China Life's Profitability: A Strong Investment Performance Story

Table of Contents

China Life's Strategic Investment Portfolio: A Key Driver of Profitability

China Life's success stems significantly from its sophisticated and diversified investment strategy. The company employs a long-term, value-oriented approach, carefully balancing risk and reward across various asset classes. This strategic diversification is a cornerstone of China Life's profitability.

- Diversified Asset Allocation: China Life's portfolio includes a mix of:

- Fixed Income: Government bonds, corporate bonds, and other fixed-income securities provide stability and consistent returns.

- Equities: Investments in both domestic and international equity markets offer potential for higher growth.

- Real Estate: Strategic real estate investments contribute to long-term capital appreciation.

- Alternative Investments: A carefully managed allocation to alternative investments like private equity and infrastructure projects further diversifies risk and enhances potential returns.

- Successful Investments: China Life's astute investment decisions have yielded significant returns, notably in its early investments in the burgeoning Chinese real estate market and strategic equity holdings in key domestic companies. These successes have directly contributed to the impressive growth in China Life's profitability.

- Robust Risk Management: Stringent risk management practices, including stress testing and scenario analysis, ensure that the portfolio remains resilient even in volatile market conditions. This proactive approach mitigates potential losses and safeguards China Life's profitability.

- Geographical Diversification: While a significant portion of their investments remain within China, leveraging the domestic growth story, China Life is increasingly exploring international markets to further diversify its portfolio and reduce exposure to regional economic fluctuations. This global outlook is crucial for maintaining long-term profitability.

