China's Automotive Market: A Deeper Look At The Challenges For Premium Brands

Table of Contents

Intense Competition from Domestic and International Players

The Chinese automotive market is fiercely competitive, with premium car brands facing pressure from both domestic and international rivals.

Rise of Domestic Chinese Brands

The meteoric rise of homegrown brands like BYD, Nio, and Xpeng is a significant factor. These companies are leveraging advanced technologies and sophisticated designs to offer compelling alternatives to established premium brands. Their success stems from several key factors:

- Aggressive pricing strategies: Domestic brands often undercut established premium players, making their vehicles more accessible to a wider range of consumers.

- Increasing sophistication and quality: Chinese automakers are rapidly improving the quality and technological capabilities of their vehicles, closing the gap with premium international brands.

- Strong government support: The Chinese government actively supports the growth of its domestic auto industry, providing incentives and fostering innovation. This support fuels the competitive landscape for premium brands.

Established Global Competitors

Premium car brands also contend with established international players like BMW, Mercedes-Benz, and Audi, which already have a strong presence and brand loyalty within the Chinese market. These competitors employ various strategies to maintain their market share:

- Brand loyalty: Many Chinese consumers exhibit strong brand loyalty towards established European and American luxury car brands.

- Aggressive marketing and sales strategies: International competitors utilize extensive marketing campaigns and robust sales networks to reach consumers effectively.

- Localized marketing strategies: Tailoring marketing campaigns to resonate with specific cultural nuances and regional preferences is crucial for success. Ignoring this aspect can severely hinder a premium brand's penetration.

Unique Consumer Preferences and Expectations

Understanding and catering to the unique preferences and expectations of Chinese consumers is paramount for premium car brands.

Technology and Innovation

Chinese consumers, especially in the premium segment, are highly tech-savvy and expect cutting-edge technology in their vehicles. This translates into a strong demand for:

- Advanced driver-assistance systems (ADAS): Features like lane-keeping assist, adaptive cruise control, and automatic emergency braking are highly valued.

- Electric and hybrid vehicles: The Chinese market shows a strong preference for environmentally friendly vehicles, driving demand for electric and hybrid models.

- Connected car features and digital services: Integration with smartphones, online services, and advanced infotainment systems are essential for attracting tech-savvy consumers.

Brand Perception and Image

Building a strong and positive brand image is crucial in China. Cultural understanding and nuanced marketing strategies are essential for success. Premium brands need to consider:

- Adapting marketing strategies to Chinese cultural values: Marketing campaigns should resonate with Chinese cultural values and avoid cultural missteps.

- Building strong relationships with key influencers: Collaborating with influential figures in Chinese society can significantly enhance brand visibility and credibility.

- Understanding regional variations in consumer preferences: Consumer preferences and expectations can vary significantly across different regions within China.

Navigating Regulatory and Infrastructure Hurdles

The Chinese automotive market is subject to a complex regulatory environment and evolving infrastructure challenges.

Government Regulations and Policies

Navigating the regulatory landscape is critical for premium car brands operating in China. Key considerations include:

- Understanding and complying with ever-changing regulations: Regulations regarding emissions, safety, and import duties are frequently updated, necessitating continuous monitoring and adaptation.

- Potential impact of trade tariffs and import duties: Import taxes can significantly impact the pricing and competitiveness of imported vehicles.

- Adapting to new emission standards and environmental regulations: China's increasingly stringent environmental regulations place a greater emphasis on fuel efficiency and emission reduction.

Charging Infrastructure for EVs

The development of charging infrastructure for electric vehicles (EVs) is still ongoing in some parts of China. This presents a significant challenge for premium EV brands:

- Ensuring access to sufficient charging stations: A robust network of charging stations is vital to address consumer range anxiety.

- Addressing range anxiety concerns among consumers: Addressing consumer concerns about battery range and charging infrastructure is crucial for EV adoption.

- Investing in or partnering with charging infrastructure providers: Collaboration with charging network providers can ensure access to charging infrastructure and alleviate range anxiety.

Conclusion

The Chinese automotive market, while immensely lucrative, presents formidable challenges for premium car brands. Intense competition, discerning consumers, and complex regulations demand a sophisticated and adaptable approach. By understanding and addressing the issues outlined above—from intense competition and unique consumer preferences to regulatory hurdles and infrastructure limitations—premium brands can position themselves for success in this vital market. To thrive in this dynamic landscape, a deep understanding of the complexities facing premium car brands in China is paramount for long-term growth and profitability. Invest the time and resources necessary to understand these challenges, and you'll be better equipped to succeed.

