Canadian Housing Market Slowdown: Recession Fears Weigh On Buyers (BMO)

Table of Contents

Rising Interest Rates: The Primary Driver of the Slowdown

The Bank of Canada's monetary policy tightening is the primary culprit behind the Canadian housing market slowdown. Increased interest rates directly impact mortgage affordability, making it significantly more expensive for potential homebuyers to finance a purchase. This translates to reduced purchasing power and a smaller pool of qualified buyers.

The impact is substantial. Even a seemingly small increase in the interest rate can dramatically increase monthly mortgage payments. For example, a 1% increase on a $500,000 mortgage can add hundreds of dollars to the monthly payment, significantly impacting a household budget. This increased borrowing cost is forcing many potential buyers to reconsider or postpone their purchase decisions.

- Increased borrowing costs: Higher interest rates mean higher mortgage payments.

- Reduced purchasing power: Buyers can afford less house for the same monthly payment.

- Higher monthly mortgage payments: Stretching household budgets and reducing affordability.

- Fewer qualified buyers: Stricter lending criteria and higher rates exclude potential buyers.

Recessionary Fears: Uncertainty Weighs on Consumer Confidence

Concerns about an impending economic recession are further dampening buyer enthusiasm in the Canadian housing market. Inflation is eroding purchasing power, and the threat of job losses is increasing uncertainty. This atmosphere of economic instability leads many consumers to delay large purchases like buying a home, opting for a wait-and-see approach. The psychology of economic uncertainty encourages caution and risk aversion, impacting consumer confidence and slowing down market activity.

- Decreased consumer confidence: Fear of job losses and economic downturn affects spending.

- Delayed purchasing decisions: Buyers postpone home purchases until greater economic certainty.

- Increased market uncertainty: A volatile economic climate creates unpredictable market conditions.

- Potential for further price drops: Recessionary fears can lead to expectations of lower housing prices.

Inventory Levels and Market Supply: A Shifting Landscape

While certain areas of Canada experienced historically low housing inventory, the current market is witnessing a shift. Increased supply in some regions is altering the power dynamic between buyers and sellers. This increased inventory gives buyers more negotiating power, potentially leading to price adjustments and a more balanced market. Regional variations remain significant; some areas continue to experience tight supply, while others are seeing a surplus of listings.

- Increased housing inventory in some areas: More homes on the market are giving buyers more choices.

- Shifting power dynamic between buyers and sellers: Buyers now hold more leverage in negotiations.

- Potential for price negotiations: Increased supply can lead to more competitive pricing.

- Regional variations in market conditions: Market dynamics differ significantly across Canadian provinces and cities.

BMO's Predictions and Outlook for the Canadian Housing Market

BMO's report offers valuable insights into the potential trajectory of the Canadian housing market. While specific predictions vary depending on the region, BMO generally anticipates a period of moderation, with slower price growth and potentially some further price corrections in certain overheated markets. Their analysis emphasizes the significant impact of interest rate adjustments and ongoing economic uncertainty. BMO's recommendations for buyers include thorough research, careful budgeting, and seeking professional financial advice before making any significant purchase.

- BMO's forecast for house price growth: Predicts slower growth compared to the previous years.

- Predictions on interest rate changes: Anticipates further interest rate adjustments by the Bank of Canada.

- Expected changes in market activity: Forecasts a period of slower transaction volumes.

- Advice for buyers and sellers: Recommends careful planning and strategic decision-making.

Conclusion: Navigating the Canadian Housing Market Slowdown

The Canadian housing market slowdown is a complex phenomenon driven by several interacting factors: rising interest rates, recessionary fears, and evolving market dynamics. BMO's analysis highlights the need for caution and careful planning for both buyers and sellers. Potential homebuyers should proceed with caution, conduct thorough research, and seek professional financial and mortgage advice before making such a significant investment. Stay informed about the evolving Canadian housing market slowdown and make informed decisions based on the latest data and expert analysis from reputable sources like BMO. Understanding the current climate is crucial for navigating the complexities of the Canadian housing market.

