Chinese Stocks Rebound After Dip: US Discussions And Key Indicators

Table of Contents

Easing US-China Tensions

The thawing of relations between the US and China has played a crucial role in the recent rebound of Chinese stocks. Improved communication and de-escalation of trade disputes have significantly boosted investor confidence.

De-escalation of Trade Disputes

Recent positive developments in US-China trade talks offer a glimmer of hope. While a complete resolution remains elusive, the reduction of some tariffs and a more conciliatory tone from both sides have calmed market anxieties.

- Specific examples of de-escalation: The pause in imposing new tariffs and the resumption of some dialogue channels have eased fears of a further escalation of the trade war.

- Statements from officials: Public statements emphasizing a commitment to constructive dialogue have helped to improve investor confidence and reduce uncertainty.

- Impact on investor sentiment: The de-escalation has led to a more positive investor sentiment, encouraging investment in Chinese assets. This shift in sentiment is clearly visible in the increased trading volumes and the upward trend in stock prices.

Improved Communication Channels

The re-establishment of open communication channels between the US and China is equally important. Increased dialogue, even on limited fronts, helps to reduce misunderstandings and fosters predictability.

- Examples of increased dialogue: High-level meetings and working-level discussions on various issues, including trade and technology, suggest a renewed commitment to diplomacy.

- High-level meetings: Recent high-profile meetings between officials from both countries have helped to signal a more cooperative approach to bilateral agreements.

- Impact on market predictability: The improved communication reduces uncertainty and improves market predictability, which is crucial for attracting long-term investments. This risk mitigation directly benefits the market stability and fuels confidence in Chinese stocks.

Positive Economic Indicators in China

Beyond geopolitical factors, positive economic indicators within China itself are fueling the stock market rebound. Strengthening GDP growth, controlled inflation, and robust corporate earnings all contribute to a more optimistic outlook.

Strengthening GDP Growth

Recent GDP figures show a continued, albeit slower than expected, growth in the Chinese economy. This signals resilience and ongoing economic expansion despite global headwinds.

- GDP growth rates: While growth rates might be slightly lower than previous years, they remain positive and indicate a healthy economy. Analysis of these GDP growth rates reveals a sustained expansion.

- Contributing factors (consumption, investment, exports): Strong domestic consumption, continued government investment in infrastructure, and improving export performance all contribute to the overall economic strength. Understanding these investment trends and export performance is key to assessing the economic recovery.

- Comparison with previous quarters: The current GDP growth rates, while slightly moderated, demonstrate a clear improvement compared to previous quarters, suggesting a stabilization of the economy.

Inflation and Interest Rates

China has managed to keep inflation relatively low while maintaining stable interest rates. This balanced approach fosters a conducive environment for investment and economic growth.

- Inflation rates: Low and stable inflation rates ensure that investment returns are not eroded by rising prices. A careful analysis of inflation and interest rates shows a positive outlook for growth.

- Interest rate adjustments: The central bank's careful adjustments to interest rates reflect a measured approach to monetary policy designed to support sustainable growth.

- Monetary policy implications: The prudent monetary policy creates an environment of confidence and stability, reducing risks for investors considering Chinese stocks.

- Impact on investment decisions: The predictable monetary environment encourages investment and bolsters market sentiment, making it attractive for both domestic and foreign investors.

Robust Corporate Earnings

Many Chinese companies have reported strong earnings, demonstrating resilience and growth potential. This positive trend further supports the market rebound.

- Examples of companies with strong earnings: Several leading companies across diverse sectors have showcased impressive revenue growth and profitability. This company performance demonstrates the strength of the Chinese economy.

- Sector-specific trends: Certain sectors, such as technology and renewable energy, have demonstrated particularly strong growth, offering further opportunities for investment in Chinese stocks.

- Projected future growth: Analysts forecast continued growth for many Chinese companies, suggesting the current rebound could continue into the foreseeable future. This revenue growth and profitability are driving stock valuations upwards.

