Cenovus Prioritizes Organic Growth, Dimming Prospects Of MEG Bid

Table of Contents

Cenovus's Focus on Organic Growth Strategies

Cenovus's commitment to maximizing returns from its existing assets underpins its new strategic direction. This commitment translates into a robust organic growth strategy, prioritizing capital allocation towards enhancing operational efficiency and production optimization within its existing portfolio. This approach diverts resources away from large-scale acquisitions like a potential MEG Energy merger. Key elements of this strategy include:

-

Increased investment in oil sands operations: Cenovus is significantly increasing investment in its oil sands operations. This involves upgrading existing facilities to improve production capacity and efficiency, leading to higher output and profitability. This focus on the oil sands reflects Cenovus's core competency and its belief in the long-term viability of this resource.

-

Strategic investments in technology: Cenovus is leveraging technological advancements to improve operational efficiency and reduce costs across its upstream operations. This includes implementing advanced data analytics for predictive maintenance, utilizing automation to streamline processes, and adopting innovative extraction techniques to maximize resource recovery. These technological upgrades are crucial for enhancing long-term profitability and competitiveness.

-

Exploration and development of new reserves: Rather than pursuing external acquisitions, Cenovus is concentrating on exploring and developing new reserves within its existing portfolio. This approach allows for a more controlled and predictable expansion of production capacity, reducing the risks associated with large-scale mergers and acquisitions. This also ensures a better alignment with its long-term financial goals.

This focus on organic growth aligns perfectly with Cenovus's long-term financial goals. By maximizing the return on its existing assets, the company aims to achieve sustainable and predictable growth, minimizing the financial risks associated with large acquisitions in the volatile energy sector.

Why a MEG Acquisition is Less Likely Now

Several factors contribute to the decreased probability of a Cenovus-MEG merger. The primary driver is Cenovus's shift towards organic growth, but other elements play a significant role:

-

MEG Energy's current valuation: The current market valuation of MEG Energy may present challenges in structuring a mutually beneficial deal for both companies. The perceived price premium required to acquire MEG could be deemed too high by Cenovus, given its focus on maximizing returns from internal projects.

-

Revised capital allocation strategy: Cenovus's revised capital allocation strategy explicitly prioritizes organic growth over large acquisitions. This strategic shift reallocates capital towards internal projects offering higher returns and lower risk compared to the uncertainties associated with a major merger.

-

Regulatory hurdles and antitrust concerns: A merger between Cenovus and MEG would likely face significant regulatory scrutiny and potential antitrust concerns in the Canadian energy sector. These potential hurdles add complexity and uncertainty to the deal, further discouraging Cenovus from pursuing the acquisition.

-

Current market conditions: The current market conditions, including oil prices and overall economic uncertainty, also influence the attractiveness of MEG as an acquisition target. These factors make a large acquisition less appealing for Cenovus at this time.

Implications for the Canadian Energy Sector

Cenovus's decision to prioritize organic growth has significant implications for the broader Canadian energy sector:

-

Reshaped competitive landscape: Cenovus's decision leaves MEG Energy potentially open to other acquirers, reshaping the competitive landscape within the Canadian oil and gas industry. This could trigger increased merger and acquisition activity among other players.

-

Market stability impact: While the direct impact on oil and gas prices may be limited, Cenovus's strategy could influence market stability by reducing the potential for significant industry consolidation in the short term.

-

Long-term strategic implications: Cenovus's focus on organic growth signals a long-term strategic shift towards sustainable and controlled expansion, while MEG Energy will need to adapt to the changed competitive landscape and pursue its own growth strategy.

-

Alternative partnerships: The shift could also lead to alternative strategic partnerships or collaborations within the Canadian energy sector, fostering innovation and collaboration between companies.

Conclusion

Cenovus Energy's prioritization of organic growth significantly diminishes the likelihood of a bid for MEG Energy. This strategic shift reflects a focus on optimizing existing assets and internal expansion rather than large-scale acquisitions. This decision has implications not only for the two companies but also for the broader Canadian energy sector, potentially reshaping the competitive landscape and influencing future industry consolidation. To stay informed about the evolving strategies of Cenovus and the future of the Canadian energy sector, continue to follow our coverage on Cenovus's organic growth initiatives and the potential for future mergers and acquisitions in the oil and gas industry.

Featured Posts

-

Rehoboth Beach A Tranquil Retreat From Stressful Times

May 26, 2025

Rehoboth Beach A Tranquil Retreat From Stressful Times

May 26, 2025 -

Link Nonton Live Moto Gp Inggris Race Sprint Pukul 20 00 Wib

May 26, 2025

Link Nonton Live Moto Gp Inggris Race Sprint Pukul 20 00 Wib

May 26, 2025 -

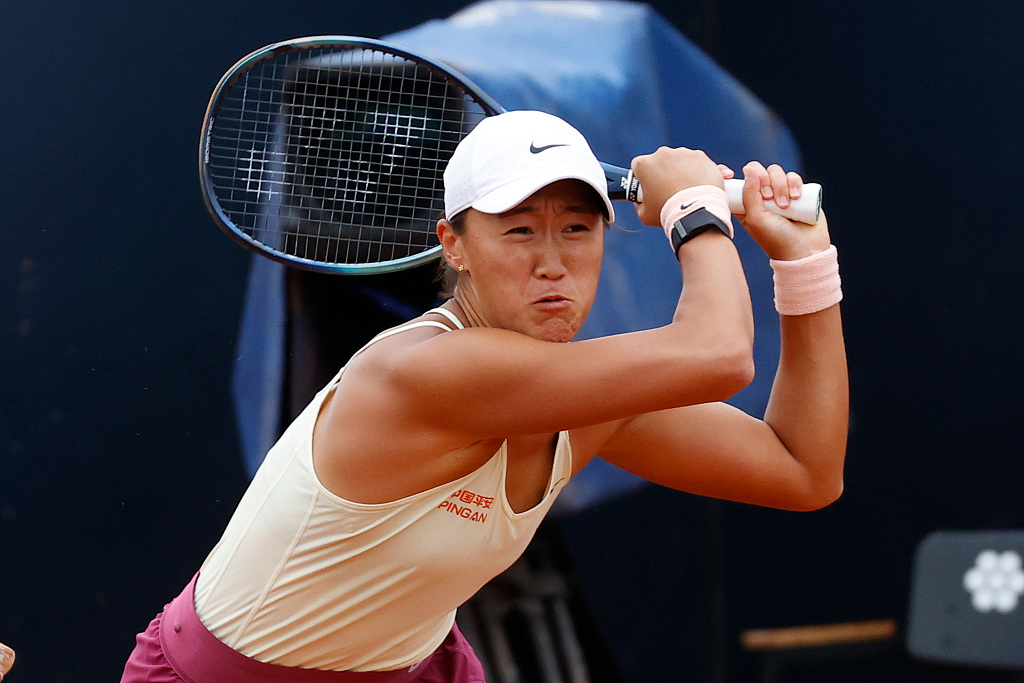

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 26, 2025

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 26, 2025 -

Virtue Signalling Has It Destroyed Architectural Integrity An Interview

May 26, 2025

Virtue Signalling Has It Destroyed Architectural Integrity An Interview

May 26, 2025 -

Naomi Campbell Met Gala Ban Truth Behind The Wintour Feud

May 26, 2025

Naomi Campbell Met Gala Ban Truth Behind The Wintour Feud

May 26, 2025