Colombia Pension Reform At Risk Amid Corruption Allegations

Table of Contents

The Proposed Pension Reform: A Summary

The proposed pension reform in Colombia aims to address the long-standing challenges within the existing system, primarily the significant pension deficit and concerns about the sustainability of the private pension fund system (AFP). The reforms propose substantial changes impacting both public and private pension schemes.

-

Changes to the private pension fund system (AFP): The reform seeks to modify the way private pension funds operate, potentially introducing greater government oversight and regulation to ensure better returns for contributors and greater transparency in their management. This includes reevaluating the fees charged by AFPs and potentially creating a more competitive market.

-

Proposed government contributions and guarantees: The government is considering increasing its contributions to the pension system and potentially introducing stronger guarantees to protect retirees' benefits, particularly for those with lower lifetime earnings. This would aim to alleviate the burden on individual contributors and ensure a minimum level of retirement income.

-

Projected impact on retirees' benefits: The anticipated effects on retirees' benefits are complex and depend heavily on the specific details of the final legislation. While some reforms aim to increase benefits for low-income retirees, others could lead to minor adjustments or even reductions for higher-income earners, depending on the chosen model.

-

Addressing the pension deficit: A primary goal is to reduce or eliminate the significant pension deficit. This will likely involve a combination of measures, including increased contributions, improved investment strategies for pension funds, and potentially adjustments to benefit calculations.

Corruption Allegations and Their Impact

Serious allegations of corruption have significantly hampered the progress of the pension reform. These allegations include claims of bribery, influence peddling, and the misuse of public funds during the reform's planning and implementation phases.

-

Allegations of bribery and influence peddling: Reports suggest that certain individuals and organizations may have sought to influence the design of the reform to benefit their own interests, leading to allegations of significant bribery. These allegations are currently under investigation.

-

Involvement of specific individuals or organizations: While investigations are ongoing, some names of individuals and organizations have been implicated in the alleged corruption, although formal charges have yet to be filed against many of them. This lack of transparency fuels public distrust.

-

Investigations underway and their current status: Several investigations are currently underway, conducted by both Colombian authorities and possibly international bodies. The outcomes of these investigations will be crucial in determining the future direction of the reform and holding those responsible accountable.

-

Public reaction and protests: The allegations have sparked widespread public outrage and protests, highlighting a growing lack of confidence in the government’s ability to manage the pension system effectively and fairly. This public discontent presents a significant challenge to the successful implementation of the reforms.

The Erosion of Public Trust

The corruption allegations have severely eroded public trust in the government and the pension reform process. This loss of confidence presents a major obstacle to the reform's success.

-

Reduced public support for the pension reform: The revelations have led to a decline in public support for the proposed pension changes, hindering the political will needed for successful implementation. Many citizens now view the reform with skepticism and distrust.

-

Increased skepticism towards government initiatives: The scandal has extended beyond the pension reform, contributing to a broader decline in public trust in the government's ability to manage public finances and implement crucial policies effectively.

-

Potential for social unrest and political instability: The growing public dissatisfaction and mistrust could escalate into widespread social unrest and further political instability, jeopardizing the country's overall stability. This underscores the urgent need to address the situation transparently and decisively.

Economic Consequences and Potential Solutions

The failure of the pension reform could have severe economic consequences for Colombia.

-

Impact on the Colombian economy: A flawed or stalled pension reform could negatively impact investor confidence, reduce economic growth, and strain public finances, potentially increasing the national debt.

-

Consequences for retirees and future generations: The lack of a robust and sustainable pension system will have a devastating impact on retirees and future generations, potentially increasing poverty and inequality.

-

Potential for increased poverty and inequality: A failing pension system will disproportionately affect the most vulnerable segments of the population, exacerbating existing inequalities and leading to increased poverty rates.

-

Proposed solutions to address the crisis: To mitigate the crisis, several solutions are proposed, including increased transparency and accountability in government operations, the establishment of stricter regulations for pension funds, and the introduction of independent oversight bodies to monitor the pension system's activities.

Conclusion

The corruption allegations surrounding Colombia's pension reform pose a grave threat to the nation's social security system and its economic stability. The erosion of public trust, combined with the potential for severe economic consequences, underscores the urgent need for swift and decisive action. The future of millions of Colombians' retirement security, and the overall health of the Colombian economy, hangs in the balance.

Call to Action: Stay informed about the developments in the Colombia pension reform and demand accountability from your government. Understanding the complexities of the Colombian pension system is crucial for advocating for a fair and sustainable future. Let's work together to ensure a secure retirement for all Colombians by demanding a transparent and corruption-free pension reform process.

