Common Financial Mistakes Women Make And How To Avoid Them

Table of Contents

Underestimating the Importance of Retirement Planning

Many women face specific challenges when it comes to retirement planning, often leading to significant financial insecurity later in life. Understanding these challenges and proactively addressing them is crucial for securing a comfortable retirement.

Delaying Retirement Savings

Many women delay saving for retirement, often due to career interruptions, prioritizing family needs, or simply feeling overwhelmed by the task. This delay can significantly impact their long-term financial security.

- Start saving early, even if it's a small amount. The power of compounding interest is crucial. The earlier you begin, the more time your money has to grow.

- Take advantage of employer-sponsored retirement plans like 401(k)s and match programs. These plans offer valuable tax advantages and often include employer matching contributions, essentially giving you free money.

- Consider opening a Roth IRA or traditional IRA to maximize tax benefits. These retirement accounts offer different tax advantages, depending on your income and financial goals. Consult a financial advisor to determine which is best for you.

- Regularly review and adjust your retirement savings plan as your circumstances change. Life throws curveballs. Regularly reviewing your plan ensures it aligns with your current financial situation and long-term goals.

Not Considering Longevity

Women tend to live longer than men, meaning they require a larger retirement nest egg to cover their expenses for a potentially longer retirement period. This is a critical factor often overlooked in retirement planning.

- Plan for a longer retirement period than you might initially assume. Aim for a retirement plan that covers at least 20-30 years, potentially longer.

- Consult a financial advisor to determine the appropriate savings amount for your lifespan. A financial advisor can help you create a personalized retirement plan considering your life expectancy and desired lifestyle.

- Consider long-term care insurance to mitigate potential healthcare costs. Long-term care can be extremely expensive, and insurance can help protect your retirement savings from these significant costs.

Ignoring Debt Management Strategies

High levels of debt can severely hinder a woman's financial progress and make achieving financial goals significantly more challenging. Effective debt management is crucial for building a secure financial future.

High-Interest Debt

Credit card debt and high-interest loans can quickly spiral out of control, impacting your credit score and overall financial health. Addressing this debt aggressively is vital.

- Create a budget to track your spending and identify areas for savings. Understanding where your money goes is the first step to controlling your spending and paying down debt.

- Prioritize paying down high-interest debt aggressively. Focus on the debts with the highest interest rates first to minimize the total interest paid.

- Consider debt consolidation options to lower your interest rates. Consolidating your debt into a single loan with a lower interest rate can make repayment more manageable.

- Explore balance transfer options to reduce interest charges. Transferring high-interest credit card balances to cards with lower introductory APRs can save you money in the short term.

Lack of Financial Literacy

A lack of understanding about basic financial concepts can lead to poor financial decisions and exacerbate existing problems. Improving your financial literacy is an empowering step towards better financial health.

- Read books and articles about personal finance. There are numerous resources available to help you improve your financial literacy.

- Attend financial literacy workshops or seminars. These workshops can provide valuable insights and practical strategies for managing your finances.

- Seek advice from a qualified financial advisor. A financial advisor can provide personalized guidance and help you create a plan to achieve your financial goals.

Underestimating the Impact of Life Events

Life events, both positive and negative, can significantly impact a woman's financial well-being. Planning for these events is crucial for maintaining financial stability.

Marriage and Divorce

Marriage and divorce can significantly alter a woman's financial situation. Understanding your rights and responsibilities is essential in both scenarios.

- Maintain separate financial accounts, even within a marriage. This can help protect your assets and avoid future complications.

- Understand your rights and responsibilities regarding finances in a divorce. Seek legal advice to protect your financial interests during a divorce.

- Seek legal advice to protect your financial interests. A lawyer can help you navigate the complex financial aspects of marriage and divorce.

Having Children

Raising children is expensive. Careful planning is essential to manage the increased financial demands while still ensuring your own financial security.

- Budget for childcare, education, and other child-related expenses. Factor these costs into your budget early on.

- Consider life insurance to protect your family's financial security. Life insurance can provide financial support for your family in the event of your death.

