Celtics Sale To Private Equity: A $6.1 Billion Deal And Fan Concerns

Table of Contents

The $6.1 Billion Deal: Details and Implications

The sale of the Boston Celtics marks a pivotal moment in the franchise's history and the broader landscape of professional sports. Understanding the intricacies of this deal is crucial to assessing its potential impact.

Who Bought the Celtics?

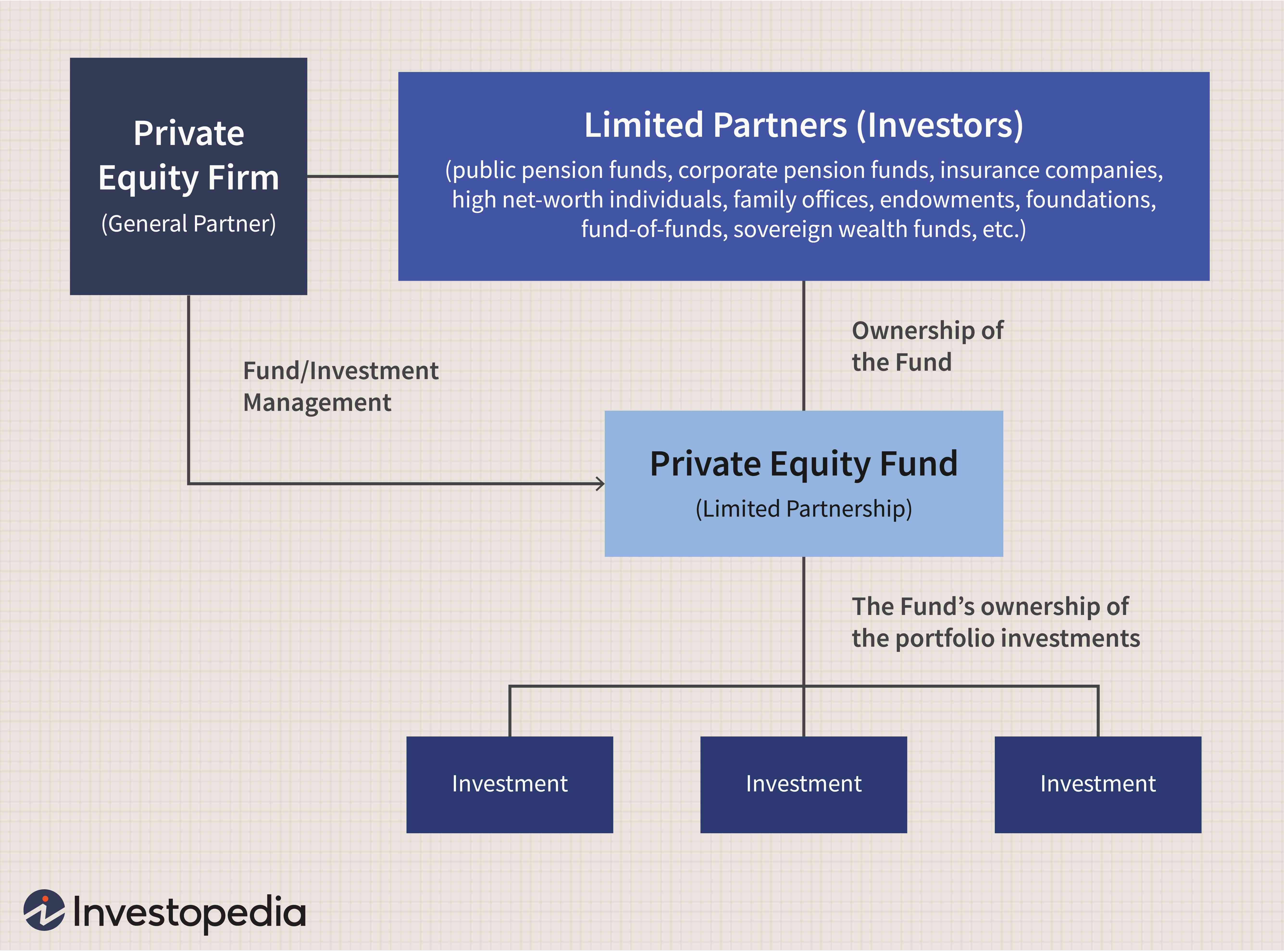

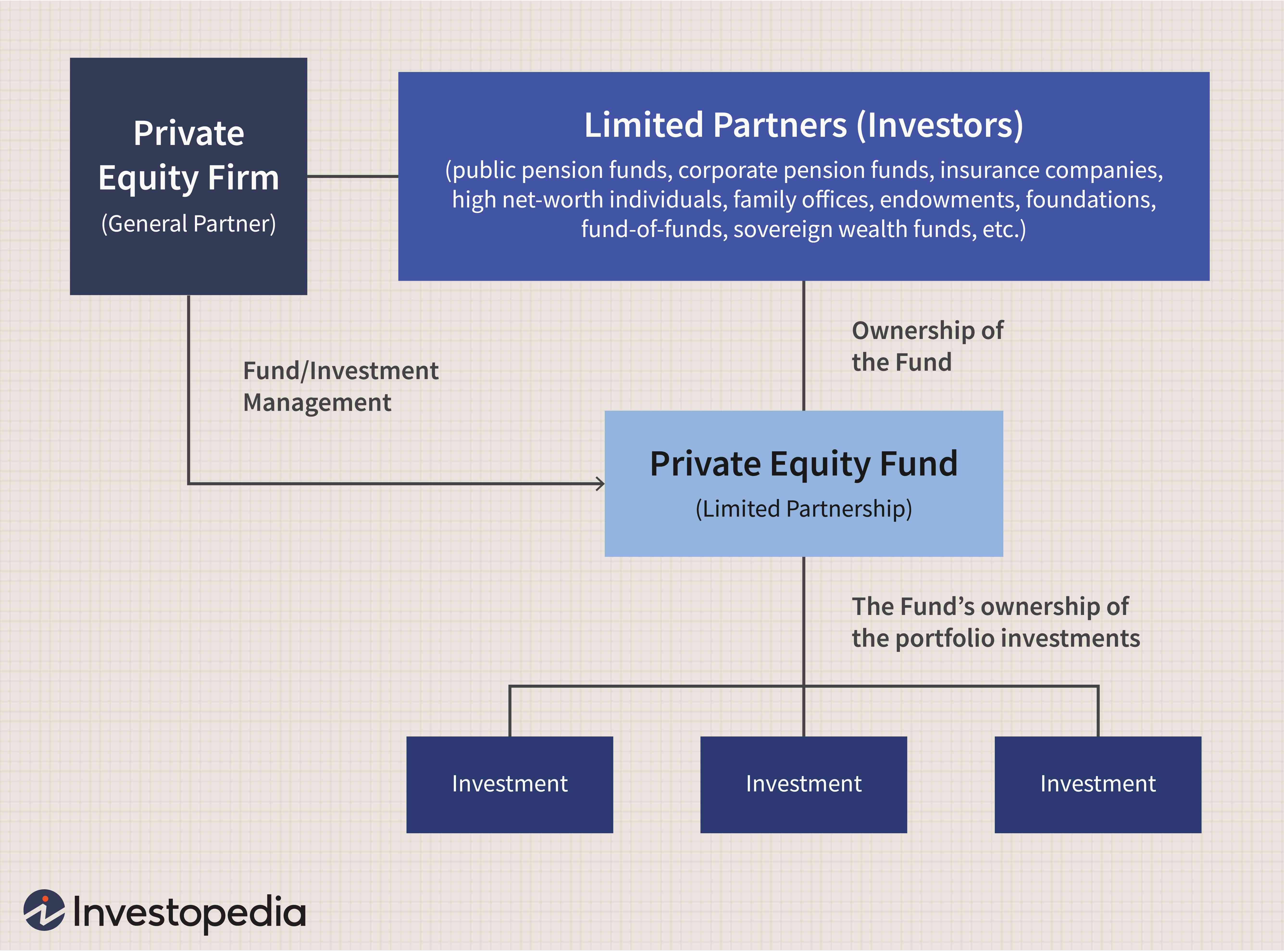

While the specific private equity firm involved may not be publicly announced immediately, the sheer scale of the $6.1 billion purchase signifies a major player in the financial world. The identity of the buyer will undoubtedly shape the future direction of the franchise, influencing everything from strategic decisions to investment priorities. This level of financial backing could reshape the competitive landscape of the NBA.

The Financial Aspects: A Deep Dive

The $6.1 billion price tag represents a significant valuation in the sports market. This astronomical figure reflects not only the Celtics' on-court success but also their considerable off-court revenue streams, including merchandise sales, broadcasting rights, and arena operations. The financing mechanisms behind this deal—whether through debt, equity, or a combination—will play a crucial role in shaping the buyer's long-term strategy. Analyzing the potential return on investment (ROI) for the private equity firm is also key to understanding their motivations and expected outcomes.

- Sale Agreement Details: The specifics of the sale agreement, including any stipulations regarding team management, player contracts, or future investments, are yet to be fully revealed.

- Valuation Significance: This record-breaking sale sets a new benchmark for NBA team valuations, influencing future transactions and potentially driving up prices across the league.

- Role of Existing Owners: The roles of existing owners and their potential involvement in the transition are important aspects that need clarification.

