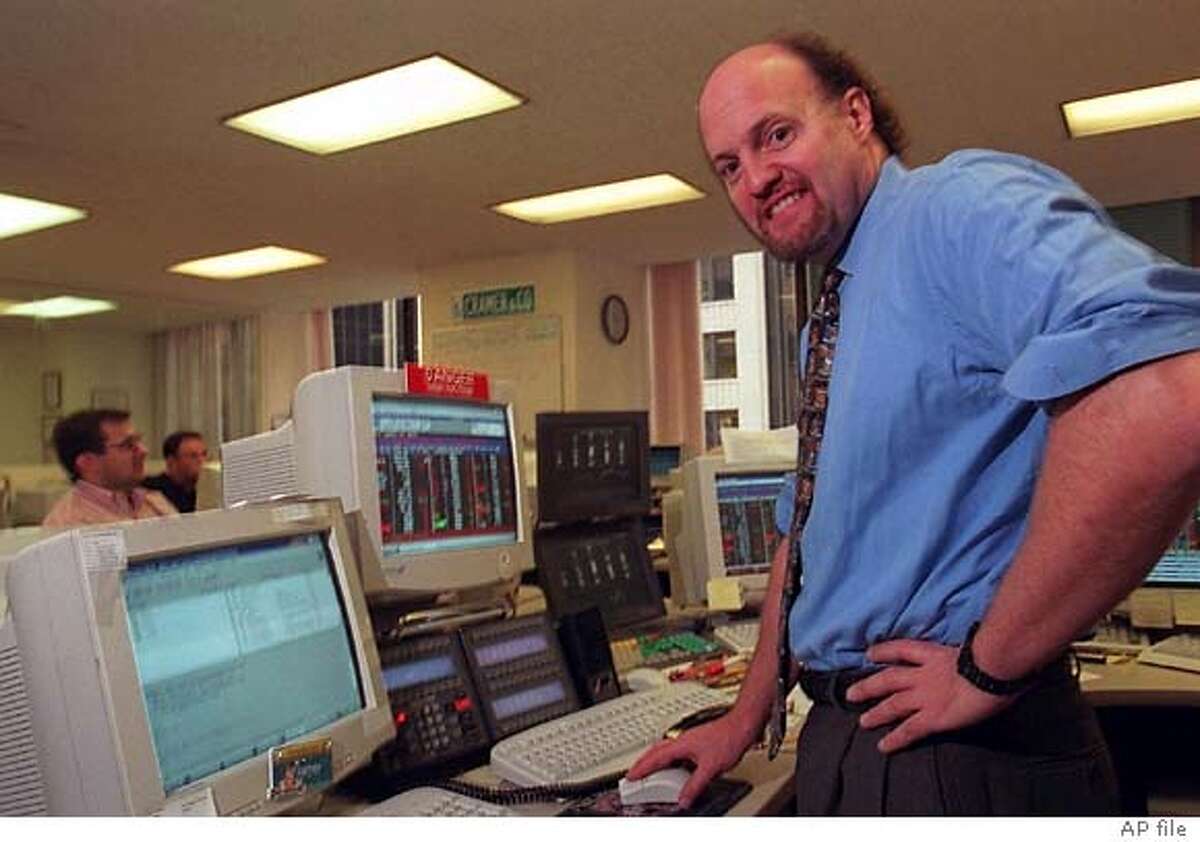

CoreWeave (CRWV): Jim Cramer's Assessment And The Future Of AI Infrastructure

Table of Contents

Jim Cramer's Perspective on CoreWeave (CRWV)

While publicly available information regarding specific statements by Jim Cramer on CoreWeave is limited at this time, analyzing his broader commentary on similar technology stocks and the AI infrastructure sector can offer insight. Cramer often emphasizes companies with strong growth potential and disruptive technologies. If he has commented on CRWV, his assessment would likely focus on factors such as:

- Market opportunity: The immense and rapidly expanding AI market presents significant growth opportunities for companies like CoreWeave.

- Competitive landscape: Cramer would likely consider CoreWeave's position relative to major cloud providers like AWS, Google Cloud, and Azure. A strong competitive advantage is crucial for success in this space.

- Financial performance: Profitability, revenue growth, and other key financial metrics would undoubtedly factor into his analysis.

It’s important to note that differing viewpoints exist within the financial community. While Cramer's insights are valuable, it's crucial to consider analyses from other financial experts before making any investment decisions. A balanced perspective is essential when navigating the complexities of the stock market.

CoreWeave's Business Model and Competitive Advantages

CoreWeave's core business revolves around providing GPU cloud computing resources specifically tailored for AI workloads. This means offering powerful graphics processing units (GPUs) via the cloud, allowing developers and businesses to train and deploy AI models without the significant upfront investment in hardware and infrastructure. Their competitive advantages include:

- Specialized infrastructure: CoreWeave leverages a vast network of GPUs optimized for AI processing, providing superior performance compared to general-purpose cloud offerings.

- Scalability and flexibility: Their cloud platform allows users to easily scale their computing resources up or down based on their needs, ensuring cost-effectiveness and efficiency.

- Focus on AI: Unlike general-purpose cloud providers, CoreWeave's entire focus is on providing optimal infrastructure for AI development and deployment. This specialized expertise provides a key advantage.