- Explore options for saving for your children's college education. Start saving early to take advantage of compounding interest and minimize the burden of college expenses.

Lack of Negotiation and Assertiveness

Women often underestimate their negotiating power, leading to missed opportunities for financial advancement and better financial outcomes. Assertiveness is key to achieving financial success.

Salary Negotiations

Women often negotiate less aggressively for salary increases than men. This can lead to significant lost income over a lifetime.

- Research industry salary standards before negotiating your salary. Knowing your worth is crucial for successful negotiation.

- Practice articulating your value and accomplishments. Be prepared to highlight your contributions and justify your requested salary.

- Be confident and assertive during salary negotiations. Believe in your worth and don't be afraid to advocate for yourself.

Financial Decisions

A lack of assertiveness can lead to poor financial decisions, accepting suboptimal options without questioning them. Be proactive and assertive in managing your finances.

- Don't be afraid to ask questions and seek clarification. Understanding financial products and services is crucial for making informed decisions.

- Be proactive in managing your finances. Don't wait for problems to arise; actively monitor your finances and address issues promptly.

- Trust your instincts and don't be afraid to say no. It's okay to decline offers or proposals that don't align with your financial goals.

Conclusion

Avoiding common financial mistakes is crucial for women to achieve long-term financial security. By addressing retirement planning, debt management, life events, and negotiation skills, women can significantly improve their financial well-being. Taking proactive steps towards financial literacy and seeking professional guidance when needed are key to building a strong financial future. Don't let these common financial mistakes women make hold you back – start planning your financial success today. Take control of your financial future and learn how to avoid these financial mistakes for women.

