CFP Board CEO Stepping Down In Early 2026

Table of Contents

Impact on CFP Professionals and Certification

The CEO's departure will undoubtedly have a ripple effect on CFP professionals and the certification itself. Understanding the potential short-term and long-term impacts is crucial for those invested in maintaining their CFP certification. Key areas to consider include:

-

CFP Certification Requirements: While the core tenets of the CFP certification are unlikely to change drastically, the transition period could see minor adjustments to requirements or processes. This might involve refinements to the examination process, updates to continuing education mandates, or slight alterations to the ethical conduct guidelines.

-

Continuing Education Programs: The CFP Board oversees a robust continuing education program for CFP professionals. The leadership change might influence the direction and content of these programs, potentially incorporating new technological advancements or addressing evolving regulatory needs within the financial planning landscape.

-

Ethical Standards and Disciplinary Processes: Maintaining ethical standards is paramount for the CFP Board and the CFP professionals it certifies. The transition period requires careful management to ensure that the disciplinary processes remain effective and transparent, upholding the integrity of the CFP designation. Any changes to these processes would need careful consideration to avoid disrupting the established system.

-

Ongoing Initiatives: The CFP Board is likely involved in several ongoing initiatives aimed at improving the financial planning profession. The leadership transition needs to ensure a smooth handover to avoid any disruption to these important projects and maintain their momentum for the benefit of all CFP professionals.

The Search for a New CEO and Future Direction of the CFP Board

The search for a new CEO will be a critical process shaping the future direction of the CFP Board. The success of this transition will heavily influence the organization's ability to navigate the challenges and seize the opportunities facing the financial planning industry. Key aspects to watch include:

-

CEO Search Process: The CFP Board will likely announce details about its search process, including the timeline, selection criteria, and the individuals or firms involved. Transparency in this process will be crucial to maintain confidence among CFP professionals and stakeholders.

-

Potential Candidates: Speculation about potential candidates will undoubtedly emerge. The ideal candidate will likely possess a strong understanding of the financial planning industry, experience in leadership roles, and a commitment to upholding the highest ethical standards. Experience with regulatory compliance and technological advancements will also be highly desirable traits.

-

Challenges and Opportunities: The incoming CEO will inherit a complex set of challenges and opportunities. These include adapting to the rapidly changing technological landscape, navigating evolving regulatory requirements, and addressing increasing competition from other financial advisor credentials.

-

Strategic Directions: Under new leadership, the CFP Board might adopt new strategic directions. These could involve initiatives to enhance the value proposition of the CFP certification, strengthen relationships with financial professionals, or expand its reach and influence within the financial planning industry.

Potential Challenges and Opportunities

The next CFP Board CEO will face a unique set of challenges and opportunities:

-

Maintaining Certification Integrity: With increasing competition from other financial advisor designations, maintaining the integrity and value of the CFP certification will be a top priority.

-

Enhancing Services for CFP Professionals: The CFP Board can explore ways to improve its services and resources offered to CFP professionals, such as enhanced professional development opportunities, improved technology support, or stronger advocacy efforts.

-

Navigating the Regulatory Environment: The financial services industry is subject to constant regulatory changes. The new CEO will need to navigate this complex landscape effectively to ensure the CFP Board remains compliant and relevant.

-

Embracing Technological Advancements: Technology is rapidly transforming the financial planning industry. The CFP Board needs to adapt and embrace these changes, providing support and resources to CFP professionals as they integrate technology into their practices.

Conclusion

The upcoming departure of the CFP Board's CEO marks a significant juncture for the financial planning profession. A smooth transition to new leadership is vital to preserving the value and integrity of the CFP certification, while successfully navigating the complexities of the modern financial landscape. The search for a new CEO and the subsequent strategic decisions will undoubtedly shape the future of financial planning for years to come. The choices made will greatly impact the future of financial advisors and the consumers they serve.

Call to Action: Stay informed about the ongoing developments surrounding the CFP Board CEO transition and the future of the CFP certification. Follow [relevant websites/sources – e.g., CFP Board website, financial news outlets] for updates and insights on this important leadership change impacting the CFP Board and the broader financial planning industry.

Featured Posts

-

Nick Robinson And Emma Barnett Uncovering The Truth Behind Their Radio 4 Hosting Arrangements

May 02, 2025

Nick Robinson And Emma Barnett Uncovering The Truth Behind Their Radio 4 Hosting Arrangements

