CoreWeave (CRWV): Deconstructing Last Week's Stock Market Rally

Table of Contents

Analyzing the CoreWeave (CRWV) Stock Price Surge

Pre-Rally Market Sentiment

Before the recent CoreWeave (CRWV) stock rally, the market sentiment surrounding the company and the broader cloud computing sector was somewhat mixed. While the long-term prospects for cloud computing and AI infrastructure remained positive, some concerns lingered.

- Increased Competition: The cloud computing market is fiercely competitive, with established players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominating the landscape. [Link to relevant market share report].

- Economic Uncertainty: Concerns about a potential economic slowdown impacted investor confidence across various sectors, including technology. [Link to relevant economic news article].

- Analyst Ratings: Prior to the rally, analyst ratings on CRWV were varied, reflecting the uncertainty surrounding the company's growth trajectory. [Link to analyst reports].

The overall market sentiment towards cloud computing and AI infrastructure stocks was cautious, leading to some volatility in the sector before the CRWV stock price surge.

Key Catalysts for the Rally

Several key events and announcements likely contributed to the recent CoreWeave (CRWV) stock price increase:

- Major Contract Wins: Reports emerged suggesting CoreWeave secured significant contracts with major clients in the AI and high-performance computing sectors. These contracts could represent substantial revenue streams for the company. [Link to news article if available].

- Strategic Partnerships: News of potential partnerships with key technology companies could have boosted investor confidence in CRWV's future growth potential. These collaborations can enhance CRWV's market reach and technological capabilities. [Link to news article if available].

- Positive Financial Projections: The company may have released updated financial projections or guidance suggesting strong revenue growth and profitability in the coming quarters. Positive financial news often drives significant stock price increases. [Link to financial reports if available].

- Increased Institutional Investment: An increase in investment from institutional investors could also have significantly contributed to the rally, signaling a vote of confidence in CRWV's long-term prospects. [Link to SEC filings if available].

Each of these catalysts, individually and collectively, likely fueled investor optimism, leading to the sharp increase in CRWV's stock price.

