China Life Investment Strength Fuels Profit Increase

Table of Contents

Strategic Investment Portfolio: The Engine of Growth

China Life's success is largely attributed to its well-diversified investment portfolio, spanning across various asset classes. This strategic asset allocation has proven crucial in mitigating risk and maximizing returns. The company strategically invests in a mix of stocks, bonds, real estate, and other alternative investments, carefully balancing risk and reward.

The performance of each major asset class has significantly contributed to the overall profit increase. For instance:

- Successful investments in the technology sector contributed significantly to profit growth, with returns exceeding expectations. This proactive approach to identifying emerging market trends showcases China Life's forward-thinking investment philosophy.

- Strategic real estate acquisitions yielded impressive returns on investment (ROI), showcasing shrewd investment choices in prime locations with strong growth potential. These acquisitions demonstrate a deep understanding of the real estate market and its long-term prospects.

- A well-managed bond portfolio provided a stable base of income and further cushioned against market volatility. The careful selection of high-quality bonds ensured consistent returns, complementing the higher-risk, higher-reward aspects of other investments.

China Life employs sophisticated risk management strategies, including diversification across asset classes and geographies, to mitigate potential losses and ensure the long-term stability of its investment portfolio. This proactive risk management approach is a key element in the company's sustained success. Keywords: Investment portfolio, asset allocation, risk management, diversification, return on investment, technology investments, real estate investments.

Improved Investment Management and Expertise

Beyond a diversified portfolio, China Life's enhanced investment management techniques have played a pivotal role in boosting profits. The company has embraced technological advancements, incorporating data analytics and predictive modeling into its investment decision-making process. This data-driven approach allows for more informed and accurate assessments of market trends and risk factors.

Key improvements include:

- Implementation of new data-driven investment strategies: Leveraging big data and advanced analytics allows for more precise forecasts and optimized portfolio adjustments.

- Enhanced risk assessment and mitigation processes: Sophisticated risk models help identify and manage potential threats effectively.

- Improved collaboration between investment and actuarial teams: Streamlined communication and collaboration ensure a holistic view of investment opportunities and their impact on the company's overall financial health.

These improvements, coupled with the recruitment and promotion of highly skilled investment professionals, have significantly enhanced China Life's investment capabilities and overall performance. Keywords: Investment management, data analytics, predictive modeling, risk assessment, expert team, financial expertise.

Government Policies and Economic Growth

The supportive government policies in China have created a favorable environment for China Life's investment success. The country's sustained economic growth has fueled investment returns across various sectors, particularly benefiting companies with diversified portfolios like China Life. Specific government initiatives aimed at promoting financial stability and infrastructure development have also had a positive impact. The regulatory environment, while stringent, provides a stable framework for long-term investment planning. Keywords: Government policies, economic growth, regulatory environment, insurance sector, macroeconomic factors.

Future Outlook and Sustainable Growth

China Life continues to refine its investment strategies, focusing on sustainable and responsible investments. The company is increasingly integrating Environmental, Social, and Governance (ESG) factors into its investment decision-making process, aligning its investments with long-term sustainability goals.

While the future presents exciting opportunities, China Life acknowledges potential risks and challenges, including global economic uncertainty and geopolitical factors. The company’s proactive risk management and adaptive investment strategies will be crucial in navigating these complexities and ensuring continued success. Keywords: Future outlook, sustainable investments, ESG, responsible investing, long-term growth, challenges and risks.

Conclusion: China Life's Investment Strength Drives Profitability

China Life's remarkable profit increase is a testament to its strong investment performance, driven by a diverse portfolio, sophisticated investment management, and favorable macroeconomic conditions. Strategic investment decisions, coupled with improved risk management and a highly skilled investment team, have been instrumental in achieving these impressive results. The company's commitment to sustainable and responsible investments positions it for continued success in the long term.

Learn more about how China Life's investment strength ensures continued profitability and invest in understanding China Life's powerful investment strategies.