Featured Posts

-

Payton Pritchard Turning Point In Boston Celtics Playoff Opener

May 12, 2025

Payton Pritchard Turning Point In Boston Celtics Playoff Opener

May 12, 2025 -

Chantal Ladesou S En Prend Une Nouvelle Fois A Ines Reg

May 12, 2025

Chantal Ladesou S En Prend Une Nouvelle Fois A Ines Reg

May 12, 2025 -

Celtics Guard Payton Pritchard Wins Nba Sixth Man Of The Year

May 12, 2025

Celtics Guard Payton Pritchard Wins Nba Sixth Man Of The Year

May 12, 2025 -

The 500 Most Powerful Individuals In Washington Dc 2025 Predictions

May 12, 2025

The 500 Most Powerful Individuals In Washington Dc 2025 Predictions

May 12, 2025 -

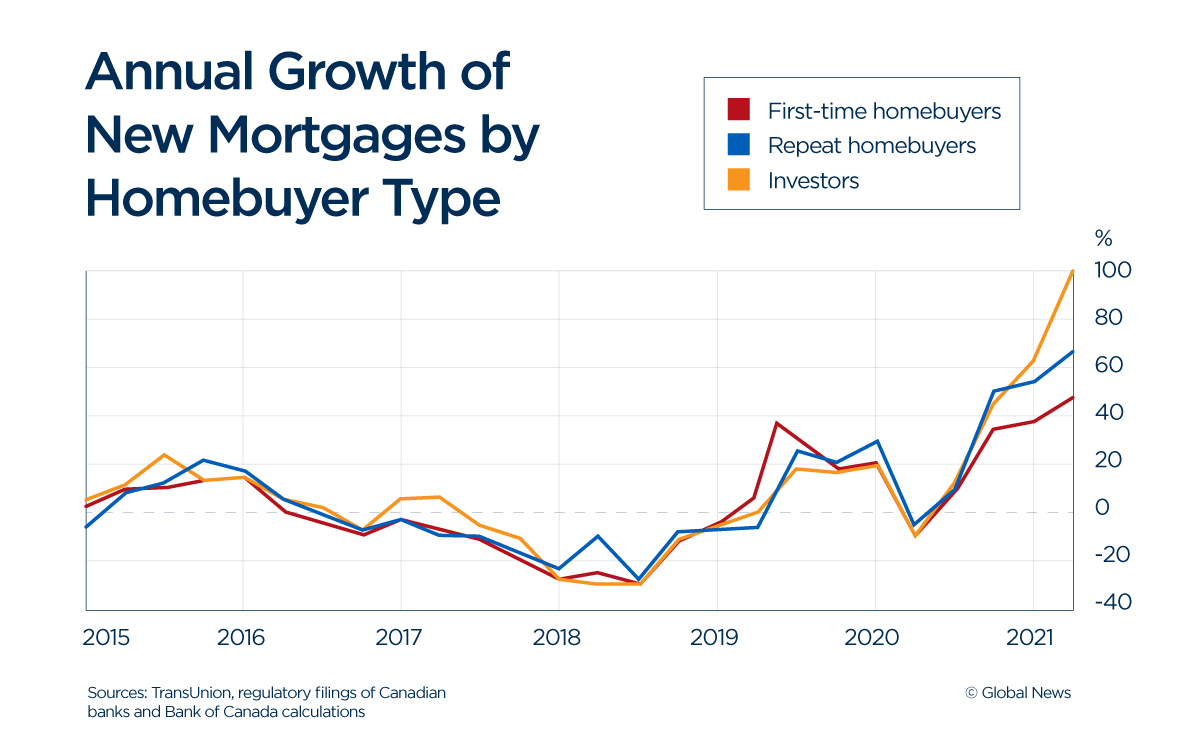

Canadas Housing Market The Impact Of Low Mortgage Rates Under 3

May 12, 2025

Canadas Housing Market The Impact Of Low Mortgage Rates Under 3

May 12, 2025

Latest Posts

-

Portola Valley Preserve Ongoing Search For Missing 79 Year Old

May 13, 2025

Portola Valley Preserve Ongoing Search For Missing 79 Year Old

May 13, 2025 -

New Taverna A Taste Of Greece Opens Its Doors In Portola Valley

May 13, 2025

New Taverna A Taste Of Greece Opens Its Doors In Portola Valley

May 13, 2025 -

Search Continues For Missing 79 Year Old Woman In Portola Valley Preserve

May 13, 2025

Search Continues For Missing 79 Year Old Woman In Portola Valley Preserve

May 13, 2025 -

New Greek Restaurant Taverna Opens In Portola Valley

May 13, 2025

New Greek Restaurant Taverna Opens In Portola Valley

May 13, 2025 -

Sue Crane 92 Dedicated Portola Valley Public Servant Passes Away

May 13, 2025

Sue Crane 92 Dedicated Portola Valley Public Servant Passes Away

May 13, 2025