China Life Financial Results: Investment Performance Highlights

Table of Contents

Investment Portfolio Performance Breakdown

China Life's investment portfolio is diversified across several asset classes, enabling them to navigate market fluctuations and optimize returns. The performance of these asset classes directly impacts their overall financial results. Let's break down the performance:

- Equities: China Life's equity investments, a significant portion of their portfolio, have shown [insert data, e.g., "a 12% return in the last fiscal year,"]. This performance can be attributed to [insert reasons, e.g., "strong growth in the Chinese stock market and strategic investments in technology companies"]. Compare this to the previous year's return of [insert data] and industry benchmarks of [insert data].

- Bonds: Their bond portfolio, characterized by [insert details, e.g., "a mix of government and corporate bonds"], yielded [insert data, e.g., "a steady 5% return"]. This demonstrates a conservative approach, mitigating risk during periods of market uncertainty. Again, a comparison to previous years and benchmarks is crucial for a complete picture.

- Real Estate: Investments in real estate, a significant long-term asset, contributed [insert data, e.g., "a 7% return,"] reflecting the robust growth of the Chinese property market in specific regions. However, recent regulatory changes in the real estate sector should be considered for future forecasts.

- Alternative Investments: This segment, including [insert examples, e.g., "private equity and infrastructure projects"], generated [insert data, e.g., "a 9% return,"] demonstrating a strategy of diversification beyond traditional assets. The risk profile and return expectations vary significantly within alternative investments.

(Insert chart/graph visualizing the above data points for each asset class.)

The overall Return on Investment (ROI) for China Life's investment portfolio reflects [insert overall ROI]. Analyzing the yield on each asset class allows for a comprehensive understanding of their investment strategy’s success.

Impact of Macroeconomic Factors on Investment Performance

China Life's investment performance is significantly influenced by macroeconomic factors prevalent in both the Chinese and global economies. Several key factors have played a role:

- Chinese Economic Growth: The overall health of the Chinese economy has a direct correlation with China Life's investment returns. Strong economic growth typically leads to higher returns on equity investments and real estate holdings.

- Interest Rate Changes: Fluctuations in interest rates significantly influence the returns from their bond portfolio. Rising interest rates generally benefit bondholders, while falling rates can reduce yields.

- Regulatory Policies: Changes in government regulations, particularly those affecting the insurance and investment sectors, directly impact investment strategies and potential returns. Regulatory changes on real estate, for example, can impact returns.

- Inflation: Inflation erodes the real value of returns. China Life's investment strategy must account for inflationary pressures to maintain real returns.

- Geopolitical Risks: Global geopolitical events and trade tensions can introduce volatility into financial markets, affecting overall investment performance.

(Insert bullet points highlighting specific events and their impact on China Life's performance.)

Understanding these macroeconomic factors is crucial for evaluating China Life's investment decisions and projecting future performance.

Key Strategies Driving Investment Success (or Challenges)

China Life's investment success (or challenges) stems from its underlying investment strategies and risk management approach.

- Portfolio Diversification: Their diversified portfolio across asset classes mitigates risks associated with market volatility in any single sector.

- Long-Term Investment Horizon: China Life adopts a long-term investment approach, prioritizing sustainable growth over short-term gains, which is reflected in their real estate and alternative investments.

- Active and Passive Management: They likely employ a blend of active and passive management strategies, tailoring their approach to different asset classes and market conditions. Details on their specific blend would require further investigation of their annual reports.

- Risk Management: A robust risk management framework is essential. Their approach likely includes stress testing, scenario planning, and diversification to minimize exposure to potential losses.

(Insert bullet points detailing specific strategies, ideally with data supporting their effectiveness.) Further research into their annual reports could reveal more specific strategic details.

Comparison to Competitors

Benchmarking China Life's investment performance against its main competitors in the Chinese insurance market provides valuable context. [Insert a table comparing key performance indicators (KPIs) such as ROI, asset allocation, and growth rates across various companies]. This comparison highlights China Life's strengths and areas for potential improvement relative to its market share and relative performance. Identifying areas where China Life excels or lags behind competitors offers valuable insights into its overall investment strategy and effectiveness.

Conclusion: Key Takeaways and Future Outlook for China Life's Investment Performance

China Life's investment performance reflects a strategy balancing growth and risk mitigation. Their diversified portfolio and long-term approach contribute to overall returns. However, macroeconomic factors and regulatory changes present both opportunities and challenges. Understanding their financial results and investment performance is crucial for investors and stakeholders.

Looking ahead, China Life's future investment prospects are intertwined with the continued growth of the Chinese economy and the evolving global landscape. Their ability to adapt to shifting macroeconomic conditions and refine their investment strategies will be crucial in maintaining strong performance. To stay informed about future China Life financial results and gain a deeper understanding of their evolving investment strategies, we recommend regularly reviewing their investor relations page and following relevant financial news sources. You can find more details on their official website [Insert Link to China Life's Investor Relations page].