Featured Posts

-

Glen Powell And Jenna Ortegas Film Collaboration Details Revealed

May 07, 2025

Glen Powell And Jenna Ortegas Film Collaboration Details Revealed

May 07, 2025 -

Explaining The Ke Huy Quan The White Lotus Season 3 Rumors

May 07, 2025

Explaining The Ke Huy Quan The White Lotus Season 3 Rumors

May 07, 2025 -

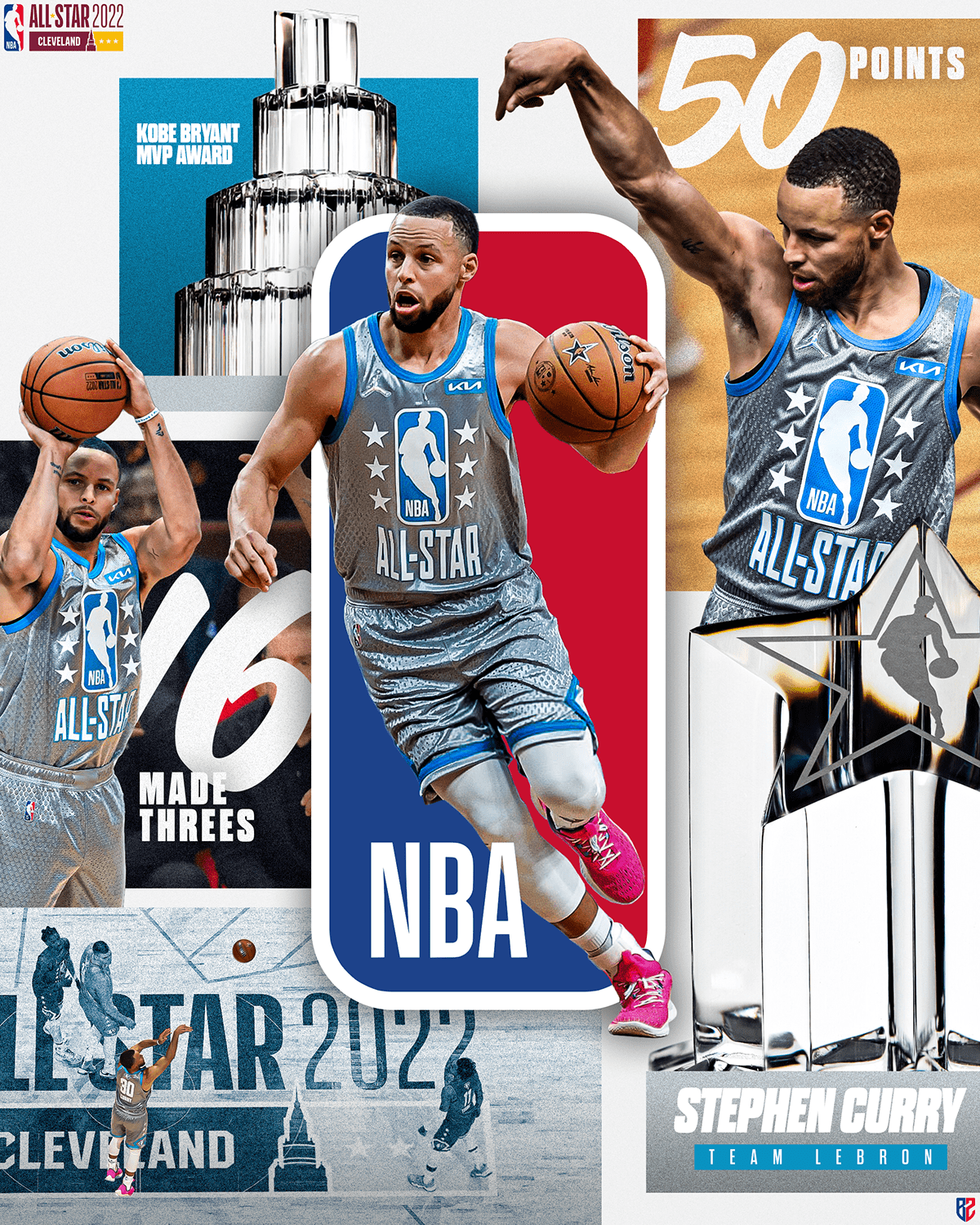

Currys All Star Weekend Triumph A New Formats First Test

May 07, 2025

Currys All Star Weekend Triumph A New Formats First Test

May 07, 2025 -

Steph Currys All Star Victory Overshadows Format Criticism

May 07, 2025

Steph Currys All Star Victory Overshadows Format Criticism

May 07, 2025 -

January 6th Ray Epps Defamation Case Against Fox News Explained

May 07, 2025

January 6th Ray Epps Defamation Case Against Fox News Explained

May 07, 2025