China's Steel Production Cuts And The Future Of Iron Ore Prices

Table of Contents

China's Steel Production Cuts: The Driving Forces

Several factors have converged to trigger substantial cuts in China's steel production. These cuts are not merely cyclical fluctuations but represent a fundamental shift in the country's industrial policy.

-

Stringent Environmental Regulations: China's commitment to meeting its carbon emission targets has led to stricter environmental regulations. Steel production, being an energy-intensive process, is a primary target of these regulations. Many inefficient and polluting steel mills have been forced to reduce or cease operations, directly impacting overall steel output.

-

Government Policies Targeting Overcapacity: For years, China struggled with overcapacity in its steel sector. To address this, the government implemented policies aimed at consolidating the industry and phasing out outdated, less efficient facilities. This has resulted in significant reductions in steel production capacity.

-

Weakening Domestic Demand: China's economic growth has slowed in recent years, leading to a weakening in domestic demand for steel. This reduced demand has further contributed to the decline in steel production. The construction sector, a major consumer of steel, has been particularly affected by the slowdown.

-

Property Market Downturn: The significant downturn in China's property market has severely impacted steel demand. Construction projects have been delayed or cancelled, leading to a sharp drop in steel consumption.

Statistics reveal the extent of these cuts. For example, [insert relevant statistic on percentage reduction in steel production in a specific period]. These cuts are not uniformly distributed across China. Regions heavily reliant on traditional steel production have experienced the most significant impact, resulting in job losses and economic hardship in certain areas. The keywords China steel production, steel output, environmental regulations, carbon emission, property market, and economic slowdown are all critical to understanding this complex situation.

The Immediate Impact on Iron Ore Prices

The immediate consequence of China's steel production cuts has been a significant reduction in iron ore demand. This directly impacted iron ore prices, causing considerable volatility. The price of benchmark iron ore (62% Fe fines), a key indicator for the market, experienced [describe the price fluctuations, including percentage changes and timeframes].

The relationship between steel production and iron ore consumption is almost directly proportional. When steel production falls, so does iron ore demand, resulting in lower prices. [Include a chart or graph illustrating the correlation between Chinese steel production and iron ore prices]. The keywords iron ore price, iron ore demand, 62% Fe fines, price volatility, and benchmark prices are essential in understanding these market dynamics.

Factors Influencing Future Iron Ore Prices

Predicting the future of iron ore prices requires considering several interacting factors:

-

Global Demand: While China remains the dominant force, global demand from other countries, particularly in developing economies, plays a role in shaping iron ore prices. Increased demand from these markets could partially offset the impact of reduced Chinese demand.

-

Technological Advancements: Advancements in steelmaking technology, such as the increased use of scrap steel and more efficient production methods, could affect future iron ore demand.

-

Market Sentiment and Speculative Trading: Market sentiment and speculative trading can significantly influence iron ore prices, creating short-term price swings that may not entirely reflect underlying supply and demand dynamics.

-

Supply Disruptions: Potential supply disruptions in major iron ore producing regions (e.g., Australia, Brazil) could lead to price increases, irrespective of demand fluctuations.

The keywords iron ore supply, global demand, steel technology, market sentiment, and supply chain disruptions are all key to understanding the complex interplay of forces affecting future iron ore pricing.

Strategies for Navigating the Changing Market

The fluctuating iron ore market demands astute strategies from businesses in the iron ore and steel industries.

-

Risk Management: Implementing robust risk management strategies is crucial to mitigate the impact of price volatility. This includes careful forecasting, hedging strategies, and diversification.

-

Diversification: Reducing reliance on the Chinese market by diversifying into other regions or product lines can help mitigate risk.

-

Hedging: Utilizing financial instruments like futures contracts can help businesses protect themselves against adverse price movements.

-

Price Forecasting: Employing sophisticated price forecasting models, incorporating data on Chinese steel production, global demand, and other relevant factors, can help businesses make informed decisions.

The keywords risk management, hedging, market diversification, price forecasting, and investment strategies highlight the tools and techniques needed to navigate this dynamic market environment.

Conclusion: Understanding China's Steel Production Cuts and the Future of Iron Ore Prices

China's steel production cuts have had a significant and multifaceted impact on iron ore prices. The interplay of environmental regulations, government policies, economic slowdown, and market sentiment has created a volatile market environment. Understanding these factors and their complex interactions is crucial. Monitoring government policies, market trends, and technological advancements is vital for making informed business decisions. The long-term implications for the iron ore market remain uncertain, but continued attention to China's steel production cuts and the future of iron ore prices is essential. To stay ahead, conduct further research on these trends and consider consulting with industry experts to navigate this challenging landscape.

