Capital Market Cooperation Deepens: Pakistan, Sri Lanka, And Bangladesh Collaboration

Table of Contents

Enhanced Regional Trade and Investment Flows

Capital market cooperation significantly facilitates increased trade and investment among Pakistan, Sri Lanka, and Bangladesh. By streamlining processes and reducing barriers, it fosters a more dynamic and interconnected regional economy. This cooperation translates to tangible benefits for businesses and investors alike.

- Reduced transaction costs: Harmonized regulatory frameworks and improved cross-border payment systems decrease the cost and complexity of international transactions, making regional trade more attractive.

- Improved access to capital: Businesses gain easier access to diverse funding sources, including equity and debt financing, fostering growth and expansion across borders. This is particularly crucial for Small and Medium-Sized Enterprises (SMEs) seeking capital for expansion.

- Increased Foreign Direct Investment (FDI) opportunities: A more integrated capital market attracts increased FDI, boosting economic growth and job creation in all three countries. Successful examples include [insert examples of successful cross-border investments, e.g., Pakistani investment in Sri Lankan infrastructure projects, Bangladeshi companies listing on Pakistani stock exchanges].

- Stimulated Regional Trade: Easier access to capital fuels regional trade by enabling businesses to invest in expanding their export capabilities and building stronger supply chains across borders.

Development of a Regional Financial Market Infrastructure

The development of a robust and integrated financial market infrastructure is crucial for effective capital market cooperation. Several initiatives are underway to achieve this goal:

- Harmonization of regulatory frameworks and standards: Aligning regulations and standards across the three nations minimizes inconsistencies and creates a more predictable environment for investors. This includes initiatives to harmonize accounting standards, listing requirements, and investor protection regulations.

- Development of shared clearing and settlement systems: Creating efficient and interconnected clearing and settlement systems reduces operational risks and speeds up cross-border transactions, boosting investor confidence and liquidity.

- Improved information sharing and transparency: Enhanced data sharing and transparency between regulatory bodies and market participants builds trust and facilitates better decision-making by investors. This can include developing a common platform for information disclosure and market data dissemination.

- Collaboration on Financial Technology (FinTech): Leveraging advancements in financial technology can streamline processes, improve efficiency, and enhance access to financial services across the region. This includes exploring the use of blockchain technology for secure and transparent transactions and the development of mobile payment systems to enhance financial inclusion.

Increased Investor Confidence and Regional Stability

Deepening capital market cooperation is instrumental in fostering investor confidence and contributing to regional economic stability. A more integrated market offers several key advantages:

- Reduced political and economic risks through diversification: Investors can diversify their portfolios across multiple markets, mitigating risks associated with any single country's economic or political landscape.

- Increased market liquidity and depth: A larger, more integrated market offers greater liquidity and depth, making it easier for investors to buy and sell securities.

- Attraction of both domestic and international investors: The enhanced stability and access to a wider range of investment opportunities draw both domestic and foreign capital, boosting economic growth.

- Greater resilience to external shocks: A more integrated regional economy is better equipped to withstand external economic shocks, providing greater stability for investors and businesses.

Challenges and Opportunities in Deepening Capital Market Cooperation

While the progress in capital market cooperation is significant, several challenges remain:

- Addressing regulatory differences and inconsistencies: Further harmonization of regulations and standards is crucial to remove barriers and create a truly integrated market.

- Promoting financial inclusion and access to capital for SMEs: Efforts are needed to extend the benefits of capital market cooperation to SMEs, which form the backbone of the regional economy. This requires developing targeted financing schemes and simplifying access to credit.

- Developing robust risk management frameworks: Strong risk management mechanisms are essential to maintain market integrity and investor confidence, particularly in a rapidly evolving financial landscape.

- Leveraging technological advancements: Further adoption of FinTech solutions can improve market efficiency, transparency, and access to financial services for all stakeholders.

The Future of Capital Market Cooperation in South Asia

Deepening capital market cooperation between Pakistan, Sri Lanka, and Bangladesh offers substantial benefits: enhanced regional trade, increased investment flows, stronger regional stability, and improved investor confidence. The initiatives undertaken to harmonize regulations, develop shared infrastructure, and leverage technology are paving the way for a more integrated and prosperous South Asian financial market. However, addressing challenges related to regulatory inconsistencies, financial inclusion, and risk management remains crucial.

Key Takeaways: This article highlighted the significant strides made in capital market cooperation among Pakistan, Sri Lanka, and Bangladesh, emphasizing the positive impacts on regional trade, investment, and stability. Successfully navigating the remaining challenges will unlock even greater potential for economic growth and prosperity.

Call to Action: Stay informed about the progress of capital market cooperation between Pakistan, Sri Lanka, and Bangladesh, and contribute to fostering a more integrated and prosperous South Asian region. Let's work together to strengthen this crucial aspect of regional development and unlock the full potential of South Asian capital market integration.

Featured Posts

-

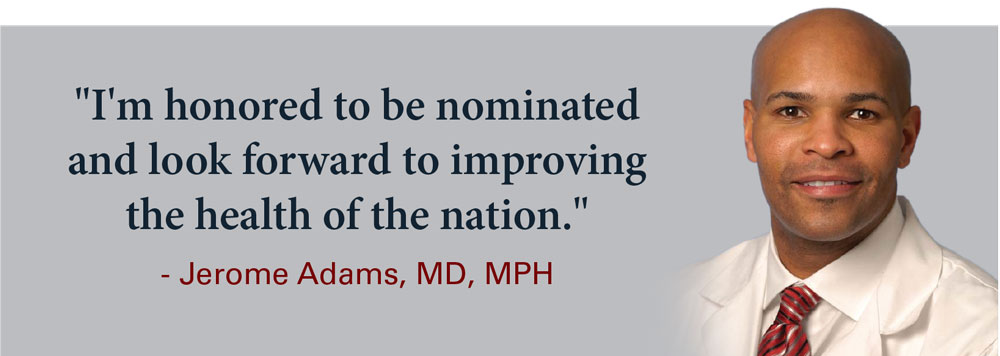

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025 -

Will Leon Draisaitl Play In The Oilers Playoffs Injury Update

May 10, 2025

Will Leon Draisaitl Play In The Oilers Playoffs Injury Update

May 10, 2025 -

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025

Investigating Us Funding For Transgender Animal Research Studies

May 10, 2025 -

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 10, 2025 -

Technical Glitch Forces Blue Origin To Abort Rocket Launch

May 10, 2025

Technical Glitch Forces Blue Origin To Abort Rocket Launch

May 10, 2025