Featured Posts

-

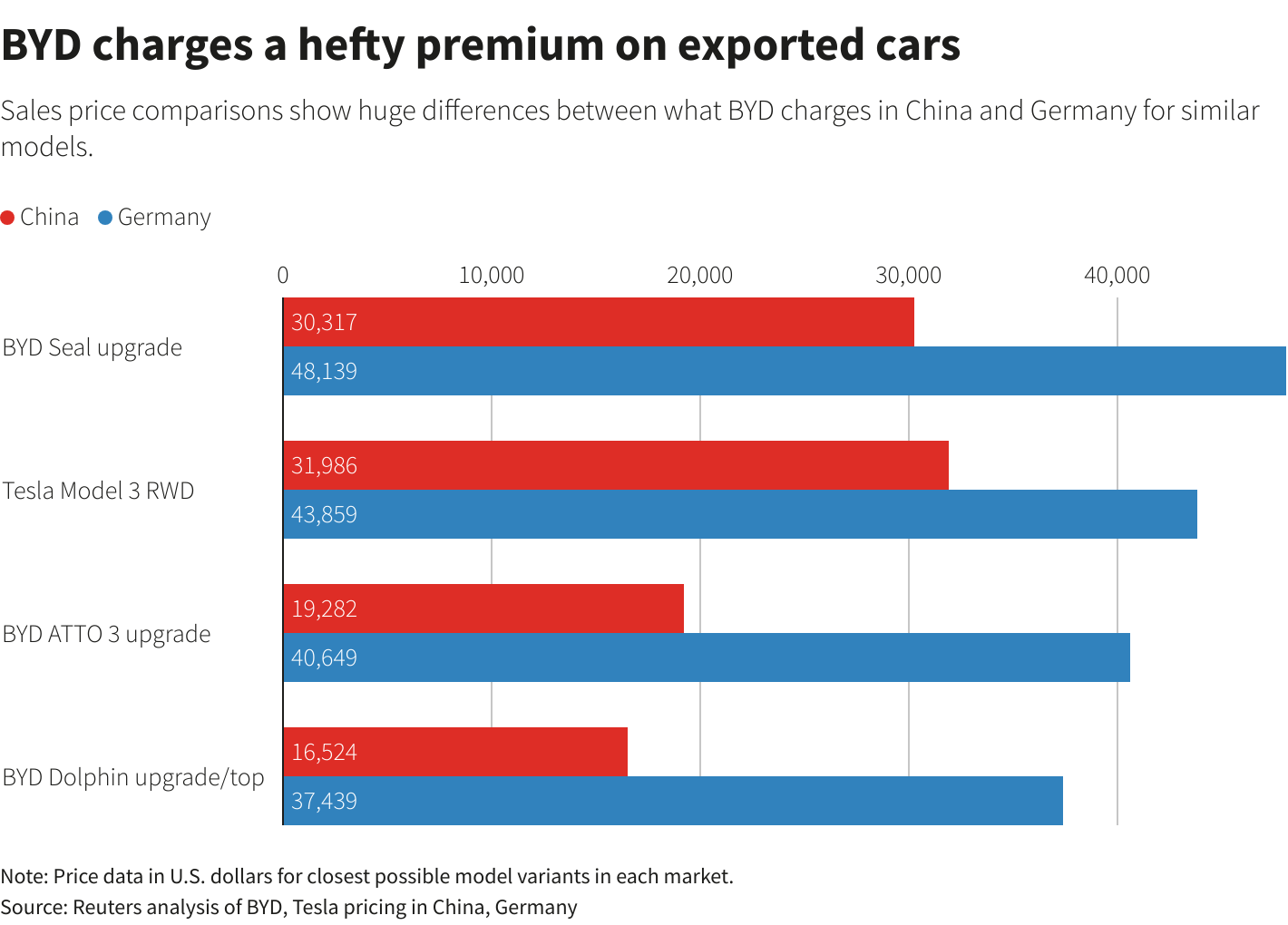

Fords Brazilian Decline And Byds Global Ev Expansion

May 13, 2025

Fords Brazilian Decline And Byds Global Ev Expansion

May 13, 2025 -

Doom The Dark Ages Early Access Release Dates And Times Across Regions

May 13, 2025

Doom The Dark Ages Early Access Release Dates And Times Across Regions

May 13, 2025 -

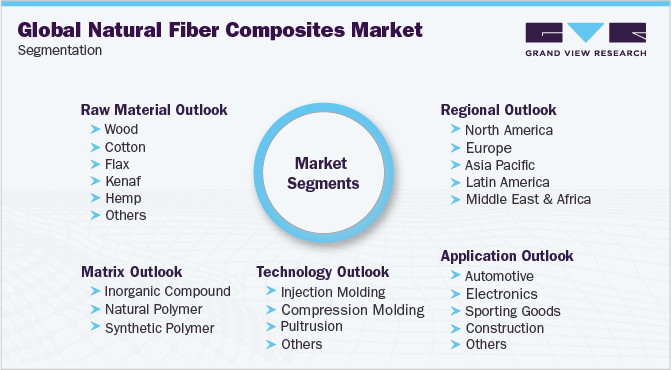

The Future Of Natural Fiber Composites Market Projections To 2029

May 13, 2025

The Future Of Natural Fiber Composites Market Projections To 2029

May 13, 2025 -

Will Corruption Claims Derail Colombias Pension Reform

May 13, 2025

Will Corruption Claims Derail Colombias Pension Reform

May 13, 2025 -

Heat Wave Cripples Manila Schools Thousands Of Students Affected

May 13, 2025

Heat Wave Cripples Manila Schools Thousands Of Students Affected

May 13, 2025