Canadian Job Market Update: Rosenberg's Analysis And Implications For Interest Rates

Table of Contents

Rosenberg's Key Findings on the Canadian Job Market

David Rosenberg, a prominent and often contrarian economist, offers a unique perspective on the Canadian employment landscape. His recent reports have focused on several key aspects of the Canadian job market:

-

Summary of Rosenberg's Recent Reports: Rosenberg's recent analyses have often highlighted the apparent strength of the Canadian job market, noting robust job creation numbers and a low unemployment rate. However, he consistently cautions against solely relying on headline figures.

-

Key Statistics and Data Points: Rosenberg's analysis often delves beyond the headline unemployment rate, scrutinizing metrics like labor force participation rates, wage growth across different sectors, and the types of jobs being created (e.g., are they high-paying, full-time positions, or lower-paying, part-time roles?). He frequently points out regional discrepancies in employment trends, highlighting areas experiencing stronger or weaker growth.

-

Assessment of Job Market Strength and Sustainability: Rosenberg often expresses skepticism about the long-term sustainability of the current job market strength. He carefully examines underlying factors to determine if the current robust employment figures reflect genuine economic health or temporary factors that might soon reverse.

-

Wage Growth and Inflation: A central theme in Rosenberg's analysis is the relationship between wage growth and inflation. He carefully considers whether wage increases are outpacing productivity, potentially fueling inflationary pressures and influencing the Bank of Canada's policy decisions. He often highlights specific sectors where wage growth is particularly strong or weak.

-

Specific Industries and Regions: Rosenberg's analysis frequently highlights specific industries, such as technology or manufacturing, and regions within Canada showing particularly strong or weak performance in the job market. This granular level of detail provides a more nuanced understanding of the overall picture.

Implications for Inflation and the Bank of Canada

Rosenberg's insights on the Canadian job market have significant implications for inflation predictions and the Bank of Canada's monetary policy.

-

Inflation Predictions: Rosenberg's analysis often informs his predictions about inflation. He considers the impact of wage growth, consumer spending patterns influenced by employment levels, and other factors to forecast future inflation rates. His perspective on whether current inflationary pressures are transitory or persistent significantly influences his interest rate outlook.

-

Bank of Canada's Monetary Policy: The Bank of Canada closely monitors the Canadian job market and inflation data when making decisions about interest rates. Rosenberg's analysis, whether optimistic or pessimistic, influences market expectations regarding the Bank's actions. His work helps anticipate potential interest rate hikes or cuts.

-

Interest Rate Increases or Cuts: Depending on his assessment of the job market's strength and its relation to inflation, Rosenberg may anticipate further interest rate increases to combat inflation or, conversely, predict potential rate cuts if he foresees economic weakness.

-

Consequences of Different Interest Rate Scenarios: Rosenberg’s analysis often explores the potential consequences of different interest rate scenarios. He discusses how varying interest rate policies impact borrowing costs for consumers and businesses, influence consumer spending, and affect overall economic growth.

Potential Risks and Uncertainties in the Canadian Economy

Rosenberg regularly identifies potential risks and uncertainties that could significantly impact the Canadian economy, including the job market.

-

Economic Risks: Rosenberg often highlights global economic risks like a potential recession in the United States or Europe, which could negatively impact Canadian exports and employment. He also considers supply chain disruptions, geopolitical instability, and commodity price volatility.

-

Impact on Job Market and Interest Rates: These global risks could impact Canadian job growth and lead to changes in the Bank of Canada's monetary policy, influencing interest rates. Rosenberg meticulously analyzes the potential ripple effects.

-

Resilience of the Canadian Economy: Rosenberg assesses the resilience of the Canadian economy to these external shocks. He considers factors that could mitigate the impact of these risks, such as diversification of exports or strong domestic demand.

-

Mitigating Factors and Opportunities: His analyses often include discussions of potential mitigating factors or emerging opportunities within the Canadian economy that could offset some of these risks.

Alternative Perspectives and Market Reactions

It's crucial to note that Rosenberg's perspective isn't the only one. Several other prominent economists offer contrasting views on the Canadian job market and its implications.

-

Comparison with Other Economic Forecasts: Comparing Rosenberg’s analysis with other economic forecasts for Canada provides a more comprehensive view. This comparison highlights areas of consensus and disagreement regarding the future outlook.

-

Market Reactions to Rosenberg's Predictions: Market reactions to Rosenberg's predictions, such as movements in the Canadian stock market or changes in bond yields, offer valuable insights into investor sentiment and confidence levels.

-

Differing Viewpoints: The existence of differing viewpoints underscores the complexity of economic forecasting and the inherent uncertainties involved. Understanding these diverse perspectives is essential for a balanced assessment of the Canadian job market.