May 02, 2025 -

Analyzing Ziaire Williams Performance Is This His Breakout Season

May 02, 2025

Analyzing Ziaire Williams Performance Is This His Breakout Season

May 02, 2025 -

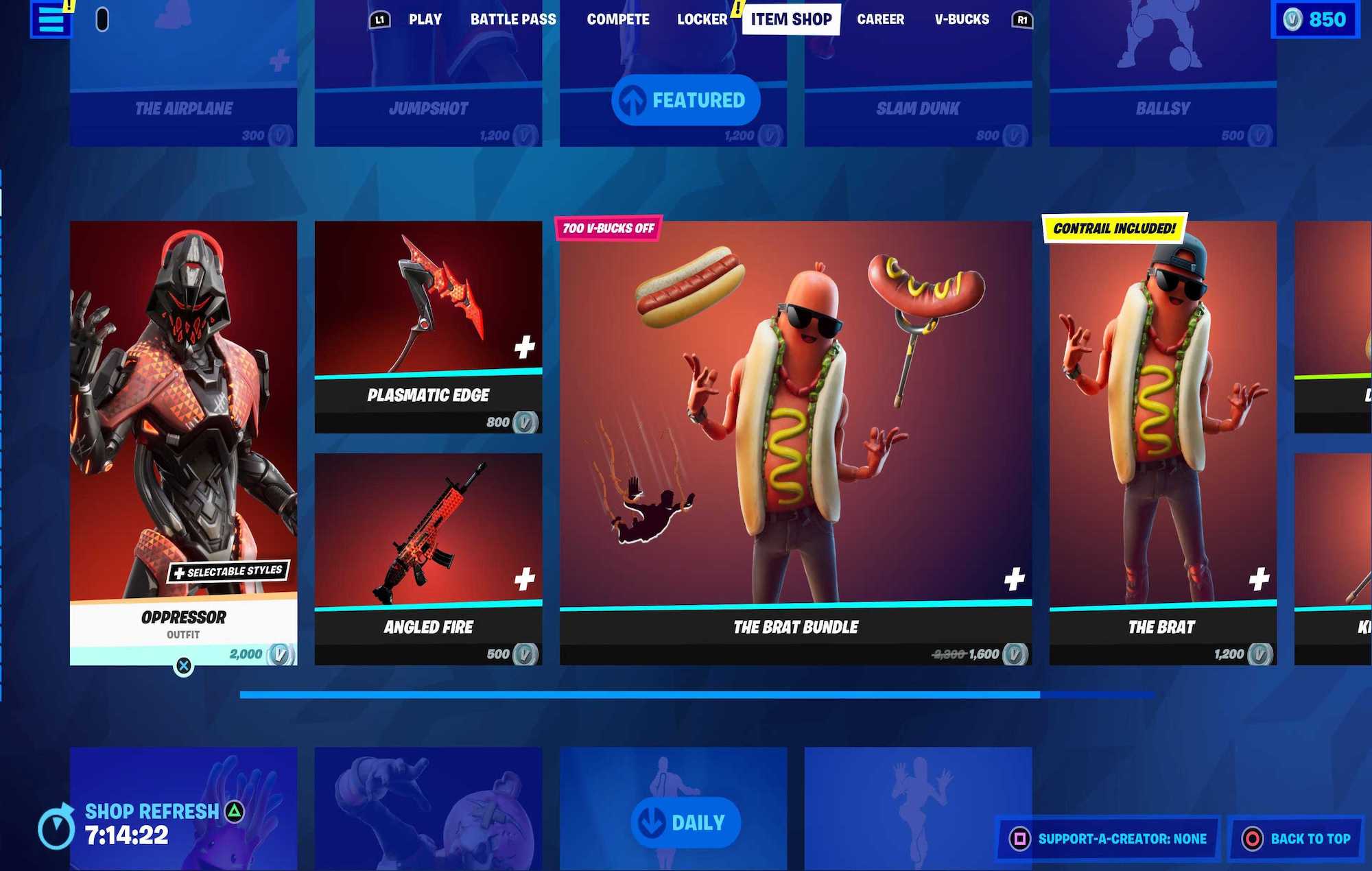

New Fortnite Item Shop Feature Easier Navigation And Purchasing

May 02, 2025

New Fortnite Item Shop Feature Easier Navigation And Purchasing

May 02, 2025 -

England Stages Late Comeback To Defeat France

May 02, 2025

England Stages Late Comeback To Defeat France

May 02, 2025 -

Supreme Court Decision Lees Presidential Hopes In Jeopardy After Acquittal Reversal

May 02, 2025

Supreme Court Decision Lees Presidential Hopes In Jeopardy After Acquittal Reversal

May 02, 2025

Latest Posts

-

Singer Wynne Evans Reveals Recent Health Struggle Hints At Stage Return

May 10, 2025

Singer Wynne Evans Reveals Recent Health Struggle Hints At Stage Return

May 10, 2025 -

Wynne Evans Shares Health Battle Recovery Update And Future Plans

May 10, 2025

Wynne Evans Shares Health Battle Recovery Update And Future Plans

May 10, 2025 -

Elizabeth Stewarts Spring Designs A Collaboration With Lilysilk

May 10, 2025

Elizabeth Stewarts Spring Designs A Collaboration With Lilysilk

May 10, 2025 -

A Look At Elizabeth Stewart And Lilysilks Collaborative Spring Line

May 10, 2025

A Look At Elizabeth Stewart And Lilysilks Collaborative Spring Line

May 10, 2025 -

New Spring Collection Elizabeth Stewarts Designs For Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewarts Designs For Lilysilk

May 10, 2025