Conquering Financial Constraints: A Guide To Managing Lack Of Funds

Table of Contents

Creating a Realistic Budget to Address Lack of Funds

Effective budgeting is the cornerstone of managing your finances when dealing with a lack of funds. It's about understanding where your money goes and making conscious decisions about where it should go.

Tracking your Income and Expenses

The first step to conquering financial constraints is understanding your current financial picture. This involves meticulously tracking both your income and expenses.

- Utilize budgeting apps or spreadsheets: Tools like Mint, YNAB (You Need A Budget), or even a simple spreadsheet can help you categorize and monitor your spending.

- Categorize expenses (needs vs. wants): Differentiating between essential needs (rent, groceries, utilities) and wants (dining out, entertainment) helps you identify areas where you can cut back.

- Identify areas for potential savings: Once you have a clear picture of your spending habits, you can pinpoint areas where you can reduce expenses without significantly impacting your lifestyle.

Setting Financial Goals (Short-Term and Long-Term)

Creating financial goals provides direction and motivation in your journey to overcoming financial constraints. Break down your goals into manageable short-term and long-term objectives.

- Prioritize essential expenses: Ensure you're covering your basic needs before allocating funds to other areas.

- Set achievable savings goals: Start small. A realistic savings goal, even if it's a small amount each month, is better than no goal at all.

- Visualize your financial goals: Create a vision board or write down your goals to keep yourself motivated and focused.

Adjusting Your Spending Habits

Once you've identified areas of overspending, it's time to adjust your spending habits. This doesn't necessarily mean depriving yourself, but rather making conscious choices.

- Cut unnecessary subscriptions: Review your streaming services, gym memberships, and other recurring subscriptions. Are you truly using them all?

- Reduce dining out and entertainment costs: Cooking at home and finding free or low-cost entertainment options can significantly reduce your expenses.

- Explore cheaper alternatives for daily needs: Consider store brands, bulk buying, or shopping at discount stores.

- Utilize coupons and discounts: Take advantage of sales, coupons, and loyalty programs to save money on your purchases.

Exploring Income-Generating Opportunities to Overcome Financial Constraints

While managing expenses is crucial, increasing your income can significantly alleviate financial constraints. Explore various avenues to boost your earning potential.

Identifying Additional Income Streams

Consider these options to supplement your existing income:

- Freelancing and gig work: Utilize your skills to earn extra income through platforms like Upwork or Fiverr.

- Part-time jobs or side hustles: A part-time job, even for a few hours a week, can make a difference.

- Renting out unused assets (car, property): If you have assets you're not fully utilizing, renting them out can generate passive income.

- Investing in low-risk options: Explore low-risk investment options to grow your wealth over time.

Negotiating Better Financial Terms

Don't hesitate to negotiate for better terms with your creditors and service providers.

- Negotiate lower interest rates on loans: Contact your lender to explore options for lowering your interest rate.

- Explore debt consolidation options: Consolidating high-interest debts into a single lower-interest loan can save you money.

- Negotiate bills (internet, phone, etc.): Contact your service providers to see if you can negotiate lower rates.

Improving your Job Security & Earning Potential

Investing in your professional development can lead to long-term financial security.

- Seek professional development opportunities: Take online courses, attend workshops, or pursue certifications to enhance your skills.

- Network to find better job opportunities: Expand your professional network to increase your chances of finding a higher-paying job.

- Consider further education or training: Investing in your education can lead to significant long-term career advancement and higher earning potential.

Seeking Financial Assistance and Resources for Managing Lack of Funds

If you're struggling to manage your finances, don't hesitate to seek assistance. Many resources are available to help.

Utilizing Government Assistance Programs

Several government programs offer financial assistance to those in need.

- Research local and national programs: Explore programs such as food stamps, housing assistance, or unemployment benefits.

- Understand eligibility requirements: Carefully review the eligibility criteria for each program.

- Apply for relevant assistance: Complete the application process and provide all required documentation.

Exploring Nonprofit Organizations and Charities

Many nonprofit organizations and charities offer financial aid and support.