Technical Analysis of the CRWV Chart

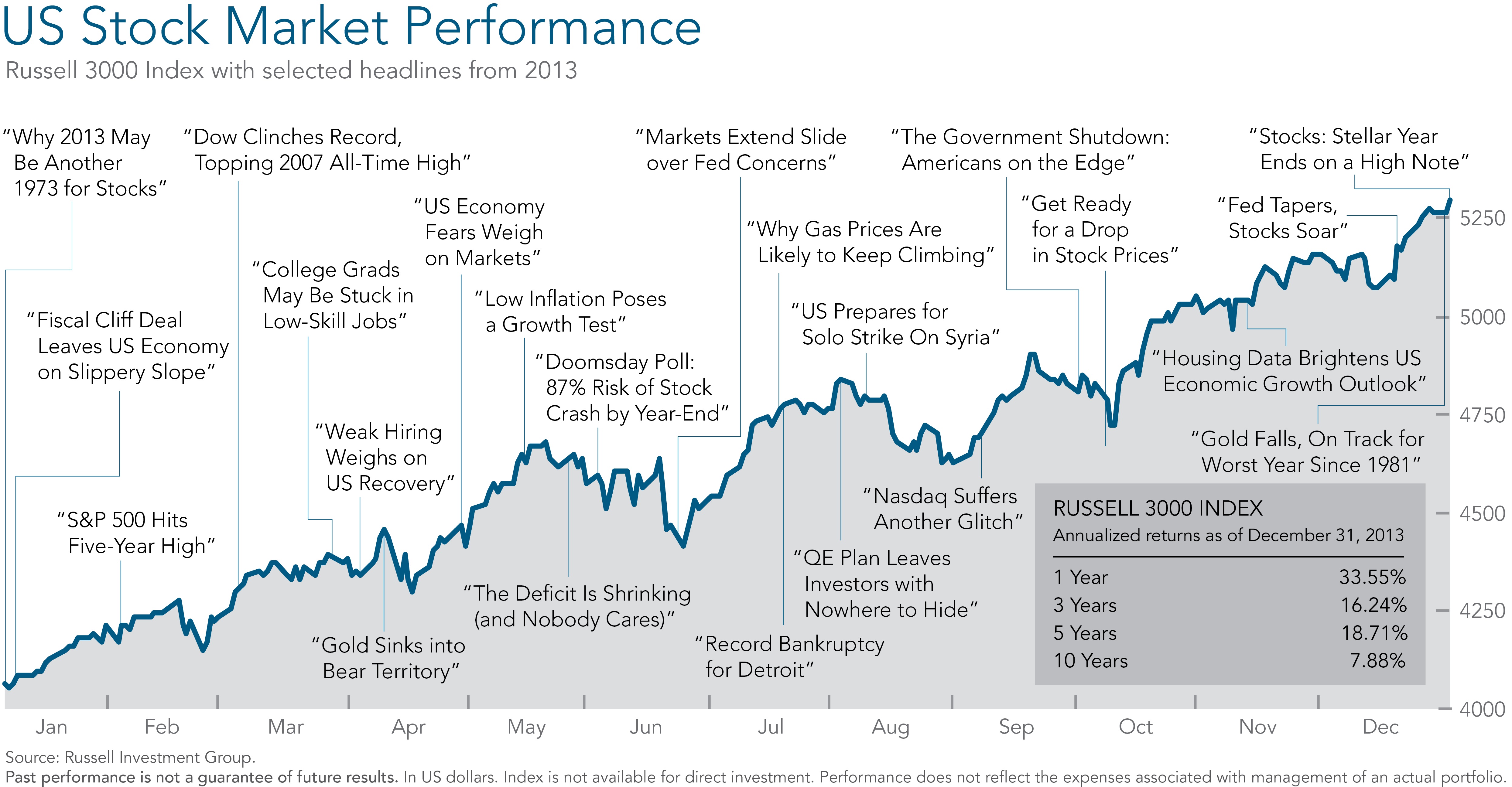

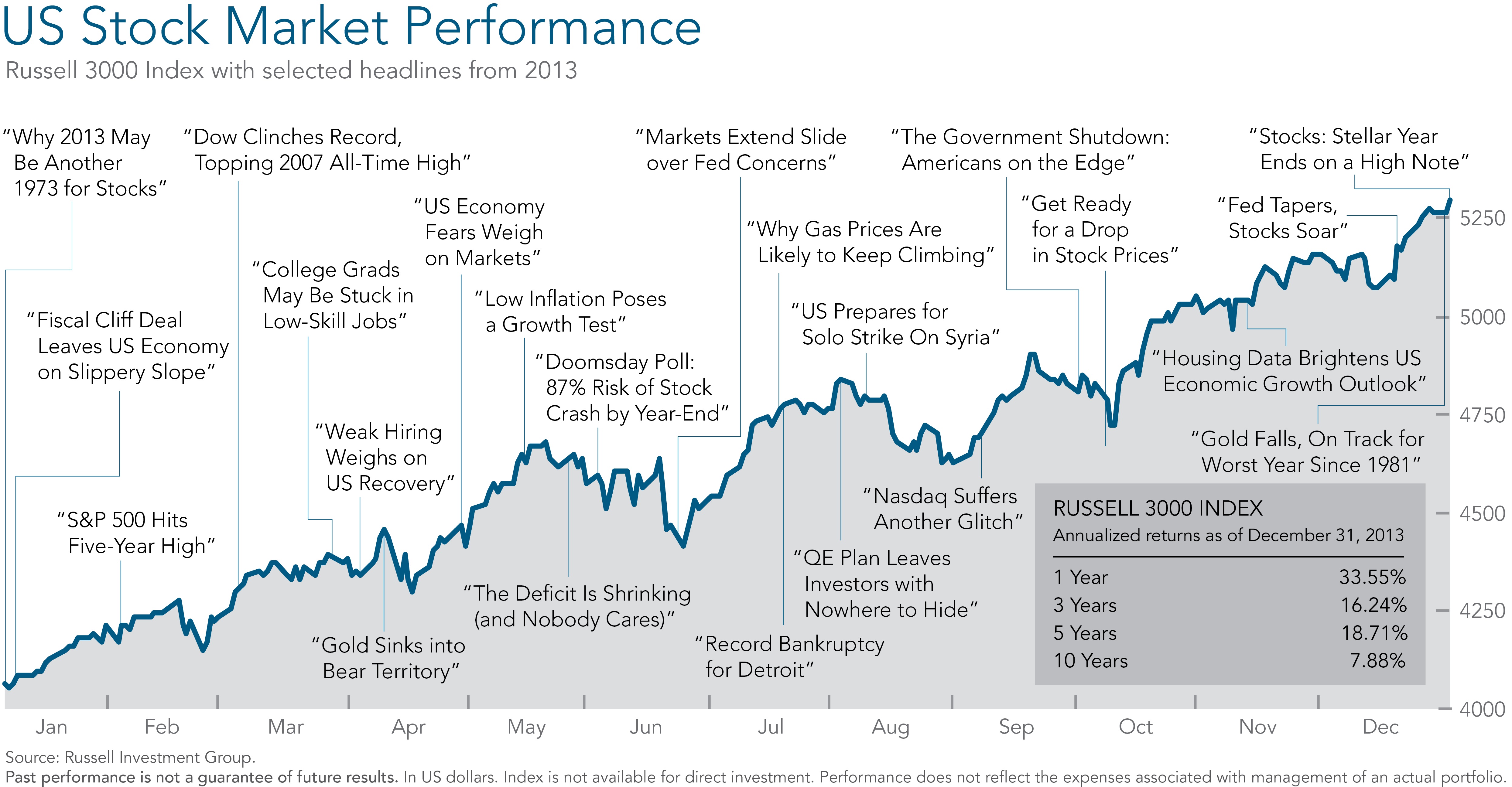

(Optional: Include a chart here if available). Analyzing the CRWV chart reveals several technical indicators that could explain the price movement. For example, a significant increase in trading volume accompanied the price surge, suggesting strong buying pressure. The price also broke through key resistance levels, indicating a potential shift in market sentiment. Further analysis of support and resistance levels, along with other technical indicators like RSI and MACD, could provide valuable insights into the sustainability of this rally.