Featured Posts

-

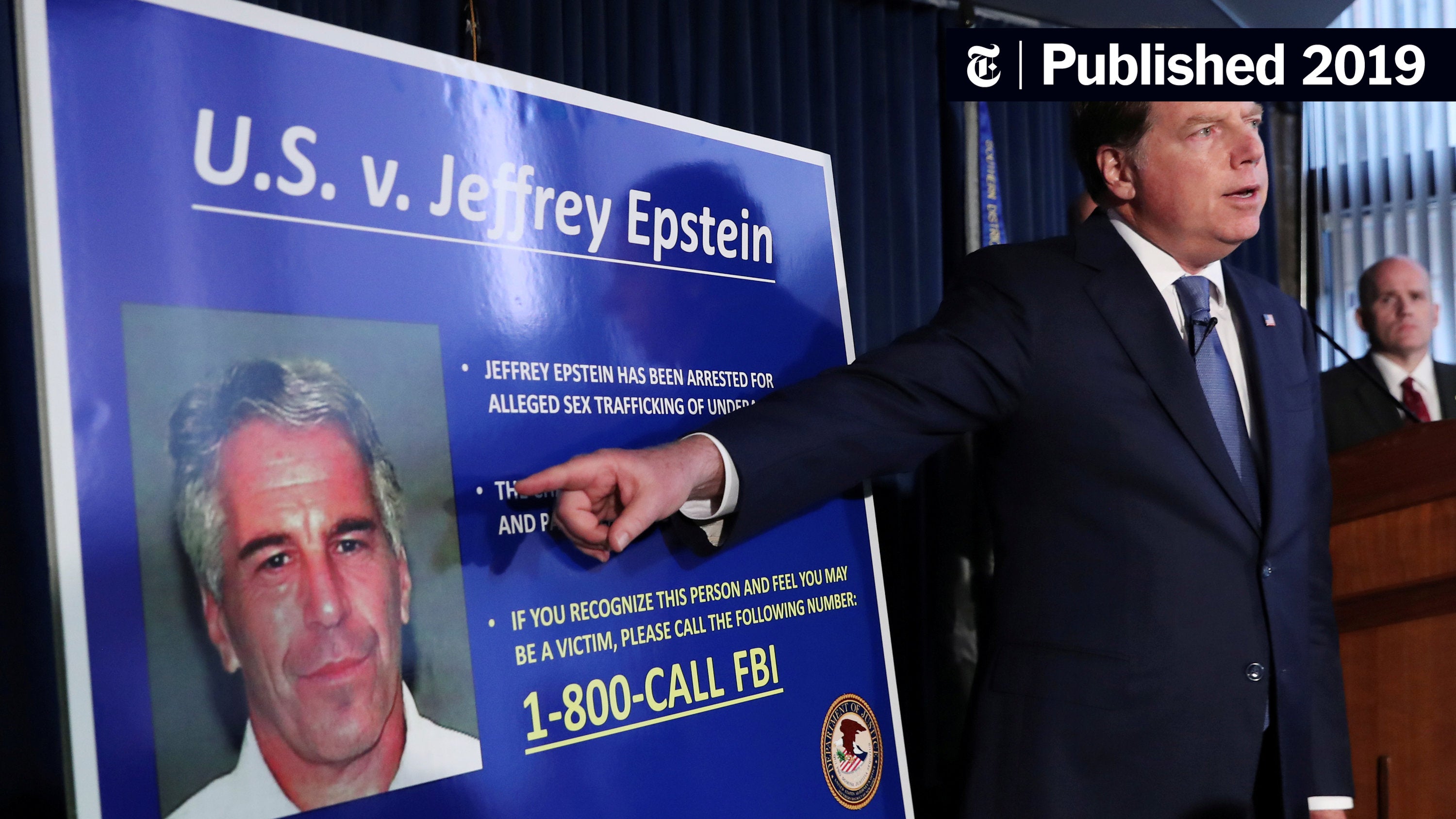

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025 -

Resistance To Ev Mandates Car Dealerships Push Back

May 10, 2025

Resistance To Ev Mandates Car Dealerships Push Back

May 10, 2025 -

Nottingham Hospital Faces Backlash Over A And E Data Breach Affecting Stabbing Victims Families

May 10, 2025

Nottingham Hospital Faces Backlash Over A And E Data Breach Affecting Stabbing Victims Families

May 10, 2025 -

Melanie Griffith And Dakota Johnsons Siblings Attend Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnsons Siblings Attend Materialist Premiere

May 10, 2025 -

Invest Smart Identifying The Countrys Newest Business Hubs

May 10, 2025

Invest Smart Identifying The Countrys Newest Business Hubs

May 10, 2025