Fan Concerns and Potential Negative Impacts

The enthusiasm surrounding the Celtics sale is tempered by significant concerns among loyal fans. The primary anxieties revolve around affordability, team performance, and the overall fan experience.

Ticket Price Increases: An Accessibility Issue

One of the most pressing concerns is the potential for steep increases in ticket prices. A shift to private equity ownership often translates to a focus on maximizing profitability, and ticket prices are a readily adjustable revenue stream.

- Historical Precedents: Numerous instances throughout sports history demonstrate that changes in ownership, particularly involving private equity, often lead to increased ticket costs, pricing out many loyal fans.

- Current Pricing Strategy: Analyzing the Celtics' current pricing strategy and comparing it to other NBA teams provides a baseline for assessing the potential magnitude of future price hikes.

- Impact on Season Ticket Holders: The impact on existing season ticket holders, who often represent the most dedicated fan base, needs careful consideration. Any substantial price increase could alienate this critical segment of supporters.

Impact on Team Performance and Player Acquisition

The shift to private equity ownership raises concerns about its impact on team performance. Will the primary focus be on maximizing profits at the expense of on-court success?

- Potential Cost-Cutting Measures: Private equity firms are often known for implementing cost-cutting measures. This could translate to limitations in player salaries, potentially affecting the team's ability to attract and retain top talent.

- Implications for Player Recruitment: The financial implications will directly affect the team’s capacity to compete in the free agency market and negotiate player contracts.

- Historical Performance Analysis: Examining the performance of other teams under similar ownership structures can offer insights into potential future outcomes for the Celtics.

Changes in Team Culture and Fan Experience

A crucial concern is the potential alteration of the Celtics' unique team culture and its connection with fans.

- Management and Branding Changes: Changes in management and branding strategies could potentially dilute the team's identity and its relationship with the loyal fan base.

- Maintaining Fan Loyalty: The new ownership group will need to prioritize maintaining fan loyalty and engagement to ensure the long-term success of the franchise.

- Impact on Fan Experience: Analyzing how similar transitions have affected fan experiences in other sports teams will be valuable in assessing the potential risks and opportunities.

Potential Benefits and Positive Outcomes of the Celtics Sale to Private Equity

While concerns are valid, it's also important to consider the potential positive outcomes associated with this sale.

Access to Capital and Investment

The influx of private equity capital could significantly benefit the Celtics, enabling investments in various areas.

- Facility Improvements: Investment in improved facilities, training grounds, and technology could enhance the overall experience for both players and fans.

- Improved Player Recruitment: Increased financial resources could significantly improve the team's ability to attract and retain top players.

- Technological Advancements: Investments in advanced technology could enhance the fan experience, offering better digital engagement and personalized interactions.

Strategic Partnerships and Business Growth

The new ownership structure could lead to strategic partnerships and broader market reach.

- Business Collaborations: Private equity firms often have extensive networks and can foster beneficial collaborations with other businesses, opening up new revenue streams.

- Global Brand Expansion: The Celtics' brand could be expanded globally through strategic partnerships and marketing initiatives.

- Marketing and Sponsorship Opportunities: The new ownership may leverage their expertise to secure enhanced marketing and sponsorship deals, boosting the franchise's financial strength.

Conclusion: The Future of the Boston Celtics After the Private Equity Sale

The "Celtics sale to private equity" presents a complex scenario with both potential benefits and significant risks. While the influx of capital could lead to upgrades and expansion, concerns about ticket prices, team performance, and the preservation of team culture remain paramount. A balanced perspective is crucial, requiring careful monitoring of the ownership group's actions and their impact on the franchise and its fans. Open communication and transparency will be key to maintaining fan trust and ensuring the long-term success of the Boston Celtics.

What are your thoughts on the Celtics sale to private equity? Share your concerns and hopes using #CelticsSale #NBASale #PrivateEquitySports.

Featured Posts

-

Nba Analyst Breen Teases Bridges About His Minutes

May 17, 2025

Nba Analyst Breen Teases Bridges About His Minutes

May 17, 2025 -

Rs 1 45 Lakh Ultraviolette Tesseract New Electric Scooter Details

May 17, 2025

Rs 1 45 Lakh Ultraviolette Tesseract New Electric Scooter Details

May 17, 2025 -

Ben Stiller On Severance The Apple Comparison And What It Means For Lumon Industries

May 17, 2025

Ben Stiller On Severance The Apple Comparison And What It Means For Lumon Industries

May 17, 2025 -

Reddit Outage In Us Users Experiencing Page Not Found Issues

May 17, 2025

Reddit Outage In Us Users Experiencing Page Not Found Issues

May 17, 2025 -

Ultraviolette F77 50 000

May 17, 2025

Ultraviolette F77 50 000

May 17, 2025