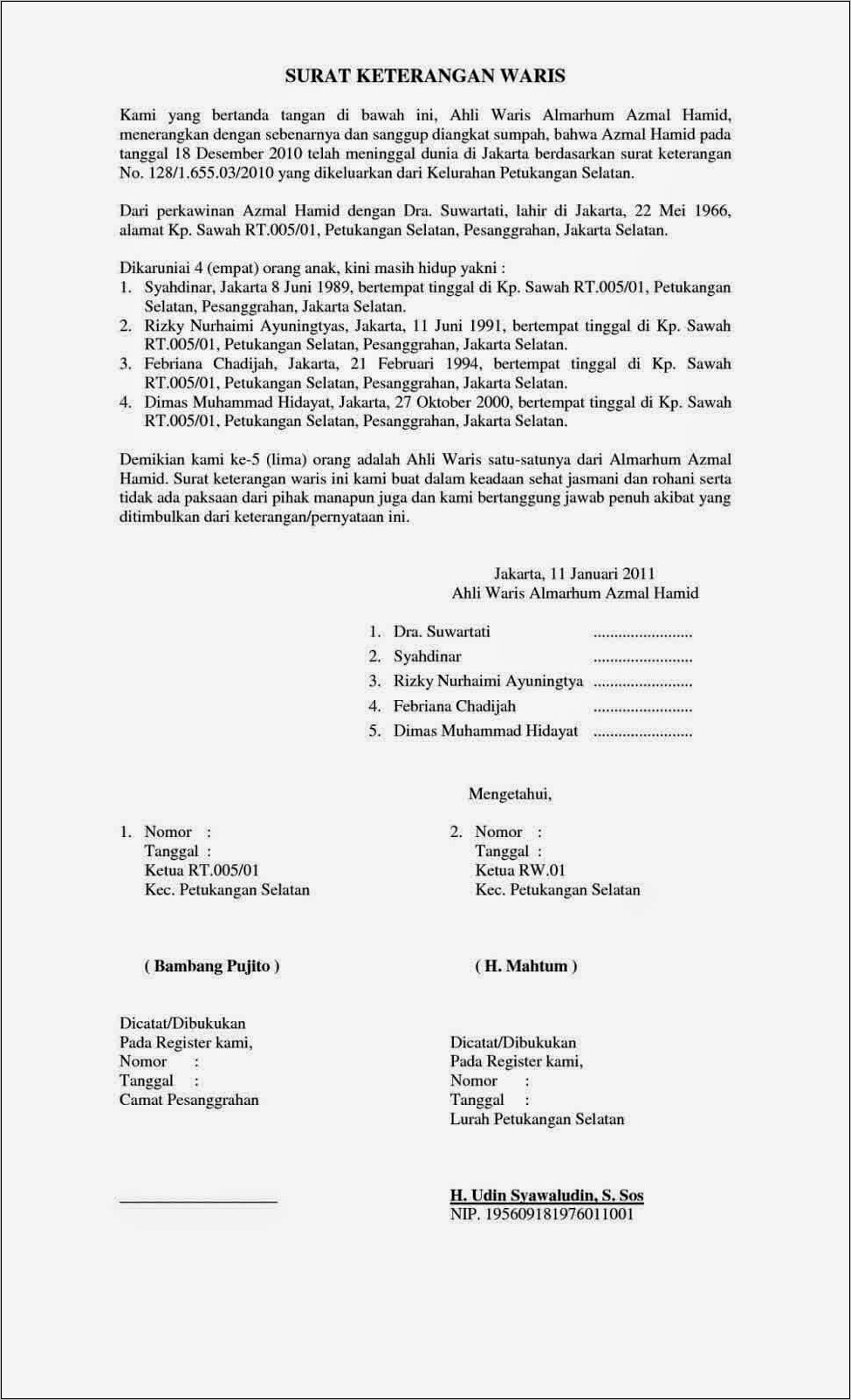

Bule Dan Kawin Kontrak Di Bali Ancaman Bagi Warga Lokal

May 28, 2025

Bule Dan Kawin Kontrak Di Bali Ancaman Bagi Warga Lokal

May 28, 2025 -

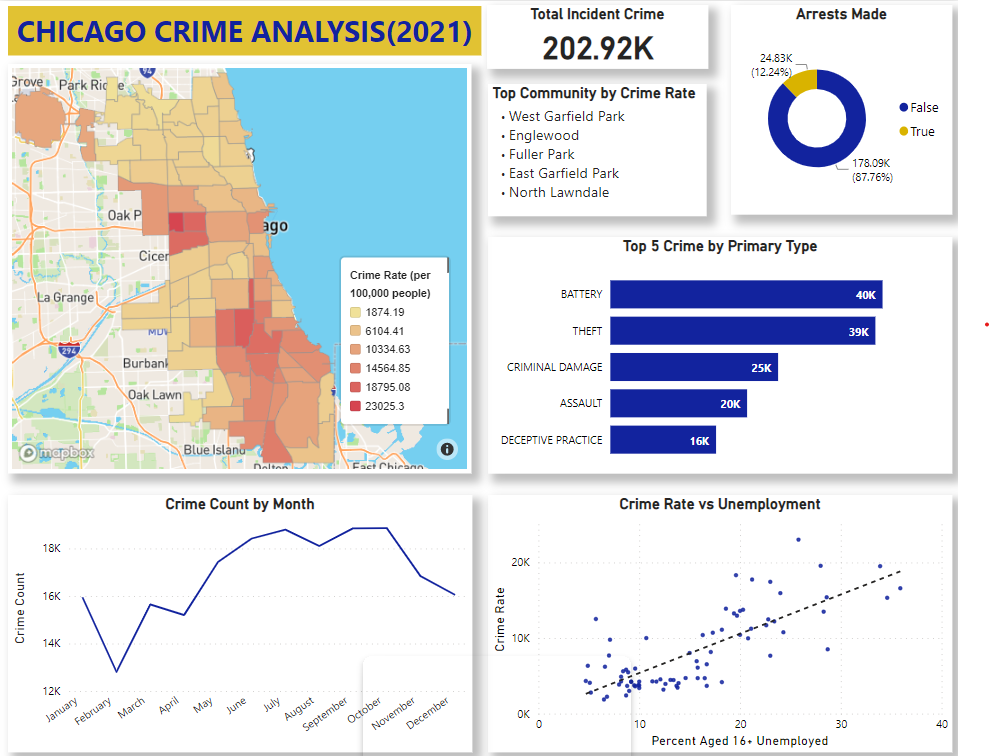

The Unexpected Drop In Chicago Crime Analysis And Potential Explanations

May 28, 2025

The Unexpected Drop In Chicago Crime Analysis And Potential Explanations

May 28, 2025

Latest Posts

-

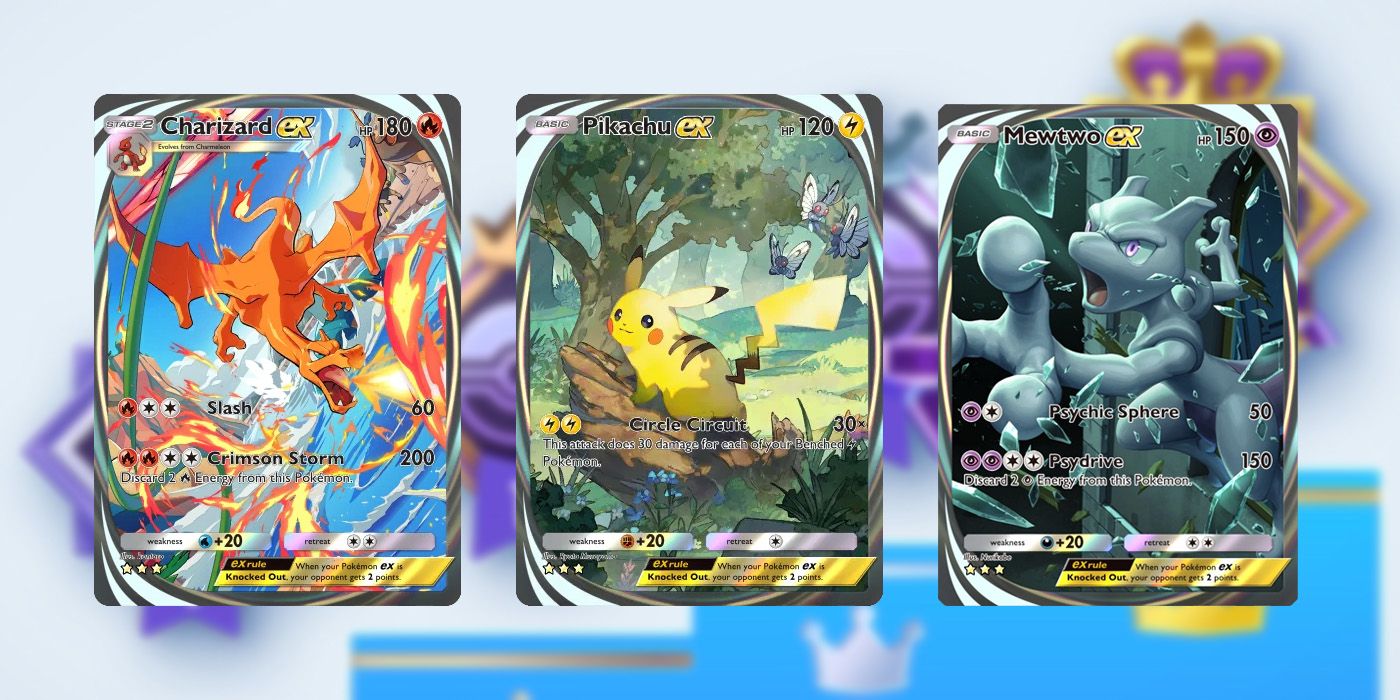

The Pokemon Tcg Pocket New Crown Zenith Whats New And Exciting

May 29, 2025

The Pokemon Tcg Pocket New Crown Zenith Whats New And Exciting

May 29, 2025 -

Analyzing The New Pokemon Tcg Pocket New Crown Zenith Cards

May 29, 2025

Analyzing The New Pokemon Tcg Pocket New Crown Zenith Cards

May 29, 2025 -

New Crown Zenith Pocket Sized Pokemon Tcg Surprises

May 29, 2025

New Crown Zenith Pocket Sized Pokemon Tcg Surprises

May 29, 2025 -

Pokemon Tcg Pocket New Crown Zenith Unexpected Cards Delight Fans

May 29, 2025

Pokemon Tcg Pocket New Crown Zenith Unexpected Cards Delight Fans

May 29, 2025 -

Pokemon Tcg Pocket Celestial Guardians A Card Performance Review

May 29, 2025

Pokemon Tcg Pocket Celestial Guardians A Card Performance Review

May 29, 2025