Changes To HMRC Tax Codes: Savings And Your Tax Liability

Table of Contents

Decoding Your HMRC Tax Code: What the Numbers Mean

Your HMRC tax code, a seemingly simple string of numbers and letters, holds the key to understanding how much tax you pay. A typical code, like 1257L, might seem confusing, but breaking it down reveals vital information about your tax allowance. The number represents your Personal Allowance – the amount you can earn tax-free. In this example, 1257 represents £12,570. The letter usually signifies additional factors, such as adjustments for student loan repayments or marriage allowance.

- Breakdown of tax code components: The number indicates your personal allowance, while the letter denotes any adjustments or reliefs applied.

- Examples of different tax codes and their respective implications: A code like 1257L might indicate a standard Personal Allowance, while a code like 1100L might reflect a reduced allowance due to other income. A higher number generally means a larger tax-free amount.

- Links to relevant HMRC resources for further information:

Common Reasons for HMRC Tax Code Changes

HMRC tax code changes aren't random; they usually result from specific life events or adjustments to your circumstances. Understanding these reasons is vital for anticipating potential changes to your disposable income.

- Changes in employment: Starting a new job, leaving a job, or changing employment status (e.g., becoming self-employed) will all trigger adjustments to your HMRC tax code.

- Pension contributions and their tax relief implications: Contributing to a pension scheme often leads to a change in your tax code, reflecting tax relief on your contributions. This can impact your take-home pay but boosts your long-term savings.

- Marriage allowance and its effects on tax codes: If you're married or in a civil partnership, you might be eligible for the marriage allowance, potentially impacting both partners' tax codes.

- Self-assessment adjustments and their impact: If you're self-employed or a higher-rate taxpayer, any adjustments made during your self-assessment process can affect your HMRC tax code for the following year.

How HMRC Tax Code Changes Affect Your Savings

Changes in your HMRC tax code directly affect your disposable income – the money you have left after tax. This, in turn, impacts your savings potential.

- Impact on monthly budget and savings: A higher tax code usually means more take-home pay, leaving more for savings. Conversely, a lower tax code reduces disposable income, potentially impacting your savings plans.

- Implications for long-term savings goals (retirement, property purchase): Reduced disposable income due to HMRC tax code changes can delay the achievement of significant savings goals like retirement or buying a property.

- Strategies for optimizing savings despite tax code changes: Adapting your budget, exploring alternative savings vehicles, or reevaluating your financial goals are strategies to navigate changes in your HMRC tax code.

