China And US Trade: Record Exports Before Potential Truce

Table of Contents

Record Chinese Exports to the US: A Deeper Dive

The recent surge in Chinese exports to the US is a significant development in the ongoing trade saga. Several sectors have witnessed remarkable growth. Analysis of trade data reveals a substantial increase across various categories, defying expectations given the persistent trade friction.

-

Technology: Exports of technology components and electronics have seen a significant uptick, exceeding projected figures. This suggests strong demand in the US market despite alternative sourcing efforts. Growth in this sector is estimated at 15% year-on-year (Source: [Insert reputable source, e.g., International Monetary Fund]).

-

Consumer Goods: The consumer goods sector, including clothing, footwear, and household items, also showed impressive export growth. This indicates strong consumer demand in the US and potentially successful adaptation by Chinese businesses to navigate trade tariffs. Growth in this sector is estimated at 12% year-on-year (Source: [Insert reputable source]).

-

Manufacturing: Chinese manufacturing exports experienced a robust increase, driven by both increased demand and competitive pricing strategies. Specifically, exports of machinery and intermediate goods displayed strong growth. This showcases the resilience of China's manufacturing capabilities amidst trade disputes. Growth in this sector is estimated at 8% year-on-year (Source: [Insert reputable source]).

Examples of successful Chinese exports include [mention specific product examples and companies, if possible, with links to relevant news articles]. The reasons behind this growth are multifaceted, including increased US demand, strategic pricing adjustments by Chinese exporters to offset tariffs, and the resilience of established supply chains.

Factors Contributing to the Export Surge Despite Trade War

The continued strength of Chinese exports to the US, despite the trade war, highlights the remarkable adaptability of the Chinese economy. Several key factors contribute to this resilience:

-

Economic Diversification: China has actively pursued economic diversification strategies, reducing its reliance on any single market. This has involved increased investment in infrastructure, technological advancements, and expansion into emerging markets.

-

Alternative Markets: China has successfully penetrated other global markets, mitigating the impact of trade restrictions with the US. This has provided a buffer against any decline in US demand. Examples include increased exports to the EU and ASEAN countries.

-

Global Supply Chains: The intricate nature of global supply chains has played a significant role. Many US companies rely heavily on intermediate goods and components sourced from China, making it difficult to completely decouple from Chinese supply chains.

The Implications of a Potential US-China Trade Truce

A potential truce in the US-China trade war could significantly impact global markets. Several scenarios are possible:

-

Increased Trade Volume: A resolution of the trade conflict would likely lead to a substantial increase in bilateral trade between the two countries.

-

Increased Investment: Improved trade relations could stimulate greater foreign direct investment (FDI) flows between the US and China.

-

Enhanced Cooperation: A truce could pave the way for closer cooperation on other global issues, such as climate change and pandemic preparedness.

However, even with a truce, challenges remain.

-

Technological Competition: Competition in advanced technologies will continue to be a source of tension.

-

National Security Concerns: Concerns about intellectual property rights and national security will persist and may still hinder certain sectors of trade.

Long-Term Outlook for China and US Trade Relations

Predicting the future trajectory of US-China trade relations is complex. Both cooperation and competition are likely to define the relationship for years to come.

-

Future Trade Volumes: Trade volumes are projected to increase following a truce, although the rate of growth will depend on various factors, including the specific terms of any agreement and the ongoing geopolitical landscape.

-

Areas of Cooperation: Potential areas of cooperation include infrastructure development, clean energy technologies, and combating climate change.

-

Sources of Conflict: Potential sources of future conflict include technological rivalry, disputes over intellectual property, and differing geopolitical stances.

Conclusion: Navigating the Future of China and US Trade

The record Chinese exports to the US, even amidst trade tensions, showcase the dynamism and resilience of the Chinese economy. The potential for a truce offers significant opportunities for both countries, but also presents challenges. Understanding the intricate dynamics of China and US trade relations is crucial for navigating the complexities of the global economy. Staying informed about developments in US-China trade relations, Sino-American trade, and the broader geopolitical context is critical. For further research, refer to publications from organizations like the World Trade Organization (WTO) and the Peterson Institute for International Economics. Understanding the future of this vital trade relationship requires continuous monitoring and analysis.