Conclusion

David Rosenberg's analysis of the Canadian job market provides valuable insights into the country's economic health and its implications for interest rates. His assessment often focuses on the interplay between employment figures, wage growth, and inflationary pressures, offering a critical perspective on the Bank of Canada's policy decisions. While he frequently highlights potential risks and uncertainties, understanding his insights is crucial for navigating the complexities of the Canadian economy. Stay informed about the evolving Canadian job market and its impact on interest rates by regularly consulting reputable economic sources that cover David Rosenberg’s analysis. Understanding the Canadian job market’s dynamics and its relationship with interest rates is essential for making informed financial decisions. Continue to monitor the Canadian job market for further updates and insightful analyses from experts like David Rosenberg.

Featured Posts

-

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Watchdog Proposes Price Caps And Vet Comparison Websites

May 31, 2025

Watchdog Proposes Price Caps And Vet Comparison Websites

May 31, 2025 -

Rising Covid 19 Cases Investigating The Role Of A New Variant

May 31, 2025

Rising Covid 19 Cases Investigating The Role Of A New Variant

May 31, 2025 -

Pope Leo Xiv To Greet Giro D Italia Cyclists At The Vatican

May 31, 2025

Pope Leo Xiv To Greet Giro D Italia Cyclists At The Vatican

May 31, 2025 -

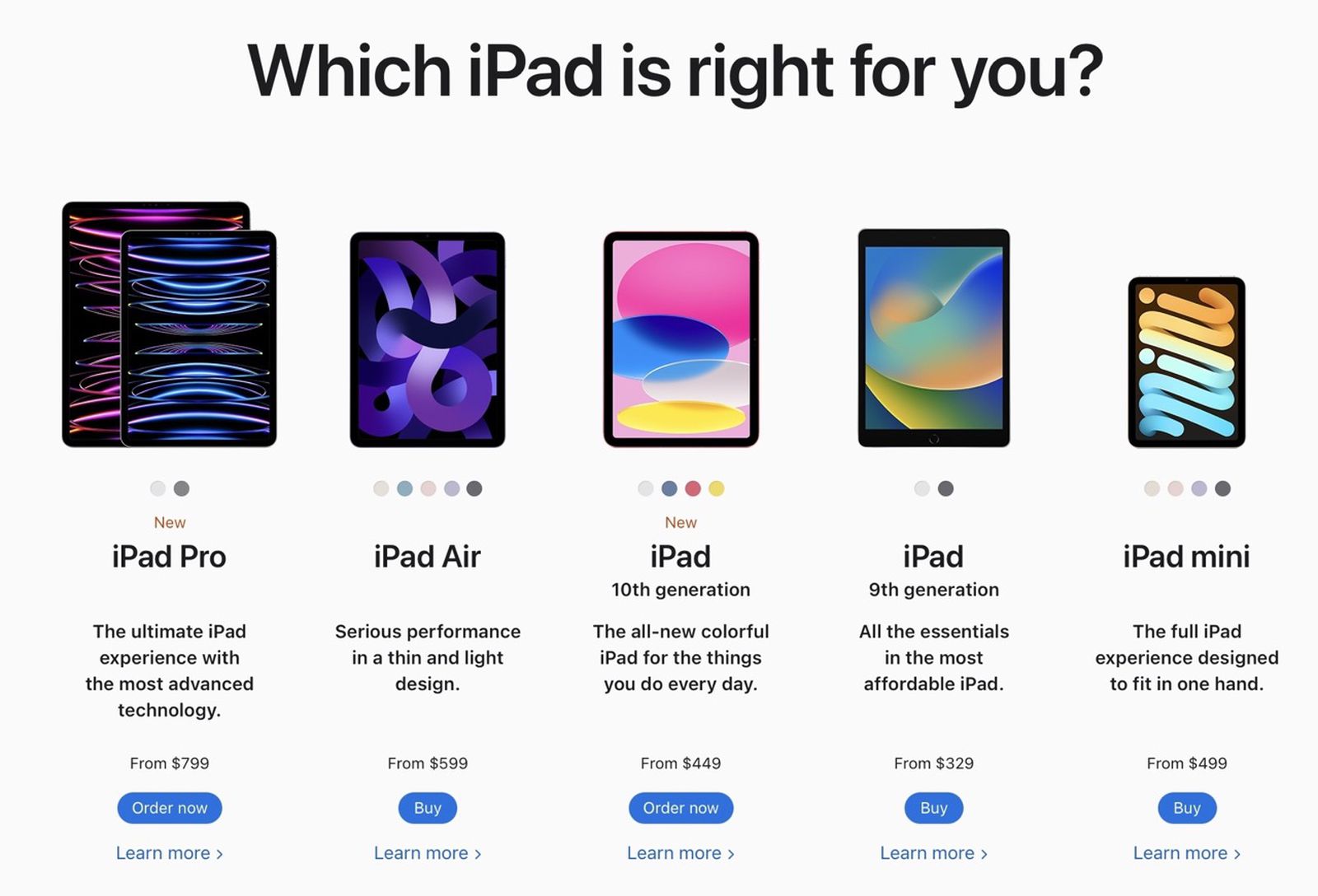

Samsungs Budget Tablet 101 Price Point Targets I Pad Market

May 31, 2025

Samsungs Budget Tablet 101 Price Point Targets I Pad Market

May 31, 2025