Featured Posts

-

Dosarele X O Redeschidere Posibila Ancheta Continua

Apr 30, 2025

Dosarele X O Redeschidere Posibila Ancheta Continua

Apr 30, 2025 -

Fondi 8xmille Slittamento Apertura Processo Fratello Becciu Ultime Notizie

Apr 30, 2025

Fondi 8xmille Slittamento Apertura Processo Fratello Becciu Ultime Notizie

Apr 30, 2025 -

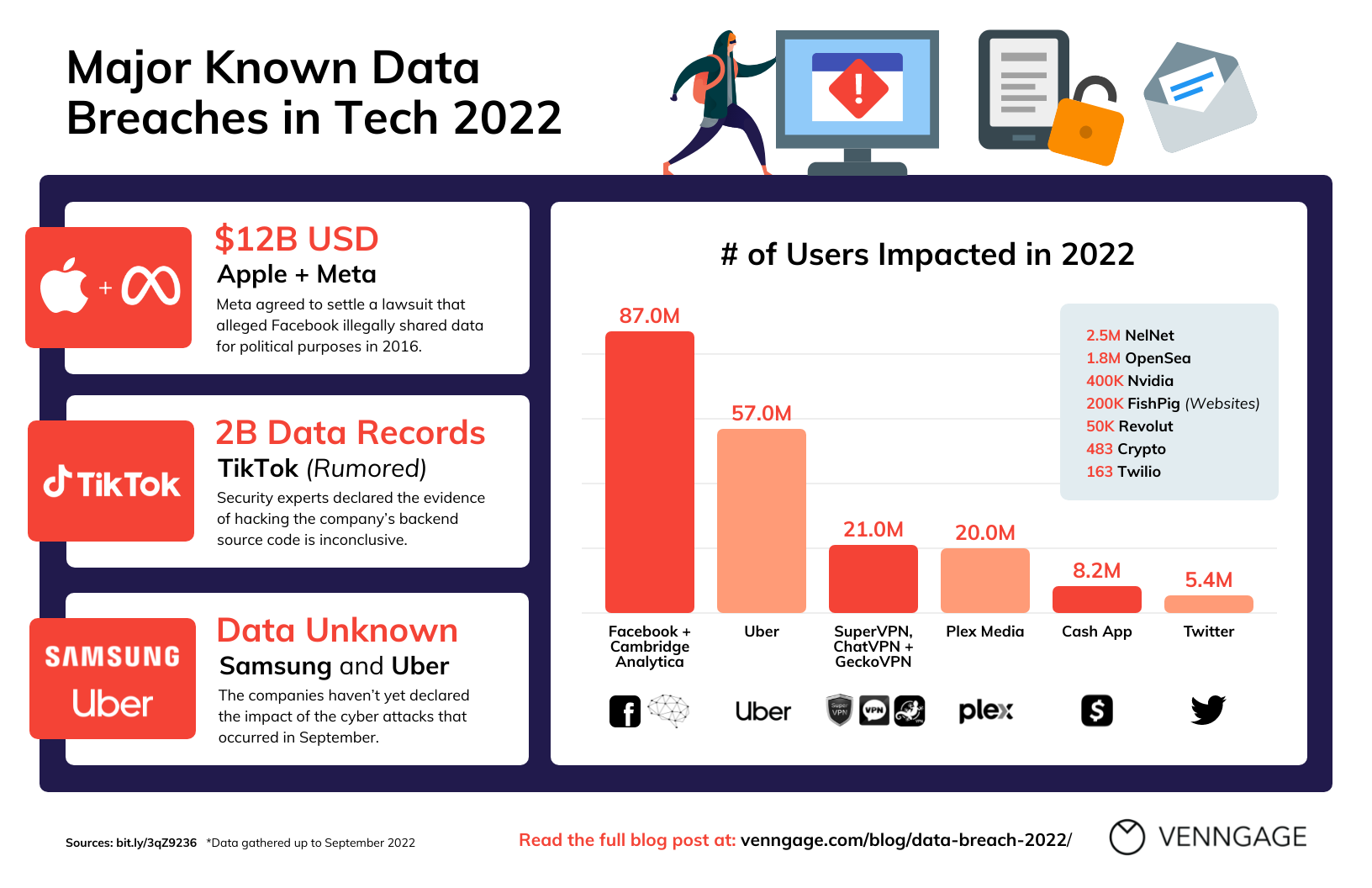

T Mobile Penalty 16 Million For Years Of Data Breaches

Apr 30, 2025

T Mobile Penalty 16 Million For Years Of Data Breaches

Apr 30, 2025 -

Processo Becciu Data D Inizio Dell Appello E Dichiarazione Di Innocenza

Apr 30, 2025

Processo Becciu Data D Inizio Dell Appello E Dichiarazione Di Innocenza

Apr 30, 2025 -

Luto En El Futbol Argentino Fallece Joven Referente De Afa

Apr 30, 2025

Luto En El Futbol Argentino Fallece Joven Referente De Afa

Apr 30, 2025