Assessing the Sustainability of the CoreWeave (CRWV) Rally

Fundamental Analysis of CoreWeave's Business Model

CoreWeave's business model centers around providing high-performance cloud computing infrastructure, particularly for AI workloads. Its success hinges on several factors:

- Strong Customer Base: The company’s ability to attract and retain major clients in the AI and HPC sectors is crucial.

- Technological Advantages: CoreWeave's specialized infrastructure and proprietary technologies give it a competitive edge.

- Scalability and Reliability: The ability to scale its infrastructure to meet growing demand and ensure high reliability is essential.

- Competitive Landscape: Intense competition from established cloud providers remains a significant challenge.

A thorough fundamental analysis is needed to assess CoreWeave's long-term potential and the sustainability of its recent stock price increase.

Market Risks and Potential Corrections

Despite the recent rally, several factors could lead to a correction in CRWV's stock price:

- Economic Downturn: A broader economic slowdown could reduce demand for cloud computing services, impacting CoreWeave's revenue growth.

- Increased Competition: The entry of new competitors or aggressive pricing strategies from established players could erode CRWV's market share.

- Regulatory Changes: Changes in data privacy regulations or antitrust laws could negatively impact the company's operations.

- Negative News: Any negative news concerning the company's financial performance, technology, or management could trigger a sell-off.

Investors should carefully consider these risks before investing in CRWV.

Expert Opinions and Analyst Forecasts

(Include summaries of analyst reports and forecasts here, with links to credible sources). Analyst opinions on CRWV's future prospects vary, reflecting the inherent uncertainties in the market. Some analysts express bullish sentiments, citing the company's strong technology and potential for growth, while others express caution, highlighting the competitive landscape and potential economic headwinds. A balanced review of these expert opinions is crucial for making informed investment decisions.

Conclusion

The recent CoreWeave (CRWV) stock rally can be attributed to a combination of factors, including significant contract wins, strategic partnerships, positive financial projections, and increased institutional investment. However, it's important to acknowledge the inherent risks associated with investing in the technology sector, including competition, economic uncertainty, and regulatory changes. Thorough due diligence and a comprehensive understanding of the company's business model, competitive landscape, and financial health are essential for making informed investment decisions. Stay informed about the latest developments in CoreWeave (CRWV) and the broader cloud computing market to make informed investment decisions. Continue your research into CRWV stock to understand its long-term potential and manage risk effectively.

Featured Posts

-

Investigating The Cause Of Core Weave Crwv Stocks Tuesday Fall

May 22, 2025

Investigating The Cause Of Core Weave Crwv Stocks Tuesday Fall

May 22, 2025 -

Southport Councillors Wife Convicted Of Incitement To Racial Hatred

May 22, 2025

Southport Councillors Wife Convicted Of Incitement To Racial Hatred

May 22, 2025 -

Questionable Ai Reporting Practices At The Chicago Sun Times

May 22, 2025

Questionable Ai Reporting Practices At The Chicago Sun Times

May 22, 2025 -

Wife Of Jailed Tory Councillor Claims Migrant Hotel Remarks Were Misinterpreted

May 22, 2025

Wife Of Jailed Tory Councillor Claims Migrant Hotel Remarks Were Misinterpreted

May 22, 2025 -

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai

May 22, 2025

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai

May 22, 2025

Latest Posts

-

Liga Natsiy Onovleniy Rozklad Ta Rezultati Matchiv 20 03 2025

May 22, 2025

Liga Natsiy Onovleniy Rozklad Ta Rezultati Matchiv 20 03 2025

May 22, 2025 -

Suksesi I Kosoves Ne Ligen E Kombeve Analiza E Perfitimeve Nga Uefa

May 22, 2025

Suksesi I Kosoves Ne Ligen E Kombeve Analiza E Perfitimeve Nga Uefa

May 22, 2025 -

Ronaldo I Kho Lund Imitatsi A Na Proslavata I Reaktsi Ata Na Legendata

May 22, 2025

Ronaldo I Kho Lund Imitatsi A Na Proslavata I Reaktsi Ata Na Legendata

May 22, 2025 -

Kosova Ne Ligen B Te Liges Se Kombeve Nje Hap I Madh Perpara Fale Uefa S

May 22, 2025

Kosova Ne Ligen B Te Liges Se Kombeve Nje Hap I Madh Perpara Fale Uefa S

May 22, 2025 -

Metallicas M72 World Tour 2026 Uk And European Dates Announced

May 22, 2025

Metallicas M72 World Tour 2026 Uk And European Dates Announced

May 22, 2025