Featured Posts

-

Sag Aftra Joins Wga Complete Hollywood Shutdown Now In Effect

May 23, 2025

Sag Aftra Joins Wga Complete Hollywood Shutdown Now In Effect

May 23, 2025 -

The Hunger Games Prequel Kieran Culkin Confirmed As Caesar Flickerman

May 23, 2025

The Hunger Games Prequel Kieran Culkin Confirmed As Caesar Flickerman

May 23, 2025 -

Metallica To Play Two Nights At Dublins Aviva Stadium In June 2026

May 23, 2025

Metallica To Play Two Nights At Dublins Aviva Stadium In June 2026

May 23, 2025 -

Shadman Islams Innings Secure Bangladeshs Win Over Zimbabwe

May 23, 2025

Shadman Islams Innings Secure Bangladeshs Win Over Zimbabwe

May 23, 2025 -

Emissary Reveals Hamas Deception In Witkoff Deal

May 23, 2025

Emissary Reveals Hamas Deception In Witkoff Deal

May 23, 2025

Latest Posts

-

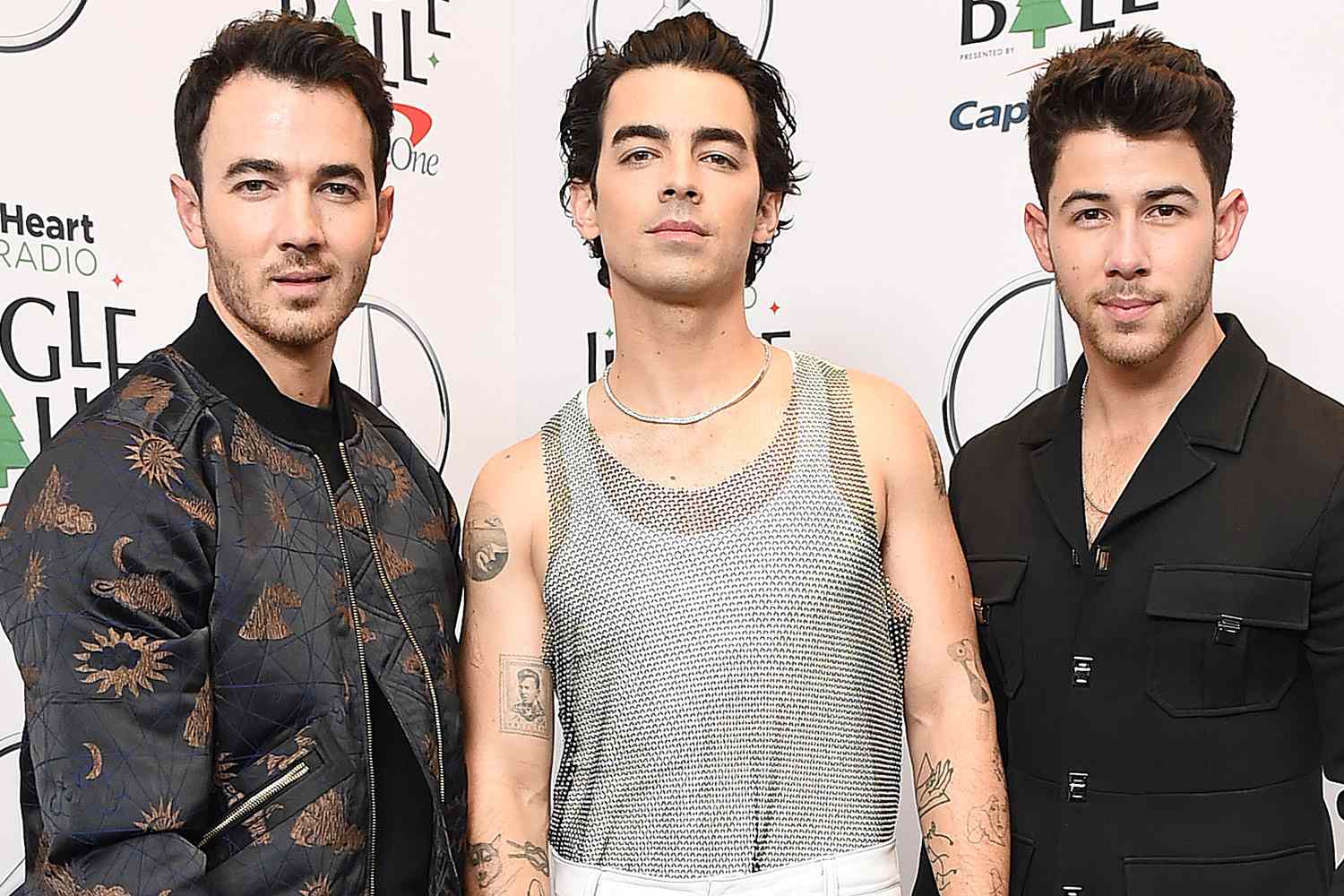

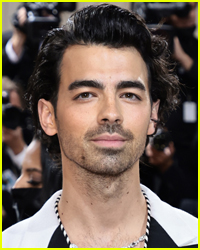

Joe Jonass Mature Response To A Couples Argument

May 23, 2025

Joe Jonass Mature Response To A Couples Argument

May 23, 2025 -

The Jonas Brothers Joe Jonas His Reaction To A Couples Dispute

May 23, 2025

The Jonas Brothers Joe Jonas His Reaction To A Couples Dispute

May 23, 2025 -

Joe Jonas Responds To Couples Public Argument About Him

May 23, 2025

Joe Jonas Responds To Couples Public Argument About Him

May 23, 2025 -

Joe Jonass Mature Reaction To A Couples Argument

May 23, 2025

Joe Jonass Mature Reaction To A Couples Argument

May 23, 2025 -

Joe Jonas Addresses Couples Argument About Him The Full Story

May 23, 2025

Joe Jonas Addresses Couples Argument About Him The Full Story

May 23, 2025