Compare Live Now, Pay Later Options: Find The Best Fit For You

Table of Contents

Understanding Live Now, Pay Later (LNPL) Services

Live now, pay later services allow you to purchase goods or services and pay for them over time, typically in installments. These services offer a convenient way to manage your finances, especially for larger purchases or unexpected expenses. There are several types of LNPL services available:

-

Point-of-sale financing: This is the most common type, where you choose the LNPL option at the checkout of a participating retailer. The payment plan is set up directly with the provider.

-

Buy now, pay later installment loans: These are more like traditional loans, often with a fixed interest rate and repayment schedule, and may be available for a broader range of purchases.

-

Typical Repayment Schedules: Most LNPL services offer repayment plans ranging from a few weeks to several months. Some plans might offer interest-free periods if you pay on time, while others charge interest from the outset.

-

Key Benefits:

- Improved cash flow: Spread payments over time to avoid putting a strain on your monthly budget.

- Budgeting assistance: LNPL plans can help you manage larger purchases by breaking them down into smaller, more manageable payments. Improved financial planning.

- Easier access to goods and services: Provides access to things you might not otherwise be able to afford upfront.

-

Potential Drawbacks:

- High interest rates: If you miss payments or don't pay on time, interest rates can quickly accumulate, making the final cost significantly higher. Late payment fees can also apply.

- Impact on credit score: Missed payments or late payments can negatively affect your credit score. Always check your credit report regularly.

- Potential for overspending: The ease of using LNPL can tempt you to overspend if you're not careful. Overextension of credit.

Comparing Popular Live Now, Pay Later Providers

Several prominent LNPL providers compete for your business. Here's a comparison of some of the most popular:

| Provider Name | Interest Rates/Fees | Repayment Terms | Credit Check Requirements | Customer Reviews | Available Retailers |

|---|---|---|---|---|---|

| Affirm | Varies, often 0% APR for qualified purchases, otherwise interest charges apply | 3, 6, or 12 months | Soft credit check | Generally positive, but experiences vary | Thousands of online and in-store retailers |

| Klarna | Varies, often 0% APR for qualified purchases, otherwise interest charges apply | Flexible options available | Soft credit check | Generally positive, but experiences vary | Thousands of online and in-store retailers |

| Afterpay | Typically no interest if paid on time, late fees apply | 4 installments over 6 weeks | Soft credit check | Mixed reviews, some concerns about late fees | Thousands of online and in-store retailers |

| PayPal Credit | Interest rates vary depending on creditworthiness | Different repayment options available | Hard credit check | Reviews vary widely | Many online retailers and some in-store |

Affirm: Affirm offers a virtual card, allowing you to shop at retailers who don't directly integrate with their platform. Their eligibility criteria depend on factors like your creditworthiness and purchase amount. They offer various repayment plans to suit different needs and budgets. Excellent for larger purchases and flexible plans.

Factors to Consider When Choosing a Live Now, Pay Later Plan

Choosing the right LNPL provider depends on several key factors:

-

Your credit score: A good credit score can help you qualify for lower interest rates and more favorable terms. A poor credit score might limit your options or result in higher fees.

-

Purchase amount: Different providers have different limits on how much you can borrow. Consider this when choosing a provider.

-

Interest rates and fees: Carefully compare interest rates, late payment fees, and other charges across different providers.

-

Repayment terms and flexibility: Consider the length of the repayment plan and the flexibility to adjust payments if needed.

-

Customer service and reviews: Read online reviews to get a sense of a provider's customer service and overall reliability.

-

Retailer acceptance: Ensure the provider is accepted by the retailers where you plan to shop.

Protecting Yourself from LNPL Pitfalls

While LNPL can be beneficial, it's crucial to use these services responsibly:

-

Budget carefully: Only use LNPL for purchases you can comfortably afford to repay. Create a realistic budget that incorporates your LNPL payments.

-

Understand late payment fees: Be aware of the penalties for late payments and make sure you can meet your payment deadlines.

-

Credit score impact: Missed payments can seriously damage your credit score. Pay on time, every time!

-

Avoid overspending: Don't use multiple LNPL accounts simultaneously, as this can quickly lead to overwhelming debt. Always prioritize managing your debts effectively.

Conclusion

Live now, pay later services offer a convenient way to manage purchases, but responsible use is key. High interest rates and potential negative impacts on your credit score can arise if not managed properly. By comparing providers carefully, understanding your financial situation, and practicing responsible borrowing, you can harness the benefits of LNPL while avoiding the pitfalls.

Ready to find the best live now, pay later option for your needs? Use our comparison guide to explore different providers and make an informed decision. Start comparing live now, pay later options today and take control of your finances!

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For The Future

May 30, 2025

The Zuckerberg Trump Dynamic Implications For The Future

May 30, 2025 -

Des Moines Public Schools Temporarily Suspends Central Campus Agriscience Program

May 30, 2025

Des Moines Public Schools Temporarily Suspends Central Campus Agriscience Program

May 30, 2025 -

Will Kg Motors Mibot Revolutionize Japans Electric Car Landscape

May 30, 2025

Will Kg Motors Mibot Revolutionize Japans Electric Car Landscape

May 30, 2025 -

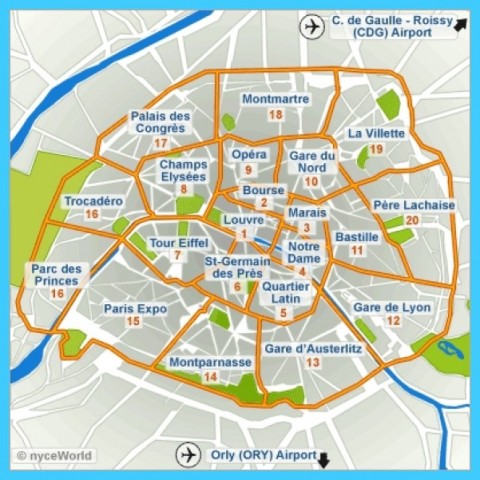

Exploring Paris A Guide To Its Best Neighborhoods

May 30, 2025

Exploring Paris A Guide To Its Best Neighborhoods

May 30, 2025 -

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And Special London Performances

May 30, 2025

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And Special London Performances

May 30, 2025

Latest Posts

-

Rosemary And Thyme Recipes Simple Dishes With Fresh Herbs

May 31, 2025

Rosemary And Thyme Recipes Simple Dishes With Fresh Herbs

May 31, 2025 -

Growing Rosemary And Thyme A Practical Guide For Beginners

May 31, 2025

Growing Rosemary And Thyme A Practical Guide For Beginners

May 31, 2025 -

Rosemary And Thyme A Culinary Guide To Herb Gardening And Cooking

May 31, 2025

Rosemary And Thyme A Culinary Guide To Herb Gardening And Cooking

May 31, 2025 -

Creating The Good Life Practical Tips For A More Fulfilling Existence

May 31, 2025

Creating The Good Life Practical Tips For A More Fulfilling Existence

May 31, 2025 -

Is This The Good Life Evaluating Your Current Path And Making Changes

May 31, 2025

Is This The Good Life Evaluating Your Current Path And Making Changes

May 31, 2025