Identifying Investment Opportunities in Rebounding Chinese Stocks

The rebound presents opportunities for investors, but careful consideration of risk and diversification is crucial.

Sector-Specific Analysis

Certain sectors within the Chinese stock market offer particularly attractive opportunities for growth.

- High-growth sectors (technology, renewable energy, consumer goods): These sectors are poised for significant expansion in the coming years. Investing in high-growth sectors provides opportunities for substantial returns.

- Undervalued stocks: The recent dip might have created opportunities to acquire undervalued stocks with significant growth potential. Identifying these undervalued stocks requires careful analysis.

- Long-term investment strategies: A long-term perspective is generally recommended when investing in Chinese stocks, allowing time to navigate market fluctuations and realize long-term growth. A well-defined investment strategy is crucial for success.

Risk Management and Diversification

Investing in the Chinese stock market carries inherent risks, including geopolitical uncertainties and market volatility.

- Diversification strategies: Diversifying investments across different sectors and asset classes reduces overall portfolio risk. Implementing effective portfolio diversification is crucial.

- Risk assessment: A thorough assessment of geopolitical risks and market volatility is essential before making investment decisions. Thorough risk assessment and investment due diligence are vital.

- Geopolitical considerations: The ongoing US-China relationship and other geopolitical factors need careful consideration. Understanding geopolitical risks and their impact on market volatility is essential.

- Due diligence: Conducting comprehensive due diligence on individual companies is crucial before investing.

Conclusion

The rebound in Chinese stocks is driven by a combination of factors, including easing US-China tensions and positive economic indicators within China. This presents significant investment opportunities, but it's crucial to remember the inherent risks. The strengthening of Chinese stocks, fueled by positive economic indicators and improving US-China relations, signifies a potential turning point.

The rebound in Chinese stocks presents significant investment opportunities. However, thorough research and a well-diversified investment strategy are crucial. Begin your research into Chinese stocks today and explore the potential for growth. Remember to conduct thorough due diligence and practice effective risk management for a successful investment journey.

Featured Posts

-

Revealed The Identity Of Alex Ovechkins Florida Workout Partner Is Darius Kasparaitis

May 07, 2025

Revealed The Identity Of Alex Ovechkins Florida Workout Partner Is Darius Kasparaitis

