CoreWeave (CRWV) Stock: Jim Cramer's Insights And OpenAI's Role

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV) Stock

Analyzing Cramer's past comments and recommendations on CRWV

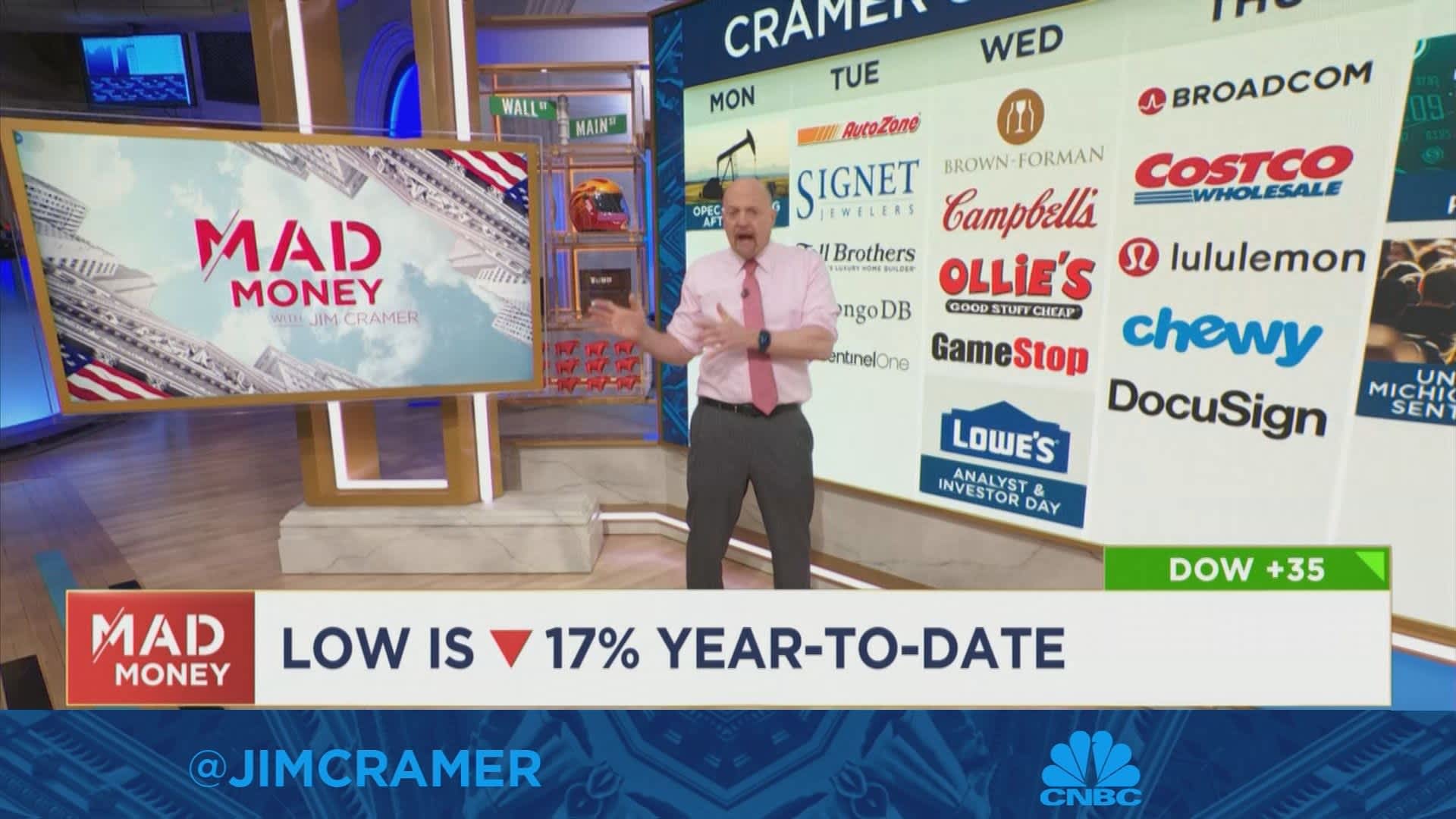

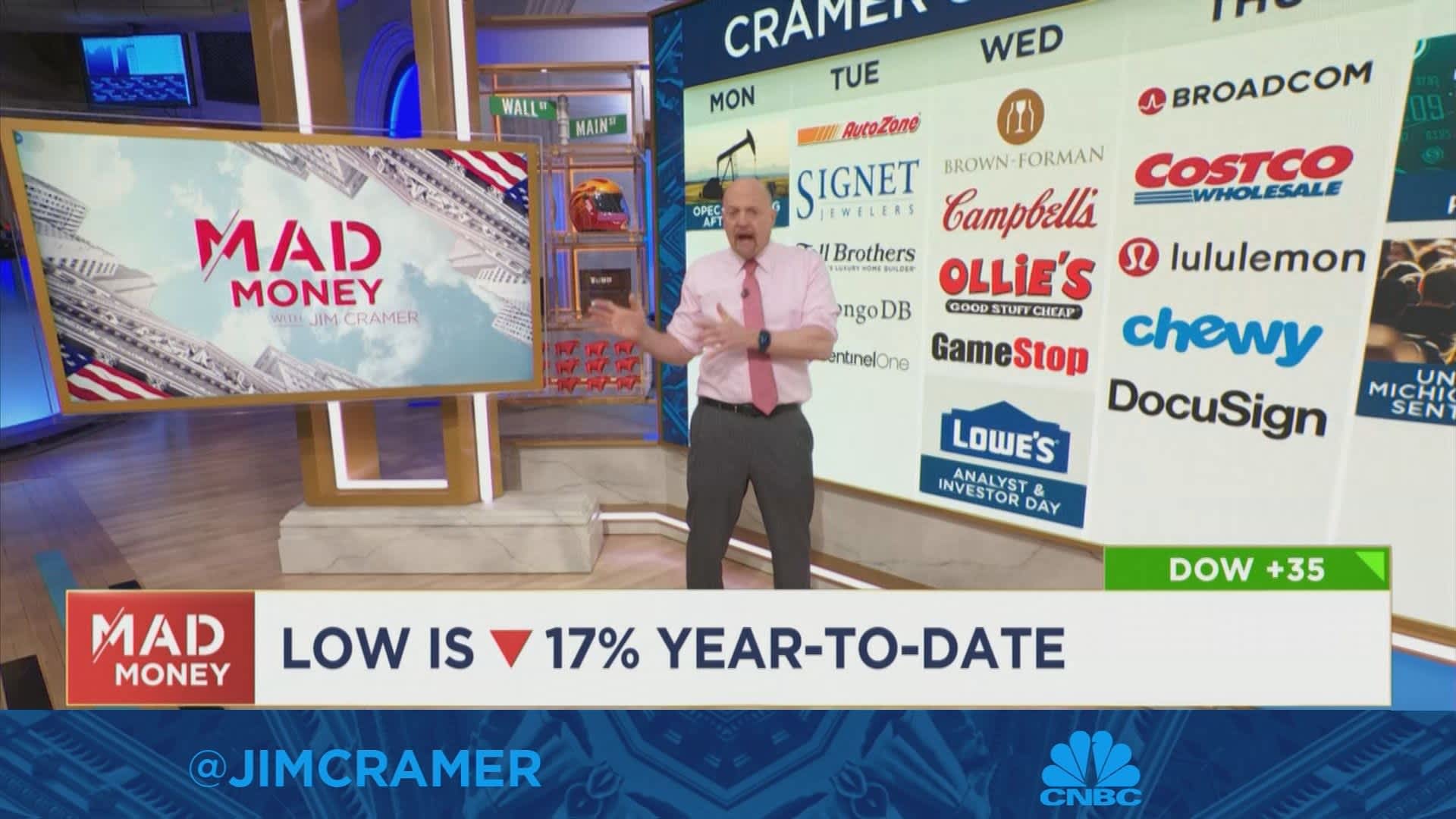

Jim Cramer, the renowned host of CNBC's "Mad Money," has frequently discussed the burgeoning AI cloud computing sector. While pinpointing every specific mention of CoreWeave across his numerous broadcasts and writings can be challenging, analyzing his overall commentary on similar companies and market trends provides valuable insight.

- Positive Mentions (Examples): While direct, explicit endorsements of CRWV might be sparse, Cramer's enthusiastic coverage of the broader AI revolution and the need for robust cloud infrastructure often indirectly supports companies like CoreWeave. He has frequently emphasized the explosive growth potential within this sector. [Insert link to relevant Mad Money segment or news article if available].

- Neutral or Cautious Comments (Examples): Cramer, known for his sometimes volatile opinions, may have expressed reservations about the overall market volatility or specific risks associated with investing in newly public companies in the tech sector. These comments, while not necessarily directed at CoreWeave specifically, should be considered when assessing his overall stance. [Insert link to relevant Mad Money segment or news article if available].

- Impact on CRWV Stock Price: Any significant comments from Cramer, positive or negative, can influence the stock price of mentioned companies, leading to short-term volatility. Understanding his overall sentiment helps contextualize these price fluctuations.

Interpreting Cramer's overall sentiment towards CoreWeave and the AI cloud computing sector

Based on his general commentary about the AI and cloud computing market, it appears Cramer holds a largely bullish sentiment towards the sector’s long-term potential. His frequent highlighting of the rapid advancements in AI and the increasing demand for high-performance computing strongly suggests a positive outlook for companies like CoreWeave that are well-positioned within this space. However, his cautionary notes regarding market risks serve as a reminder that even in a bullish market, individual stock performance can be unpredictable.

OpenAI's Influence on CoreWeave's Growth Potential

The symbiotic relationship between OpenAI and cloud computing providers like CoreWeave

OpenAI's groundbreaking advancements in AI, particularly with models like GPT, require enormous computational power. This creates a symbiotic relationship with cloud computing providers like CoreWeave. CoreWeave's specialized infrastructure, designed to handle the intense demands of AI training and deployment, positions it ideally to serve OpenAI and other similar organizations.

