China's Lithium Export Restrictions: A Boon For Eramet?

Table of Contents

China's Tightening Grip on Lithium Exports: The Geopolitical Landscape

The Drivers Behind China's Lithium Export Restrictions:

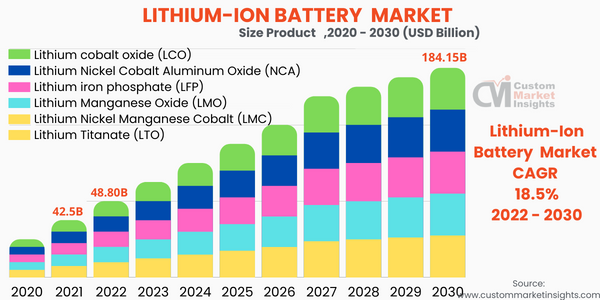

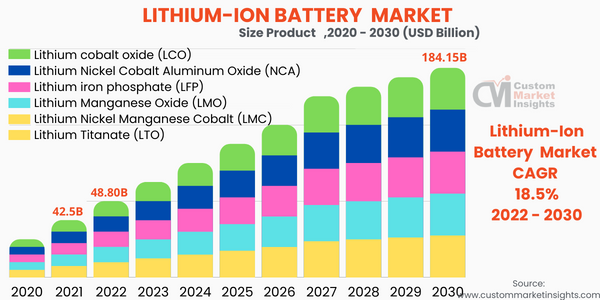

China's decision to tighten its grip on lithium exports is driven by a confluence of factors. The most prominent is the surge in domestic demand for lithium, fueled by its ambitious EV and battery manufacturing goals. Securing its own supply chain is another key driver; China aims to reduce its reliance on foreign sources of this critical raw material, thereby mitigating geopolitical risks. Finally, resource nationalism plays a significant role, with China asserting greater control over its strategic resources. This policy shift is a manifestation of China's broader strategy to dominate key sectors of the global economy.

- Specific Policy Changes: Implementation of quotas on lithium exports, increased scrutiny of export licenses, and preferential treatment for domestic lithium processing companies.

- Impact on Global Markets: These restrictions have led to immediate price increases and uncertainty in the global lithium supply chain, forcing companies to reconsider their sourcing strategies. This creates both challenges and opportunities for international players.

Impact on Global Lithium Prices and Supply:

The immediate impact of China's export restrictions has been a significant spike in global lithium prices. The long-term effects remain uncertain but are expected to lead to increased market volatility. The disruption to the lithium supply chain could force manufacturers to seek alternative suppliers, potentially leading to higher production costs and longer lead times.

- Price Trends: We've already seen significant price increases in the past year, and further increases are anticipated in the short-to-medium term.

- Potential Scenarios: The market could see a period of prolonged price volatility, with prices fluctuating based on supply chain disruptions and global demand. Diversification of sourcing will be crucial for businesses to mitigate future risk.

Eramet's Position and Strategic Advantages in the New Lithium Landscape

Eramet's Current Lithium Operations and Investments:

Eramet is strategically positioned to benefit from China's restrictions. The company has ongoing lithium projects in various locations, including its activities in Australia and its involvement in refining processes. These strategic geographic locations help diversify its supply chain and mitigate some risks associated with reliance on a single region. It also engages in key partnerships and collaborations to enhance its operations and strengthen its market position.

- Production Capacity and Expansion: Eramet's current production capacity, coupled with its ambitious expansion plans, positions it to meet growing global demand. These expansions target sustainable lithium mining practices.

- Key Projects: [Insert specific details about Eramet's key lithium projects, their locations, and production capacity].

Opportunities for Eramet Amidst China's Restrictions:

China's export restrictions create significant opportunities for Eramet. With reduced supply from China, the global demand for lithium from alternative sources like Eramet is likely to increase dramatically. This opens up pathways for considerable market share growth and increased profitability.

- Market Share Gains: Eramet is well-positioned to capture a larger share of the global lithium market as companies seek reliable, alternative sources.

- New Customer Acquisition: The shift in the global lithium landscape could lead to new partnerships and contracts with battery manufacturers and other downstream players.

Risks and Challenges Facing Eramet:

Despite the favorable circumstances, Eramet faces challenges. Intense competition from other lithium producers is a major concern. Fluctuating lithium prices, inherent to the commodity market, present a risk to profitability. Finally, geopolitical instability in various regions where Eramet operates could disrupt its supply chain.

- Mitigation Strategies: Eramet needs to focus on cost optimization, strategic partnerships, and robust supply chain management to mitigate these risks. Diversifying its customer base and refining operations will also be crucial.

Conclusion: Will China's Lithium Export Restrictions Truly Benefit Eramet?

China's tightening grip on lithium exports presents both challenges and opportunities for the global lithium market. Eramet, with its existing operations and expansion plans, is well-positioned to capitalize on the increased demand and reduced supply from China. The company's strategic geographic diversification and focus on sustainable practices further strengthen its position. However, Eramet must proactively address potential risks like competition and price volatility. Understanding China's lithium export restrictions is crucial for investors and industry experts alike, particularly those interested in the future of companies like Eramet. Further research into Eramet's lithium market involvement and close monitoring of China's lithium policy updates are recommended for informed decision-making regarding Eramet investment and overall lithium market analysis.

Featured Posts

-

Nottingham Forest Striker Awoniyi Undergoes Surgery Out For Extended Period

May 14, 2025

Nottingham Forest Striker Awoniyi Undergoes Surgery Out For Extended Period

May 14, 2025 -

Dataverzameling Nederlander Bayerns Hoge Kosten

May 14, 2025

Dataverzameling Nederlander Bayerns Hoge Kosten

May 14, 2025 -

Oqtf Et Saint Pierre Et Miquelon L Insistance De Laurent Wauquiez Face Aux Protestations

May 14, 2025

Oqtf Et Saint Pierre Et Miquelon L Insistance De Laurent Wauquiez Face Aux Protestations

May 14, 2025 -

Miercoles 7 De Mayo En Sevilla Ideas Para Tu Dia

May 14, 2025

Miercoles 7 De Mayo En Sevilla Ideas Para Tu Dia

May 14, 2025 -

Uruguays Ex President Mujica Receives Palliative Care Wifes Statement

May 14, 2025

Uruguays Ex President Mujica Receives Palliative Care Wifes Statement

May 14, 2025