Competition Heats Up: Assessing Novo Nordisk's Ozempic Strategy In The Weight-Loss Market

Table of Contents

Novo Nordisk's Market Positioning and Ozempic's Strengths

Ozempic's Efficacy and Safety Profile

Ozempic, initially approved for type 2 diabetes management, has demonstrated significant efficacy in weight loss. Clinical trials have showcased impressive results, with patients experiencing substantial reductions in body weight.

- Significant Weight Loss: Studies have shown average weight loss exceeding 10-15% in many participants, a remarkable outcome compared to other weight loss methods.

- Improved Metabolic Parameters: Beyond weight loss, Ozempic has shown improvements in other metabolic parameters, such as blood sugar control and reduced cardiovascular risk factors. This makes it an attractive option for individuals with both obesity and diabetes.

- Safety Profile: While generally well-tolerated, Ozempic, like other GLP-1 agonists, can cause side effects. Common side effects include nausea, vomiting, constipation, and diarrhea. These side effects are generally mild and transient for many patients, but it is crucial to monitor patients closely. The safety profile of Ozempic needs to be carefully weighed against its efficacy in weight loss.

Marketing and Branding Strategies

Novo Nordisk has implemented a multi-pronged marketing strategy for Ozempic. This includes:

- Physician Marketing: Targeting healthcare professionals through conferences, educational materials, and direct engagement to increase awareness and prescription rates.

- Consumer Marketing: Employing carefully crafted campaigns that highlight the efficacy and safety profile of Ozempic, focusing on improving quality of life and long-term health outcomes.

- Brand Building: Cultivating a strong brand image associated with scientific rigor, patient well-being, and long-term success in managing obesity and diabetes.

Pricing and Accessibility

The pricing of Ozempic is a crucial factor influencing its market accessibility. While its effectiveness is undeniable, its cost can pose a significant barrier for many patients.

- Insurance Coverage: The extent of insurance coverage for Ozempic varies considerably, impacting affordability for different patient populations.

- Affordability Concerns: The high price of Ozempic raises concerns about equitable access to this effective weight-loss medication, especially for those without comprehensive insurance coverage.

- Financial Assistance Programs: Novo Nordisk offers patient assistance programs to mitigate the cost burden, but these programs may not reach all those in need.

Competitive Landscape and Emerging Challenges

Competition from Rival Drugs

Ozempic is not alone in the weight-loss medication market. Several strong competitors have emerged, posing significant challenges.

- Wegovy (semaglutide): Another GLP-1 receptor agonist developed by Novo Nordisk itself, Wegovy directly competes with Ozempic in the weight-loss market.

- Mounjaro (tirzepatide): A novel dual GIP and GLP-1 receptor agonist from Eli Lilly and Company, Mounjaro has shown impressive weight-loss results, putting pressure on Ozempic's market share.

- Other Competitors: Other weight-loss drugs are entering the market, creating even more intense competition and potentially fragmenting the market share.

Regulatory Scrutiny and Potential Risks

The success of Ozempic is not without regulatory risks.

- FDA Scrutiny: The FDA and other regulatory bodies are carefully monitoring the safety and efficacy of Ozempic and other GLP-1 agonists.

- Potential for Adverse Events: Ongoing vigilance is required to identify and manage potential long-term adverse effects.

- Legal Challenges: Novo Nordisk may face legal challenges related to Ozempic’s marketing or safety profile.

The Role of Generics and Biosimilars

The emergence of generic or biosimilar versions of Ozempic poses a significant long-term threat to Novo Nordisk's market position. Once patents expire, cheaper alternatives will likely emerge, significantly impacting sales.

- Patent Expiry: The timing of patent expiry for Ozempic's active ingredient will determine the timeframe for the entry of biosimilars.

- Market Disruption: The arrival of biosimilars is anticipated to trigger a major price war and significantly disrupt the market.

Novo Nordisk's Strategic Response and Future Outlook

Innovation and Pipeline Development

To maintain its competitive edge, Novo Nordisk is heavily investing in research and development.

- Next-Generation GLP-1 Agonists: Developing improved versions of GLP-1 agonists with enhanced efficacy and a better safety profile.

- Combination Therapies: Exploring combination therapies to address multiple metabolic issues simultaneously.

Adapting to Market Dynamics

Novo Nordisk needs to adapt its Ozempic strategy to address the evolving market dynamics.