- Competitive pricing: While pricing details are often confidential, CoreWeave likely aims for competitive pricing to attract customers from both AI startups and large enterprises.

The Growing Demand for AI Infrastructure

The demand for AI infrastructure is exploding. The rapid advancements in AI technology, coupled with its increasing adoption across various sectors (healthcare, finance, manufacturing, etc.), are driving exponential growth.

- Market Size: The AI infrastructure market is projected to reach [Insert market size projection from a reputable source] by [Insert year].

- GPU Computing's Crucial Role: Training large AI models requires immense computing power, and GPUs are the workhorses of this process. Their parallel processing capabilities accelerate model training significantly, making them essential for AI development.

- Examples of Usage: Companies like OpenAI (with its GPT models), Google (with its DeepMind AI), and numerous AI startups rely heavily on GPU computing resources to power their AI initiatives.

CoreWeave's Growth Potential and Financial Performance (CRWV Stock)

CoreWeave's financial performance, as a publicly traded company, is subject to market fluctuations and should be analyzed using publicly available financial statements such as quarterly and annual reports. Key aspects to consider include:

- Revenue Growth: Examine the trend in CoreWeave's revenue growth to assess its market penetration and customer acquisition.

- Profitability: Analyze profit margins and overall profitability to gauge the company's efficiency and financial health.

- Debt Levels: High debt levels can present a financial risk, so it's important to assess CoreWeave's capital structure.

- Potential Catalysts: Positive developments such as securing large contracts, expanding into new markets, or launching innovative products can significantly impact future growth.

However, challenges exist. Competition from established cloud providers is a significant factor, and market fluctuations within the tech sector can also affect performance.

Conclusion

While definitive public statements from Jim Cramer regarding CoreWeave (CRWV) may be limited, analyzing his broader views on the AI infrastructure market and similar companies provides a useful context for understanding the potential of CoreWeave. The company's focus on GPU cloud computing for AI workloads positions it well within a rapidly growing market. However, assessing CoreWeave's strengths and weaknesses requires a thorough analysis of its financial performance, competitive landscape, and the overall market dynamics. Remember to conduct your own thorough research before investing in CRWV or any other stock. Learn more about CoreWeave (CRWV) and the exciting world of AI infrastructure. Conduct your own thorough research before investing.

Featured Posts

-

Dau Tu Ha Tang Giao Thong 7 Vi Tri Tp Hcm Long An Can Phat Trien

May 22, 2025

Dau Tu Ha Tang Giao Thong 7 Vi Tri Tp Hcm Long An Can Phat Trien

May 22, 2025 -

Tory Politicians Wife Remains Jailed Following Migrant Rant In Southport

May 22, 2025

Tory Politicians Wife Remains Jailed Following Migrant Rant In Southport

May 22, 2025 -

Provence Hiking Adventure Self Guided Walk Mountains To Mediterranean

May 22, 2025

Provence Hiking Adventure Self Guided Walk Mountains To Mediterranean

May 22, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 22, 2025

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 22, 2025 -

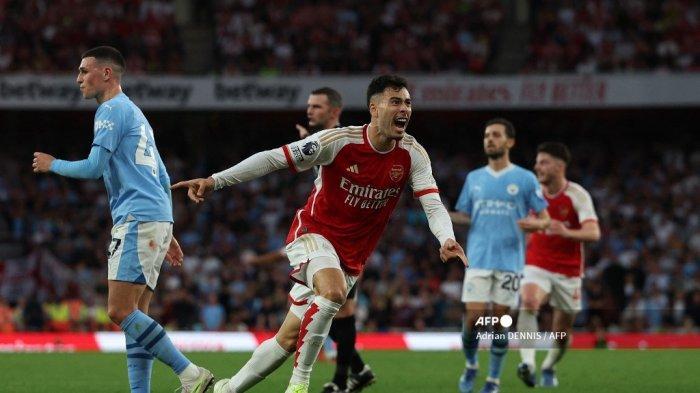

Fuel Costs Increase 20 Cent Jump In Average Gas Prices

May 22, 2025

Fuel Costs Increase 20 Cent Jump In Average Gas Prices

May 22, 2025

Latest Posts

-

Tragedy In Dc Israeli Embassy Staff Fatalities In Jewish Museum Shooting

May 22, 2025

Tragedy In Dc Israeli Embassy Staff Fatalities In Jewish Museum Shooting

May 22, 2025 -

Understanding The Israeli Diplomat Shooting Incident In Washington D C

May 22, 2025

Understanding The Israeli Diplomat Shooting Incident In Washington D C

May 22, 2025 -

Ap Photos Israeli Embassy Staff Killed In Dc Shooting Near Jewish Museum

May 22, 2025

Ap Photos Israeli Embassy Staff Killed In Dc Shooting Near Jewish Museum

May 22, 2025 -

Washington Diplomat Shootings Updates And Key Information

May 22, 2025

Washington Diplomat Shootings Updates And Key Information

May 22, 2025 -

Washington Attack German Chancellor Merz Issues Strong Condemnation

May 22, 2025

Washington Attack German Chancellor Merz Issues Strong Condemnation

May 22, 2025