Featured Posts

-

Sustainability Excellence Schneider Electric Wins Top Global Award Again

Apr 30, 2025

Sustainability Excellence Schneider Electric Wins Top Global Award Again

Apr 30, 2025 -

The Cnils Revised Ai Guidelines Key Changes And Practical Implications

Apr 30, 2025

The Cnils Revised Ai Guidelines Key Changes And Practical Implications

Apr 30, 2025 -

Coronation Streets Daisy Midgeley A Look At Her Past Roles

Apr 30, 2025

Coronation Streets Daisy Midgeley A Look At Her Past Roles

Apr 30, 2025 -

Franche Comte Consentement Eclaire Et Chirurgie Des Hemorroides

Apr 30, 2025

Franche Comte Consentement Eclaire Et Chirurgie Des Hemorroides

Apr 30, 2025 -

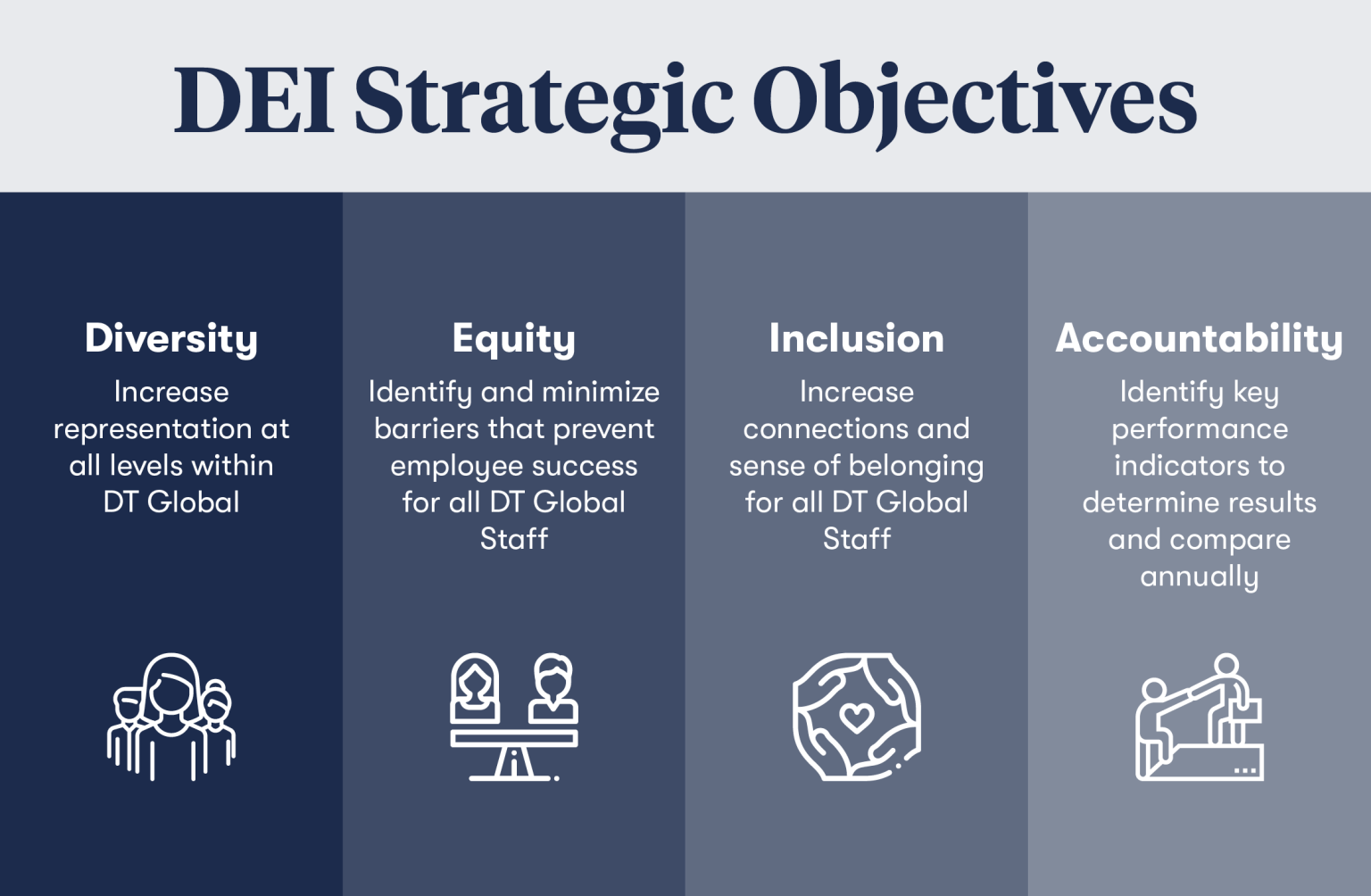

A Critical Look At Targets Evolving Dei Commitment

Apr 30, 2025

A Critical Look At Targets Evolving Dei Commitment

Apr 30, 2025