- Pricing Strategies: Potential adjustments to Ozempic's pricing to maintain competitiveness without compromising profitability.

- Marketing and Sales Efforts: Refining its marketing approach to counter competitor strategies and highlight Ozempic's unique advantages.

- Focus on Patient Support: Strengthening patient support programs to improve adherence and address accessibility barriers.

Conclusion: The Future of Ozempic in a Crowded Weight-Loss Market

The weight-loss medication market is incredibly dynamic. While Ozempic has enjoyed considerable success, the increasing competition from rival drugs, regulatory scrutiny, and the eventual arrival of generics pose significant challenges to Novo Nordisk. The company's ability to adapt its strategy, innovate, and maintain a strong brand image will be crucial in determining Ozempic's future market position. To maintain its leadership, Novo Nordisk must focus on innovation, adapt to market dynamics, and carefully manage pricing and accessibility. Stay tuned for further updates on the Ozempic strategy and the evolving weight-loss market.

Featured Posts

-

Primera Effective Natural Bladder Control For Women

May 30, 2025

Primera Effective Natural Bladder Control For Women

May 30, 2025 -

Kenin Out Pegula Faces Alexandrova In Charleston Final

May 30, 2025

Kenin Out Pegula Faces Alexandrova In Charleston Final

May 30, 2025 -

Korevoy Krizis V Mongolii Chto Nuzhno Znat

May 30, 2025

Korevoy Krizis V Mongolii Chto Nuzhno Znat

May 30, 2025 -

Via Rails High Speed Rail Strategy A 330 000 Investment In Quebec Marketing

May 30, 2025

Via Rails High Speed Rail Strategy A 330 000 Investment In Quebec Marketing

May 30, 2025 -

Dwytshh Bnk Fy Alimarat Drast Halt Llnjah Fy Alswq

May 30, 2025

Dwytshh Bnk Fy Alimarat Drast Halt Llnjah Fy Alswq

May 30, 2025

Latest Posts

-

Megarasaray Hotels Acik Turnuvasi Ciftler Sampiyonlari Bondar Ve Waltert

May 31, 2025

Megarasaray Hotels Acik Turnuvasi Ciftler Sampiyonlari Bondar Ve Waltert

May 31, 2025 -

Bondar Waltert Ikilisi Megarasaray Hotels Acik Turnuvasi Ni Kazandi

May 31, 2025

Bondar Waltert Ikilisi Megarasaray Hotels Acik Turnuvasi Ni Kazandi

May 31, 2025 -

Megarasaray Hotels Acik Turnuvasi Nda Ciftler Sampiyonlugu Bondar Ve Waltert In Zaferi

May 31, 2025

Megarasaray Hotels Acik Turnuvasi Nda Ciftler Sampiyonlugu Bondar Ve Waltert In Zaferi

May 31, 2025 -

Bondar Ve Waltert Megarasaray Hotels Acik Turnuvasi Ciftler Sampiyonu Oldu

May 31, 2025

Bondar Ve Waltert Megarasaray Hotels Acik Turnuvasi Ciftler Sampiyonu Oldu

May 31, 2025 -

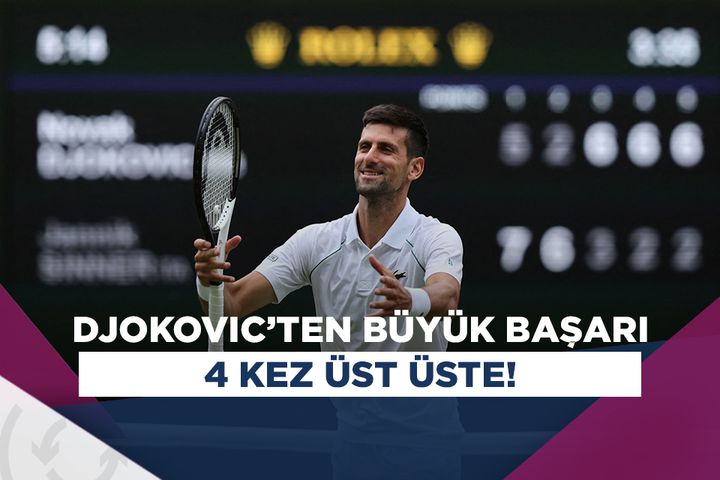

Novak Djokovic Bir Rekor Daha Bir Ilke Daha

May 31, 2025

Novak Djokovic Bir Rekor Daha Bir Ilke Daha

May 31, 2025