Featured Posts

-

College De Clisson Reglementation Et Symboles Religieux

May 22, 2025

College De Clisson Reglementation Et Symboles Religieux

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 22, 2025 -

Delayed Promotions 50 000 Accenture Staff To Be Upgraded

May 22, 2025

Delayed Promotions 50 000 Accenture Staff To Be Upgraded

May 22, 2025 -

Invasive Zebra Mussel Infestation Found On Casper Boat

May 22, 2025

Invasive Zebra Mussel Infestation Found On Casper Boat

May 22, 2025 -

Trump Irish Pm And Jd Vance Hilarious White House Moments

May 22, 2025

Trump Irish Pm And Jd Vance Hilarious White House Moments

May 22, 2025

Latest Posts

-

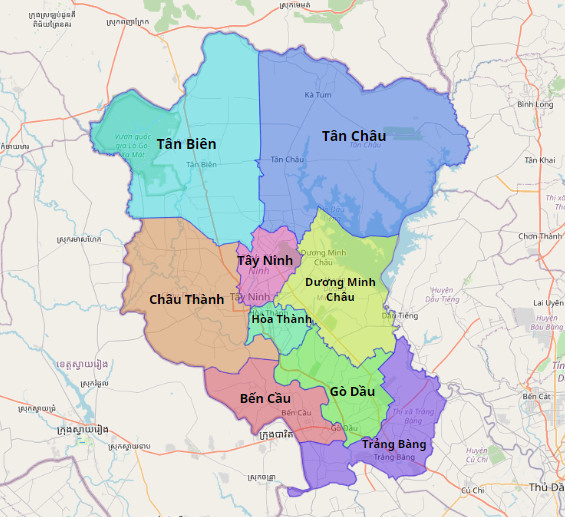