- Increased Demand for CoreWeave's Services: As OpenAI continues to develop and refine its AI models, the demand for powerful and scalable computing resources will only intensify. This translates to potentially significant growth opportunities for CoreWeave.

- Technological Advantages: CoreWeave's focus on NVIDIA GPUs and its optimized infrastructure offers a competitive edge in servicing the unique needs of AI development.

Analyzing the competitive landscape and CoreWeave's market positioning within the AI cloud computing space

CoreWeave faces stiff competition from established giants like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. However, CoreWeave differentiates itself through its specialization in AI workloads.

- Competitive Advantages: CoreWeave's dedication to AI infrastructure, its partnerships with leading hardware providers, and its scalable solutions provide key advantages in this niche market.

- Potential Vulnerabilities: Market share dominance by larger competitors, technological disruptions, and economic downturns represent potential risks to CoreWeave's future.

- Strategic Partnerships: CoreWeave actively seeks strategic collaborations within the AI ecosystem to enhance its offerings and secure its market position.

Investing in CoreWeave (CRWV): Risks and Rewards

Assessing the financial performance and future growth prospects of CoreWeave

Analyzing CoreWeave's financial performance requires a detailed examination of its revenue, profitability, and debt levels. This analysis should be conducted using publicly available financial statements and industry reports. [Link to financial reports and relevant analysis].

- Revenue Growth: Assess the rate of revenue growth and its sustainability.

- Profitability: Analyze profitability margins and identify key cost drivers.

- Debt Levels: Evaluate the company's debt burden and its impact on financial health.

- Potential Risks: Market volatility, increasing competition, and the inherent risks associated with emerging technology companies all contribute to the investment risk profile of CoreWeave.

Providing a balanced perspective on the potential for return on investment (ROI) in CoreWeave

Investing in CoreWeave (CRWV) offers potential for substantial ROI, given the company's position in the rapidly expanding AI cloud computing market. However, investors must carefully weigh this against the significant risks involved.

- Potential Upsides: High growth potential, strategic partnerships, and strong market positioning contribute to the potential upsides.

- Potential Downsides: Market volatility, competitive pressures, and the uncertainty inherent in a rapidly evolving technology landscape represent substantial downsides.

Disclaimer: Investing in the stock market involves significant risk, and CoreWeave (CRWV) is no exception. Past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

CoreWeave (CRWV) Stock: A Final Verdict and Call to Action

Jim Cramer's overall positive sentiment towards the AI cloud computing sector, coupled with OpenAI's increasing reliance on powerful cloud infrastructure, paints a promising picture for CoreWeave's future. However, the competitive landscape and inherent market risks must be carefully considered. While this article provides insights into CoreWeave (CRWV) stock and its connection to Jim Cramer and OpenAI, remember to conduct your own thorough due diligence before making any investment decisions. Consider consulting with a financial advisor for personalized guidance. The future of CoreWeave (CRWV) remains exciting, but informed investment choices are crucial in navigating this dynamic landscape.

Featured Posts

-

Wisconsin Gas Prices Jump 3 Cents Reaching 2 98 Gallon

May 22, 2025

Wisconsin Gas Prices Jump 3 Cents Reaching 2 98 Gallon

May 22, 2025 -

Cyberattack On Marks And Spencer To Cost 300 Million

May 22, 2025

Cyberattack On Marks And Spencer To Cost 300 Million

May 22, 2025 -

Festival Le Bouillon Spectacles Et Engagement A Clisson

May 22, 2025

Festival Le Bouillon Spectacles Et Engagement A Clisson

May 22, 2025 -

Vybz Kartels Support As Dancehall Stars Trinidad Trip Faces Restrictions

May 22, 2025

Vybz Kartels Support As Dancehall Stars Trinidad Trip Faces Restrictions

May 22, 2025 -

Swiss Government Criticizes Chinese Military Drills

May 22, 2025

Swiss Government Criticizes Chinese Military Drills

May 22, 2025

Latest Posts

-

Israeli Embassy Identifies Couple Killed In Washington D C Shooting

May 22, 2025

Israeli Embassy Identifies Couple Killed In Washington D C Shooting

May 22, 2025 -

Tragedy In Dc Israeli Embassy Staff Fatalities In Jewish Museum Shooting

May 22, 2025

Tragedy In Dc Israeli Embassy Staff Fatalities In Jewish Museum Shooting

May 22, 2025 -

Understanding The Israeli Diplomat Shooting Incident In Washington D C

May 22, 2025

Understanding The Israeli Diplomat Shooting Incident In Washington D C

May 22, 2025 -

Ap Photos Israeli Embassy Staff Killed In Dc Shooting Near Jewish Museum

May 22, 2025

Ap Photos Israeli Embassy Staff Killed In Dc Shooting Near Jewish Museum

May 22, 2025 -

Washington Diplomat Shootings Updates And Key Information

May 22, 2025

Washington Diplomat Shootings Updates And Key Information

May 22, 2025