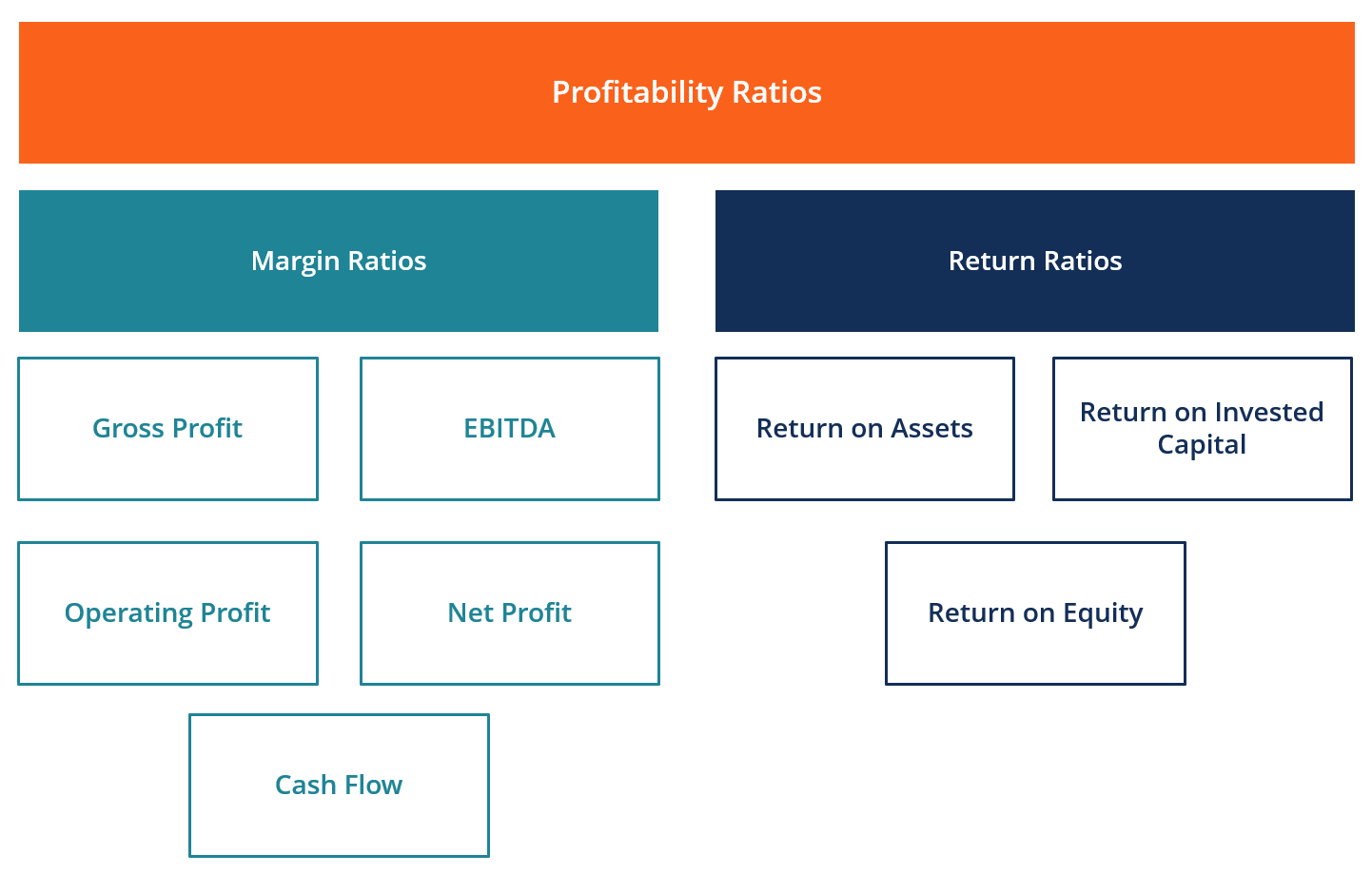

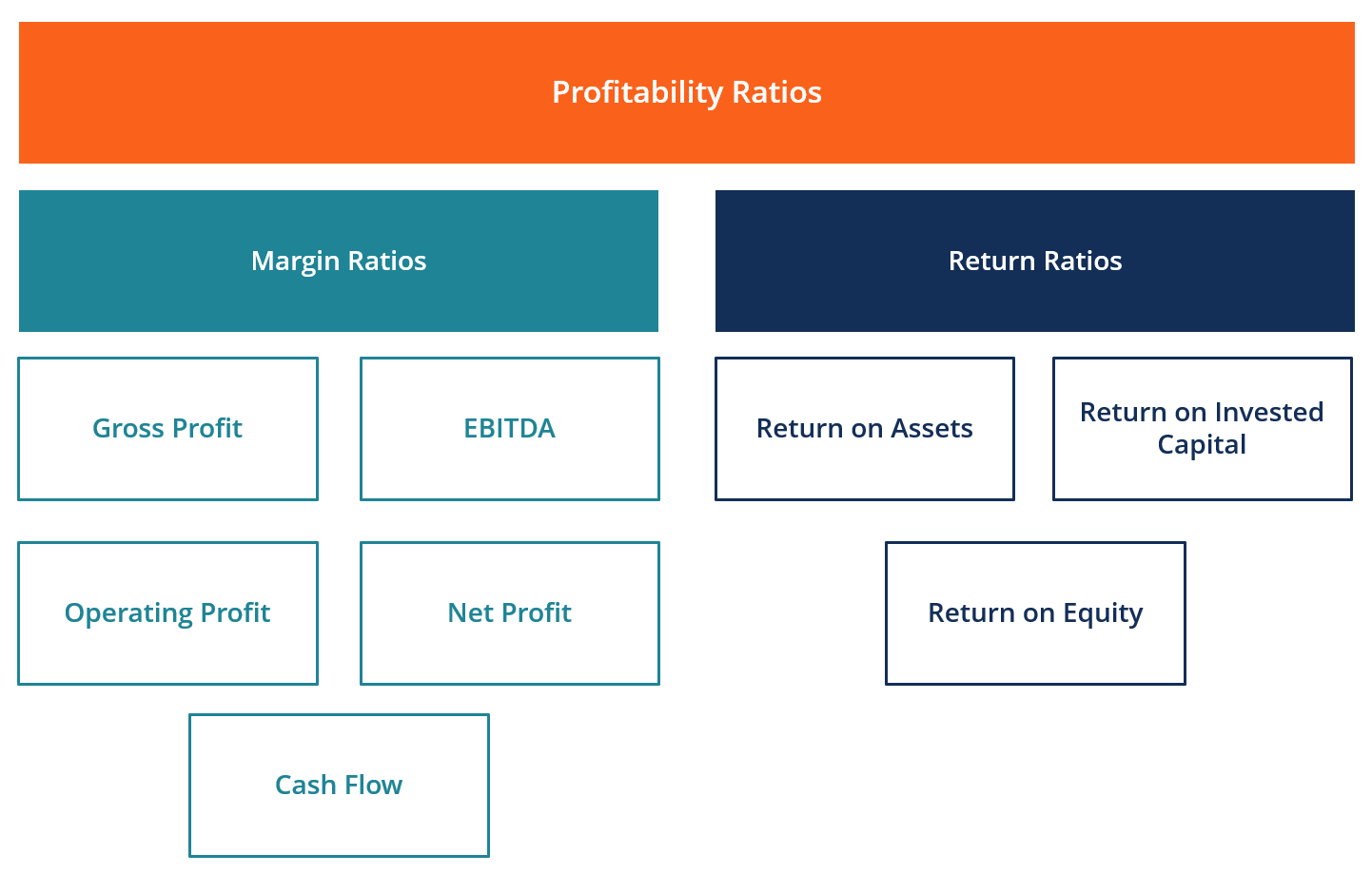

Analyzing China Life's Financial Performance and Key Metrics

China Life's financial performance consistently demonstrates its robust profitability. Key metrics paint a picture of sustained growth and strong returns:

- High Return on Equity (ROE): China Life consistently boasts a high ROE, indicating efficient use of shareholder capital and strong profitability.