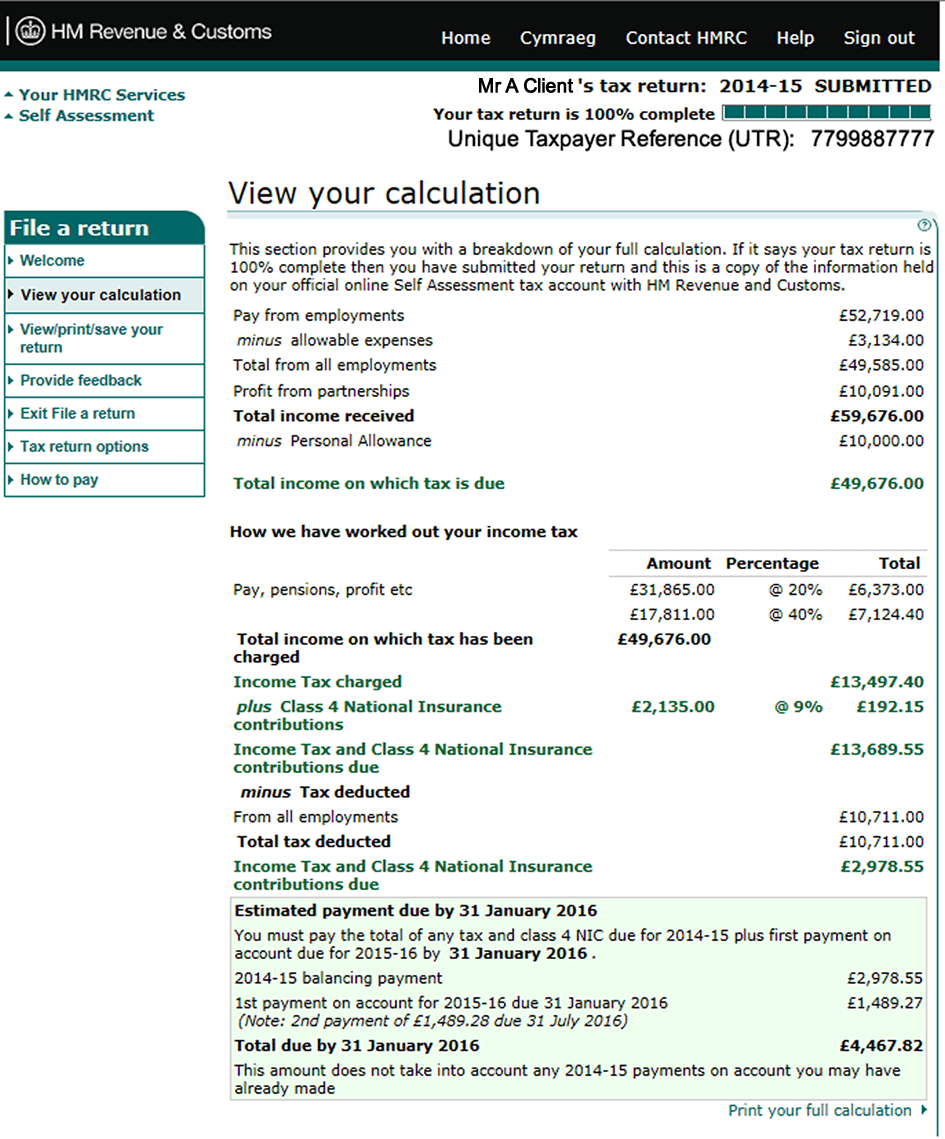

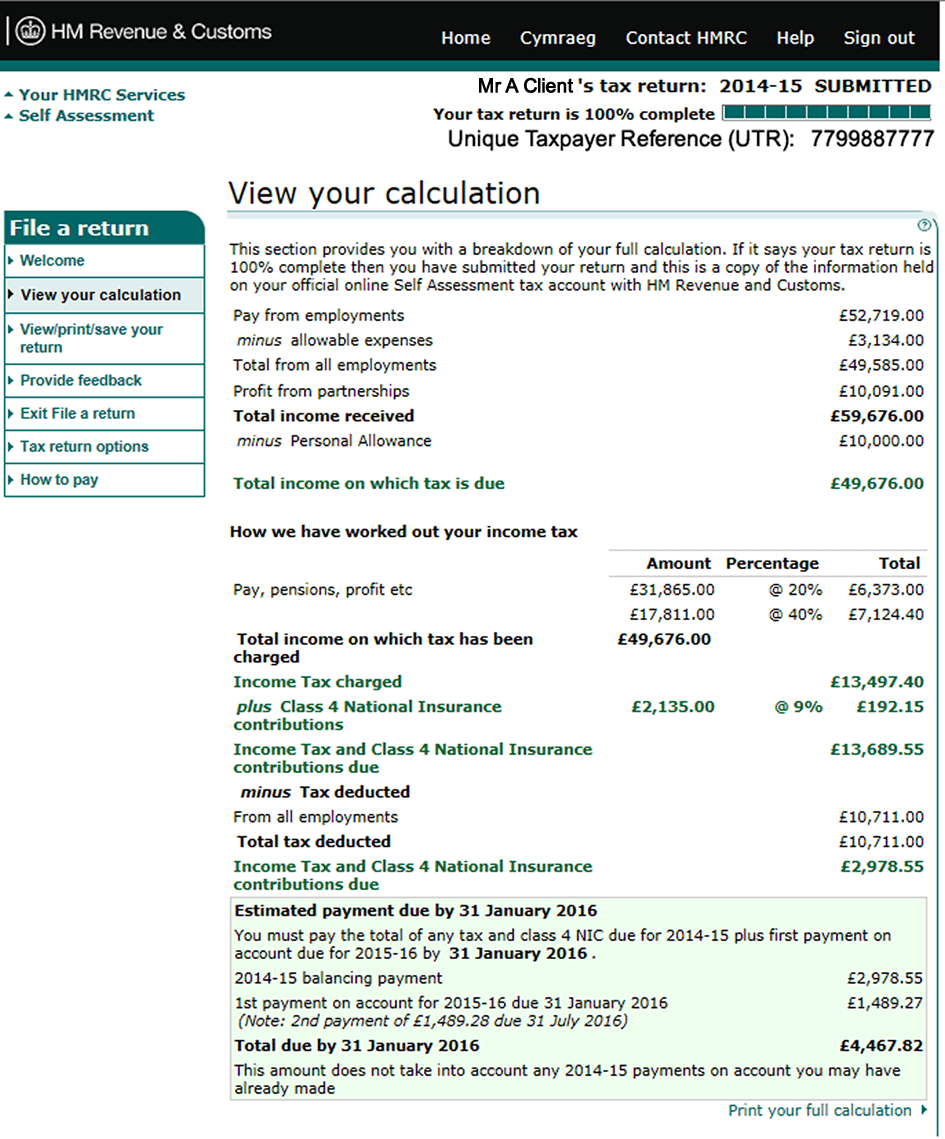

Checking Your HMRC Tax Code and Making Corrections

It's crucial to regularly check your HMRC tax code to ensure its accuracy. Discrepancies can lead to overpayment or underpayment of tax, directly impacting your savings.

- Step-by-step instructions for accessing tax code online: Log in to your HMRC online account, navigate to the tax details section, and locate your current tax code.

- Contact details for HMRC helpline and online support: [Insert HMRC helpline number and online support link here]

- Information on correcting errors in tax codes: If you notice any errors, contact HMRC immediately to request a correction. Provide all necessary documentation to support your claim.

Conclusion: Maximizing Your Savings with Informed HMRC Tax Code Understanding

Understanding your HMRC tax code is essential for effective financial planning and maximizing your savings. Changes in your HMRC tax code directly impact your disposable income, influencing both short-term and long-term savings goals. Regularly review your HMRC tax code to ensure accuracy and optimize your savings potential. Don't let unexpected changes to your HMRC tax code impact your financial goals! Take control of your finances by understanding your tax code and planning accordingly.

Featured Posts

-

D Wave Quantum Inc Qbts Stock Drop On Thursday Reasons And Analysis

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Thursday Reasons And Analysis

May 20, 2025 -

Tampoy Mega Leptomereies Gia To Simerino Epeisodio

May 20, 2025

Tampoy Mega Leptomereies Gia To Simerino Epeisodio

May 20, 2025 -

Diskvalifikatsiya Leklera I Khemiltona Analiz Gonki Ferrari

May 20, 2025

Diskvalifikatsiya Leklera I Khemiltona Analiz Gonki Ferrari

May 20, 2025 -

Ai Digest Transforming Scatological Data Into Engaging Podcast Content

May 20, 2025

Ai Digest Transforming Scatological Data Into Engaging Podcast Content

May 20, 2025 -

Sasol Sol Strategy Update Investors Demand Answers

May 20, 2025

Sasol Sol Strategy Update Investors Demand Answers

May 20, 2025