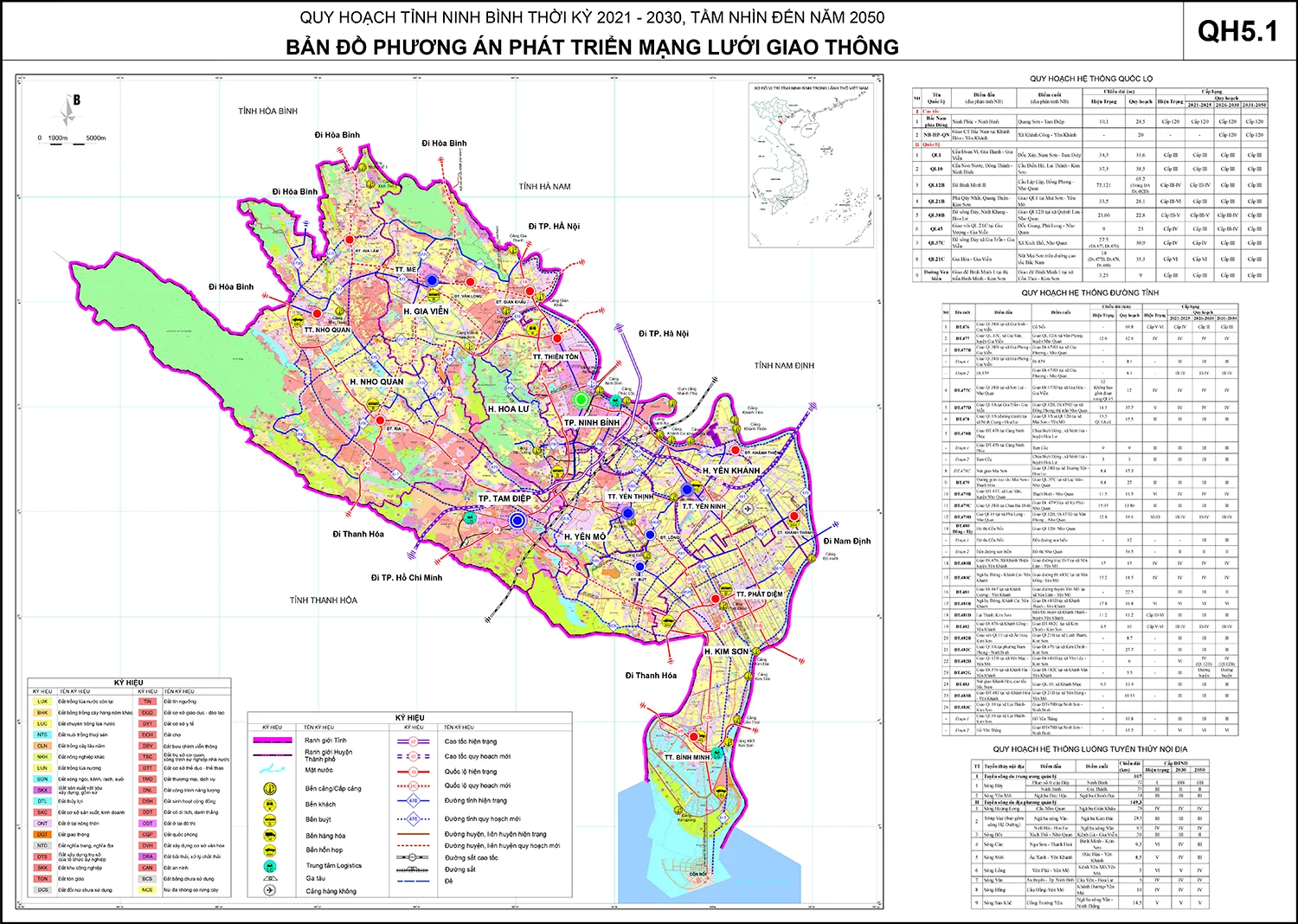

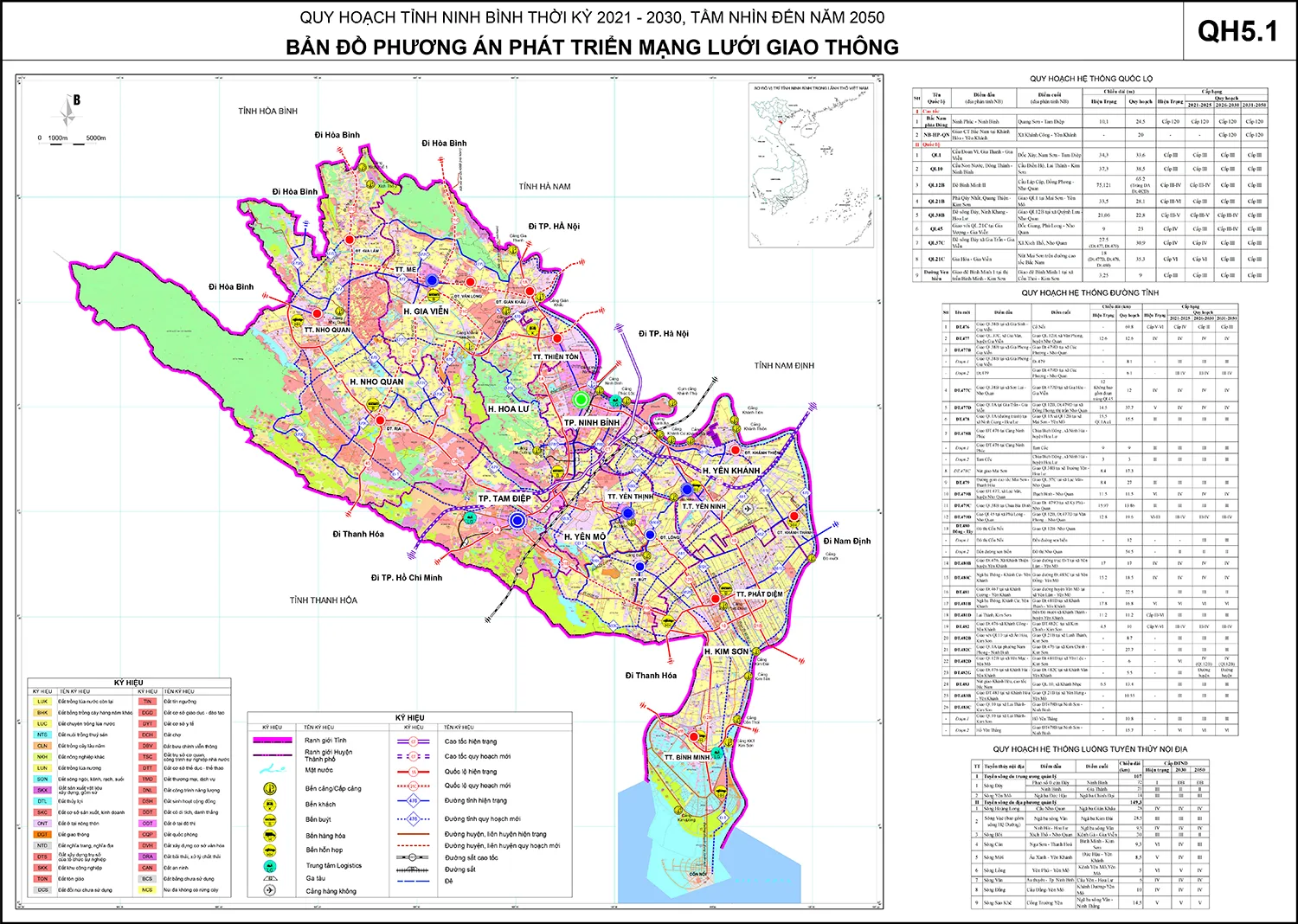

Binh Duong Tay Ninh Duong Bo Va Cau

May 22, 2025

Binh Duong Tay Ninh Duong Bo Va Cau

May 22, 2025 -

Tim Hieu Ve Cau Va Duong Ket Noi Binh Duong Tay Ninh

May 22, 2025

Tim Hieu Ve Cau Va Duong Ket Noi Binh Duong Tay Ninh

May 22, 2025 -

Tuyen Duong Va Cau Noi Binh Duong Voi Tay Ninh

May 22, 2025

Tuyen Duong Va Cau Noi Binh Duong Voi Tay Ninh

May 22, 2025 -

He Thong Giao Thong Binh Duong Tay Ninh Duong Va Cau

May 22, 2025

He Thong Giao Thong Binh Duong Tay Ninh Duong Va Cau

May 22, 2025 -

Cau Va Duong Lien Tinh Binh Duong Tay Ninh

May 22, 2025

Cau Va Duong Lien Tinh Binh Duong Tay Ninh

May 22, 2025