Chime Launches $500 Instant Loans For Direct Deposit Customers

Table of Contents

Who Qualifies for Chime's $500 Instant Loan?

To qualify for a Chime $500 instant loan, you need to meet several eligibility requirements. It’s designed to help existing customers already demonstrating responsible financial habits. Understanding these Chime loan eligibility criteria is key.

- Active Chime checking account with direct deposit: You must have an active Chime checking account and receive regular direct deposits.

- Consistent direct deposit history: Chime requires a history of consistent direct deposits over a specific timeframe (this timeframe is not publicly specified, so you should check the Chime app for the most up-to-date information). This shows consistent income and financial stability.

- Meeting specific spending and account activity criteria: Chime analyzes your account activity to assess your financial behavior. This includes factors like regular account usage and responsible spending patterns. The specifics of these criteria aren't publicly available, but responsible financial practices increase your chances of approval.

- No credit score requirement: A major advantage of this loan is that it doesn't require a credit check. This makes it accessible to a wider range of customers who might struggle to qualify for traditional loans. Keywords: Chime loan eligibility, Chime loan requirements, qualify for Chime loan.

How to Apply for a Chime $500 Instant Loan

Applying for a Chime $500 instant loan is quick and easy, done entirely through the Chime mobile app. Here's a step-by-step guide on how to apply for a Chime loan:

- Check eligibility within the Chime app: The first step is to check if you're eligible. The app will guide you through a quick eligibility assessment.

- Complete the application process within the app: If eligible, you'll be presented with a simple application to fill out. This process typically involves verifying information already held by Chime.

- Review loan terms and conditions: Carefully review the loan agreement, including interest rates, repayment terms, and any applicable fees.

- Accept the loan and receive funds instantly: Once you accept the terms, the funds will be deposited into your Chime checking account almost immediately. Keywords: Chime loan application, apply for Chime loan, how to get a Chime loan.

Benefits of Chime's $500 Instant Loan

Chime's $500 instant loan offers several advantages over traditional loan options, making it a compelling choice for emergency loan needs:

- Instant funding: Unlike traditional loans that can take days or weeks to process, Chime's loan provides instant access to funds. This speed is crucial in emergency situations.

- No hidden fees or excessive interest rates: While specific interest rates and fees will be displayed before acceptance, Chime aims to provide transparent and competitive terms compared to payday loans or other high-interest short-term borrowing options. Always review the terms carefully.

- Convenience and accessibility through the Chime app: The entire process is completed conveniently within the Chime app, eliminating the need for paperwork or trips to a physical branch.

- Designed for emergency situations and unexpected expenses: This loan is specifically designed to provide financial support during unexpected emergencies, such as car repairs, medical bills, or other unforeseen expenses. Keywords: Chime loan benefits, advantages of Chime loan, best instant loan.

Alternatives to Chime's $500 Loan

While Chime's $500 instant loan is a valuable resource, it's not suitable for everyone. If you don't qualify, explore these alternatives:

- Chime SpotMe: (If available and applicable) Chime SpotMe is an overdraft protection service that may provide small amounts of cash up to a certain limit. This is a good option for smaller, short-term needs.

- Other similar financial services offering small loans or emergency funds: Several other financial institutions offer small loans or emergency funding options. Research these alternatives to find the best fit for your specific needs. Keywords: emergency funds, small loans, alternative financial services.

Conclusion

Chime's $500 instant loan offers a fast, convenient, and accessible solution for direct deposit customers needing quick financial assistance. The speed of funding, lack of credit check, and convenient in-app application are key advantages. Eligibility requires an active Chime account with a history of consistent direct deposits and responsible account activity. Need a quick $500? Check your eligibility for a Chime instant loan today! Download the Chime app and apply now. Keywords: Chime instant loan, Chime $500 loan, apply for a Chime loan, get a Chime loan.

Featured Posts

-

Lindts Central London Chocolate Shop A Paradise Opens Its Doors

May 14, 2025

Lindts Central London Chocolate Shop A Paradise Opens Its Doors

May 14, 2025 -

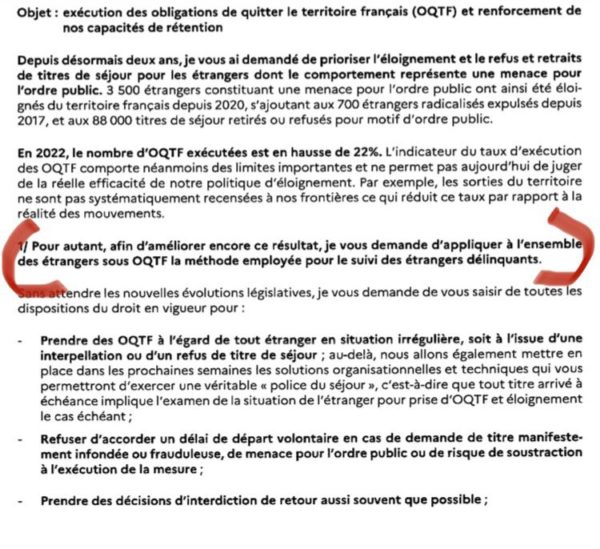

C Etait Mon Meilleur Ami Expulsion Sous Oqtf Le Choc Des Collegiens Et De Leurs Camarades

May 14, 2025

C Etait Mon Meilleur Ami Expulsion Sous Oqtf Le Choc Des Collegiens Et De Leurs Camarades

May 14, 2025 -

Que Hacer En Sevilla Hoy Miercoles 7 De Mayo De 2025 Guia Completa De Planes

May 14, 2025

Que Hacer En Sevilla Hoy Miercoles 7 De Mayo De 2025 Guia Completa De Planes

May 14, 2025 -

Festival Di Sanremo 2026 Apertura Del Bando A Tutte Le Tv

May 14, 2025

Festival Di Sanremo 2026 Apertura Del Bando A Tutte Le Tv

May 14, 2025 -

Intervention Policiere A Toulon Individu Sous Oqtf Arrete Pres D Une Ecole

May 14, 2025

Intervention Policiere A Toulon Individu Sous Oqtf Arrete Pres D Une Ecole

May 14, 2025