- Identify organizations offering financial aid: Research local and national organizations that provide assistance to individuals facing financial hardship.

- Understand application processes and eligibility criteria: Review the application requirements and eligibility criteria for each organization.

- Leverage community resources: Connect with local community centers and social services for additional support.

Seeking Professional Financial Advice

Consider seeking professional help from a financial advisor.

- Consult a financial advisor for personalized guidance: A financial advisor can provide personalized advice and create a financial plan tailored to your specific needs.

- Explore credit counseling services: Credit counseling services can help you manage debt and improve your credit score.

- Consider debt management plans: Debt management plans can help you consolidate and repay your debts more effectively.

Mastering Financial Constraints and Achieving Financial Stability

Overcoming financial constraints requires a multifaceted approach. By creating a realistic budget, exploring income-generating opportunities, and seeking assistance when needed, you can take control of your finances and build a more secure financial future. Consistent effort and planning are crucial. Remember, effective financial management is not a destination, but a journey. The long-term benefits – reduced stress, greater financial security, and the ability to achieve your goals – are well worth the effort. Start conquering your financial constraints today by implementing these strategies and taking control of your finances. Learn more about effectively managing your finances and overcoming a lack of funds.

Featured Posts

-

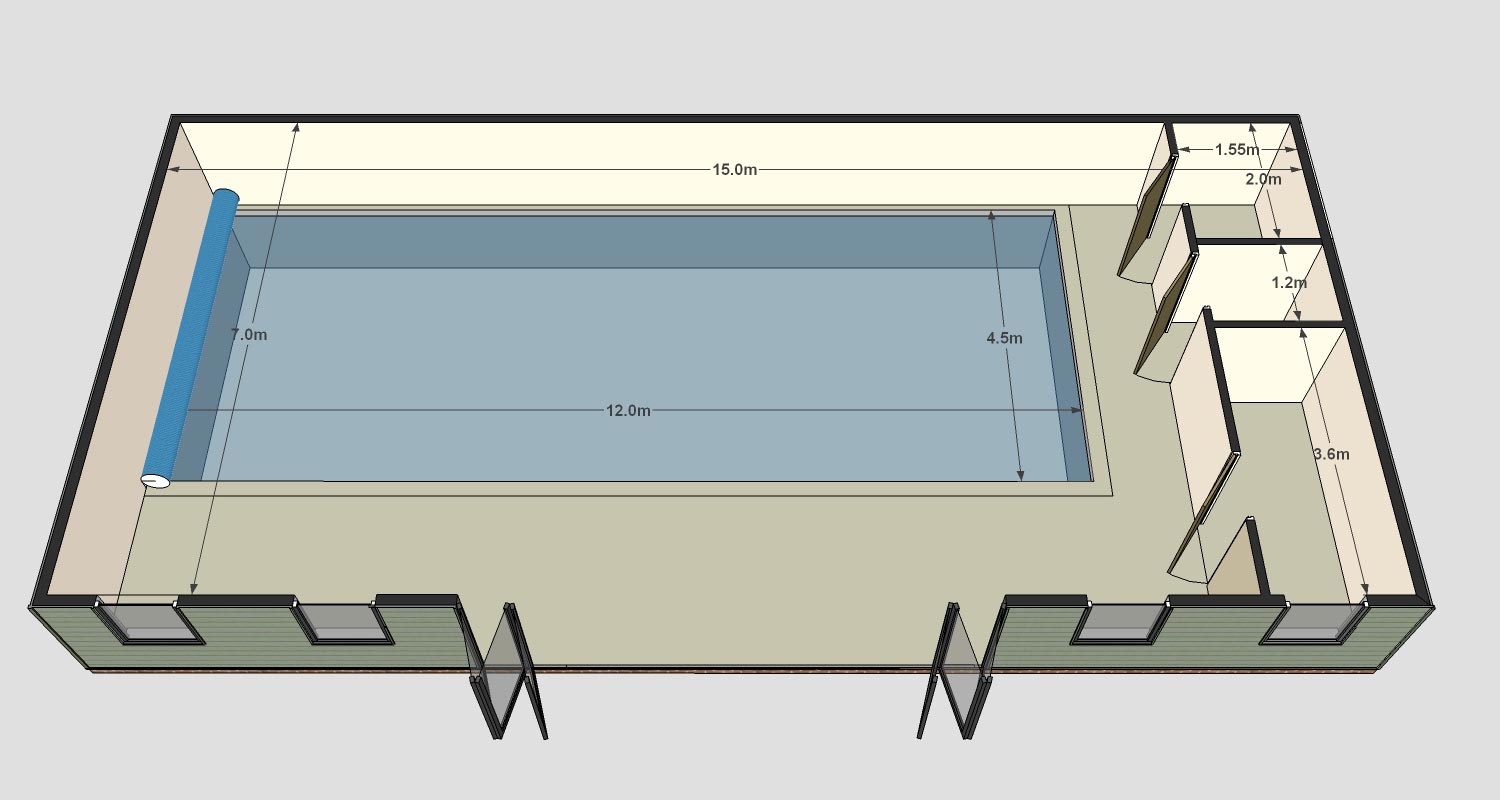

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025 -

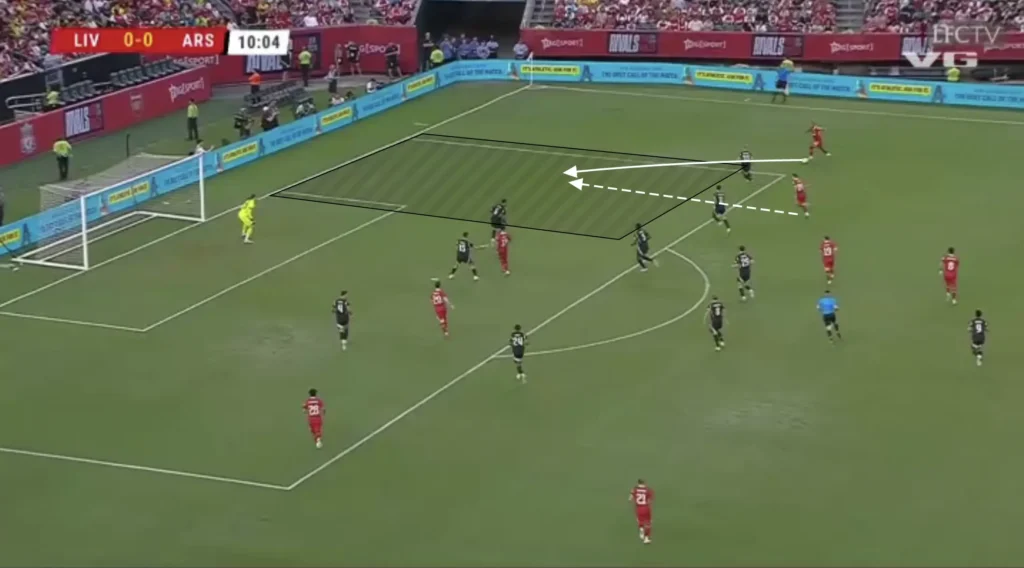

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson Becker

May 22, 2025

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson Becker

May 22, 2025 -

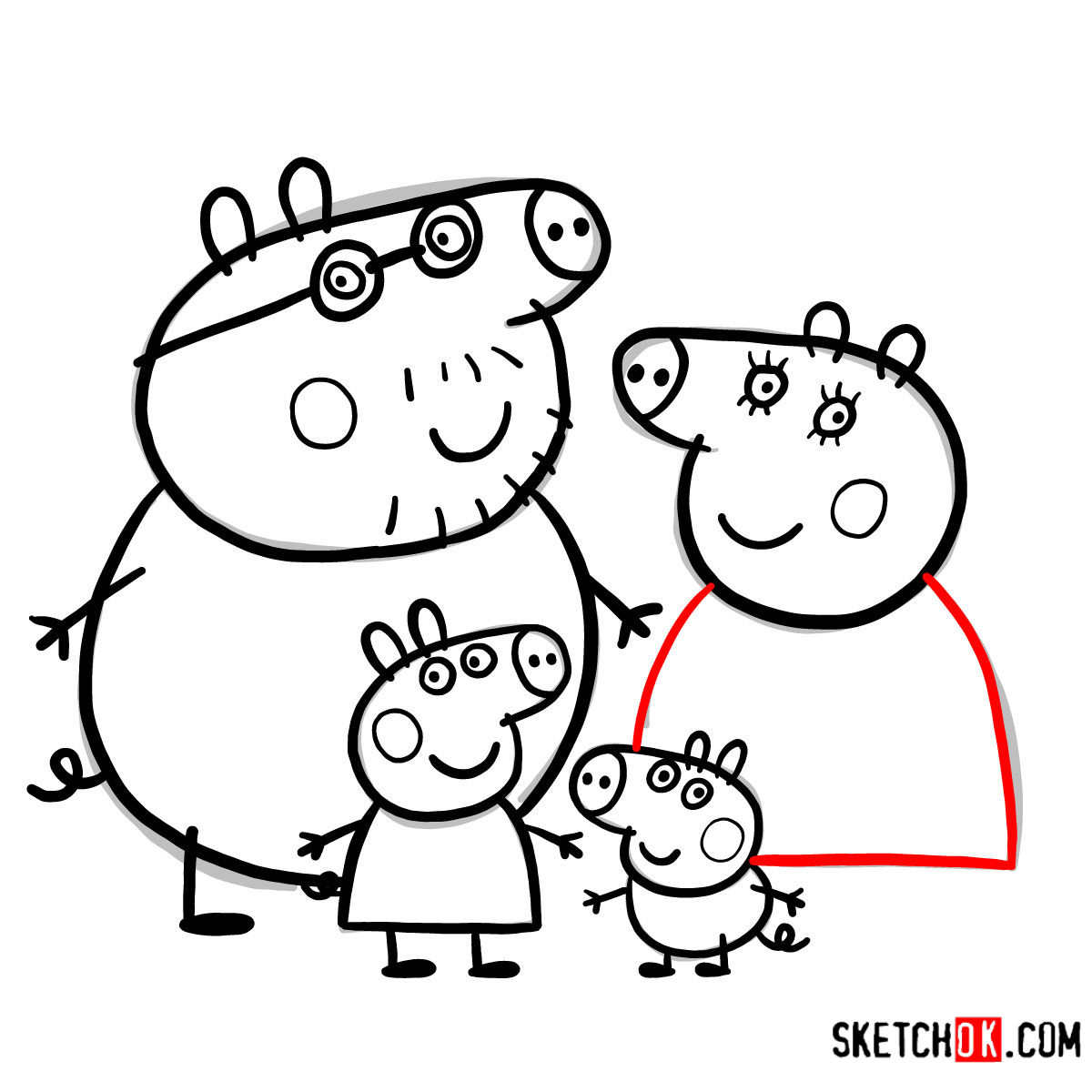

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

May 22, 2025

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

May 22, 2025 -

Peppa Pigs Secret Identity The Name That Left Fans Speechless

May 22, 2025

Peppa Pigs Secret Identity The Name That Left Fans Speechless

May 22, 2025 -

Sourcing High Quality Cassis Blackcurrant A Buyers Guide

May 22, 2025

Sourcing High Quality Cassis Blackcurrant A Buyers Guide

May 22, 2025

Latest Posts

-

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rezultativ

May 22, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rezultativ

May 22, 2025 -

Reyting Providnikh Finansovikh Kompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 22, 2025

Reyting Providnikh Finansovikh Kompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 22, 2025 -

The Full Story Heated Exchange Between Pub Landlady And Departing Employee

May 22, 2025

The Full Story Heated Exchange Between Pub Landlady And Departing Employee

May 22, 2025 -

Unfiltered Pub Landlords Angry Tirade At Employee Who Handed In Notice

May 22, 2025

Unfiltered Pub Landlords Angry Tirade At Employee Who Handed In Notice

May 22, 2025 -

Snowflake Insult Pub Landladys Explosive Reaction Captured On Video

May 22, 2025

Snowflake Insult Pub Landladys Explosive Reaction Captured On Video

May 22, 2025