- Solid Return on Assets (ROA): A consistently healthy ROA reflects efficient asset utilization and strong operational efficiency.

- Growing Net Profit Margin: The company's net profit margin has displayed steady growth, indicating effective cost management and pricing strategies.

[Insert Chart/Graph showing ROE, ROA, and Net Profit Margin over several years]

- Yearly Performance Highlights: [Include bullet points highlighting significant yearly achievements and growth].

- Competitive Advantage: [Compare key metrics with competitors to showcase China Life's superior performance].

- Regulatory Impact: While regulatory changes in the Chinese insurance sector can impact profitability, China Life has consistently adapted and navigated these changes effectively.

- Industry Recognition: China Life has received numerous awards and accolades for its financial strength and operational excellence, further validating its strong profitability.

The Role of China's Economic Growth in China Life's Success

China Life's success is inextricably linked to China's remarkable economic expansion. The sustained growth of the Chinese economy, coupled with increasing insurance penetration, has fueled the company's expansion and profitability.

- Correlation with GDP Growth: China Life's profitability has shown a strong positive correlation with China's GDP growth rate. As the economy expands, so does the demand for insurance products.

- Demographic Factors: China's large and aging population presents both opportunities and challenges. The growing middle class is driving increased demand for insurance products, while the aging population necessitates solutions for retirement and healthcare.

- Key Economic Indicators:

- GDP Growth: A key driver of overall economic activity and insurance demand.

- Inflation: Impacts pricing and profitability.

- Interest Rates: Influence investment returns and borrowing costs.

- Government Policies: Supportive government policies promoting financial inclusion and the development of the insurance sector have created a favourable environment for China Life’s growth.

Future Outlook and Potential Challenges for China Life's Profitability

While China Life enjoys a strong position, several factors could influence its future profitability:

- Growth Opportunities: Expansion into new insurance segments, including health insurance and wealth management, presents significant growth opportunities. Strategic acquisitions and partnerships can further accelerate growth.

- Potential Challenges and Risks:

- Geopolitical Uncertainty: Global economic instability and geopolitical events can impact investment returns.

- Increased Competition: Growing competition within the Chinese insurance market requires ongoing innovation and strategic adaptation.

- Regulatory Changes: Future regulatory shifts could impact operational efficiency and profitability.

- Mitigation Strategies: China Life is proactively addressing these challenges through strategic investments in technology, diversification of its product offerings, and a robust risk management framework. Their long-term sustainability plan focuses on adapting to changing market conditions and maintaining a competitive edge.

- Growth Projections: While precise projections are difficult, China Life’s management demonstrates confidence in their ability to maintain strong profitability through a diversified strategy and proactive risk management.

Conclusion: China Life's Profitability: A Solid Investment for the Future?

China Life's profitability is a result of a potent combination of strategic investment decisions, strong financial performance, and the benefits of operating within a rapidly growing economy. While potential challenges exist, the company's proactive approach to risk management and its focus on innovation position it well for continued success. To delve deeper into China Life's impressive financial history and explore potential investment opportunities, we encourage you to visit their investor relations website and review their annual reports. Understanding China Life's profitability is key to assessing its potential as a long-term investment.

Featured Posts

-

Scandalo Becciu Le Chat Pubblicate Da Domani Gettano Nuova Luce Sul Caso

Apr 30, 2025

Scandalo Becciu Le Chat Pubblicate Da Domani Gettano Nuova Luce Sul Caso

Apr 30, 2025 -

Schneider Electrics Strong 2024 Outlook Revenue And Earnings Growth Driven By Data Center Boom

Apr 30, 2025

Schneider Electrics Strong 2024 Outlook Revenue And Earnings Growth Driven By Data Center Boom

Apr 30, 2025 -

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 30, 2025

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 30, 2025 -

The Impact Of Trumps Statements On The Upcoming Canadian Election

Apr 30, 2025

The Impact Of Trumps Statements On The Upcoming Canadian Election

Apr 30, 2025 -

Did Target Abandon Its Dei Commitment Analyzing The Recent Shift

Apr 30, 2025

Did Target Abandon Its Dei Commitment Analyzing The Recent Shift

Apr 30, 2025