May 07, 2025 -

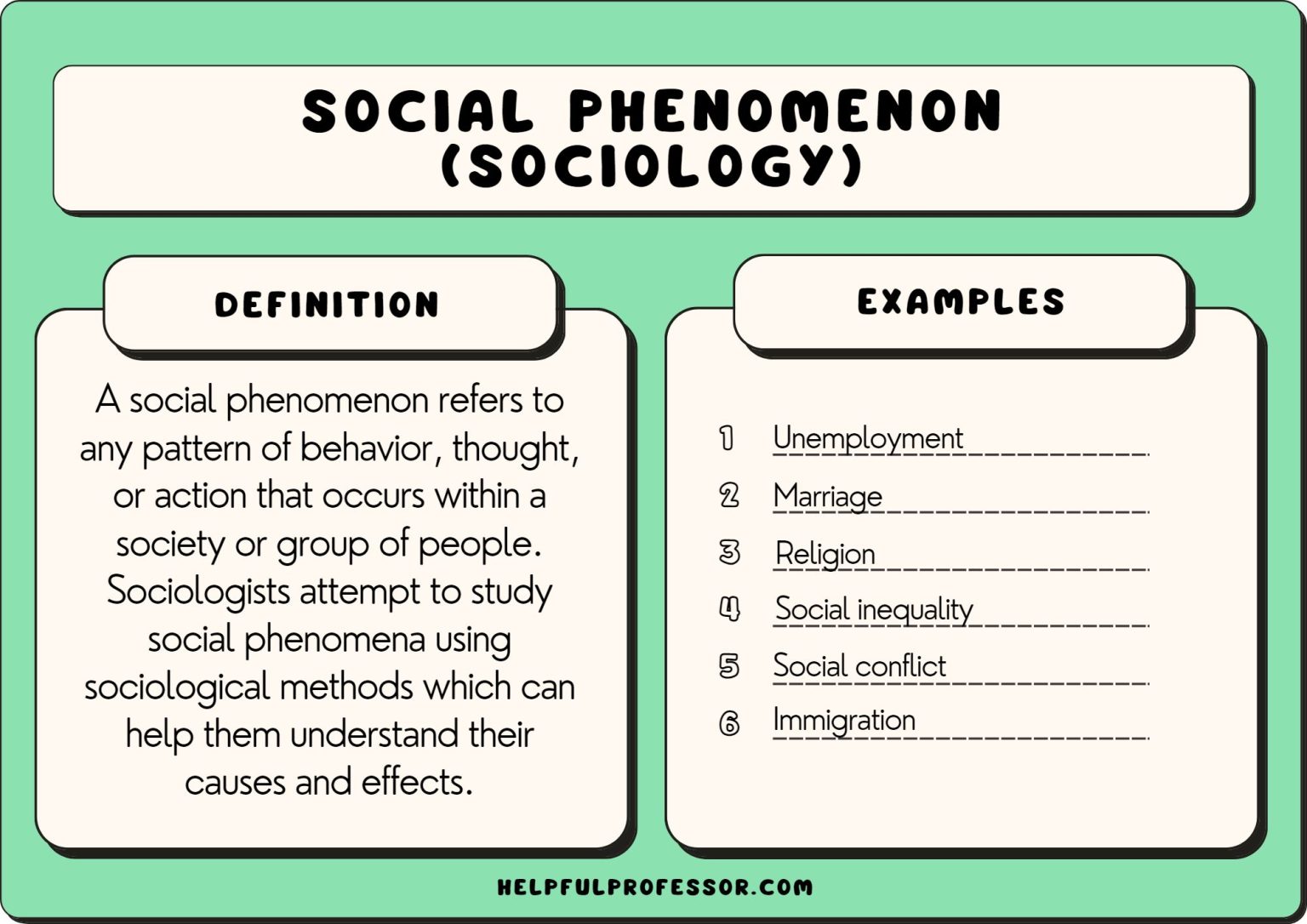

Understanding The Phenomenon The Karate Kids Cultural Influence

May 07, 2025

Understanding The Phenomenon The Karate Kids Cultural Influence

May 07, 2025 -

Curry Caps All Star Weekend With Championship Win

May 07, 2025

Curry Caps All Star Weekend With Championship Win

May 07, 2025 -

Cavaliers Win Over Bulls Secures No 1 Eastern Conference Seed

May 07, 2025

Cavaliers Win Over Bulls Secures No 1 Eastern Conference Seed

May 07, 2025 -

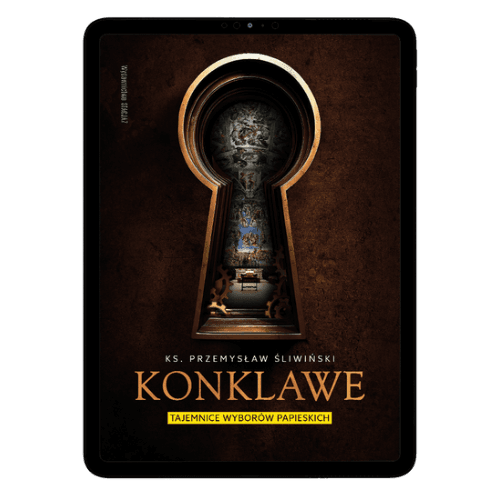

Konklawe Nowa Ksiazka Ks Sliwinskiego Premiera W Warszawie

May 07, 2025

Konklawe Nowa Ksiazka Ks Sliwinskiego Premiera W Warszawie

May 07, 2025