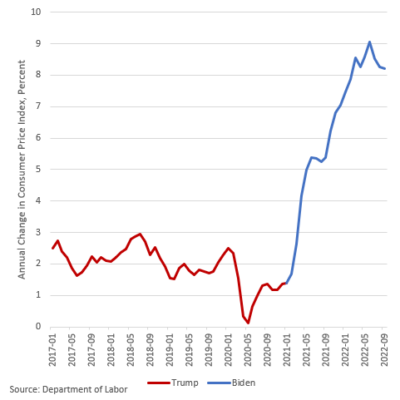

Core Inflation Surge: The Bank Of Canada's Policy Challenge

Table of Contents

Drivers of the Core Inflation Surge in Canada

Several interconnected factors have fueled the recent rise in core inflation in Canada. Understanding these drivers is crucial for assessing the effectiveness of the Bank of Canada's response.

-

Supply Chain Disruptions: The lingering effects of the global pandemic continue to disrupt supply chains, leading to shortages and increased prices for various goods. This supply chain inflation impacts everything from manufacturing to transportation costs.

-

Increased Demand: Strong consumer demand, fueled by government stimulus measures and pent-up demand after lockdowns, has put upward pressure on prices. This demand-pull inflation is particularly evident in sectors like housing and services.

-

Wage Inflation Canada: Rising wages, while positive for workers, also contribute to inflationary pressures as businesses pass increased labor costs onto consumers. This wage inflation Canada is particularly noticeable in sectors experiencing labor shortages.

-

Housing Costs Canada: The Canadian housing market has experienced significant price increases in recent years, significantly impacting core inflation. Rising mortgage rates, alongside limited housing supply, continue to fuel this pressure.

-

Energy Prices Canada: While energy prices are excluded from core inflation calculations, their volatility significantly influences other prices throughout the economy. Fluctuations in global energy markets directly impact transportation, manufacturing, and overall consumer costs.

The combination of these factors has created a complex inflationary environment, requiring a nuanced policy response. Statistics Canada data on various price indices provide strong evidence for the significant impact of these factors.

The Bank of Canada's Policy Response

The Bank of Canada's primary tool for managing inflation is its monetary policy, primarily focusing on Bank of Canada interest rates. To combat the core inflation surge, the Bank has implemented a series of interest rate hikes.

-

Interest Rate Hikes: Increasing interest rates makes borrowing more expensive, cooling down economic activity and reducing demand-pull inflation. This strategy aims to curb spending and investment, thereby easing pressure on prices.

-

Monetary Policy Canada: The Bank of Canada's approach is guided by its inflation targeting framework, aiming to maintain inflation within a specific range. However, the current surge requires a more aggressive approach.

The impact of these interest rate hikes on the Canadian economy is complex. While they aim to control inflation, they also risk slowing economic growth Canada and potentially increasing the unemployment rate Canada. The Bank must carefully navigate this trade-off between controlling inflation and maintaining economic stability.

Challenges and Risks

The Bank of Canada faces several significant challenges in managing this core inflation surge:

-

Inflation Risk: The persistence of high inflation poses a risk of entrenched inflation expectations, making it more difficult to bring prices under control.

-

Recession Risk Canada: Aggressive interest rate hikes increase the risk of a recession, as businesses and consumers reduce spending due to higher borrowing costs. This recession risk Canada necessitates careful calibration of monetary policy.

-

Financial Stability Canada: Rapid interest rate increases can also destabilize the financial system, impacting asset prices and potentially leading to financial distress. Maintaining financial stability Canada is paramount.

-

Global Inflation: Global economic factors, such as geopolitical instability and ongoing supply chain issues, add further complexity, impacting global inflation and its effect on the Canadian economy. The Bank must consider these external pressures when formulating its strategy.

The Bank is also exploring tools beyond interest rates such as quantitative tightening, to further manage liquidity in the financial system.

Potential Future Scenarios and Outlook

Forecasting the future trajectory of core inflation is challenging, with several possible scenarios:

-

Scenario 1: Successful Inflation Control: The Bank of Canada's current policy proves effective, gradually bringing core inflation back to the target range without triggering a significant recession.

-

Scenario 2: Stagnant Inflation: Inflation remains elevated for an extended period, requiring further interest rate increases, potentially increasing the risk of a recession.

-

Scenario 3: Recessionary Pressure: Aggressive interest rate hikes lead to a significant economic slowdown or recession, potentially dampening inflation but at a considerable cost to economic growth.

The inflation forecast Canada and the Canadian economy forecast are closely linked, with the Bank of Canada’s actions significantly impacting the economic outlook Canada in both the short and medium term. The future inflation path will depend on the effectiveness of current policies and the evolution of global economic conditions.

Conclusion: Navigating the Core Inflation Challenge – A Path Forward

The surge in core inflation presents a significant challenge for the Bank of Canada. Managing inflation while maintaining economic stability requires a delicate balance. The Bank’s use of interest rate hikes and its monetary policy decisions are crucial, but fraught with risk. Understanding the drivers of core inflation, the potential consequences of different policy choices, and the interplay of global and domestic factors are essential.

Staying informed about core inflation developments and the Bank of Canada's policy decisions is critical. Consult resources like the Bank of Canada's website for the latest data and analysis. By understanding the complexities of this challenge, we can better navigate the path forward and contribute to informed discussions about the Canadian economy and its future.

Featured Posts

-

Intoarcerea Fratilor Tate In Romania Parada Fastuoasa Prin Capitala

May 22, 2025

Intoarcerea Fratilor Tate In Romania Parada Fastuoasa Prin Capitala

May 22, 2025 -

Decouvrir La Petite Italie De L Ouest Une Architecture Toscane A Admirer

May 22, 2025

Decouvrir La Petite Italie De L Ouest Une Architecture Toscane A Admirer

May 22, 2025 -

Chennai Wtt Star Contender Oh Jun Sungs Winning Performance

May 22, 2025

Chennai Wtt Star Contender Oh Jun Sungs Winning Performance

May 22, 2025 -

Emerging Business Hubs In Country Name Investment Opportunities And Trends

May 22, 2025

Emerging Business Hubs In Country Name Investment Opportunities And Trends

May 22, 2025 -

Ukrayina Ta Nato Yevrokomisar Ozvuchiv Golovnu Zagrozu Chlenstva

May 22, 2025

Ukrayina Ta Nato Yevrokomisar Ozvuchiv Golovnu Zagrozu Chlenstva

May 22, 2025

Latest Posts

-

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Lua Chon

May 22, 2025

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Lua Chon

May 22, 2025 -

200 Van Dong Vien Tham Gia Chay Bo Lien Tinh Dak Lak Phu Yen

May 22, 2025

200 Van Dong Vien Tham Gia Chay Bo Lien Tinh Dak Lak Phu Yen

May 22, 2025 -

Hanh Trinh Chay Bo 200 Nguoi Kham Pha Ve Dep Dak Lak Va Phu Yen

May 22, 2025

Hanh Trinh Chay Bo 200 Nguoi Kham Pha Ve Dep Dak Lak Va Phu Yen

May 22, 2025 -

Ket Noi Giao Thong Tp Hcm Va Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025

Ket Noi Giao Thong Tp Hcm Va Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025 -

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025